Video on NotebookLM, Amazon's response to WSJ, Brown & Brown 2Q'25

I have been using NotebookLM pretty frequently for the last 6 months or so. It’s pretty neat to feed a report to NotebookLM and make a podcast out of it which I can then listen during my daily walk. Yesterday, they launched video feature. So, now I can feed a report and make a “video podcast” out of it. I decided to try the feature by feeding my most recent Cognex Deep Dive, and I was quite impressed with the output. See it in action below:

I was so impressed with the feature that I have decided to launch a YouTube channel for MBI Deep Dives. I will basically feed my daily updates to NotebookLM, generate a video, and then upload it on my YouTube channel.

This is a great showcase of Google’s strength. A neat feature that its billions of users can utilize and then be shared across Google owned surfaces. Content will be created once and then repurposed across all the possible mediums and then users can just choose the medium they prefer to consume the content. No expensive software tools are necessary at least for casual consumer use cases in the entire creation process…imagine the consumer surplus!

Amazon’s response to WSJ piece on raising price post-tariff

A week ago, I wrote about a WSJ piece that looked into ~2,500 items and compared the price changes from January 20 to July 1. I did mention “Amazon has millions of SKUs. An analysis looking at even 2,500 items may not be representative of overall data, so I am not sure I want to extrapolate too much here.”

It turns out Amazon was not pleased with WSJ’s analysis as they responded with a scathing tone:

“The WSJ’s article about Amazon's pricing practices isn't just flawed—it seems fundamentally misleading by design. Amazon offers over 6 million everyday essential items, yet the WSJ focused their story on just under 2,500 low-priced everyday essentials products—less than 0.04% of our everyday essentials selection. This isn’t responsible sampling; it's surgical cherry-picking

If the WSJ had averaged prices for their subset of about 2,500 products across the months of January and June, they would have found that over 92% had either no price change or a price decrease.”

The reality is this was always going to be very difficult analysis to be confident about for any outside observer given the sheer number of SKUs Amazon has. I liked Byrne Hobart’s take on this issue:

there are still retail business ambiguities at work here that make the overall picture hard to read. Retail economics are driven by cross-elasticities—if you bought X, does that make you more or less price-sensitive when buying Y? So in some categories, Amazon might be keeping prices constant, but highlighting the deal to fewer customers, because the product in question is either a newly-expensive way to drive sales for other products or because the complementary sales it leads to are now lower-margin. So the mix of loss-leaders presented to customers might skew towards lower-tariff goods, while Amazon can keep the price of tariff-affected goods fairly low and sell them mostly to customers who are specifically looking for them. There's probably an Amazon-specific CPI that the company can calculate internally, though it wouldn't be that important a number for them to know compared to the more granular price changes that actually drive revenue. And if someone's outside of the company and doesn't know what calculations go into determining what offers they put in front of their customers, it's impossible to know what overall price levels on the site are really doing.

Brown & Brown 2Q’25

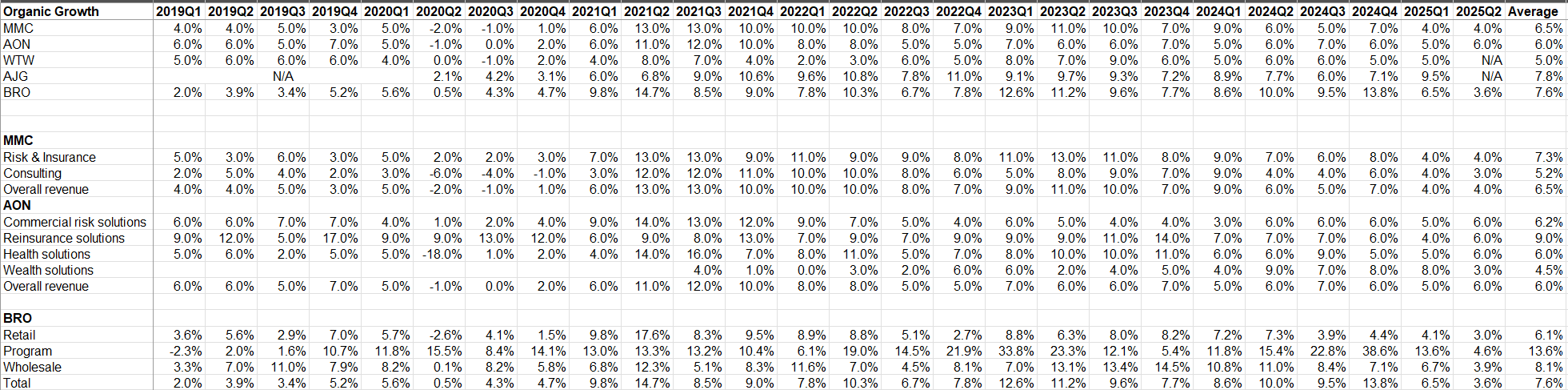

Brown & Brown (BRO) had bit of a soft Q2 as they reported organic growth of only +3.6% in 2Q’25 which was lower than both AON and MMC. I do want to note that BRO’s comp was pretty challenging as 2Q’24 organic growth was +10.0%. However, comp for the next couple of quarters is also fairly challenging as 3Q’24 and 4Q’24 organic growth was +9.5% and 13.8% respectively.

