Microsoft: The Quintessential Technology Company

You can listen to the Deep Dive here

“The personal computer revolution had begun with a game played on a small blue box with blinking lights named after the brightest star in the constellation. 30 years earlier, people in Albuquerque had witnessed the sun come up in the South when the world's first atomic bomb exploded in the pre-dawn darkness a hundred miles away, heralding in the nuclear age. Now another age had dawned in Albuquerque. It began at a ragtag company located next to a massage parlor.

Its prophets were two young men, not yet old enough to drink, whose computer software would soon bring executives in three-piece suits from all around the country to a highway desert town to make million-dollar deals with kids in blue jeans and T-shirts.

…You've got to remember that in those days, the idea that you could own a computer, your own computer, was about as wild as the idea today of owning your own nuclear submarine. It was beyond comprehension.”

-From the book “Hard Drive: Bill Gates and the Making of the Microsoft Empire” (Note: I haven’t read the book(s); I, however, listened to David Senra’s four podcast episodes that covered three books on Bill Gates, Paul Allen, and/or Microsoft)

Of course, these “prophets” are Bill Gates and Paul Allen who met each other at Lakeside High School, one of the few schools to have computer during late ‘60s.

Although Allen was almost three years older than Gates, their mutual passion for computers led to a close friendship; nonetheless, they were very different personalities, as alluded by Allen’s recollection of how his mother used to describe Gates: “My mother had a term for adrenaline junkies, people who would court risk for the thrill of it. Bill Gates was an edge walker, where I was wary of danger, Bill seemed to enjoy it.”

By the time Allen decided to leave his “dead-end job” at Honeywell to start a company with “the edge walker” named Gates, Gates and Allen were just 19-year and 22-year old respectively. While the popular perception of the teen Gates mostly focuses on being a computer nerd prodigy, it was his sales skills, in addition to technical prowess, that became important backbone of Microsoft’s early days. From the book “Hard Drive”:

Gates sustained Microsoft through tireless salesmanship. For several years, he alone made the cold calls and haggled, cajoled, browbeat, and harangued the hardware makers of the emerging personal computer industry, convincing them to buy Microsoft's services and products. He was the best kind of salesman there is. He knew the product, and he believed in it. He approached every client with the zealotry of a true believer, from the day he first articulated the Microsoft mantra: "A computer on every desktop, and Microsoft software in every computer."

It wasn’t just sales or technical prowess, Gates’ strategic acumen was also almost unrivaled and Microsoft’s consequential deal with IBM is the perfect testament to that.

Microsoft initially paid $25k in December, 1980 to Seattle Computer Products (SCP) for a non-exclusive license of an operating system, but they later bought the license outright from SCP for $50k in July, 1981 just two weeks before IBM started shipping its first PC. Microsoft then renamed the operating system to MS-DOS and licensed it to IBM. But Microsoft made sure it was non-exclusive deal with IBM i.e. they could sell the same software to any other PC hardware manufacturers out there (regulators’ intense focus on IBM for monopolistic and anticompetitive behavior might have also prompted IBM not to push on this too hard). IBM did ask for a fixed lump-sum deal with Microsoft initially which Bill Gates rejected; Gates correctly concluded it would be a much better deal to get paid on a per PC basis as the world would likely go through a computer revolution. That one decision turned Microsoft to be effectively a money-printing machine. For every PC sold, Microsoft received royalty for their software.

Of course, even if you won the lottery, you still need financial discipline to remain rich for decades to come. Gates’ parents and grandparents were all very financially conservative and such values were passed onto Gates as well. Microsoft never really needed to raise money from anyone before the IPO; the only VC money they took was just ~$1-2 Mn primarily for advice. In fact, Microsoft only came to IPO because of their employee stock option policy which meant they were approaching 500 shareholders that required them to register with SEC. Microsoft raised $61 Mn in IPO at $777 mn valuation in 1986. Today, Microsoft is almost $2 Tn market cap company, a >2,000x over almost four decades in public market!

