The Curious Case of Big Tech

Disclosure: Nearly 60% of my personal portfolio is invested in Meta, Amazon, and Alphabet

“Most people overestimate what they can achieve in a year and underestimate what they can achieve in ten years.”

While most market participants want to focus on what happens next quarter or the next year, it is often revealing to look back and see what has been achieved over ten years! What I am about to discuss is something I have discussed with some fellow investor friends over the past month or so, and I have noticed how frequently some of these data startled them. So, I thought about writing a brief note to share this with my readers.

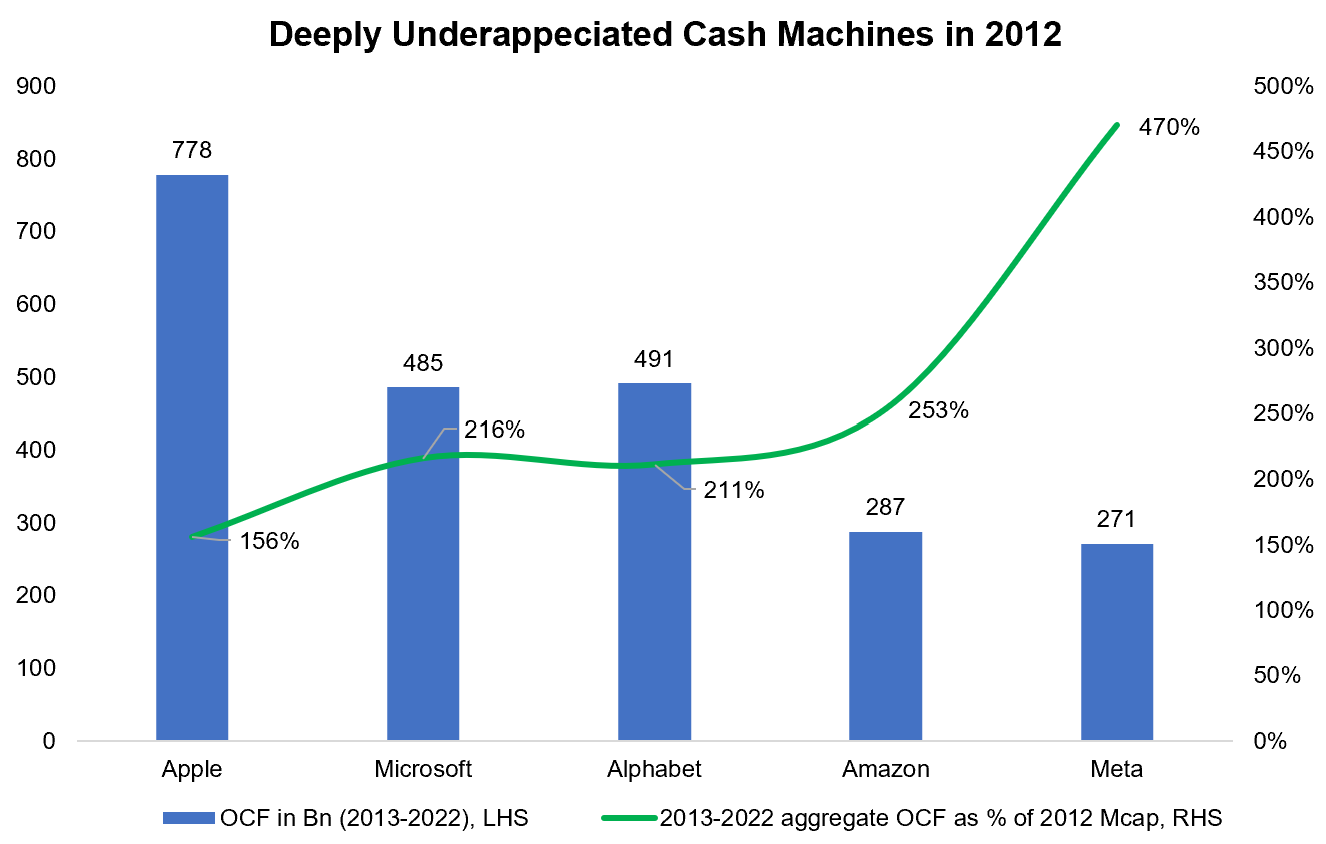

In the beginning of 2013, Big Tech’s (defined as Apple, Microsoft, Alphabet, Amazon, and Meta) market cap were:

