Tesla: A Bet on Dominance in Potentially Compelling Megatrend(s)

You can listen to the Deep Dive here

“…if someone in the year 1900 had to bet on the outcome of the battle between external steam combustion, internal gasoline combustion, and electricity as the future standard for powering cars, they’d have probably put their money on electricity. And at the time, electricity was not only winning the battle over gasoline with far more cars on the road, but the world’s most prominent inventors, including Edison and Tesla, were pouring their efforts into an electric car future. Early in the century, the New York Times referred to the electric car as “ideal,” citing it as quieter, cleaner, and more economical than the gas car.

But ideal wasn’t the driving force of the early auto industry—scalable was.”

-Tim Urban (“Wait But Why”)

Indeed, in early 1900s, the future of automobile was an open question. ~40% of American cars was powered by steam whereas ~38% was electric. The rest 22% was driven by gas. Despite gas being the underdog in this race, one person through his sheer ingenuity, will power, and raw ambition transformed automobile from mere toys of rich people to a basic necessity for everyday Americans! Henry Ford invented the “modern age”.

Sheer ingenuity, will power, and raw ambition of a different person in a different era are also exactly why we are discussing Tesla today. What Thomas Edison and Nikola Tesla imagined the future of automobile ought to be, Elon Musk is almost on a mission to prove them right. However, when Tesla was founded in 2003, electric automobile was the clear underdog this time as gas powered automobiles had already appeared to have conquered the world. In fact, the last successful American car company (Chrysler) was founded in 1925.

Tesla, of course, isn’t an up and coming startup today. It’s an ~$800 Bn juggernaut. The market is betting that not only Electric Vehicles (EV) are the future of automobile but also has likely crowned Tesla to remain utterly dominant in this industry. Warren Buffett, however, uttered a cautionary tale on the history of automobile:

Take automobiles first: I have here one page, out of 70 in total, of car and truck manufacturers that have operated in this country. At one time, there was a Berkshire car and an Omaha car. Naturally I noticed those. But there was also a telephone book of others.

All told, there appear to have been at least 2,000 car makes, in an industry that had an incredible impact on people’s lives. If you had foreseen in the early days of cars how this industry would develop, you would have said, “Here is the road to riches.” So what did we progress to by the 1990s? After corporate carnage that never let up, we came down to three U.S. car companies — themselves no lollapaloozas for investors. So here is an industry that had an enormous impact on America — and also an enormous impact, though not the anticipated one, on investors.

