Spotify's Teachable Moments

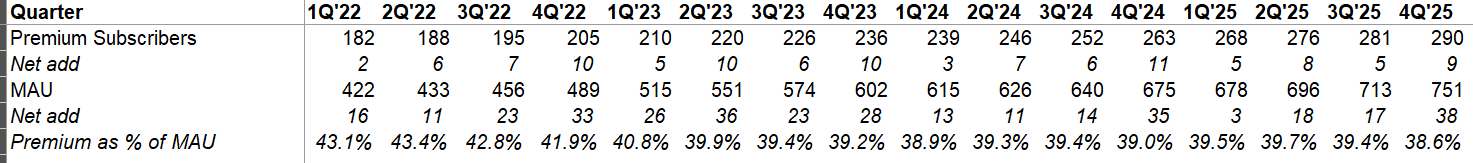

Spotify launched its premium subscription plan back in 2009 and it took them nearly a decade to reach the milestone of 100 million premium subscribers back in 1Q’19. It took them 16 quarters to add the next 100 million premium subscribers. As they are set to reach 300 million premium subscribers by 2Q’26, they are going to add the next 100 million premium subscribers even faster. Despite such growth, Spotify emphasized that only ~3.5% of the world currently subscribes to their service and even though they’re not a monopoly, they still see a path towards ~10-15% of world’s population as their premium subscribers which implies ~3-5x of their current subscriber base.