Apple: $500 Bn

Microsoft: $225 Bn

Alphabet: $232 Bn

Amazon: $114 Bn

Meta: $58 Bn

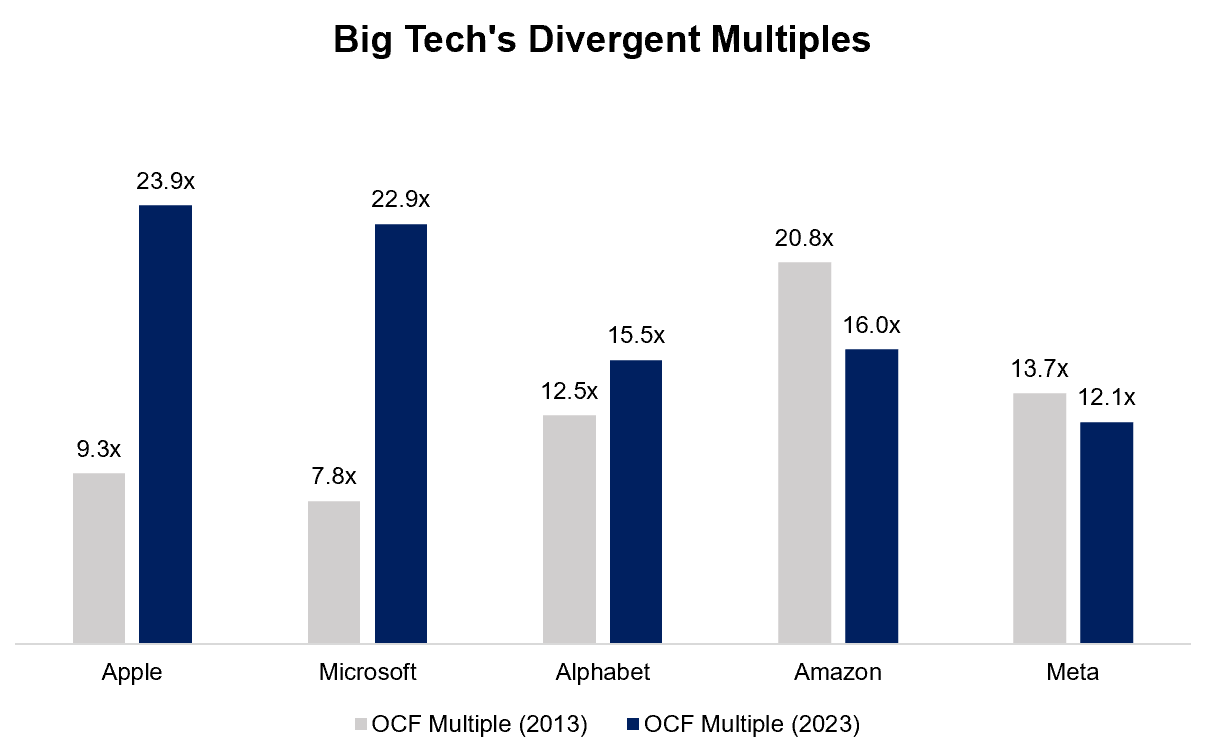

In aggregate, Big Tech was worth $1.1 Tn at the end of 2012. Over the last ten years (2013-2022), Big Tech collectively generated $2.3 Tn Operating Cash Flow (OCF), slightly more than double their aggregate market cap ten years ago! To say it differently, Big Tech was a form of deep value investing that was deeply underappreciated even though they are all widely followed companies at that time! Believe it or not, back then 10-year treasury was yielding below 2%! Perhaps this is what people call “generational opportunity”!

What is perhaps even more strange is that this underappreciation was not quite specific to one or two companies, but to the entire group. No company was, however, as underestimated as Meta Platforms (formerly known as Facebook) generating $271 Bn OCF in 2013-2022, which was 470% of their market cap in 2012!

