ASML: The Machine that Builds the "Machine God(s)"

You can listen to this Deep Dive here

“It is perfectly normal to feel dizzy in this place. Not because of the sterile air, but because the mere thought of the extremely complex tools needed to make the chips destined for the phones of the future can make you lightheaded. A machine invented in Veldhoven, manufactured with parts from all over Europe and shipped to chip factories in Asia and the US, where it produces silicon wafers full of processors and memory chips that, in just a few years, will end up in the palm of your hand.”

From the book Focus: The ASML Way (it is perhaps a required reading if you want to study ASML)

Indeed, I felt a little dizzy too even reading about the most complex machines mankind has ever built. I know almost everyone, including me, feels a little nervous about the fragility of semiconductor value chain these days, but while working on this Deep Dive, I at times felt that there is an inherent beauty in the fact that people from so many different regions, ethnicities, and beliefs play such an instrumental role in creating tiny little chips which in aggregate will perhaps one day create our own “Machine God(s)”. Europe’s biggest contribution to these “Machine God(s)” comes from a company started in 1984 in Veldhoven, a somewhat nondescript town in Netherlands.

This company was initially named “ALS”, but once they realized it could be misconstrued as the motor neuron disease, they rebranded to “ASM Lithography” and finally shortened it further to just “ASML” in 1996.

What exactly is lithography? ASML says in its annual report: “A lithography (more formally known as ‘photolithography’) system is essentially a projection system, with light projected through a blueprint of the pattern that will be printed (known as a ‘mask’ or ‘reticle’). With the pattern encoded in the light, the system’s optics shrink and focus the pattern onto a photosensitive silicon wafer. After the pattern is printed, the system moves the wafer slightly and prints another copy.”

I’m sure many of you are already probably feeling like Michael Scott!

Okay, let’s try again then. Imagine you have a stencil, like a piece of paper with a star cut out of it, and a flashlight. If you shine the flashlight through the stencil onto the wall, you see a big star made of light.

Photolithography is very similar, but it’s a magic projector that works backward. Instead of making the picture bigger, it makes the picture incredibly tiny. Scientists create a blueprint of the tiny wires that will go inside a computer chip. This blueprint is called a "mask." A big machine shines a very special light through the mask. As the light passes through, the machine uses powerful lenses to shrink the pattern from the mask until it is much, much smaller than a human hair. The tiny light pattern is projected onto a shiny disc called a "wafer." This disc is covered in a special coating that is sensitive to light. The light "draws" the pattern onto the wafer. The machine stamps the pattern, moves the wafer a tiny bit, and stamps it again. It does this over and over until the whole wafer is covered in tiny copies of the chip. I strongly encourage you to watch this YouTube video to visualize this process.

Don’t be fooled by the simple analogy; these machines are anything but simple.

As late as the 1960s, engineers used rudimentary methods like applying wax to etch simple circuits. However, as the number of transistors on a chip scaled from a handful to trillions, the components became infinitesimally small, making physical methods unfeasible. This led to a technological shift toward "etching with light," or photolithography. To pattern these microscopic features, the light used must be incredibly precise. This demand for precision has forced the industry to utilize ever-narrower wavelengths, pushing the technology far beyond the visible spectrum.

