2021 Annual Letter

I have been thinking about writing my annual letter to subscribers for quite some time. My initial plan was to write the letter during my trip in Nepal. With beautiful mountains in the background, I thought I would be able to summon a larger-than-life inspiration in myself. As a testament to the general unpredictability of life itself, I am now writing this letter confined in a small apartment in Kathmandu to satisfy my quarantine requirement as I tested positive for Covid.

Speaking of unpredictability, it indeed encapsulates the very beginning of MBI Deep Dives. For the uninitiated and/or new subscribers, I would like to tell the story.

Two and half years ago when I graduated from business school, my dream was to get a buy-side role. Since I was an international student in the US, recruiting was a tough slog as most of the discussions reached an impasse when my visa situation came to the fore. I could hardly blame them. Most buy-side teams consist of a handful of people and turnover in research teams is frowned upon in the industry. Since there was a high probability for me to leave the US, I was perhaps an unacceptable recruiting risk for most firms. I, however, kept at it and eventually found a job after my MBA.

As my work authorization expired in the US and could not be renewed, I became unemployed in the middle of the pandemic in 2020. For someone who came from Bangladesh and financed 100% of tuition via student loan, it was a nerve wracking experience. My wife is a PhD student at Cornell and thankfully, we could still pay rent and groceries via her scholarship.

In the meantime, something magical happened to me: twitter. Once the pandemic started, I became more active on fintwit, a community I thought was pretty cool, and was eager to be part of. I wrote this thread on “Facebook” which sort of blew up after Paul Graham retweeted it. My following grew from 500 to ~2.5K in just one day. It was the first time I started to appreciate the power of the interest graph. Paul Graham wasn't following me (and still doesn’t); yet somehow he came across my thread and thought it was interesting enough for a retweet. I told myself I should not underestimate the possibility of how far my writing could travel because of the interest graph.

As I kept writing, my following kept growing rapidly on twitter. Once I became unemployed in the US, my first plan was to move to Canada as a Permanent Resident (PR) and look for a job there. However, even though I applied for their PR program, the pandemic stalled the progress in my application. As I had no idea when I could possibly hear from the immigration office in Canada, I started to entertain alternative ideas. By August 2020, I had 15k twitter followers and although I could not legally work for someone else, I was getting a lot of messages from PMs/Analysts from different firms which made me think perhaps there is a potential demand if I launch an independent research service. I perused Scuttleblurb’s “2019 business update” and felt encouraged that this model could potentially work. Of course, if I still had my buy-side job at that time, I would think long and hard about opportunity cost and there is perhaps 99% probability I would just stick to my full-time job.

However, since my opportunity cost came down to zero, I thought there is very little to lose. Even if ~1% of my twitter followers subscribe, that’s enough to at least pay my student loan repayment every month. As you can see, there was never any grand plan before launching MBI Deep Dives. It was a mere survival strategy on my part and on September 1st, 2020 I launched MBI Deep Dives. On the very first day, I sensed I might have underestimated the potential for my service as ~1% of my twitter followers subscribed on the launch day. But since I kept the first two and half months of MBI Deep Dives free, I wasn’t sure how many of them would remain a paid subscriber when I would start billing them. It turns out there was indeed a product market fit with the vast majority of them!

To sum up, I became unemployed in July 2020, launched MBI Deep Dives in September 2020, and actually billed my subscribers from mid-November 2020. For four and half months since I had to leave my buy-side job, I made exactly zero-dollar income in a foreign country with very little idea what the future holds for me.

