Waymo's Surge

In May 2023, Waymo was doing just 10k commercial public rides per week. Then exactly a year ago, Sundar Pichai disclosed Waymo was doing 175k rides per week. Yesterday, this tweet indicated weekly number of rides has now shot to 450k, growing 157% YoY!

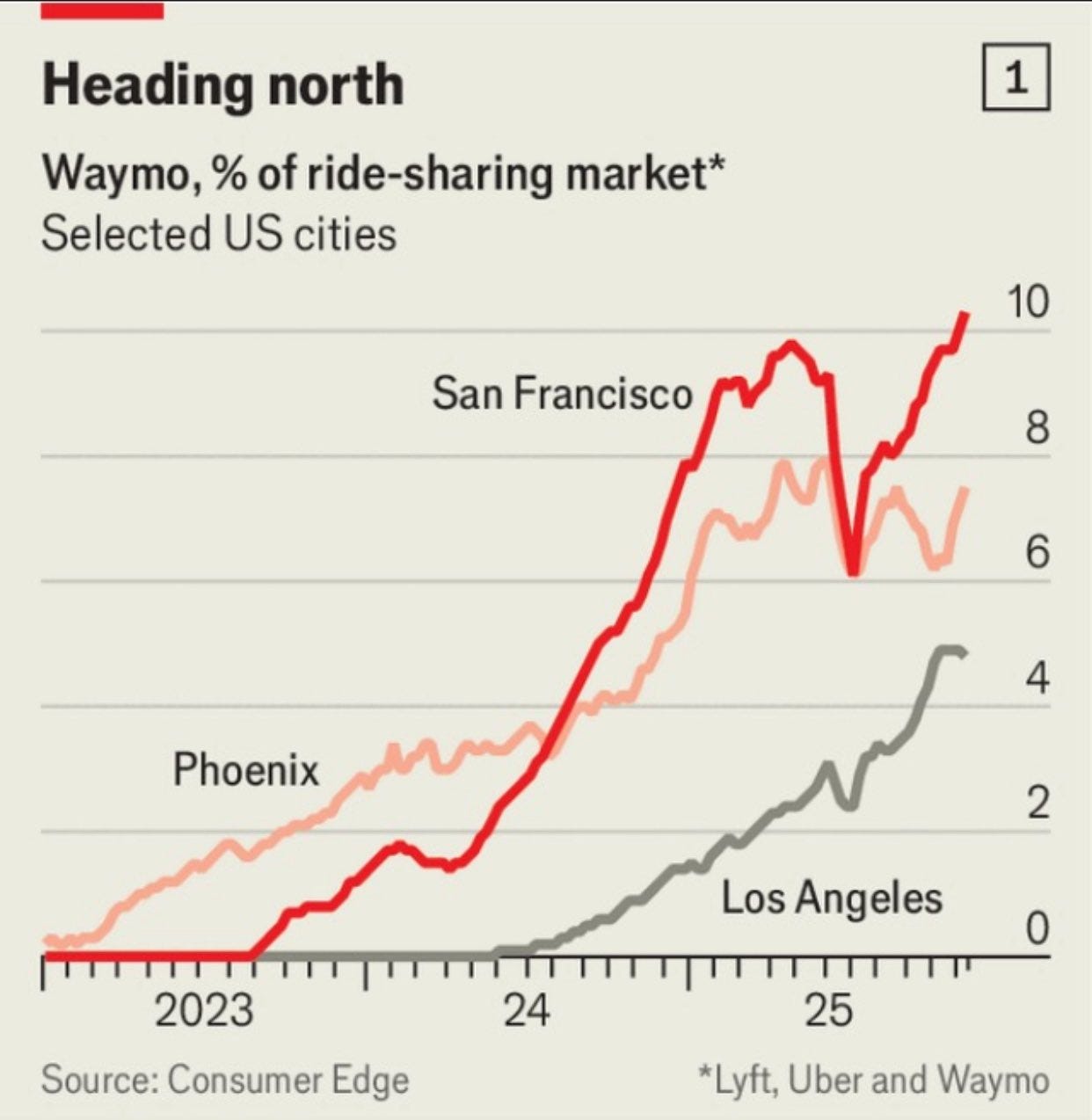

Of course, Waymo is still only available in handful of cities. But in cities they are operational for a while, their market share gain seems to be one-way street!