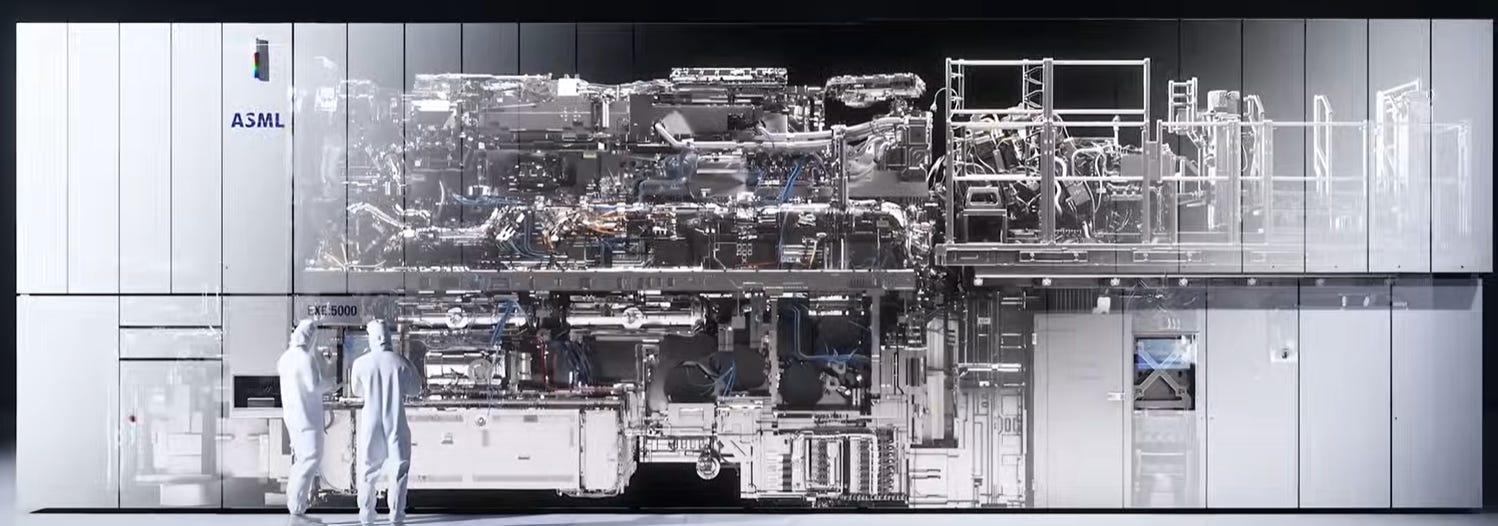

Today, the most advanced ASML machines are the size of a steam locomotive and requires seven Boeing 747s to transport to a chip factory!! If that didn’t raise your eyebrows, wait till you hear the sticker price for the most advanced lithography machines: 400 Million! Despite such price tag, these machines aren’t always perfect:

You may think a lithography machine with a price tag of hundreds of millions of euros would be able to make perfect copies of chip structures. Think again.

The mask, which carries the original image of the chip, does not leave an exact replica on the photosensitive layer. The chemical processes that occur on the wafer create rough and messy lines. However, with mathematical models, you can calculate how to shape the mask so that, despite these deviations, a pattern emerges that will transmit the electric signals on the chip without fault. You can compare it to the beauty filters on TikTok or Instagram, which correct the 'imperfections' on your face to make you look like a model. However, making a mask takes much more time than snapping a selfie, and it takes weeks for the pattern of the chip to be converted into a flawless image. (From the book “Focus: The ASML Way”

With 100,000 components doing a “tightly coordinated dance”, a lithography machine required a deep scientific understanding of optics, mechatronics, physics, chemistry, and who knows what else for ASML to get here. Like Boeing and Airbus, ASML outsources most components to focus on just designing the system and essentially become the orchestrator of one of the most complex, and yet tight-knit supply chains in the world.

Of course, ASML didn’t get here overnight!

Philips, the 19th century Dutch electronics giant, played a crucial and foundational role in the creation of ASML. In the early 1980s, Philips had been developing its own lithography systems, called "wafer steppers". They had developed a series of prototypes, but the project lacked the resources to become a commercially viable product. After facing the high costs of further development, Philips decided to spin off this activity. This led to a joint venture with ASM International, a chip-machine manufacturer, creating ASML in 1984. Philips provided the initial technology, intellectual property, and a team of engineers, which formed the core of the new company. The early years were very challenging, but focusing too much on those years is a bit beyond the scope of this Deep Dive.

ASML muddled through those initial years and reached profitability in 1993 and then went for an IPO in two years after being profitable. As you can imagine, there were few times in history more favorable than going public in mid-90s for a tech company. I went back to read their 1999 annual report which is perhaps the height of the frenzy for anything remotely related to tech. You could sense the unbridled optimism for the future and technology’s role in it in that 1999 annual report. Some excerpts:

…Today the artists for the most diverse applications are the lithography systems, patterning the structures in silicon to create integrated circuits.

Society today is seeing rapid innovation in the electronics industry with many new products and services coming on to the market every year. The rapid improvements in the performance of these devices are made possible by revolutions in the IC industry.

The structure of an IC resembles that of a building with multiple floors. Rooms compare to functional components like transistors, the corridors and the stairs to the interconnections between the components. A further analogy exists in building the ICs as they are built layer after layer (floor after floor). Lithography plays the key role in defining the precise structures to form the layers and hence the components.