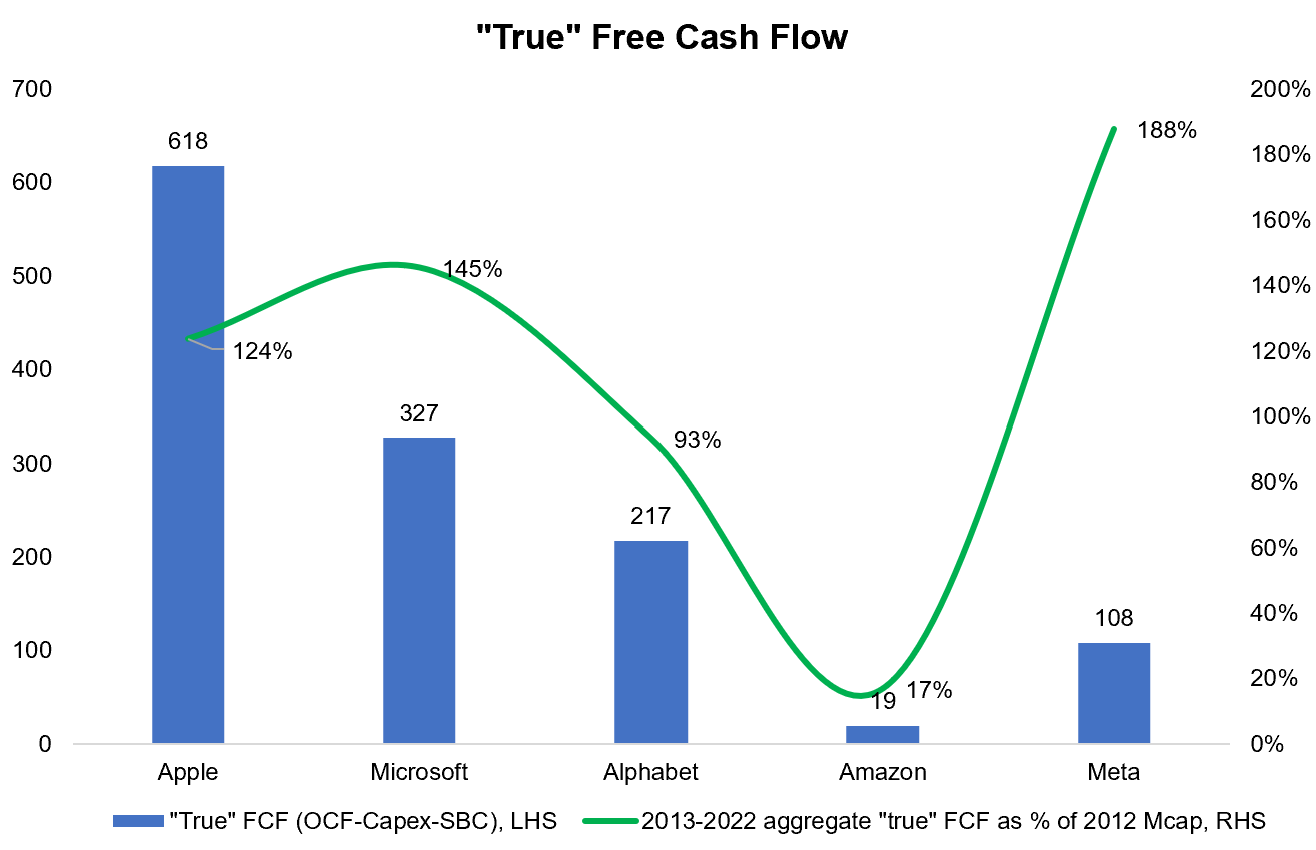

Skeptics may point out these companies tendency to dole out SBC and the higher capital intensity over the years which necessitate more and more to focus on FCF. As I will show you later, the skeptics may have a point, but the numbers still point out how attractive Big Tech was in retrospect! Amazon is an anomaly here as they relentlessly deploy all of their operating cash flow. Nonetheless, Big Tech generated $1.3 Tn “true” Free Cash Flow (FCF), which is defined as Operating Cash Flow-Capex-Stock-based Compensation (SBC). Again, this “true” FCF was ~$160 Bn higher than their aggregated market cap in 2012.