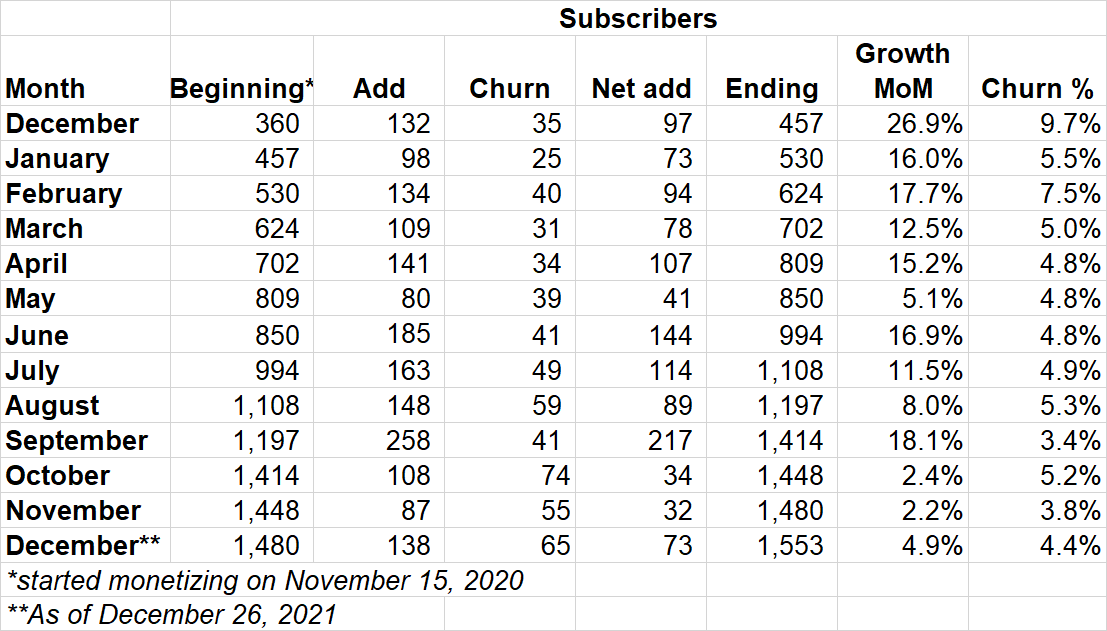

Today, MBI Deep Dives has 1,553 paid subscribers (~$168k net ARR), ~45% of which are monthly and the rest are annual subscribers. The subscriber base is almost equally divided between professional and individual investors. This is way beyond what I expected to be at the end of 2021. You have not only put food on my table but much more importantly, all of you in aggregate have freed me from much of the shackles of immigration laws. It is difficult for me to put into words how much the latter means to me and my family. My life has become immeasurably better ever since I could stop thinking about immigration laws/process while thinking about earning a livelihood.

In this letter, I would also like to highlight some of the weaknesses of MBI Deep Dives today and my optimism for the service in the future.

Each month when I start studying a company, I try my best to start from a beginner’s mindset. For example, take the most recent deep dive: Spotify. Before December 2021, I had a very surface level understanding of Spotify. Imagine a scale of 1 to 10 for understanding the business of Spotify, in which 1 indicates ignorance about the company and 10 indicates the knowledge equivalent to Daniel Ek’s. Considering Spotify is a relatively familiar company, I think I started from “2-3” on that scale. Every month, it requires an intense workload for me to travel from “1-3” to “6-8” within a month on this scale. There is hardly any doubt in my mind that my understanding of every company I write about is somewhat incomplete. I do believe it takes months (and even years) to truly understand a business. But writing in public creates an element of intensity which helps me compress this timeframe and still deliver a somewhat satisfactory result. However, because of the business model of MBI Deep Dives, it can be challenging to choose certain companies for deep dives. For example, I am nervous to take a shot at semiconductor companies (crypto is also another area of apprehension) since I suspect one month may not be enough to understand the complexity of the whole industry. In a nutshell, this is the crux of the weakness I identified for MBI Deep Dives. As a generalist, I am ramping up my understanding of several industries simultaneously. I believe the true benefit of being a generalist is realized over time and the initial phases of covering an industry are some of the most uncomfortable yet exhilarating periods of learning. I encourage my readers to keep these limitations in mind. But I can promise you that I am trying as hard as I can to be a better analyst/investor everyday!

I am determined to keep at it for a very long period of time. As I cover more and more companies, my breadth of knowledge will improve further and I hope it will allow me to do even better analysis in the coming years. 100% of my livelihood (ignoring capital gains from my portfolio holdings) comes from my work on MBI Deep Dives and I have always said no to consulting services to other funds as I want to remain razor-sharp focused in being my best possible version of analyst/investor and I will consistently push myself to test my limit as an investor/analyst. This, of course, cannot happen overnight and will take many, many years. I am fortunate to have found and met so many people through my work at MBI Deep Dives as well as my twitter account: Mostly Borrowed Ideas (MBI). I would like to thank Rishi Gosalia, Liberty, Jerry Capital, MI Capital (no longer active on twitter), Ali Imam, and many others who have become both friends and mentors over time. What excites me the most is I have been able to surround myself with people who are smarter, more experienced, and more savvy investors than I am today. Not only many of these people want me to succeed but I also have constantly felt a sense of affection from them. MBI Deep Dives is hardly a monolog for me; it is indeed very much a collaborative exercise through which I hope to learn this great game of investing! I am still just walking near the shores, and despite the challenge, complexity, and vicissitudes of investing, I am excited to look forward to a future which entails going deep to understand some of the best businesses in the world. I consider this a journey without any destination or expiration date!

Let me finish by reiterating how grateful I am to all of you for giving me this freedom to diligently study business after business every month. I do not take this for granted and I certainly do not have any sense of entitlement which is why I hope to try my best to earn your support every month.

I hope all of you have a wonderful holiday season and my very best wishes to each one of you for a healthy happy new year!