Dollar General: Rural America's Retailer

You can listen to the Deep Dive here

I am not sure how many of my readers ever set their foot in a Dollar Store in America, but there are more Dollar Stores in the US than Starbucks, Walmart, and McDonald's combined. Dollar General is the leading Dollar Store brand in the US with almost 20,000 locations across 47 states in the US.

The origin of Dollar General was reminisced by Cal Turner Jr. ,who was CEO of Dollar General from 1965 to 2003, in his book “My Father's Business: The Small-Town Values That Built Dollar General into a Billion-Dollar Company”:

J.L. Turner and Son, as it was called then (James Luther Turner was my grandfather), had 36 retail stores, generally partnerships with local merchants, in small Kentucky and Tennessee towns. The business, headquartered in Scottsville, Kentucky, was grossing about $2 million annually, and my dad was always looking for ways to grow. He was a keen observer of both his customers and the competition, and he became intrigued by the “Dollar Days” sales put on by the big department stores in Nashville and Louisville. Once a month, they would take out huge full-color newspaper ads and sell merchandise with $1 as the single price point. My dad knew what those ads cost, and he understood that if they were spending that kind of money, they were selling a lot of goods. Customers obviously loved that $1 price point. Somehow, it made real value seem even more obvious.

“Why couldn’t we simplify all of our operations,” he thought, “by opening a store with only one price—a dollar?” Every day would be Dollar Day. In that flash of insight, he saw any number of benefits. Customers could keep track of what they were spending more easily, and checkout would be simplified.

While Dollar Stores have become quite prevalent in the US, the original idea of a Dollar Store has become somewhat obsolete. Dollar General stopped selling items only for a dollar decades ago; its closest competitor Dollar Tree held onto the original Dollar Store philosophy for far longer before giving up just a couple of years ago. Therefore, today the Dollar Stores mostly evoke a sense of “value” even though they have moved away from the original idea of Dollar Stores.

After Turner family successfully ran the Dollar General business from 1955 to 2003, David Perdue was the first outside CEO and led the company for four years before KKR acquired Dollar General in 2007. When Dollar General first came to IPO in 1968, one share of Dollar General was worth $16.5 which would be $6,555 in 2007, implying ~16.6% CAGR over 39 years.

KKR’s buyout of Dollar General was incredibly well-timed. During the Global Financial Crisis while S&P 500 Index went down by 38% in 2008, Dollar Tree was the best stock in the S&P 500 Index with +64% gain in the year. As the recession forced many people to trade down, Dollar Stores proved to be quite countercyclical.

KKR bought Dollar General for $7.2 Bn, but put down only $2.8 Bn equity and the rest was financed via debt. When Dollar General became public again in 2009, its Enterprise Value was ~$12 Bn and the equity was worth ~$8 Bn. Dollar General was a home run for KKR.

