September Update

Exactly three years ago, I launched MBI Deep Dives in September, 2020. Thanks to your support, I have been able to keep at it for the past thirty six months writing Deep Dives every single month. I have never had as much fun as I have had "working" for MBI Deep Dives. I want to keep doing what I am doing for decades, so we are still hopefully in the very early days. Thank you for allowing me to pursue what has been genuinely fun and intellectually stimulating experience for me.

Some quick updates for this month:

- Speaking of fun, I am indeed enjoying studying Tesla very much. Tesla is not only just a controversial stock but also perhaps one of the more complicated ones I have studied so far. I hope to publish the Deep Dive sometime during the final week of September.

- I recently appeared on my friend Liberty's podcast to discuss Meta Platforms. We explored what are likely misunderstood aspects about the company as well as some risks and opportunities ahead of the company. Give it a listen if you are curious.

- Following Tesla, I plan on covering Enphase Energy. I haven't decided on the schedule for the rest of the year yet, but I will let you know once I do.

- I have received a number of feedback on last month's Deep Dive: Dollar General (DG). A few readers let me know that I may have underappreciated the inherent complexities associated with increasing new stores from ~1k/year to 1.5k-2k/year. The constraint is not necessarily capital, rather labor, real estate etc. During my due diligence of DG, I spoke with a couple of shareholders and in fact, they did mention this when I shared my criticism of DG's capital allocation. I, unfortunately, forgot to mention this counterpoint on my Deep Dive. While I do think this is a very fair counterpoint to my criticism, I still think DG management should have been a bit more proactive in penetrating their TAM a bit more quickly since 2015; perhaps not by increasing new stores by 2k/year, but more like 1.2-1.5k/year if they indeed believe the US market opportunity is closer to 30k stores.

Another reader mentioned a pretty neat point on why they think DG's historical Same Store Sales (SSS) growth may not be quite indicative of the end-state same store sales growth:

"a dirty trick for retailers same store sales growth is that store roll out is also a tailwind to SSS growth. If it takes 5 years for a store to fully mature, the SSS benefit is counted after year 1 as a tailwind to the group. The implication is that the underwhelming same store sales figures are actually worse if we were to look at the mature subset of long-standing stores (a better proxy for terminal SSS)"

I have also received a couple of emails/messages requesting me to comment on yesterday's large drop on DG's prices. While I'll try to not make it a habit to comment on short term stock price movements on every stock that I have covered, let me address a couple of points here.

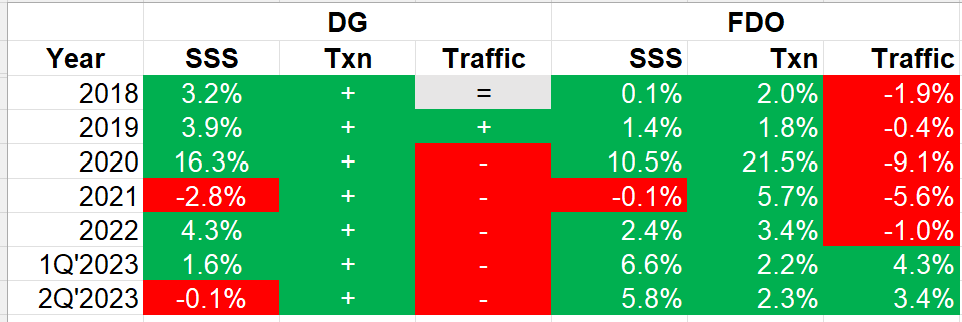

One of my primary concerns about DG was declining Same Store traffic trend that started in 2020. Family Dollar (FDO), the closest comp, had the same issue but they turned to positive traffic in the last two quarters whereas DG's traffic remains negative. The traffic comp should be "easy" by now since it declined for three consecutive years. Therefore, it is indeed a bit concerning that traffic trend hasn't turned around yet, especially when the closest competitor's did.

There has been another narrative that is increasingly gaining momentum across US retail is the rise of Temu and how much it is potentially affecting other retailers in the US. It is perhaps too early to comment on Temu, but I think it is unlikely that it is the primary reason for DG's recent weakness. If Temu were such a force, I would assume it would show up in FDO's number as well. In fact, one could argue that given FDO over-indexes on more urban regions than DG, delivering low priced items to FDO-adjacent regions would be more convenient than DG-adjacent regions. ~80% of DG's stores are in towns with fewer than 20,000 people. Transaction amount per customer trip to a DG store is ~$15. I don't see how delivering such low value products to towns with <20k people can make compelling economic sense. Therefore, even if Temu threat were real, I would be lot less worried about DG than most other retailers in the US.

Finally, I do think following DG's drop in stock price yesterday, DG's risk-reward is slowly becoming more attractive than I considered them before. I am not a shareholder yet, but I am watching DG with interest. As I have mentioned before, questions are always evolving depending on changes in stock prices and the business fundamentals. Every now and then, the questions just seem easier to answer.

5. I have provided more details on my back-of-the-envelope math on Adyen here. While that thread primarily speaks about the numbers, I encourage you to read my Deep Dive to understand the broader narrative. Moreover, if you want to get up to speed on some of the recent developments on payments industry, especially Adyen, Stripe, and PayPal, I encourage you to listen to this Stratechery podcast.

Thank you again for your support!