Readers' Feedback, and A Simpler Amazon Model

Disclosure: I own shares and January 2025 call options of Amazon

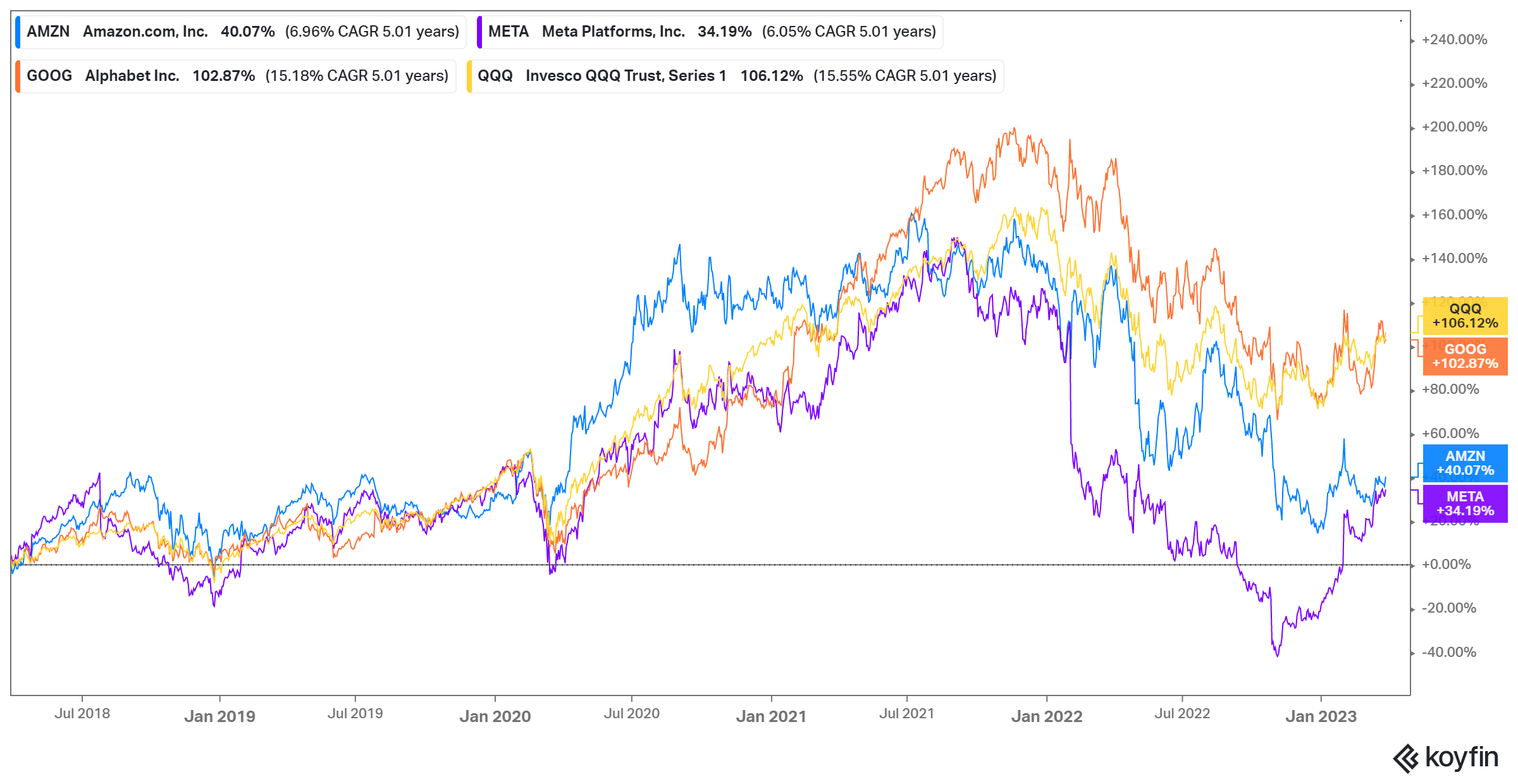

There has been a persistent misperception among investors who mostly observe Big Tech from a distance that Big Tech is "consensus" investment. But if you look at realized volatility in some of the Big Tech stocks over the last five years, you can sense a vigorous debate among the market participants.

Never have I sensed this debate more tangibly after posting my thoughts on Amazon over the last week. While my update on Meta (no paywall) and Alphabet attracted some feedback/debate from readers, my thoughts on Amazon led to a deluge of emails and messages; thankfully, it came from both sides of the table. Thank you for your thoughtful, incisive, constructive, and respectful engagement on Amazon. I have certainly learnt from these interactions; a decentralized feedback from smart, curious readers all over the world is exactly why I love my job so much!

Before I share some of these feedback from readers and my own thoughts on these comments, a couple of housekeeping notes: a) I will be in Washington, D.C. on Thursday and Friday (April 6-7) next week; if you're around and would love to meet, reply to this email to set up something, and b) I am currently working on Microsoft Deep Dive which I plan on publishing in late April (think sometime between 20th-25th of April). After Microsoft Deep Dive, I plan on covering a couple of mid-cap companies (<$20 Bn market cap) in May-June this year.

Okay then, let me now get into some of the feedback I received and how/why these interactions led me to change some of my assumptions on Amazon.