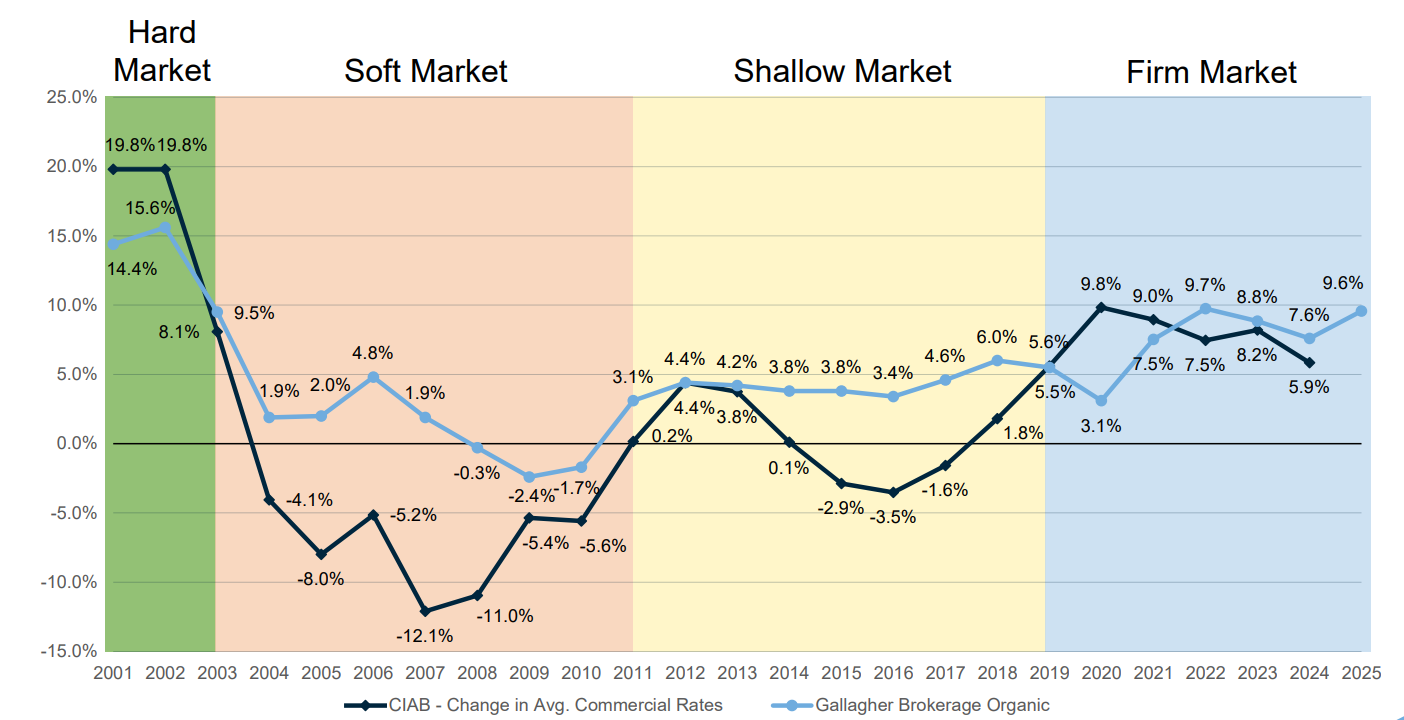

As discussed in detail in my BRO Deep Dive, insurance brokers are not immune from P&C pricing cycle. Even though BRO’s average organic growth was +7.6% during 1Q’19 to 2Q’25 period, they posted +3.7% organic growth during 2019-20 period but +9.9% during 2021-24 period.

After listening to AON, MMC, and BRO’s earnings calls, it does seem we may be exiting “firm market” cycle in P&C insurance industry. Here’s what BRO management said in the call:

So based on the consensus of what we were going to grow in Q2 in Retail versus what we delivered, over half that discrepancy was because of rates, so downward pressure on rates. The other half is we basically just had lower new business in the quarter. And so sometimes that can happen. I feel that we have good new business going into the third quarter, but it -- every quarter is a little different, and our visibility into it seems to indicate that we are in good shape for Q3. But I just want to make sure that everybody understood that over -- more than half the discrepancy was because of rate pressure.

Later in the call, J. Powell Brown expanded on the cycle:

This is a classic cycle -- and I've only been doing this for 35 years, and I've seen this rodeo a couple of times. And as you know, pricing, particularly in the case of property, typically goes up very rapidly. This is E&S. I'm just using the E&S market as the example. And then it can come down rapidly.

…And so what you have is you have more pressure today than we have seen. And so there's been a long period of upward pressure on property rates. And depending on your perspective, but if you look at it from our customer standpoint, it is very good for the customers, but it does put pressure on organic growth on any business in the industry. But if you had a lot of property, and we had a lot of property in the Q2, there -- you see it more clearly.

…I don't want to give you the impression there's some, oh, this is a weird thing. We've never seen this or absolutely not. This is exactly what we expected. I expected it to happen a year ago personally. But again, what you heard me say and my mistake, we -- it surprised us in the speed of decline in Q2 and particularly in the latter part of the quarter. That's the difference that we're talking about, not that we were surprised by the decline. It was the speed of it.

You can imagine the stock didn’t respond too well following the earnings. I was lucky to have sold my shares in March this year at $120/share. Since then, BRO has noticeably underperformed the index. I will share behind the paywall what I’m thinking about BRO now.

In addition to "Daily Dose" like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 61 Deep Dives here.

Prices for new subscribers will increase to $30/month or $250/year from August 01, 2025. Anyone who joins on or before July 31, 2025 will keep today’s pricing of $20/month or $200/year.