Even for the cities where Waymos are currently available, Waymo is further geofenced to a fraction of the overall city. As a result, their true market share in those markets need to be further adjusted for their actual availability. In April 2025, Bond Capital cited Yipit data to show Waymo went from 0% market share to surpass Lyft’s market share and reach 27% in just 20 months in Waymo’s San Francisco operating zone. Remember, this was back in April when Waymo was doing 250k rides per week. Since current weekly ride is ~80% higher, Waymo may have continued to gain market share.

Given that Waymo captured this market share with just 1,000 cars in SF operating zone, should Waymo launch more cars here to keep increasing market share? Not so simple! You cannot build the supply with peak demand in mind since that will add to a pesky little problem called deadhead miles which refers to the distance the vehicle travels without carrying any paying passenger, essentially driving empty to get to the next pickup, or reposition to areas where pickups are more likely.

California Public Utilities Commission (CPUC) further breaks deadhead into two segments:

Period 1 (P1) is the period of time after a driver logs into a TNC application but is not yet matched with a passenger. During this time period, the driver awaits a ride request through the TNCs; (TNC= Transportation Network Company)

Period 2 (P2) starts when a match is made and accepted by the driver, but before the passenger has entered the vehicle. During this period of time, the driver is en route to pick up the passenger

What does Waymo’s deadhead miles look like? CPUC data shows 51.5% of total Vehicle Miles Traveled (VMT) was deadheading back in January 2024. As the density of demand picked up, deadheading came down to 44.3% of total VMT in September 2025.

How does that compare against Uber or Lyft? This paper suggests for ridesharing apps such as Uber/Lyft, deadheading ranged between 36% and 45% in different cities. So, Waymo in California is getting pretty close to average Uber/Lyft deadheading. But the deadheading constraint also indicates that Waymo cannot really inject more vehicles in their operating zones without risking a material increase of deadhead miles. Driverless Digest highlighted this trade-off in their piece:

Ideally, P1 should be as close to zero as possible, since all you’re doing in that period is waiting for the next trip. With a fixed fleet size though, Waymo may be forced to reposition more after drop-offs — or simply keep moving because there aren’t many legal places to wait. At a high level, the data suggests their fleet spends a lot of time driving around between trips while waiting for a request, rather than staying put, which is why P1 miles remain so high.

In the long term, AVs should do better than traditional transportation network company or TNCs, as explained by Matthew Raifman:

AV fleets should be able to best TNCs on deadheading, though. Predictive routing is a challenging one to solve, but human fleet TNCs have to motivate their drivers to go where the modeling suggests they should be for efficiency. That generally takes some monetary investment from the TNC. Sometimes that’s worth it (e.g. end of a baseball game perhaps); sometimes it is not (a brief uptick in demand from a club). Waymo, and other AV fleets, do not need to consider driver motivation. They can just allocate vehicles to where they think demand will be.

Nonetheless, the current high mix of deadheading can exert a lot of pressure on Waymo to slow down scaling. Is the rational play “multi‑channel”: use Uber/Lyft AND Waymo app simultaneously in all the markets, especially given the high upfront fixed costs and low marginal costs involved?

In more mature zones (SF downtown), Waymo is already constrained more by road geometry and peak‑hour spatial mismatch than by lack of demand. You’ll still deadhead between the residential peak origins and entertainment/office peak destinations. If Waymo is available on all ridesharing apps, they will probably lower deadheading by 10-15 percentage point max which does ease pressure in the short term. But making Waymos available in all markets can prove to be suboptimal long-term strategy since Uber/Lyft own the customer, and own the price. Partners are much more useful to launch faster and fill early capacity, especially where brand awareness is low. But in the long term if Waymo’s technology and regulatory approvals remain a differentiating factor, it will be surprising to me if Waymo doesn’t lean more towards owning the customer relationship. Right now, they are partnering with others in different permutations and combinations in different markets, perhaps only to find the data necessary to lean towards the best long-term strategy.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 65 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

I did make a small change yesterday which I will mention behind the paywall.