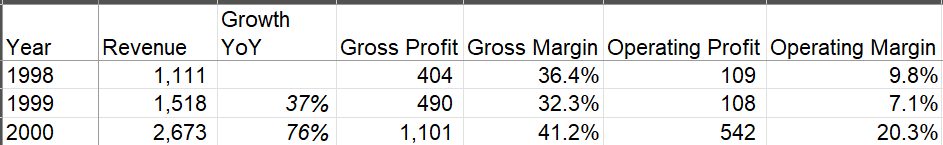

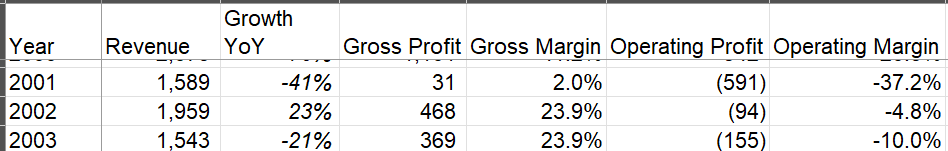

Of course, it is hard not to be optimistic about the future as their revenue grew from €1 Billion in 1998 to €2.7 Billion in 2000 and operating margin doubled from 10% to 20% in just two years! (Note: Since the Euro was introduced in January 1 1999, I have decided to show results only from 1998)