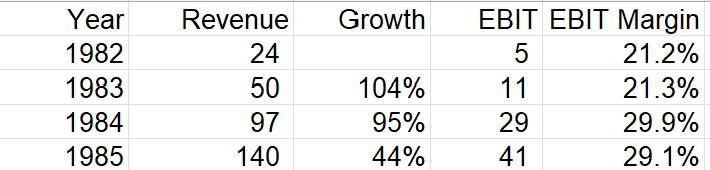

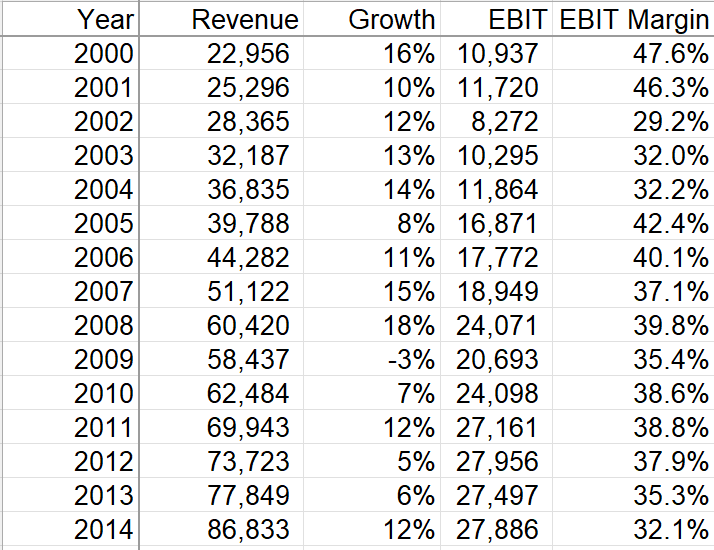

Just looking at those early years’ financials in the lead up to IPO in 1986, you could sense presence of Microsoft’s money printing machine and the financial discipline.

Even after IPO, Microsoft continued its rapid profitable growth, thanks to their release of Windows in late 1985 which would prove to be a mind boggling cash cow for decades to come. Moreover, 80s was also the decade when Microsoft launched some of the most durable software in the History of software industry: Microsoft Word (1983), Excel (1985), and PowerPoint (1987).

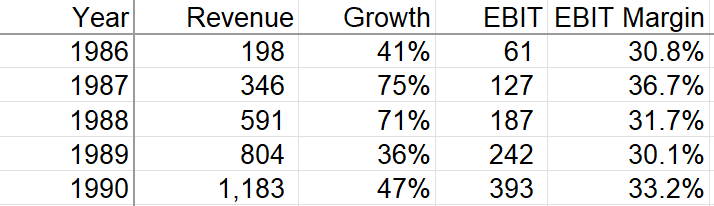

Here’s a snapshot of Microsoft’s income statement five years after IPO:

Just as Microsoft ascended to the glory days with no apparent sight of weakness, some did have prescient warnings for Microsoft. For any investor in technology, the bear case for Microsoft should sound familiar. The obsolescence risk and the rapid shift of technology could theoretically leave Microsoft to be just another tech company from the bygone eras. Bill Joy, one of the co-founders of Sun Microsystem, indeed thought exactly that in early 1990s:

"Microsoft is going to dominate for 5 to 7 years, then everything would change. There would be an industry breakthrough unimagined at the time, and it would be made by a company that didn't exist yet."

Moreover, Joy also suggested that this potential Microsoft disruptor would pursue simplicity instead of complexity to attack Microsoft’s moat. Indeed, by the mid-90s, Netscape came to the scene with their Mosaic browser that only had ~9k lines of code (vs Windows 95 that had ~10-15 mn lines of codes).

