2022 Annual Letter

What a humbling year! I genuinely believe any investor *should* want to experience a year such as 2022 as early as possible in their careers. I will share some of my introspection later, but let’s start with some business updates.

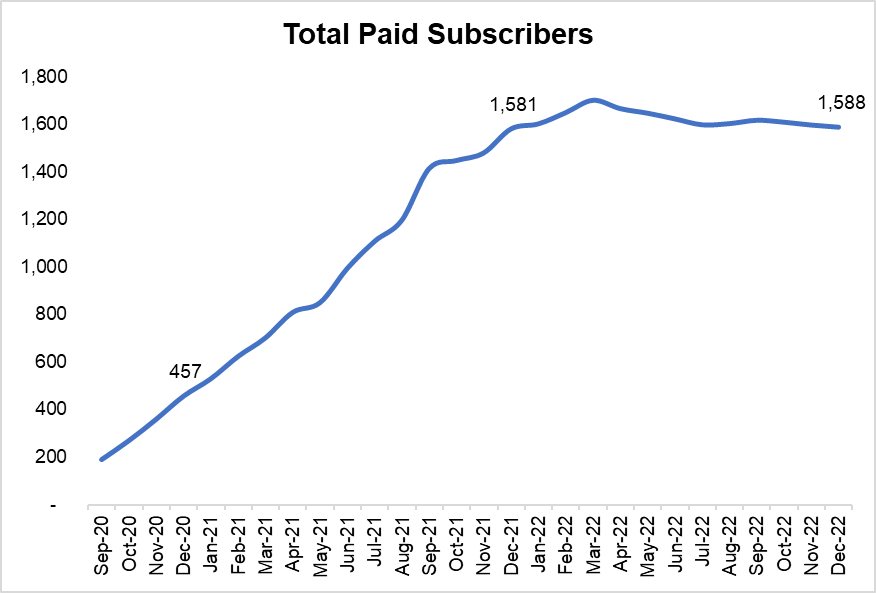

I’ll start with the good news. MBI Deep Dives is, so far, proving to be a reasonably resilient business amidst the skittish market environment. After the launch in September 2020, MBI Deep Dives had a bit of a meteoric start that defied my expectations. In retrospect, I was fortunate to launch MBI Deep Dives in 2020 as I could ride on the spike of interest in public markets. Now that we are on the other side of the cycle, subscriber growth has recently stalled. While gross bookings were +18.4% in 2022, it is likely to follow subscriber growth trajectory unless the subscriber growth returns in 2023.

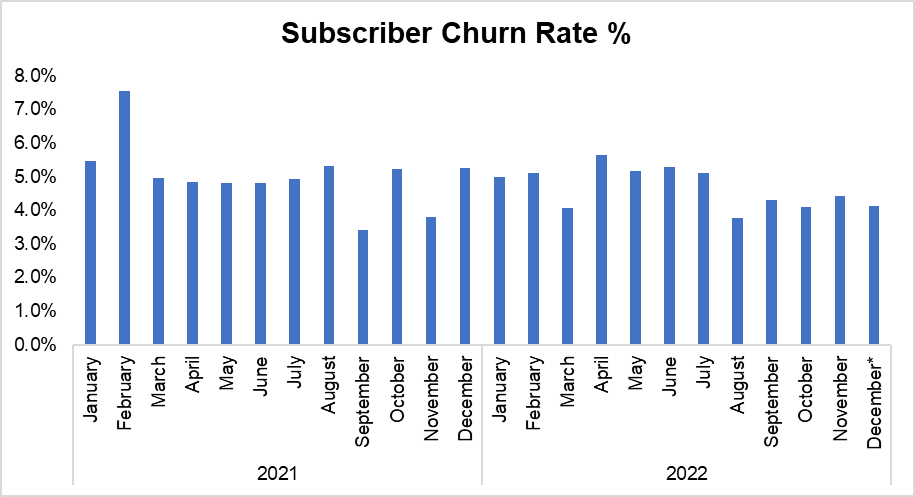

Why did the growth stall? Did churn see a spike in 2022? Not really. Average monthly churn in 2022 was 4.7% vs 5.0% in 2021.