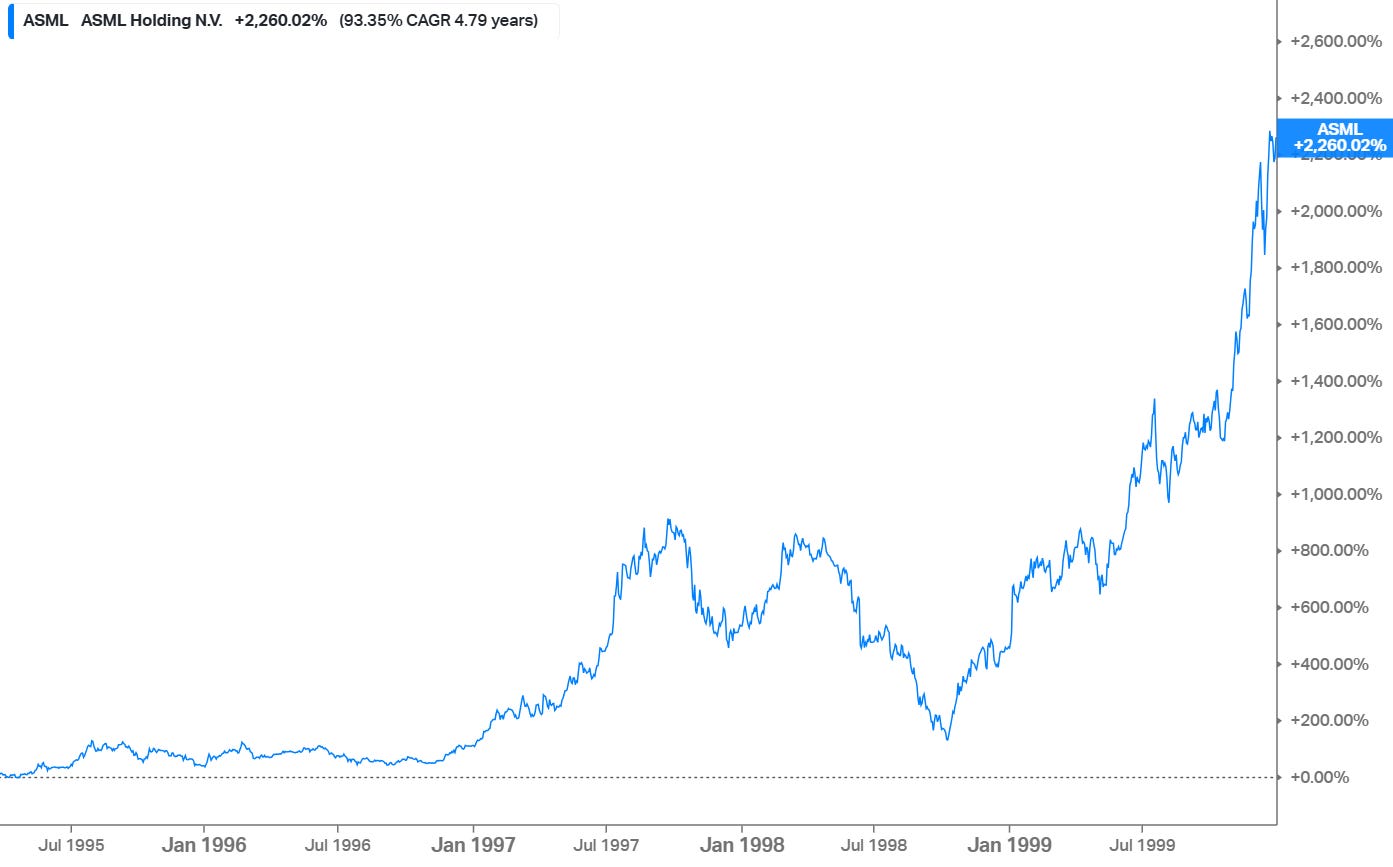

Accelerating topline and margins is obviously not just a recent love affair for investors; it is a timeless one! So, ASML stock was a cool ~23x in just five years since its IPO in 1995!

You can probably guess what happened afterwards. The lines do not go up and to the right unabated forever!

ASML was expecting to sell 700 machines in 2001. They could only sell 197! Customers started cancelling orders as the internet revolution increasingly seemed to be a temporary chimera. ASML had to take a massive inventory write-off, leading to an infinitesimal gross margin of TWO percent! ASML laid off 23% of their company and held on for their dear lives as they reported operating loss in three consecutive years!

