Amazon 3Q'25 Update

Amazon reported a fantastic quarter yesterday. Not only AWS growth has accelerated, it does appear such acceleration may continue at least in the near term. Moreover, the rest of the business, especially the core e-commerce continues to be a secular winner.

Here are my highlights from yesterday’s call.

Revenue

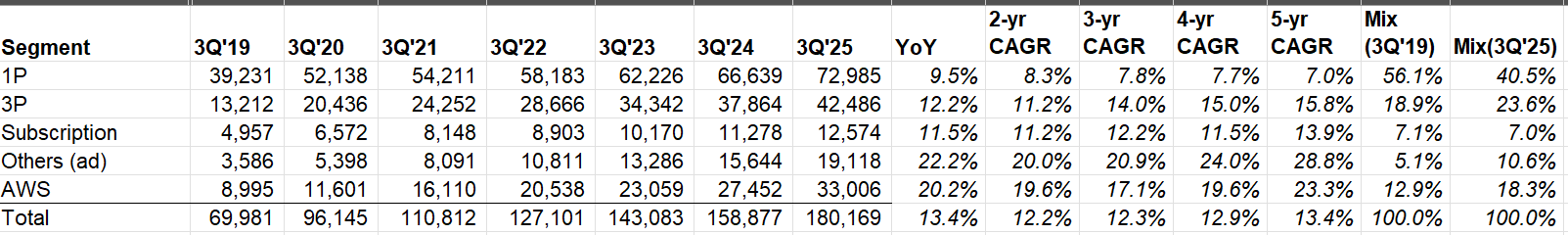

Overall revenue grew by 13.4%. After 10 quarters, AWS growth finally exceeded 20% again. Ads grew 22% (FX adjusted) YoY.

I’ll discuss more about AWS later, but let’s talk more about Amazon ex-AWS first.

Amazon ex-AWS

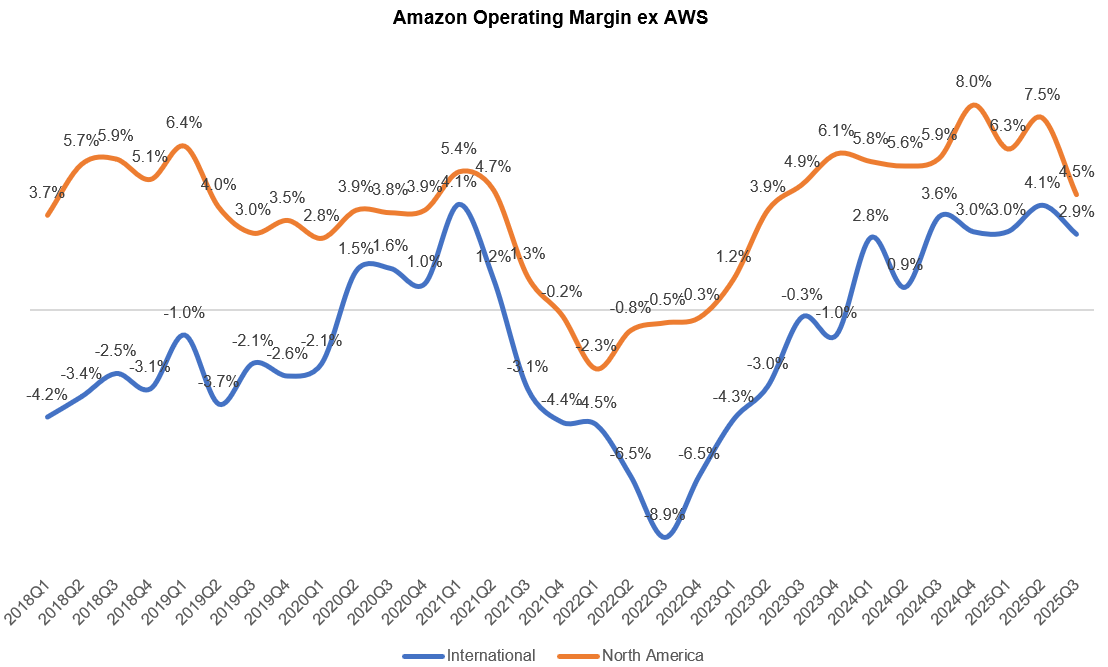

At first glance, it may seem North America and International segment’s operating margin took bit of a nosedive last quarter, but Amazon actually had two special charges: a) a legal settlement with FTC that impacted the North America segment, and b) their recent layoff related severance costs affected all three segments. Excluding these charges, North America would have 6.9% operating margin which was ~100 bps operating margin expansion YoY. While Amazon didn’t mention the exact number, international segment’s margin would also increase YoY after adjusting for the one-off charges. So, the margin expansion story is very much under way even if the headline numbers may appear otherwise.