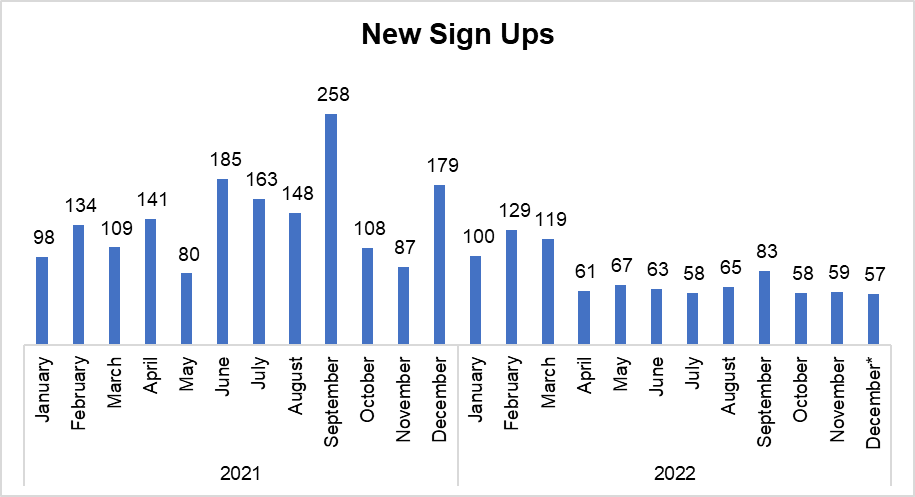

What really made the difference in 2022 was the new sign up. New sign ups have almost halved in 2022 vs 2021.

When I graduated from college in 2013, my first job paid ~$6k/year in Dhaka, Bangladesh (and that was a well-paying job in Dhaka!). In less than 10 years, I have found myself in a position that led to >30x income compared to my first post-college job. It’s really not just the income; but the joy of doing something that I truly enjoy makes me deeply committed to MBI Deep Dives. While I used to wonder about opportunity costs of focusing on MBI Deep Dives during its early months, I have developed a deep sense of affinity over time. MBI Deep Dives doesn’t feel like work to me; I think of it as my personal investing journal which I monetize to make a living and create a "perpetual" investing vehicle.

Who is paying to read my personal investing journal? Based on my recent survey, almost half of you are individual investors and the other half are professional investors (very similar to last year). The subscribers are from all over the world. Half of the subscribers are from the US, 21% from Europe, 12% from Canada, 10% from Asia, 3.5% from Latin America, 3% from Australia, and 1% from Africa. Annual subscribers are now 63.3% of overall subscribers (vs 54.5% in 2021).

Almost 75% of you came to know about MBI Deep Dives from Twitter. Given what’s going on at Twitter, it makes me uncomfortable that a supermajority of my audience comes from a single source. One of my mistakes in operating MBI Deep Dives has been not to focus on building a free subscriber list. It took me 20 months to correct this mistake.

Sluggish new sign-up growth is indeed a major hindrance for the health of the business. Every new sign up to me is more than just one subscriber when you incorporate the marginal propensity of sharing MBI Deep Dives content with their friends and colleagues. MBI Deep Dives has, so far, spent zero dollars in promotion. The only way it could grow was via word of mouth. Unfortunately, most people probably want to avoid talking or be oblivious about the stock market now. It also probably doesn’t help that of the 28 Deep Dives I published so far, many of them are experiencing drawdown larger than market itself, including some of the ones I was bullish about.

In my recent survey, I asked my subscribers how likely they are to recommend MBI Deep Dives to their friends and colleagues (on a scale of 1-10, 10 being extremely likely). ~30% of all respondents (n=203) picked 10; I drilled down further by different subscriber categories, but nothing quite stood out as the average for almost every possible category was closer to overall average. If you do enjoy my work and know someone who may also find it helpful, I will deeply appreciate it if you recommend this service to them.

|

Subscriber Category |

How likely are you to recommend MBI Deep Dives?