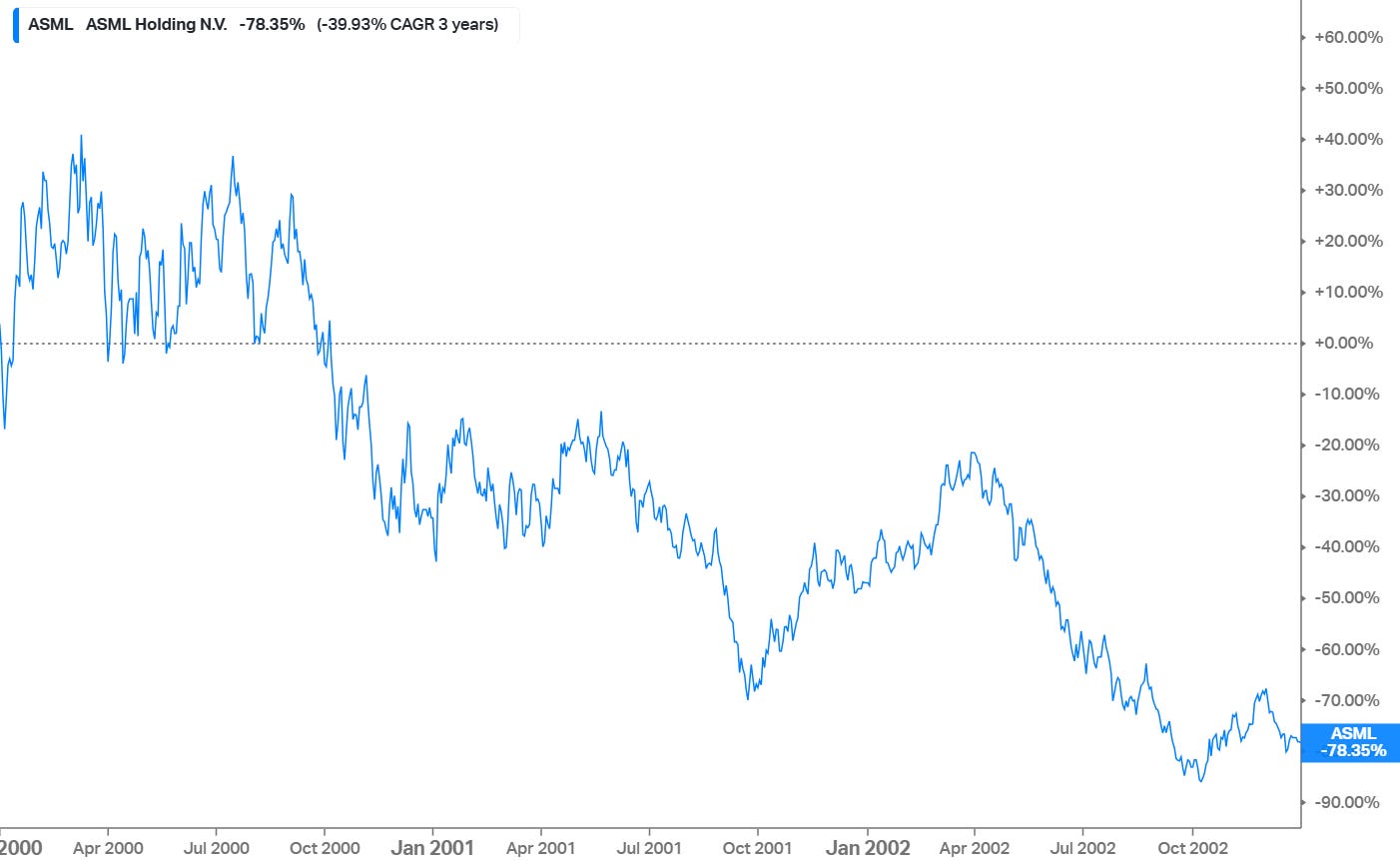

By the end of 2002, the summer of 2000 must have felt like a distant mirage for almost all tech companies! ASML shareholders experienced a brutal ~80% drawdown.

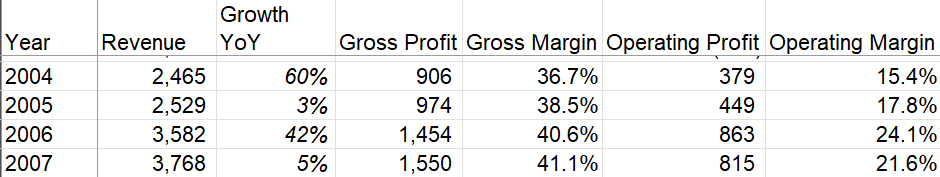

ASML did start to see light at the end of the tunnel as business came back to profitability in 2004. By 2007, ASML’s revenue was 40% higher than its revenue in 2000 and operating margin exceeded tech bubble’s peak.