As internet came to the scene, Bill Gates was infatuated with something entirely different during early to mid 90s: information superhighway. Gates imagined there would be some sort of marriage between the computer and television which would be a critical platform for this so called “information superhighway”. Gates initially massively underestimated internet; in fact, Gates, along with two other Microsoft executives, published a book named “The Road Ahead” in mid-90s to elaborate his vision around “information superhighway” in which he only briefly discussed internet. Funnily, just after the release of the book, Gates realized his mistake and decided to add another 20k words to that book to emphasize the significance of internet and published a revised edition in 1996. This sudden change of mind was on full display in his seminal internal memo to Microsoft employees: “The Internet Tidal Wave” (some key excerpts from the memo below):

“I think that virtually every PC will be used to connect to the Internet and that the Internet will help keep PC purchasing very healthy for many years to come.

…Some competitors have a much deeper involvement in the Internet than Microsoft.

…A new competitor "born" on the Internet is Netscape. Their browser is dominant, with 70% usage share, allowing them to determine which network extensions will catch on.

…We have to match and beat their offerings

…I want every product plan to try and go overboard on Internet features.

…The Internet is a tidal wave. It changes the rules. It is an incredible opportunity as well as incredible challenge.”

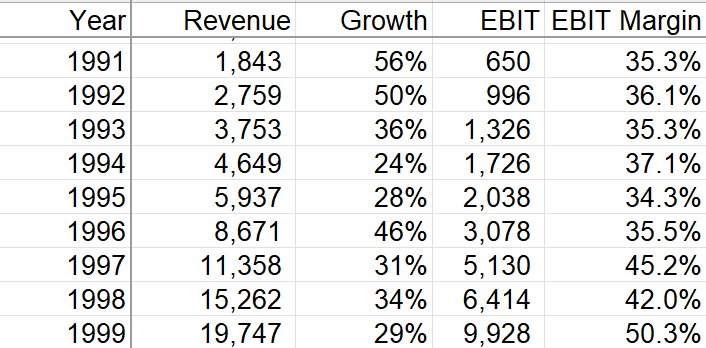

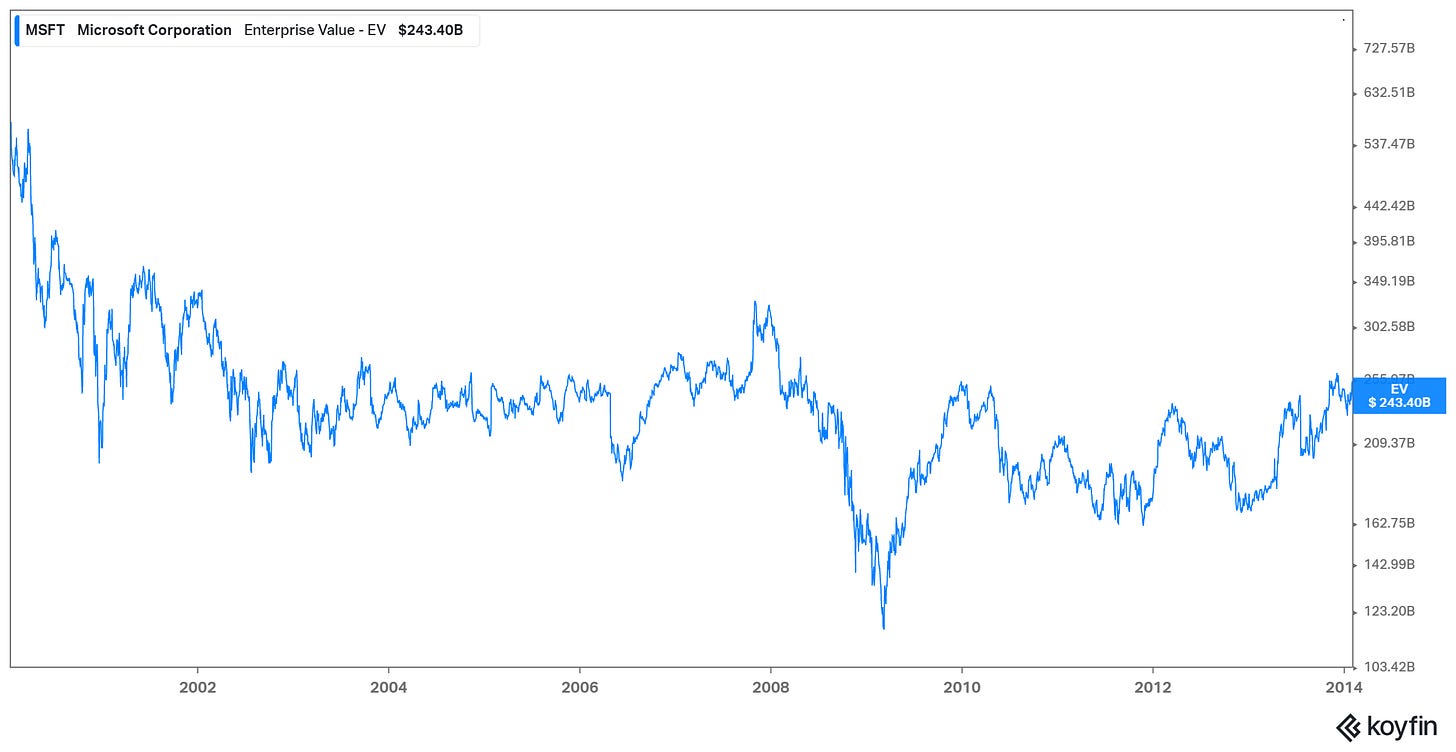

In addition to this tidal wave that could potentially capsize the Microsoft vessel, there was another big worry in the 90s. Microsoft was under intense scrutiny of regulators for its anti-competitive as well as alleged monopolistic behavior. As the company was under this regulatory scanner, it complicated their response to competitive threats. While all this was going on, Microsoft stock was on a different universe as it continued to ride PC momentum. In fact, just 12 years after its IPO, Microsoft became the largest market cap company in the world in 1998. While Microsoft was battling the technological transformation, competitive threats, and regulatory censures, Wall Street was still drooling over the seemingly never ending eyepopping topline growth and sky-high margins. Microsoft reached ~$20 Bn topline with ~50% operating margin in 1999. The next decade turned out to be diametrically opposite.