(10=Extremely Likely) |

|

Professional Investors |

8.44 |

|

Individual Investors |

8.26 |

|

Monthly Subscribers |

8.26 |

|

Annual Subscribers |

8.46 |

|

US-based Subscribers |

8.19 |

|

International Subscribers |

8.45 |

|

Overall Average |

8.32 |

Let’s talk about my lessons from investing this year. This year has been quite pedagogical not only for me but also for perhaps many investors out there. Unfortunately, schadenfreude has deluded us so much that there is perhaps very little time to look at the mirror and reflect our very own mistakes. I will take this opportunity to not philosophize mistakes in abstract or general terms and rather highlight my own three specific mistakes. Before I do that, I want to mention that I am careful not to self-flagellate too much during a downturn since that may lead to over extrapolation; as they say, don’t overlearn the last bear market. Therefore, this is, by no means, an exhaustive list of mistakes. I asked myself whether I would still consider something a mistake if the stock price were 50-100% higher today and I would consider the following ones mistakes regardless of stock price today or a year from now.

One of my mistakes was not modeling SBC correctly in the terminal year which I explained in my piece on SBC. My mistake on this point led me to think Autodesk to be trading at a much more compelling valuation in March 2021 than it actually was. I still believe SBC, in general, remains widely mismodeled and given how it is likely to remain a recurring theme in 2023, I strongly encourage you to read my short piece on SBC.

The second mistake is my apparent naiveté on Spotify’s ads business. I should have done a better job in analyzing and understanding Spotify’s right to win the advertising dollars. I didn’t quite ask probing questions on the profitability of the podcast business as I think I succumbed to perhaps an erroneous mental model of time spent and monetization. Meta and Google’s success in monetization perhaps bred this laziness among investors who are eager to assume attractive economics of any ad platform at scale. Although time spent and monetization is a decent Occam’s razor principle, I think it is lazy to assume success by default; just because Meta’s Family of Apps (FOA) and Google Search enjoyed ~50-60% operating margin doesn’t mean others can build attribution infrastructure anywhere close to what those companies have developed. Spotify can still potentially create a very successful ads business, but that won’t change the fact that asking those questions would have kept my enthusiasm in check when the stock was trading at $240.

Finally, as a Block shareholder, I really should have re-evaluated whether I want to give my capital to someone who tweets this:

Should I be surprised if in 5-10 years Jack wakes up thinking Block should not be a company too? Perhaps transferring money from one place to another should be a fundamental human right which needs to be provided with zero take rates? Jack, despite his hippy capitalist idealism, may be a pretty good Head of Product, but he does seem to be unfit to carry out his fiduciary duties as CEO in the public market. In retrospect, it is clear I was far too generous in accepting his quirky behavior amidst the height of the bull market.

As I already mentioned, this is, by no means, an exhaustive list of mistakes. Majority of my mark-to-market losses came from some of the big tech companies I own (Amazon, Google, and Meta). I don’t quite share the market's skepticism about the durability of the supremacy of these companies. Perhaps I am in denial, and there are indeed credible risks against each one of them. But amidst the bearish sentiment when we can suddenly sense risk everywhere, I am very much willing to underwrite certain risks.

Unfortunately, the risks I have been underwriting have been somewhat highly correlated and hence provided very little diversification benefit. Therefore, you can expect me to venture out to more sectors and industries in 2023 beyond what is traditionally considered “growth” or “tech” companies. The most recent Deep Dive on Sherwin Williams is a testament to that which I really enjoyed working on.

For MBI Deep Dives to thrive, I believe it is much more important for me to be a good investor first; it’s likely to be relatively easier to evolve from a good investor to a good operator in this business (not true for all other cases, I’m saying just for my own business). Being a good investor requires me to ask good questions, dig a little deeper, and think probabilistically to make good bets. Of course, I cannot just decide to be a good investor in one fine morning; it will require considerable time, patience, and embarrassing mistakes along the way. I am deeply grateful to have an intelligent, curious, and kind audience who are willing to engage in debates in a constructive way. It is an incredible privilege, and I will never take it for granted.

Happy New Year to all of you in advance. Thank you for your support.