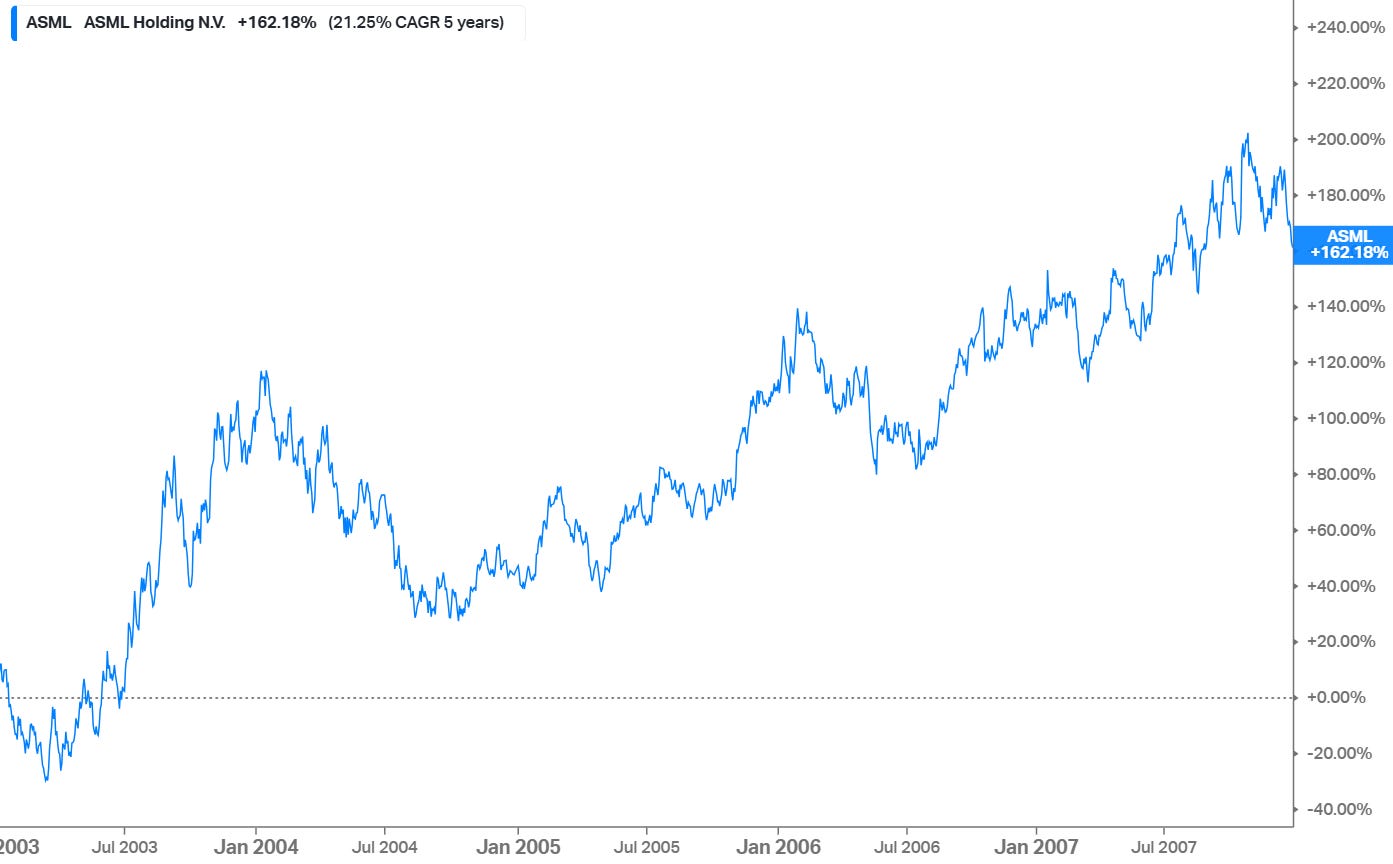

Predictably, stock prices have recovered from the dog days of 2002!