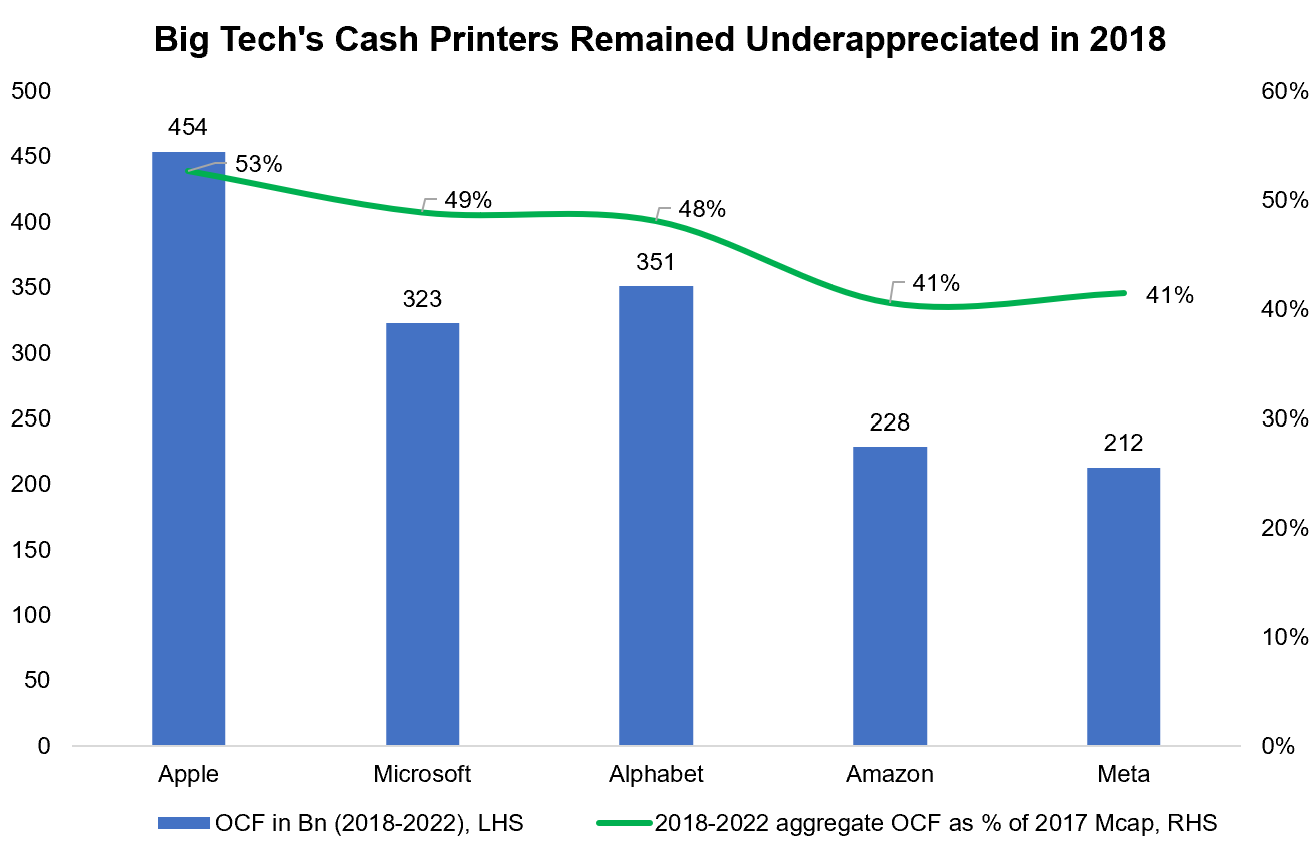

Clearly, investors deeply underestimated Big Tech ten years ago, but did things change five years ago?

From OCF perspective, it appears they were still quite underappreciated in the beginning of 2018 even though the depth of underappreciation dwindled a bit. All five companies generated ~40-50% of their 2017 year end Market cap in 2018-2022 aggregate operating cash flows. It is certainly quite conceivable that by 2027, perhaps all of them would generate OCF more than their 2017 market caps!

