Floor & Decor: A Special Specialty Retailer

You can listen to this Deep Dive here

The late Charlie Munger was asked whether there is any current imitator of Costco. Munger mentioned Floor & Decor.

Floor & Decor (FND) is a specialty retailer primarily selling hard surface flooring products. Management, however, likes to think they are in a “fashion” business since the floor of your home can be exhibition of your taste and aesthetics that can emit a sense of uniqueness. It might be tempting to roll your eyes at the idea that flooring products are a fashion category, but if you look at the history of American homes over the last two centuries, the floor of American homes was indeed bit of a canvas. Brownstoner magazine did an interesting piece looking at the history of flooring in American homes in the 19th century which made me appreciate that there may be some truth to the claim of flooring being a “fashion” category:

Up through the 1870s, the trends in flooring stayed much the same. Painted floors were recommended, especially for service areas, hallways and bedrooms. Stenciling was still popular, and a viable substitute for carpet in these areas. Tile floors were becoming more popular, especially encaustic tile in vestibules, hallways and sometimes verandahs and porches. The tile was expensive, but long lasting, and worth the expense, as it was easy to clean, and the patterns were very attractive. Very wealthy homes began to tile their receiving rooms and foyers in the European manner, often with encaustic tile, but also with marble, sometimes in patterns of different colored stone.

Floorcloths were also still popular, as was grass matting, especially in the summer months. Drugget was now used mostly as a rug underlining, and as an insulation for plank floors in winter, when contracting wood allowed drafts to seep up through the cracks and separations in the flooring. But carpeting was king.

Indeed, carpeting was king for more than a century! But it went through an incredible boom and bust period in the meantime. After carpet sales saw a meteoric rise to 83 million square yards in 1923, it took nearly four decades for carpet sales volume to consistently exceed that number again. While carpet sales remained sluggish post great depression, it gained quite the momentum when tufted carpets came to the scene in 1950s and outsold woven carpets in less than a decade (see the differences between tufted and woven carpets here).

Sales volume for tufted carpets increased from ~6 mn in early 1950s to almost ~400 Mn in 1968. Interestingly, as volume kept rising, price per square yard for tufted carpet kept going down. Between 1955 and 1965, price per square yard for tufted carpets fell by ~30% (vs ~18% cumulative general inflation during this period).

Then came the popularity of hardwood flooring. Hardwood flooring too has been around for centuries, even as early as 1600s when affluent French nobilities opted for hardwood flooring. Hardwood started to show up in the US in the 19th century. Hardwood lost popularity to carpeting after the World War (WW) II as carpeting became more common and inexpensive. Demand for hardwood declined for nearly three decades post WWII and even many hardwood manufacturers were forced to sell carpet to remain in business. But things started to shift in the 1980s and by the time housing boom started gaining momentum in the 90s, hardwood flooring seemed to be more in vogue. In more recent decades, engineered hardwood flooring also gave homeowners a relatively cheaper option with much more expansive varieties. By the middle of 2010s, hardwood flooring overtook carpeting in American homes and it continues to gain market share. As of 2021, hard surface had 57% (vs 44% in 2012) market share whereas carpeting had just 37% (vs 49% in 2012) market share.

FND doesn’t sell carpets, and as a specialty retailer selling hard surface flooring products founded in 2000, there was perhaps no other retailer that was perfectly positioned to ride on this secular trend over the last couple of decades.

George Vincent started Floor & Decor in 2000 when he allegedly couldn’t find the specific flooring his wife wanted and realized the opportunity for a retailer that can contain a much wider selection than it is typically there in home improvement centers (Home Depot or Lowe’s). But the only way to do such huge number of SKUs to meet customer desire for variety, FND had to specialize in hard surface flooring in a warehouse store format (partly why Munger identified them as “Costco” imitator).

Vincent was clearly onto something as just two years after he opened the first store, FND was acquired by a group of investors, including Najeti Ventures, Saugatuck Capital, and TWJ Capital. At that time, FND had only two stores. Over the next decade, the store footprint grew to 25 when the ownership of the company changed hands again to another group of investors (Ares, Freeman Spogli, and FND management itself) in 2010.

Following this ownership transition, Vincent left the CEO role and Thomas Taylor, who used to oversee the store operations of Home Depot, joined as CEO of the company in 2012 as FND was eyeing to become publicly listed. There was news report as early as 2014 about FND’s possibility to come to IPO, but FND’s PE investors kept waiting for the “perfect” market conditions, as alluded by Taylor in the 2022 Investor Day:

I joined the company in 2012 with the intention to take the company public. And the private equity teams that I were working with was (saying) we're going to go public pretty quick. And then we stopped and started, and stopped and started so many times because market is not right. This is a problem. There's this story. There's that. So then finally, we're like, well, there always is going to be something. So we went public in 2017.

