2023 Annual Letter

2023 was a year of...relief!

Kurt Vonnegut once correctly pondered: "The truth is, we know so little about life, we don’t really know what the good news is and what the bad news is." While 2022 was humbling and bewildering at times for many of my portfolio companies, in hindsight it was one of those moments I needed to just stay calm, keep buying some of the best businesses in the world, and hope the world would not fall apart soon! Given hopefully multiple decades of life ahead of me, it matters a lot less how 2022 or 2023 went; what matters much more is what lies ahead.

Morgan Housel's recent book "Same as Ever" had this sentence that really left a mark on my mind: "To know where we are going, we should know where we have been. And when you know where we have been, you realize we have no idea of where we are going."

After the pandemic and the massive stimulus in 2020, Russia-Ukraine war, supply chain crisis, and soaring inflation of 2021-22, and then the apparent taming of inflation in 2023, it seems like a good bet that we will keep getting surprised in 2024 (and beyond). Some of them will be positive surprises, and some negatives. So, although I remain optimistic about their long-term potential, I do not know how the mark-to-market values will evaluate my companies a year from now. While my largest portfolio holding i.e. MBI Deep Dives does not and will not have any mark-to-market value, I am encouraged to see that it remains a steady business.

Number of paid subscribers, ARPU, and ARR increased by ~4%, ~11%, and ~14% respectively YoY. This below chart, however, taught me something more valuable when I imagined an almost funny counterfactual: what if MBI Deep Dives were publicly listed and the company arranged an "Investor Day" in December, 2021? What would I guide 2023 subscriber numbers to be to my imagined investors? I think I would be tempted to guide something like 3,000 subscribers. I wouldn't be surprised if I believed the guidance to be, in fact, conservative since within just little more than a year after the launch of the service, the subscriber number was already close to ~1,600. And boy, would I be wrong!!

Imagining this hypothetical, frankly speaking, made me quite empathetic to management teams who were bamboozled by pandemic driven demands. Most forecasting in the days of Covid mostly turned out to be fiction and while it is tempting to blame management teams, I am somewhat empathetic (admittedly not towards SPAC promoters) considering my own difficulties of forecasting a rather simple business.

Churn continues to go in the right direction: lower. Average monthly churn went from 5.0% in 2021 to 4.8% in 2022 to 4.0% in 2023. ~66% of subscribers are now enrolled in annual plans (vs ~63% in December, 2022).

Do current subscribers find the service helpful? The answer seems assuredly positive. To the question in my recent survey: How likely are you to recommend MBI Deep Dives to your friends or colleagues, nearly two-third of the survey respondents selected "9" or "10". More interestingly, NPS score jumped from ~40 in 2022 to ~60 in 2023. The mean score increased from 8.32 in 2022 to 8.86 in 2023. All these are quite encouraging data points.

2023 Data

2022 Data

MBI Deep Dives remains, however, quite dependent on organic growth primarily from X (formerly known as Twitter).

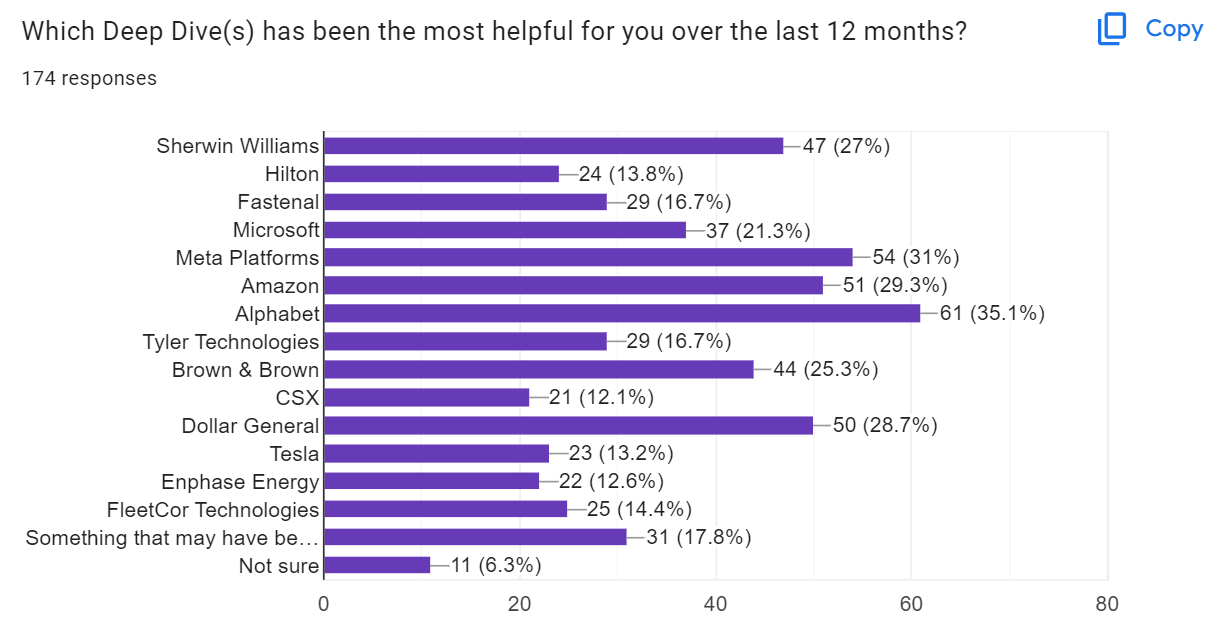

One of the somewhat surprising charts for me was the response to the question: which deep dive was the most helpful? The fact that many readers chose my coverage on Big Tech (Alphabet, Meta, Amazon, and Microsoft) was the most helpful may be obvious to many, but to me it was slightly surprising.