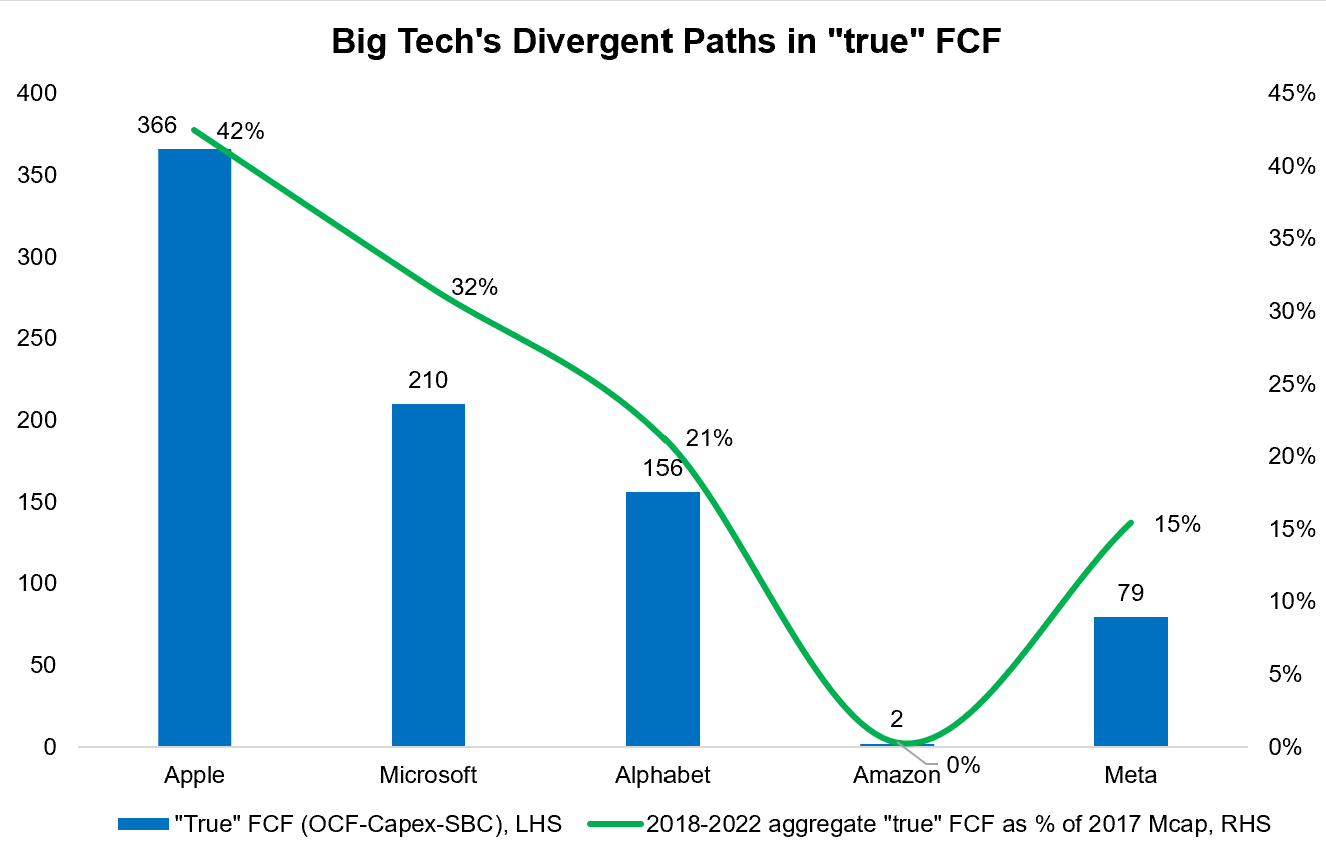

The narrative, however, gets complicated when it comes to “true” FCF. While Amazon remained true to its color by redeploying their entire OCF, Meta and Alphabet seemed to have followed a similar, but unexpected trajectory. What benefitted Apple and Microsoft (to a large extent) is their primary source of cash machines remained somewhat capital light. As a relatively late entrant, Alphabet ramped up their investments in Cloud. Alphabet was also transitioning to be “AI-first” company which likely required significant human and financial capital investments. Similarly, gone are the days of capital light social media businesses! With everyone’s feeds now being intensely personalized with ongoing shift from text to images to videos, Meta required to grow up to that reality (ATT only worsened the situation).