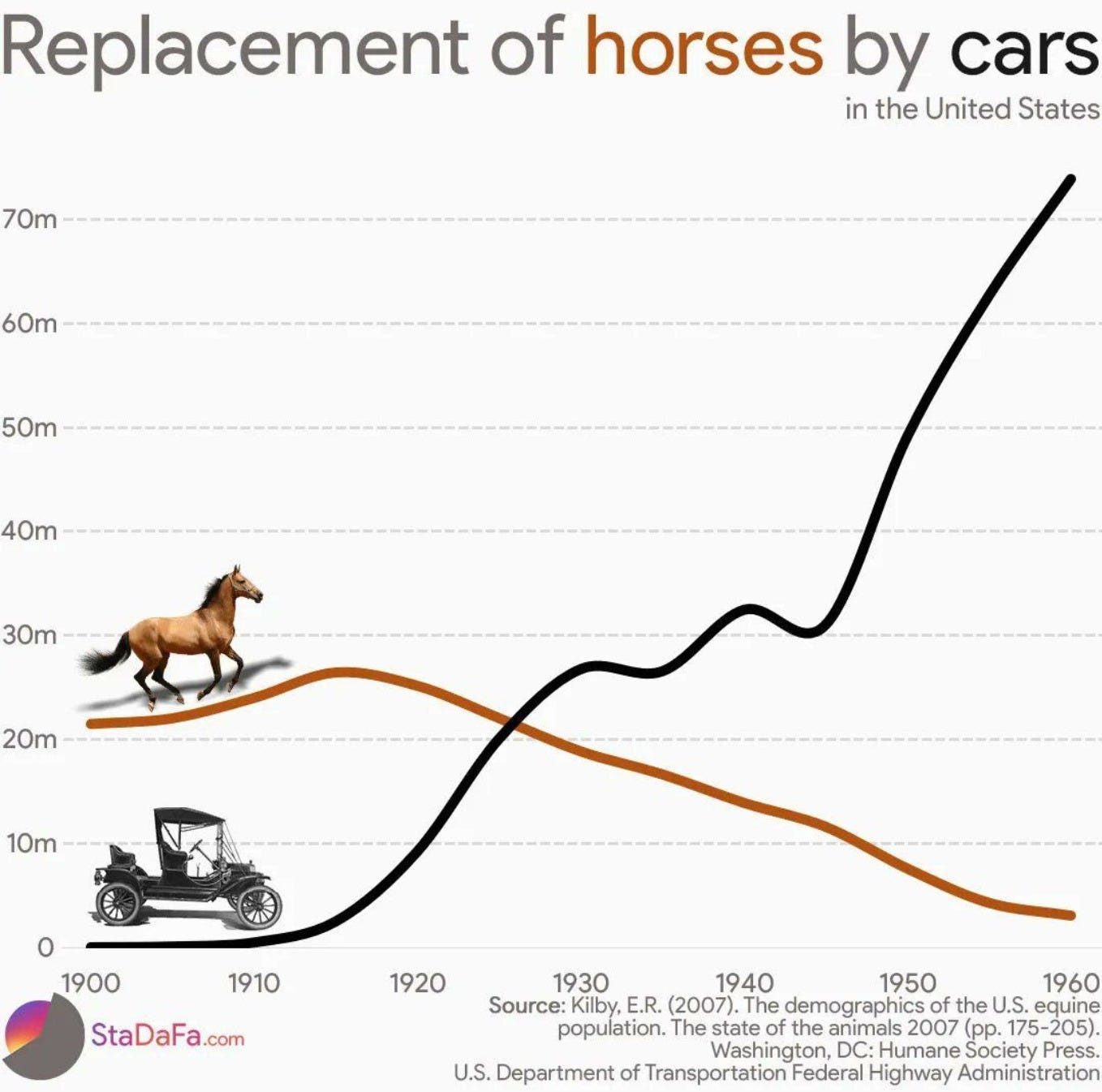

Sometimes, incidentally, it’s much easier in these transforming events to figure out the losers. You could have grasped the importance of the auto when it came along but still found it hard to pick companies that would make you money. But there was one obvious decision you could have made back then — it’s better sometimes to turn these things upside down — and that was to short horses.

Shorting horses indeed would be a terrific “trade” in hindsight!

But when I looked closely at this chart, the question that popped out to me is: are we in “1920” in the race between EV and Internal Combustion Engine (ICE)? Is the History of automobiles and the resultant industry structure the right framework to outline the future path here or should we consider the smartphone industry to be more analogous since while EVs may look like cars, they are essentially computers on wheels? Or perhaps trying to overfit pattern recognition to a new industry can lead us astray from all the important nuances?

These are indeed the kind of questions I wrestled with over the last month, and it was quite a fun month. Here’s the outline for this month’s Deep Dive:

Section 1 Why EV? First, I discussed some key skepticisms around transition to EV and dug into the merits of these concerns.

Section 2 How We Got Here: Tesla has a colorful history in the lead up to its $800 Bn market cap. I touched on some of these key moments and how Tesla defied the odds to get to where they are today.

Section 3 Tesla’s Business Overview: Following the historical contexts, I got into explaining the business as it stands today. Pay close attention to FSD accounting in this section which can have important implications in the future.

Section 4 Industry Dynamics: This section is perhaps the meat of the Deep Dive as I delved into historical perspectives around early automobile industry’s evolution and how competitive dynamics evolved over time. GM and Ford’s early rivalry, with data points, is mentioned here. Then I elaborated on Tesla’s closest competitor: BYD and why BYD may be a bit underdiscussed among Tesla bulls. Finally, I discussed Tesla’s variant approach to FSD and why I think FSD may be the widest range of outcome situations that I have ever studied.

Section 5 Management: I know everyone has already formed their opinions on Elon Musk, so I kept this section relatively short.

Section 6 Valuation: Model/implied expectations are analyzed here.

Section 7 Final Words: Concluding remarks on Tesla, and disclosure/discussion of my overall portfolio.