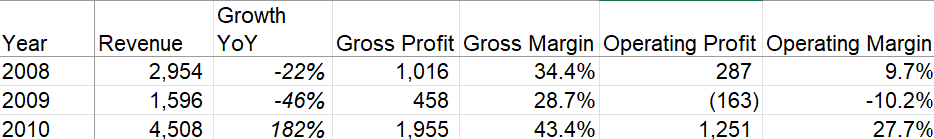

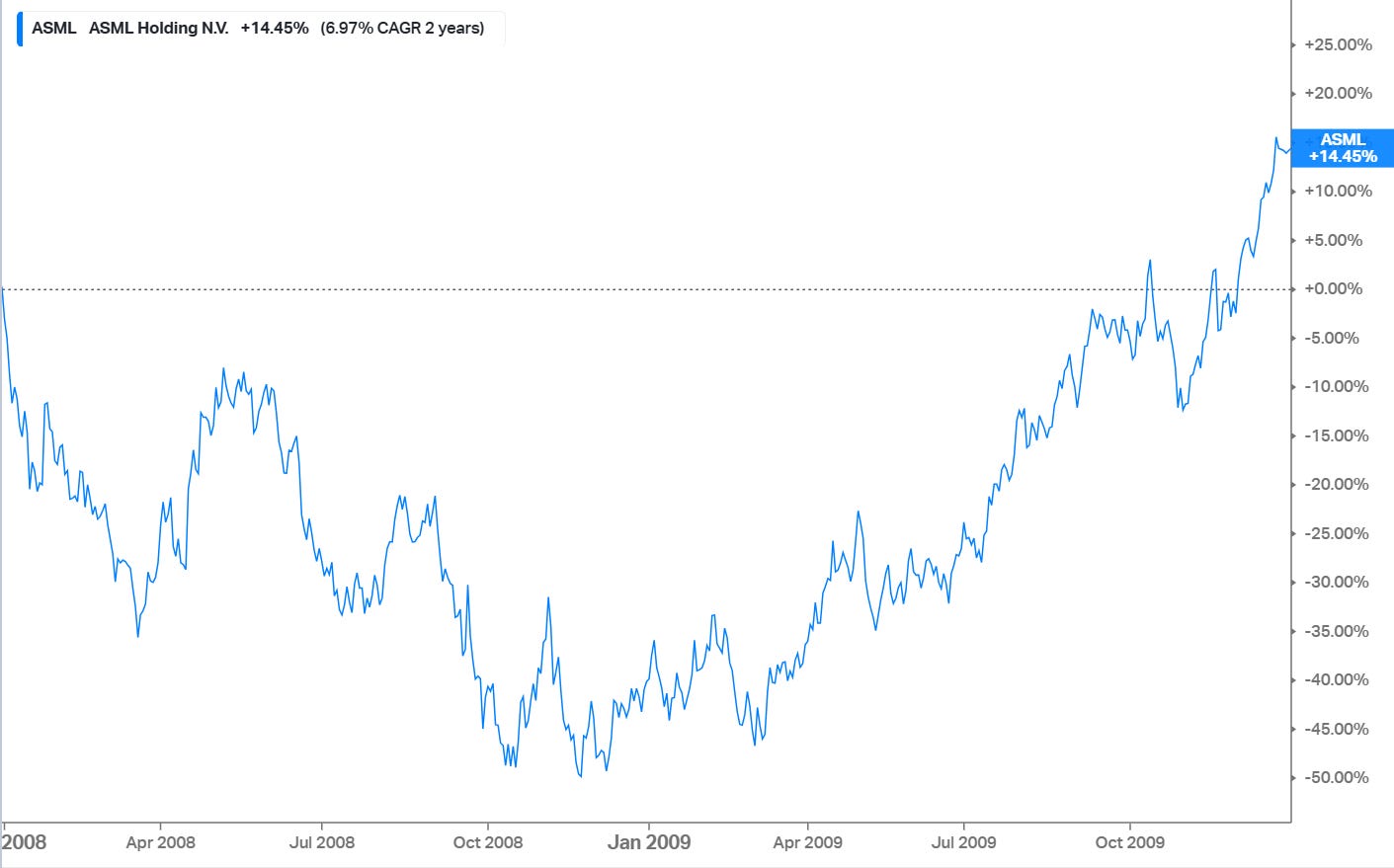

Then, of course the GFC happened. The entire world economy almost came to a halt; ASML revenue dropped by 46%! Just to put that into context, ASML’s 2009 revenue was 40% lower than their revenue in 2000. Ouch!

Thankfully, this was an intense but short-lived pain.

iPhone was launched and the promises of the internet was about to be fully unleashed through the smartphone and cloud revolution in the next decade or so. Business roared back in 2010 with operating margin reaching a new high.

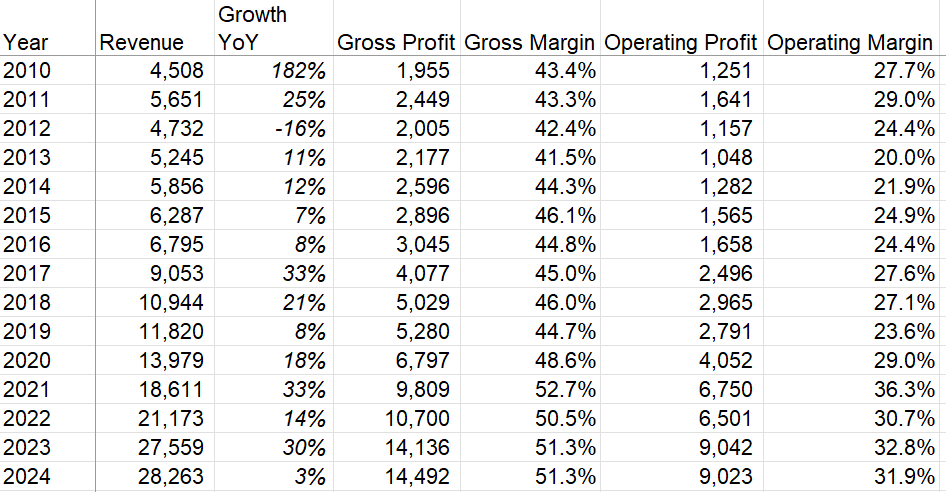

After the topsy-turvy 15 years in public market both in operating performance and stock price volatility, ASML more or less experienced one-way street in operating performance since 2010. There were some hiccups here and there (e.g. 2012) but none of them had any sustained bite.

ASML’s revenue increased ~18xed in the last 15 years! Their operating profit last year was the same as their revenue in…2017! As it turns out, being the monopoly of machines building the machine God(s) is a very, very good business!