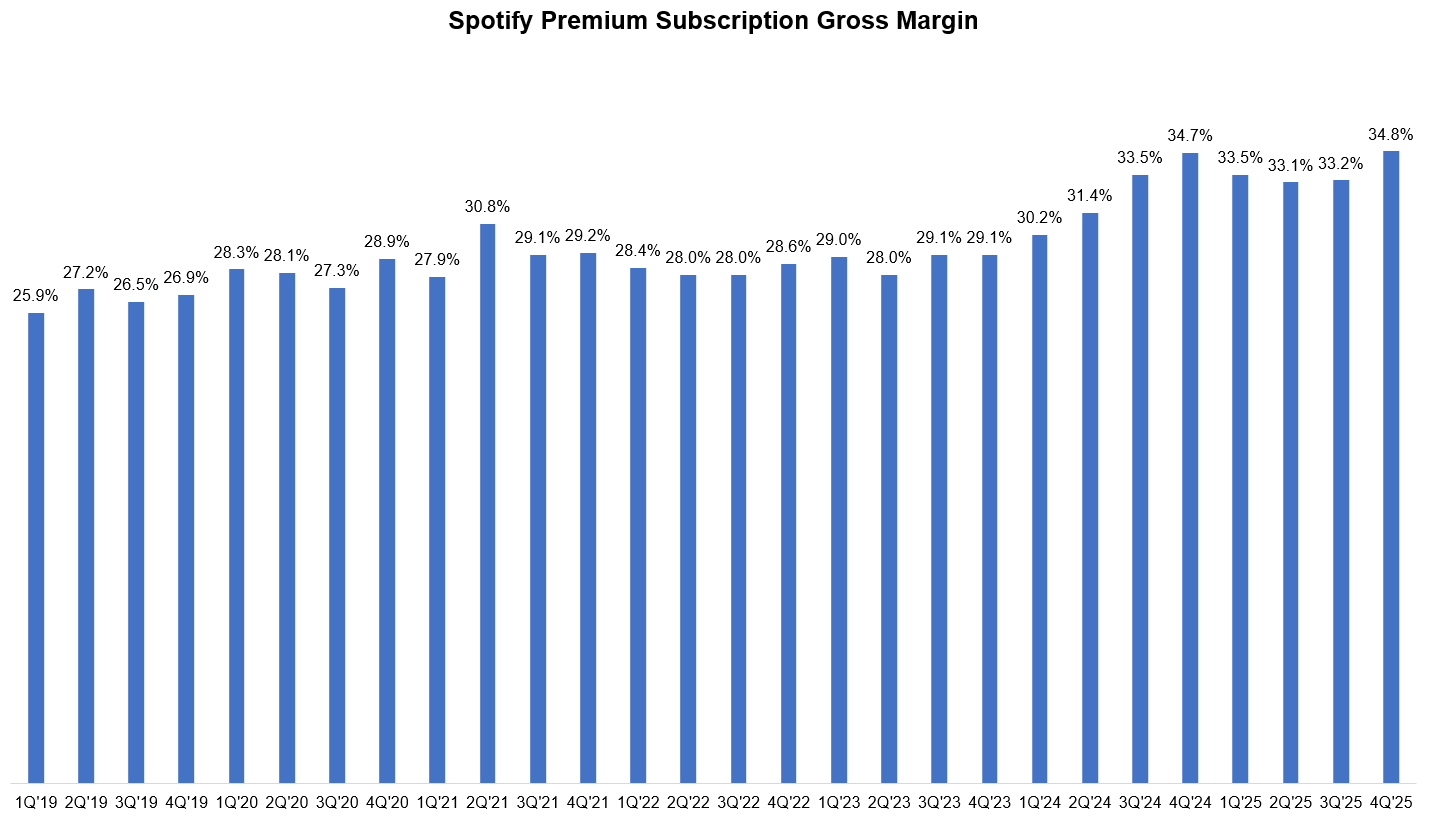

Over the last few years, Spotify has successfully raised subscription prices in key markets while simultaneously reducing its effective content costs through the expansion of marketplace tools, which allows labels to accept lower royalty rates in exchange for algorithmic promotion. The reclassification of its Premium tier as a "bundle" (by adding audiobooks) likely also helped with their gross margin expansion. Even in 2023, Spotify’s gross margin in premium subscription hovered around 28-29%; in 4Q’25, Spotify reported its highest ever gross margin of 34.8%! Ultimately, aggregating demand is so powerful that even when you have a handful of suppliers (music labels), market power gradually shifts towards you over time.

As I have covered before in “Music’s AI Mess” (see here, and here), AI should be a further tailwind for demand aggregators such as Spotify. A Cambrian explosion of music may not be good news for labels given how Spotify shares the revenue based on labels’ listening share, this is business as usual for aggregators since they were already operating under such a world. As I have mentioned before, adding infinite content to another infinite content doesn’t really change the core “job-to-do” for these aggregators. It also helps that their core business model also happens to be the right business model in the age of AI. From Spotify’s 4Q’25 call:

“…new technology is seldom disruptive on its own. Significant disruption happens when new technologies enable new asymmetric business models. For example, this is what Spotify did to music downloads. This is what Uber did to taxi service. So the question everyone should be asking is, does this evolution create new business models? Or are we mostly just seeing new technologies? For example, in SaaS, there is currently a lot of fear that the perceived business model will be challenged by more outcome-based models, which is reasonable.

However, in the consumer space that we are in, we believe the dominant business model will continue to be ads plus subscription, both places where Spotify excels. This puts Spotify in an outstanding position because we already have the right business model.”

Of course, AI can also help companies such as Spotify a great deal in accelerating new product features. Coding is clearly one of the best product market fits for AI models, and Spotify shared some neat examples in how things are changing in how they’re doing their work:

“As a concrete example, an engineer at Spotify on their morning commute from Slack on their cell phone can tell Claude to fix a bug or add a new feature to the iOS app. And once Claude finishes that work, the engineer then gets a new version of the app pushed to them on Slack on their phone so that he can then merge it to production, all before they even arrive at the office. We call this system internally Honk, and we've been told by key AI partners that our work here is industry-leading. Now as Daniel said in his remarks, we are a tech company, and we consider ourselves the R&D department for the music industry.”

I particularly liked this below example to illustrate the sea change that has happened over the last year:

“A year ago, only a very senior developer at Spotify could answer the question of what was the first track I've listened to on Spotify. Please take the ones I listened to more than 3 times and match them against what was popular at the time. Now anyone can do that, just using English.”

You will notice an ever rising number of people who write code for a living are getting spooked by model’s increasing capabilities, especially post-Opus 4.6 and Codex 5.3. How can you not be spooked if you thought something only a brilliant coder could do just 12 months ago can now be trivially done by even a random tech luddite? The very nature of these jobs is likely going through a rapid transformation which is understandably unsettling to the people near the blast area. If you are yet to experience such a feeling of unease, you may not have to wait for too long. Having experienced such unease last year myself, I can tell you that such feeling tends to be somewhat ephemeral. After embracing the pace of change, you can usually find lot more to get done than you could ever before. And despite the pace of change, Spotify convincingly argues that their position in the broader music value chain should be stable and even more relevant now:

“I would say that I think it’s obvious to everyone, but over Christmas, Christmas this year was an event, a singular event in terms of AI productivity. Certainly, I spent my entire vacation coding rather than being on holiday, and I think most people in tech did. A lot of things happened in December, including Opus 4.5 coming out Claude Code. And we crossed the threshold where things just started working. So a lot has actually changed very recently. And when I speak to my most senior engineers, the best developers we had, they actually say that they haven’t written a single line of code since December. They actually only generate code and supervise it. So it is a big change. It is real and it’s happening fast. Now as I said, we’ve discussed for the last at least 1.5 years, not if this should happen, but when it should happen. And we’ve started building systems like Honk that I explained for this type of world. So I feel very well positioned to capture this. But I want to be clear, this is the beginning of the change. There is going to have to be a lot of change in these tech companies if you want to stay competitive.

…When the Internet came along, everyone thought that we would all have our own web pages. What actually happened was there ended up being very few web pages. In times of lower friction, things actually tend to aggregate, not disaggregate. That’s the opportunity we see in front of us. I think companies such as us are simply going to produce massively more software. Up until our limiting factor is actually the amount of change that consumers are comfortable with.”

I personally consider Spotify one of the companies that taught me more than most companies I studied in my investing career. I will elaborate on such teachable moments behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 66 Deep Dives here.