It’s kind of incredible that while tariff took so much of airtime for much of this year for Amazon retail, the word “tariff” was not even mentioned once either during the prepared remarks or during the Q&A of the call.

Fulfillment+ Shipping

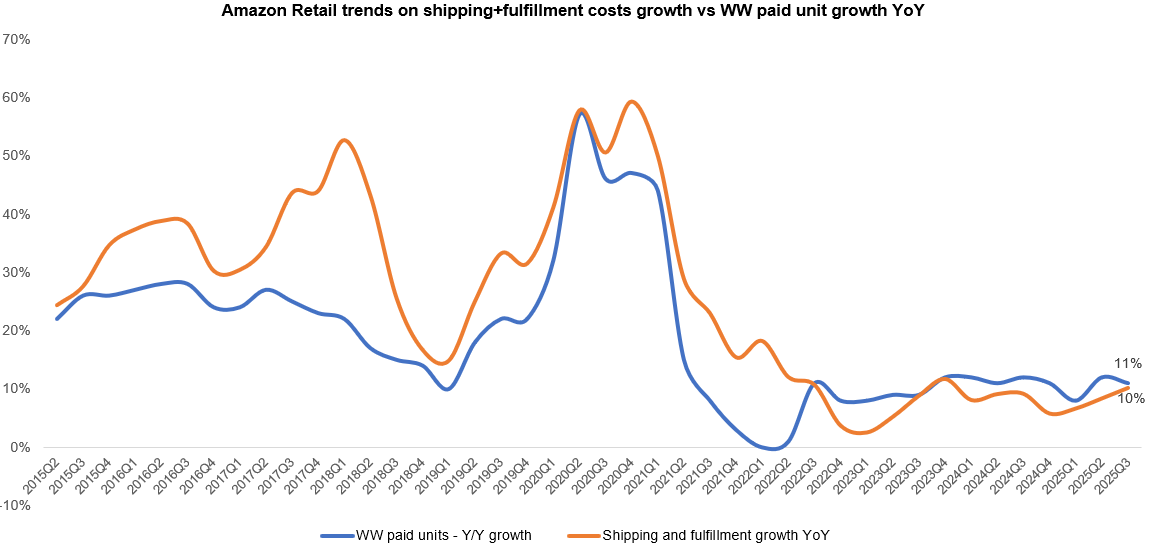

If you look at worldwide paid unit growth vs shipping+ fulfillment cost growth, you would notice that the latter used to consistently outpace the former pretty much all the time since 2015 until 3Q’22. Since then, unit growth has largely been faster than shipping+ fulfillment costs, indicating operating leverage in their logistics footprint. These two numbers were pretty close last quarter though, so maybe incremental margin expansion in retail segment will be harder from here.

The earnings call, however, increased my conviction that it is increasingly getting very, very challenging to compete against Amazon in e-commerce. Unless your name is Walmart or Costco, I really think you may suffer from insomnia in the next 10-20 years. Every year, Amazon’s shipping speed will get faster. Moreover, I imagine as the demographic cohort of millennials and Gen Z age over time, e-commerce penetration for everything will continue to increase. For physical stores that live and die by the assumption of ~2-4% SSS growth, Amazon may challenge such assumptions deeply in the next 10 years. Some quotes from the call:

“we’ve already increased the number of rural communities with access to our same-day and next-day delivery by 60%, reaching roughly half of the total communities we plan to expand to by the end of the year.

for the third year in a row, we are on track to deliver our fastest speeds ever for Prime members in 2025. We continue to tune and improve our fulfillment operations and our regionalized network is operating at scale. We see many benefits of our inbound process improvements, including a reduction of U.S. inbound lead time by nearly 4 days compared to last year. This allows us to be more efficient with our inventory purchasing, which benefits working capital. We’re also placing inventory more strategically throughout the network. And by leveraging our existing infrastructure, we’re now offering U.S. customers the ability to order perishable groceries and receive them the same day and as little as 5 hours.