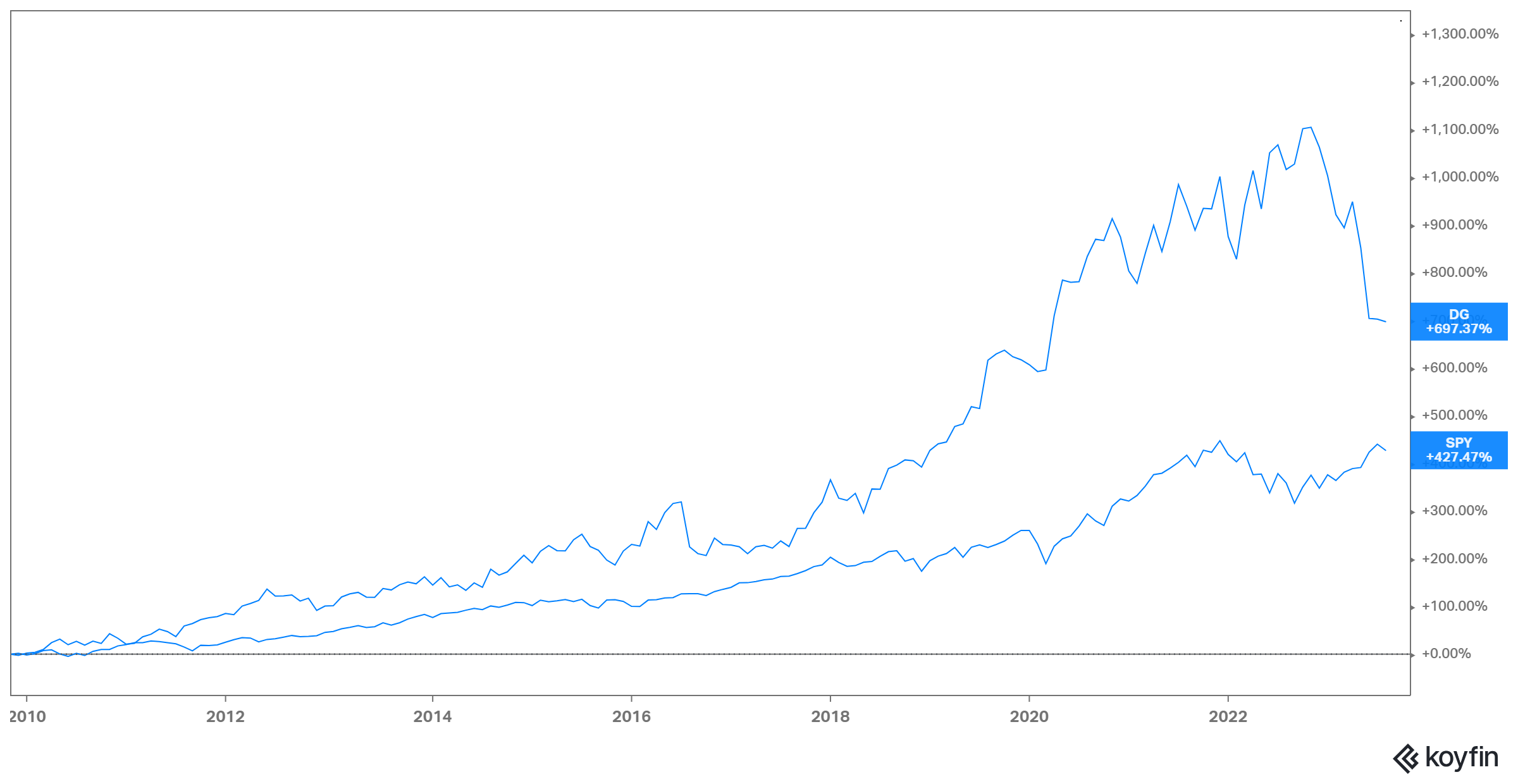

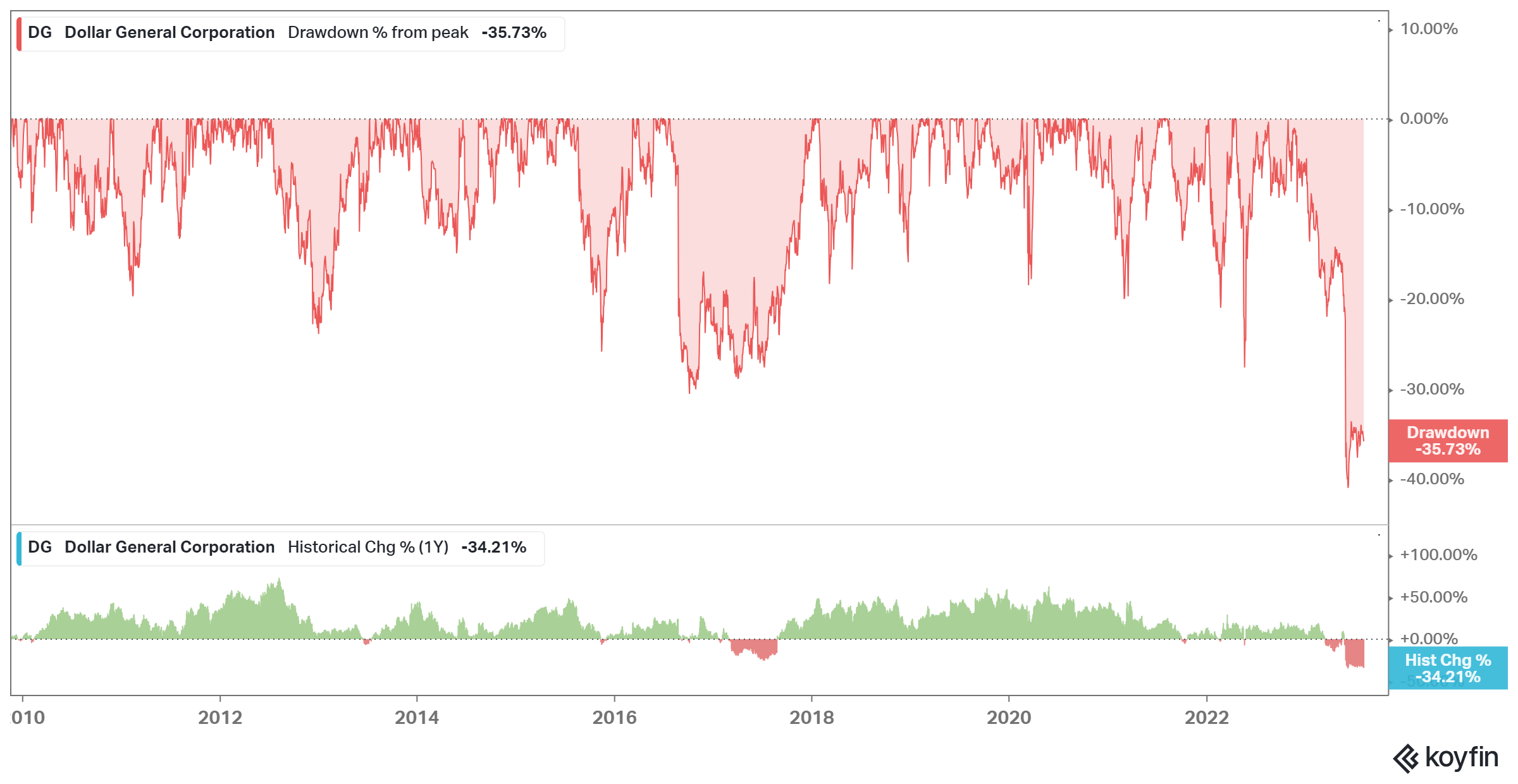

Dollar General handily beat the S&P 500 index even after it recently experienced its largest ever drawdown since becoming public again. The question is, of course, whether the current drawdown is a great opportunity for investors.

Here’s the outline for this month’s Deep Dive:

Section 1 Dollar General’s Business: I start the business overview with three key questions: a) who shops at Dollar General, b) why do they shop there?, and c) what do they buy in these stores? Then I discuss the unit economics of a Dollar General store.

Section 2 Competitive Dynamics and Near-term Challenges: In this section, I explored the rivalry between Dollar General, Family Dollar, and Walmart and some other near-term challenges that have been plaguing Dollar General.

Section 3 Long-term Debates: Beyond the near-term challenges, I mentioned some longer term concerns and what I think about them.

Section 4 Capital Allocation and Management Incentives: I explained on this section why I am a fan of neither Dollar General’s capital allocation nor their management incentives.

Section 5 Model Assumptions and Valuation: Model/implied expectations are analyzed here.

Section 6 Final Words: Concluding remarks on Dollar General, and disclosure/discussion of my overall portfolio.