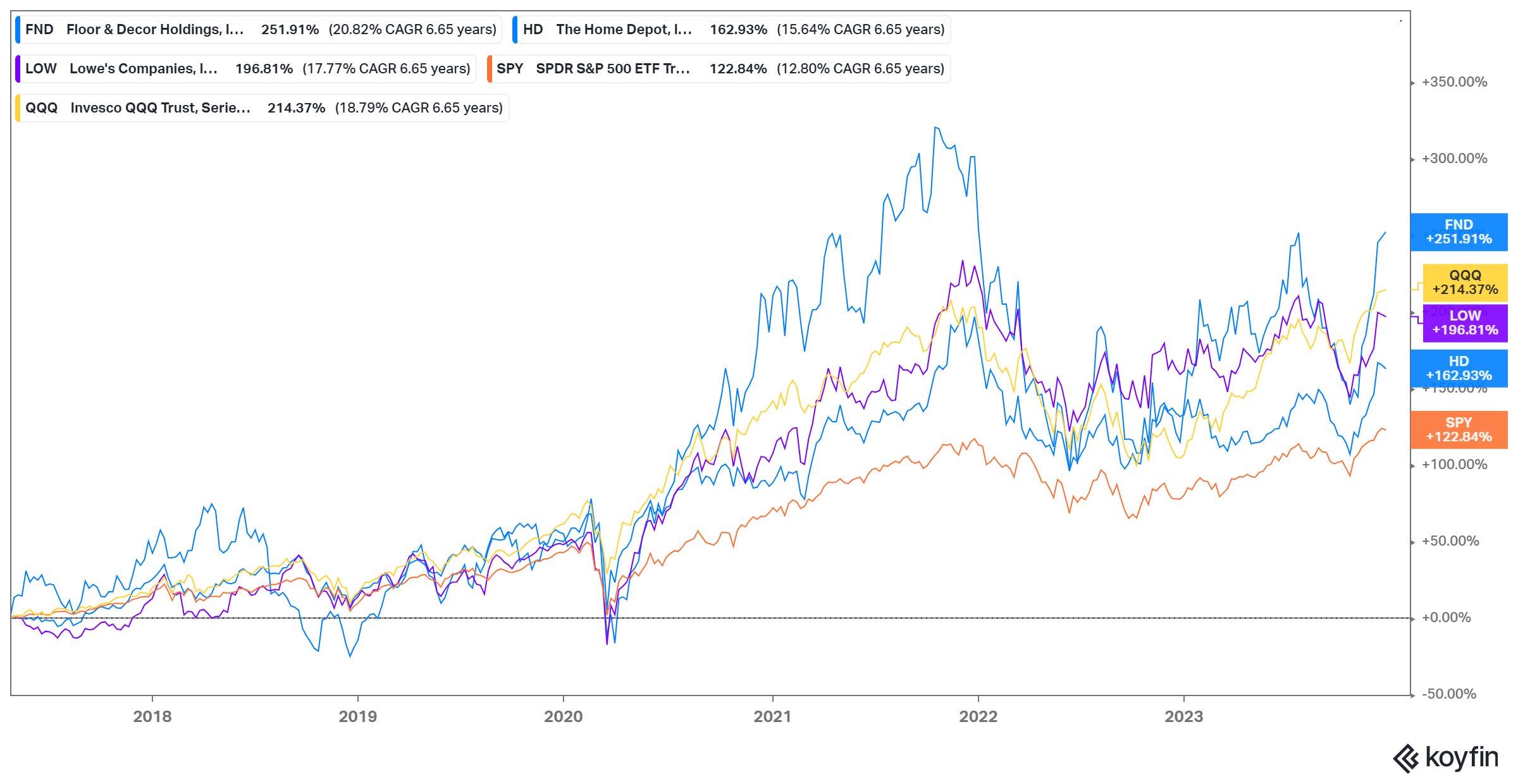

Like other home improvement retailers, FND was a huge beneficiary to post-pandemic boom in housing market. FND’s stock performed better than most retailers even though they too are struggling a little bit at the moment as we are currently going through a slump in existing home sales, thanks to rising interest rates. Despite being a relatively new public company, FND seems to have already attracted a relatively patient shareholder base. Since its IPO in 2017, FND has outperformed not only the home improvement center behemoths, but it also beat both the S&P 500 and Nasdaq 100 index.

Here’s the outline for the rest of the Deep Dive:

Section 1 Brief Overview and the Economics of Floor & Decor: I first answer these three questions in this section: Who typically shop at a FND store? What do customers buy in FND stores? And finally, why do they go to a FND store? Then I discuss the unit economics of a FND store and FND’s historical operating performance.

Section 2 Competitive Dynamics: This section also starts with wondering a couple of questions: can carpeting make a comeback? Will it ever stop ceding market share to hard surface flooring? Is hard surface flooring segment “Amazon proof”? This section also entails a brief case study on Home Depot to instill how difficult it is to outline the long-term path, which is followed by a discussion on current competitive dynamics and the competitive advantages FND enjoys.

Section 3 Management Incentives: I briefly outlined Floor & Decor management’s annual and long-term incentives in this section.

Section 4 Valuation and Model Assumptions: Model/implied expectations are analyzed here.

Section 5 Final Words: Concluding remarks on Floor & Decor, and disclosure/discussion of my overall portfolio.