We’re seeing positive early results since launching in January, when customers start shopping groceries on Amazon, they are visiting the site more often and returning twice as often as nonperishable shoppers.

we continue to experiment with various formats. But the one that we are most excited about is…the ability to provide perishable groceries with same-day deliveries…we started with a few markets about a year ago, and we were really taken aback at the adoption, not just the number of people that started buying perishables from us very quickly but how often they came back downstream to buy perishables and groceries from us in the future. And so we’ve now expanded that to 1,000 cities around the U.S. and will be in 2,300 by the end of the year. And it’s really changing the trajectory and the size of our grocery business.

As explained in my Instacart Deep Dive, I don’t quite think Amazon is existential threat to Instacart as Amazon cannot match Instacart’s (or Walmart’s) speed anytime soon. However, with robotics, over time Amazon can materially increase pick up speed that shoppers or other retailers cannot really match, and once the density of perishable demand forms, I can see how Amazon can take a decent bite in grocery in the long term. Given the early traction, Amazon does seem adamant in cracking the grocery market. There already seems to be pretty sizable demand in non-perishable groceries, so it may not be a long shot for them to encroach into perishable over time.

Amazon also shared some concrete data related to Rufus:

Rufus, our AI-powered shopping assistant has had 250 million active customers this year with monthly users up 140% year-over-year, interactions up 210% year-over-year and customers using Rufus during a shopping trip being 60% more likely to complete a purchase. Rufus is on track to deliver over $10 billion in incremental annualized sales.

Amazon was also asked about agentic commerce; while they do think it is quite promising in the long term, Amazon’s response made it clear that they think it’s way too early (I agree). From the call:

“search engines are a very small part of our referral traffic and third-party agents are a very small subset of that. But I do think that we will find ways to partner. We have to find a way, though, that makes the customer experience good. Right now, I would say the customer experience is not -- there’s no personalization. There’s no shopping history. The delivery estimates are frequently wrong. The prices are often wrong. So we’ve got to find a way to make the customer experience better and have the right exchange value. But I do think that the exciting part of this and the promise is that AI and agentic commerce solutions are going to expand the amount of shopping that happens online. And I think that’s really good for customers, and I think it’s really good for Amazon because at the end of the day, you’re going to buy from the outfit that allows you to have the broadest selection, great value and continues to deliver for you very quickly and reliably. And I think that bodes well for us.”

Advertising

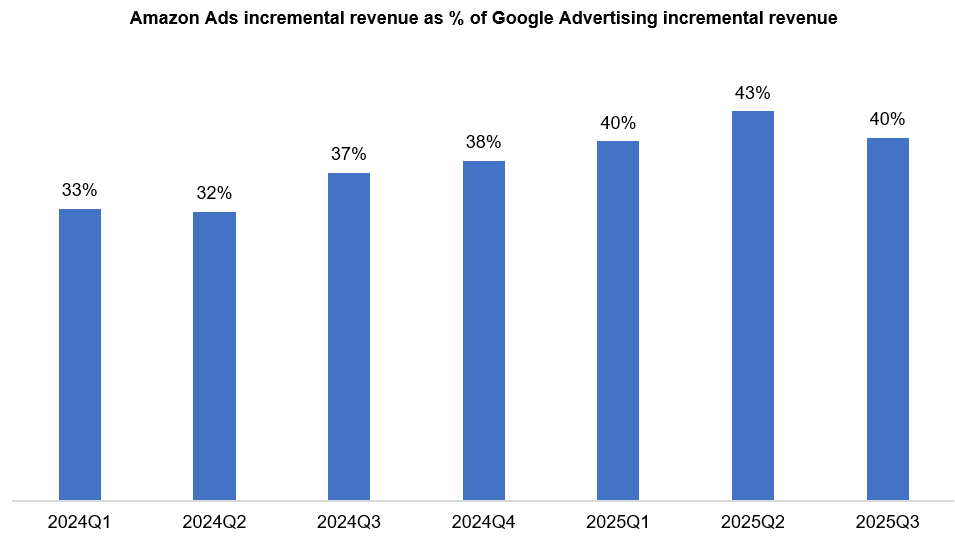

A big driver for retail profitability is advertising. Given Amazon ads are perhaps more of a competitor to Google than Meta, I think it’s interesting to track how Amazon is gaining share here.

While Amazon ads is still just ~24% the size of Google Advertising revenue, Amazon ads incremental revenue as a percentage of Google advertising incremental revenue was 40% in 3Q’25 (vs 37% in 3Q’24 and 43% in 2Q’25).

I will discuss AWS and the rest of this update behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 64 Deep Dives here.

AWS

Okay, now let’s talk about AWS.