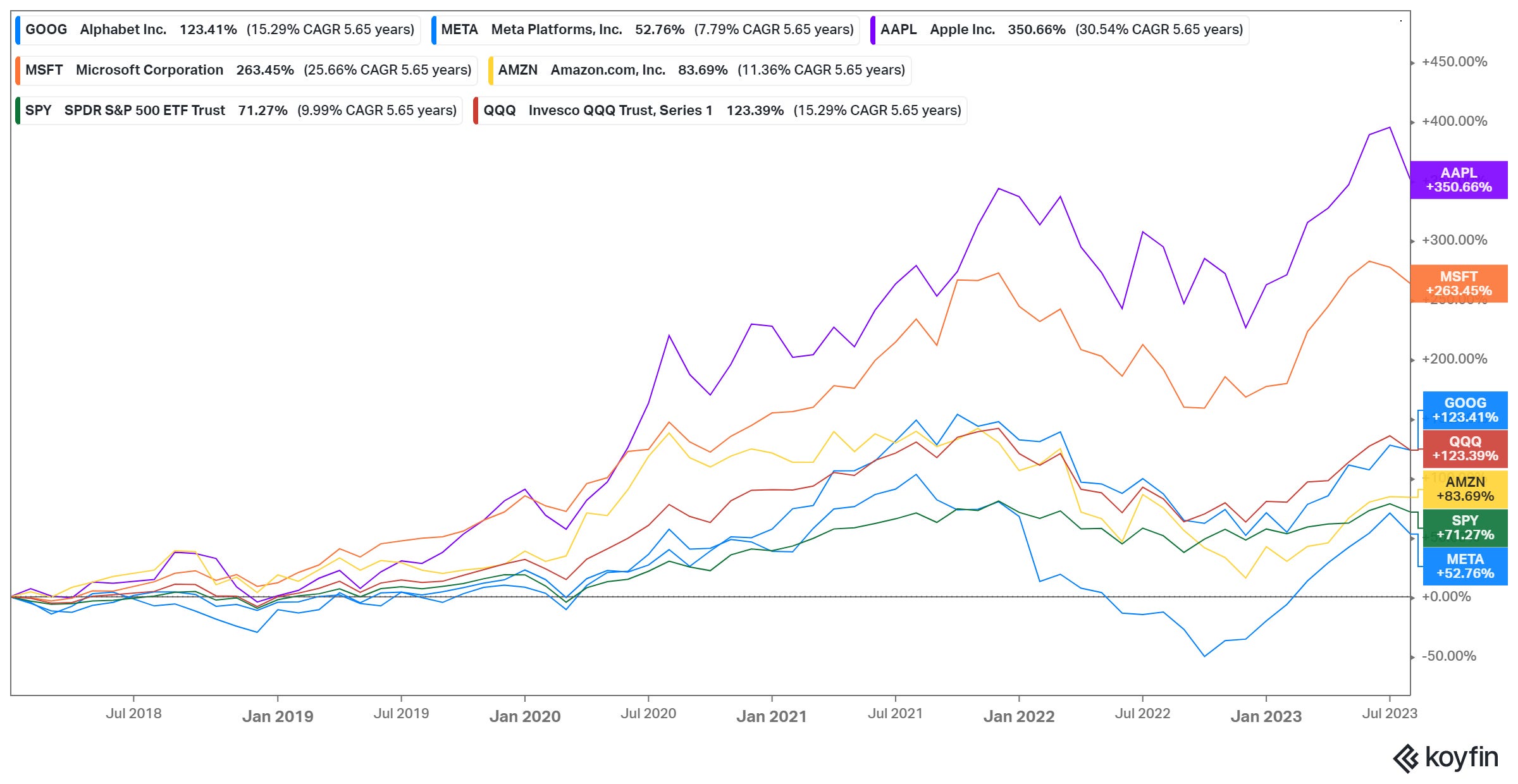

These somewhat divergent paths are reflected in their returns since 2018. Investors were surprised to understand the capital intensity of Alphabet and Meta’s core businesses whereas they likely grew a bit tired of Amazon’s relentlessness and started entertaining healthy amount of skepticism about their ROI on recent investments.