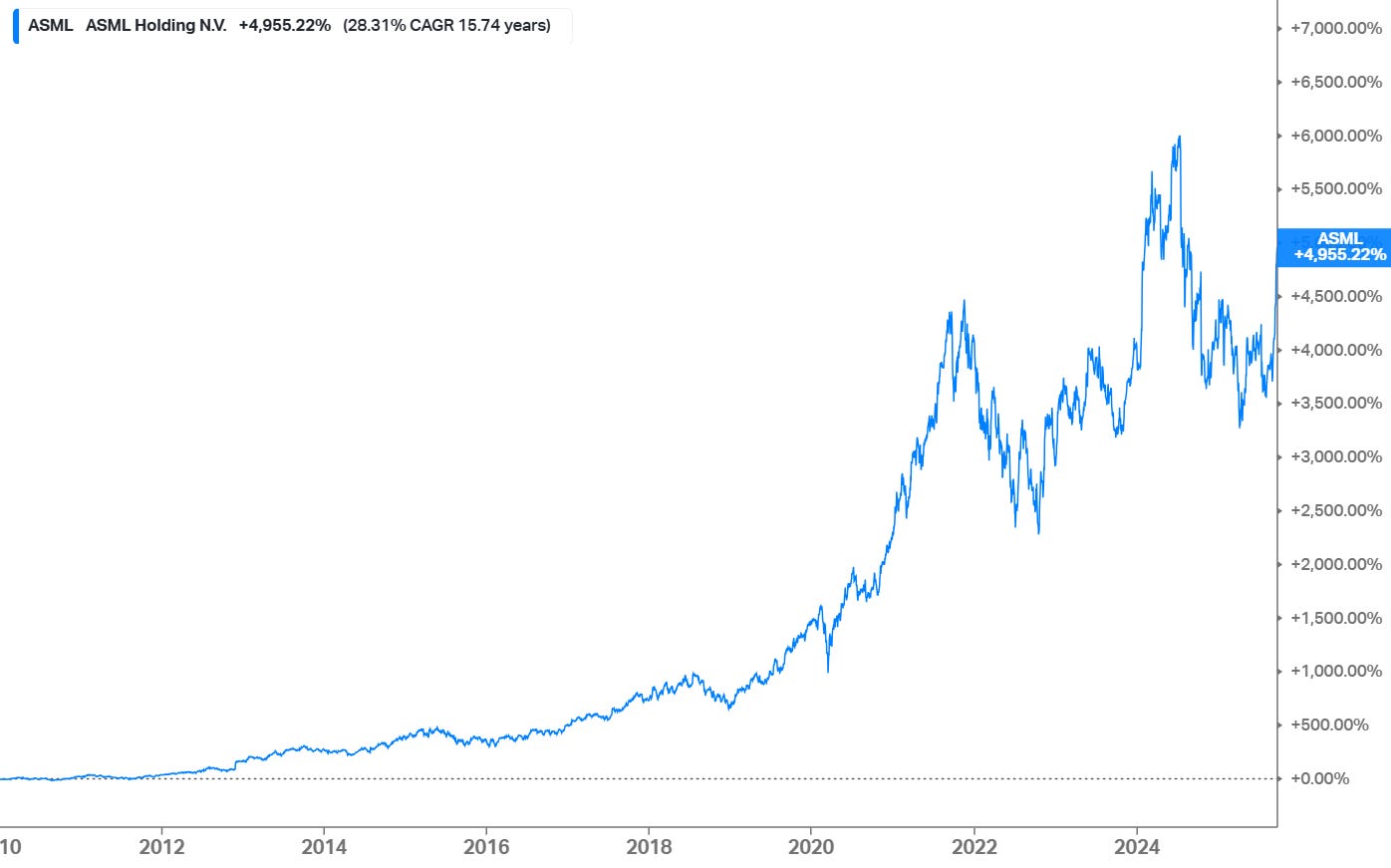

So, it’s no surprise that the stock did spectacularly well in the last decade and half; ASML stock was almost a 50-bagger during this period!

I like to do these historical operating performance and return trajectory to help you (and me) internalize how the march to greatness is anything but linear. Of course, investing is always about the future and to understand where we are heading, we need to have a deeper understanding of the present which I will dig into the Business Overview section. While the past is the foundation of where the business stands today, intricate details about the past is not going to be the primary focus in my Deep Dive. I do strongly recommend the book “Focus: The ASML Way” if you want to gain more in-depth understanding of the past. I have greatly enjoyed reading the book and excerpts the book will re-appear multiple times in this Deep Dive, but for the sake of brevity, I will largely skip the “past”.

After the business overview, I will dig into competitive dynamics and risk ASML faces today which will be followed by a discussion on their capital allocation and management incentives. As usual, I will share my model that tries to capture what expectations are embedded in current stock price. Subscribe to read the rest of the Deep Dive.

MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 63 Deep Dives here. Subscribers also receive one email everyday on topics/companies I am interested in.