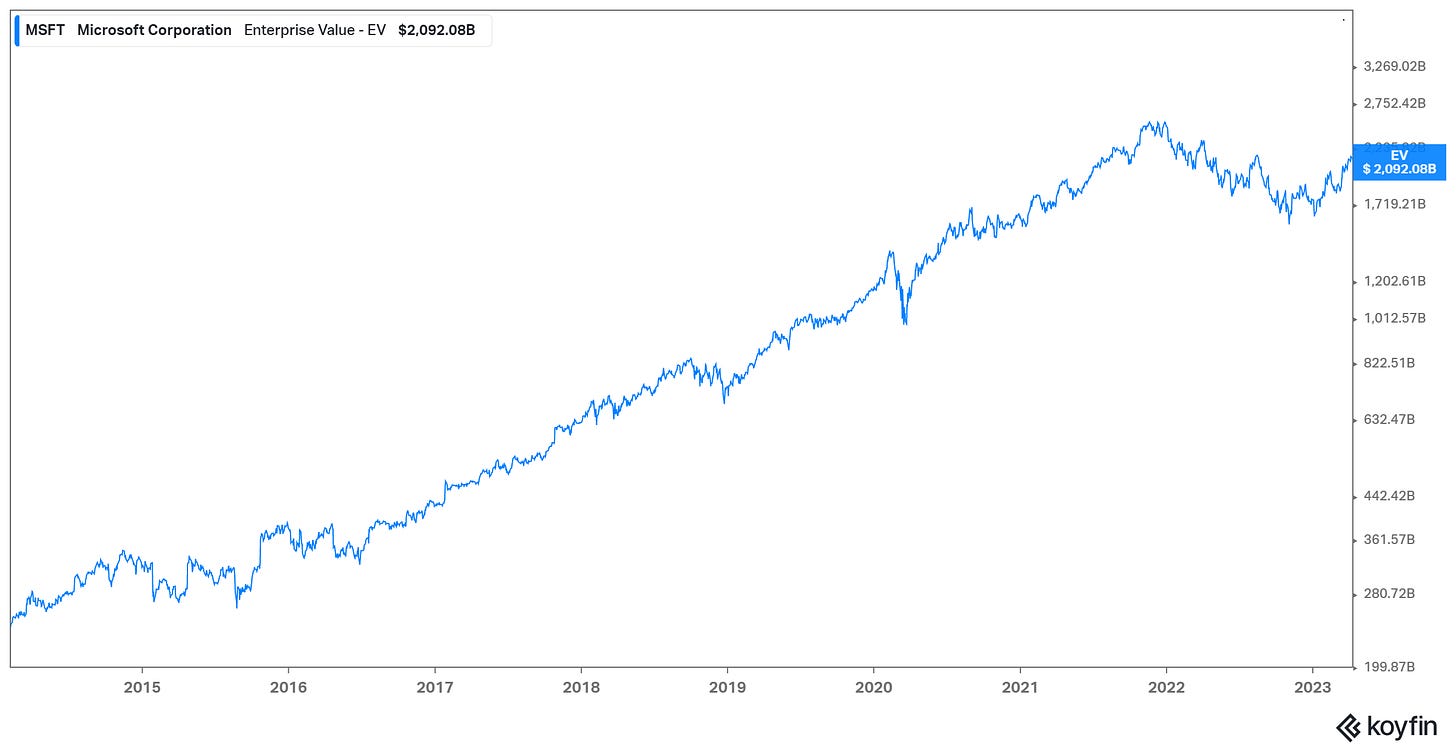

After Gates relinquished the CEO role in 2000, Steve Ballmer became the next CEO. I will keep the discussion on Ballmer era short which is perhaps most remembered for how he laughed at the launch of iPhone, missed the smartphone era only to exacerbate it later by acquiring the ailing Nokia, and nurtured a narrow vision of Microsoft’s future around Windows. When Ballmer became CEO in 2000, Microsoft’s Enterprise Value (EV) was ~$600 Bn; when he decided to retire in 2014, Microsoft’s EV was just ~$250 Bn, a stunning loss of ~$350 Bn EV over 14-year period.

Of course, it wasn’t Ballmer’s fault that investors were willing to pay ~30x revenue for Microsoft at the height of tech bubble just when he assumed the CEO role. Even if he got most of the things right, it would still be likely that Microsoft stock would have a lackluster first decade of the 21st century. Ignoring the stock price, if we just looked at operating performance, Microsoft’s performance during Ballmer era would seem far from a disaster. Nonetheless, the company stopped growing its earnings for four consecutive years (2011-2014) and operating margins went from ~50% in 1999 to ~32% in 2014.

Then came Satya Nadella. In some ways, Nadella had the opposite “luck” of Ballmer as the stock was trading at ~9x EBIT (vs ~60x in 2000) when Nadella became CEO. However, we would gravely underestimate Nadella’s contribution to Microsoft’s turnaround from ~$250 Bn EV to ~$2 Tn today in less than a decade if we focus too much on starting valuation multiples.

After this brief historical background of Microsoft, it is the Nadella era that is my primary focus of this Deep Dive. Here’s the outline for the rest of the Deep Dive:

Section 1 Microsoft’s Operating Segments: I start the discussion by outlining the different operating segments of Microsoft.

Section 2 A brief primer on Cloud: While Microsoft’s future is not solely tied to cloud, Cloud is indeed of paramount importance for shareholders today. Hence, I wanted to give a brief primer on Cloud.

Section 3 Competitive Dynamics: Even though Microsoft’s different operating segments may face different vectors of competition, the primary focus here are the hyperscalers in Cloud, competition in PC OS market, and Alphabet specifically for productivity software.

Section 4 Capital Allocation, Culture, and Management: I discussed Nadella’s influence in shaping Microsoft’s culture as well as the capital allocation and current incentive structure at Microsoft.

Section 5 Valuation/Model Assumptions: Model/implied expectations are discussed here.

Section 6 Final Words: Concluding remarks on Microsoft, and disclosure of my overall portfolio.