The real question, however, is whether this was just an investment cycle required for them to grow to the new reality further extending their moats. This question will take time to answer as given the recent Generative AI enthusiasm, the investment cycle is not quite over yet. While nobody quite expects that the capital intensity will return to the level of 2012-2017 period, it is certainly conceivable that investors extrapolating recent capex bonanza till eternity may turn out to be a key source of alpha for long-term investors.

Why do I say that? Meta, and Amazon are currently trading at lower OCF multiple than they were trading back in 2013. The set up remains quite attractive if the persistence of capital intensity (not just in absolute dollars but as % of their revenues or OCF) turns out to be overstated. Apple and Microsoft, on the other hand, went from “impending terminal businesses” to durable cash gushers in investors mind.

Despite lower multiples, we perhaps cannot expect similar returns from some of these stocks due to important changes in initial conditions. At the end of 2012, Instagram may not have generated its first dollar of revenue yet. AWS “IPO” happened in 2015, so you can imagine Google Cloud or Azure did not even enter investors consciousness back then. LinkedIn was still an independent company and Big Tech were still allowed to acquire companies and could use their massive distribution to scale those businesses. Apple was considered a “hardware business” destined to lose their profit pool to cheaper phones over time.

Many of those optionalities could not possibly be modeled back then and the reality is the world has never seen such a dominant group of global companies in the history of capitalism which led to this deep underappreciation for such a long time which arguably somewhat still persists. But it also introduces questions: what are the current set of optionalities for Big Tech today that are hard to model and hence value appropriately? For Alphabet, the first word that comes to my mind is Waymo. For Apple and Meta, it is AR/VR. Amazon has a whole host of “other bets” that are barely disclosed (Kuiper, Alexa to name a couple). It can also be hard to pinpoint how much Microsoft is the key beneficiary of Generative AI. It may understandably seem to investors that these “optionalities” are far less lucrative than their former versions. Hindsight is 20-20 and perhaps impossible to imagine today how preposterous it would seem to claim in 2012 AWS revenue would be $80 Bn in 2022! Nonetheless, I too broadly agree that these set of optionalities are likely to be much more underwhelming than the last ten years, but companies trading at similar or lower valuation multiples somewhat relieve us from making those bold predictions anyway with the caveat that we need to assume managers/operators of these businesses will act rationally if these optionalities prove to be value destructive. It is a nuanced point; in all likelihood, AR/VR is worth "negative" for Meta today; to create value for today's shareholders, AR/VR doesn't have to start a new "smartphone" revolution, but just have to be a real, not an imaginary, business. And if the real business proves to be reasonably attractive, that is quite certainly far from being priced in the stock. I can do these for Alphabet and Amazon as well, but you hopefully get the idea.

While all of these may seem quite long-term questions, I am of the opinion that these are the kind of questions, along with durability of their core businesses, are really the questions that matter. To substantiate this point, I will leave you with an excerpt from Edward Chancellor’s book “Capital Returns”:

While the case for long-term investment has tended to centre around simple mathematical advantages such as reduced (frictional) costs and fewer decisions leading (hopefully) to fewer mistakes, the real advantage to this approach, in our opinion, comes from asking more valuable questions.

The short-term investor asks questions in the hope of gleaning clues to near-term outcomes: relating typically to operating margins, earnings per share and revenue trends over the next quarter, for example. Such information is relevant for the briefest period and only has value if it is correct, incremental, and overwhelms other pieces of information. Even when accurate, the value of the information is likely to be modest, say, a few percentage points in performance. In order to build a viable, economically important track record, the short-term investor may need to perform this trick many thousands of times in a career and/or employ large amounts of financial leverage to exploit marginal opportunities.

And let’s face it, the competition for such investment snippets is ferocious…Can there really be much of value to say about industry developments over such limited time frames? Of course not. Even so, we would hate to discourage such research as, from time to time, what the short-term guys are selling can turn out to be wonderful long-term investments.

...The longer one owns the shares, however, the more important the firm’s underlying economics will be to performance results. Long-term investors therefore seek answers with shelf life. What is relevant today may need to be relevant in ten years’ time if the investor is to continue owning the shares. Information with a long shelf life is far more valuable than advance knowledge of next quarter’s earnings.

Thank you for reading!

For more detailed analysis of Big Tech, click here: Meta, Amazon, Alphabet, Microsoft.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.