When I announced that I would cover Meta/Amazon/Alphabet in the earlier part of 2023, I remember receiving a couple of emails politely telling me how this may be a waste of time for me and everyone else. I would like to reiterate "why" I do what I do at MBI Deep Dives.

There are primarily two reasons that go hand in hand: I view investing as my lens to understand the world, and I am quite interested in helping my family's wealth compound over time. Making money is super important, but if I want to do this for multiple decades, I think it is unlikely that I will be able to do so if I am only motivated by IRR. One thing that always deeply impresses me about Buffett and Munger (RIP) was not just their track record, but how long they were able to stay intellectually engaged.

Big Tech companies are perhaps some of the most important companies to ever exist in the world. What they are doing today and how they will navigate their businesses for the next few decades will almost certainly leave a tangible mark on where we are heading. Without attempting to understand these companies yourself will make it challenging to have a good grasp on how the world works (and will work). Moreover, I am always surprised how many investors assume Big Tech is just boring, "consensus" stocks whereas anyone following these companies closely knows how intensely debated they are. Ironically, they are the most monotonous companies to investors who barely follow them. Since most of us use Big Tech's products almost everyday, it can be easy to deceive yourself that you know them really well and they are easy, one decision stocks!

How will Generative AI affect how we seek information? How will short-form video influence our consumption habit of long-form content? Will we (and next generations) continue to feel comfortable in sharing our private lives with extended "friend" networks on social media? Is the market for Virtual Reality inherently niche or will there be an explosion of use cases over the course of the decade? Will AR glasses start to appear as a threat to smartphones by the end of this decade? How will the ongoing lawsuits against Big Tech shape the regulatory environment? Is this all just an unintended regulatory capture? Will self-driving cars be commonplace across the US in 2030? Will EVs decisively beat ICE automobiles by the end of this decade?

The (potential) answers to these questions are wide ranging. At the same time, these are some of the best businesses I have ever come across, and understanding why and how they have been successful so far is quite important. If I learn anything from 2022-23, it is that I should not underestimate the probability that some of the most well covered companies can still be misunderstood from time to time. I may not come to right conclusions all the time, but I'm not sure there's a better way other than doing the work yourself. Following the decision trees and how the fate may change for some of the most transformational companies in history feels quite intellectually engaging to me and I do suspect people tend to overestimate how many investors are truly diligently following these companies.

It is also why I will spend much more time on understanding semiconductors in 2024. It was perhaps totally fine to not understand Nvidia and own Google/Meta/Amazon 5-6 years ago, but given how things have evolved in the last couple of years, it is imperative for me to gain a better understanding of the semiconductor industry; you can expect me to cover 4-5 companies from semis in 2024. Apart from semis, I will hopefully cover some real estate adjacent companies as well (CoStar Group in January, perhaps followed by AppFolio). I will let you know a more specific schedule gradually as we progress through 2024.

One thing I would like to highlight here is I am never worried about the timing of my Deep Dives. What I am mostly focused on is studying the most interesting and potentially durable companies, and understanding them well enough to be able to act quickly if market volatility presents opportunities to own a piece of some of these companies.

One of the reasons I have enjoyed working on my 2023 Deep Dives much more is the breadth of my coverage has expanded. So, staying intellectually engaged doesn't just mean covering cutting edge or mega cap tech companies, it can also mean exploring how a seemingly simple business such as Sherwin Williams compounded decade after decade, or dissecting rural America's retailer such as Dollar General, or spending some focused time on the world of renewables to understand the conversation around climate change. I will continue to lean onto expanding my breadth next year (and beyond). The world around us is infinitely interesting, and I plan on exploring every nooks and crannies of the economy over time. While some subscribers may seem to prefer me to spend time mostly on tech, I am glad that I have been able to attract a subscriber base whose interest seems just as eclectic as mine (as the survey response shows).

Speaking of my subscribers, one of my favorite charts is that I have paying subscribers from all over the world. Even though I remain mostly focused on the US market, more than half of my subscribers are from outside the US. Given half of academic papers are never read by anyone other than their authors, referees and journal editors, I know it is quite a privilege and honor that people from all over the world choose to pay to read what is essentially my paywalled investing journal. It indeed fills me with joy and persuades me to work harder every month to keep earning your time, trust, and attention.

Thank you so much for your continued support. May you and your loved ones have a wonderful year ahead. Happy New Year!

Past Annual Letters

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.