Spotify 3Q'23 Update

Disclosure: I own shares of Spotify

We walked into 2023 thinking we would do just over 20 million in net subscriber adds for the full year, but we're actually on track to deliver 30 million, which is a significant beat from where we thought we would be.

I’ve been following Spotify for almost two years now and this was perhaps their best quarter. Not surprised that the stock is +10%.

Here are my notes from today’s earnings.

Users

Despite price increases for the individual subscription plan first time in the US, Spotify did not lose subscribers on net in North America:

when you think about a price increase, there's really the 2 components you're always going to be focused on. One is anything that elevates churn. And then two, anything that impacts the gross intake in any way. And so what was great was the churn was right in line with expectations. And we talked about in the past when we've raised prices that churn had never been that material, and it was similar to this go around. And then I guess even just as importantly, we outperformed on the gross intake side, which is one of the reasons why we outperformed on overall subs

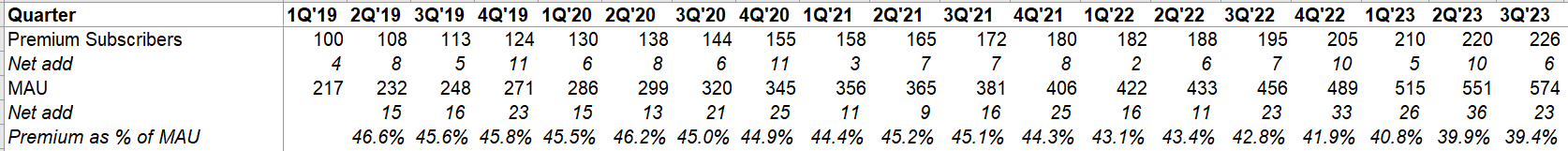

Premium Mix

Premium as % of MAU went down over the last 4-5 years as Rest of the World (RoW) region in the MAU mix went from 13% in 1Q’19 to 31% in 3Q’23. RoW MAU basically 4xed in less than four years. While MAU is generally considered a pretty good funnel to transition to premium subscription, the relationship appears to be a bit weak for RoW so far.

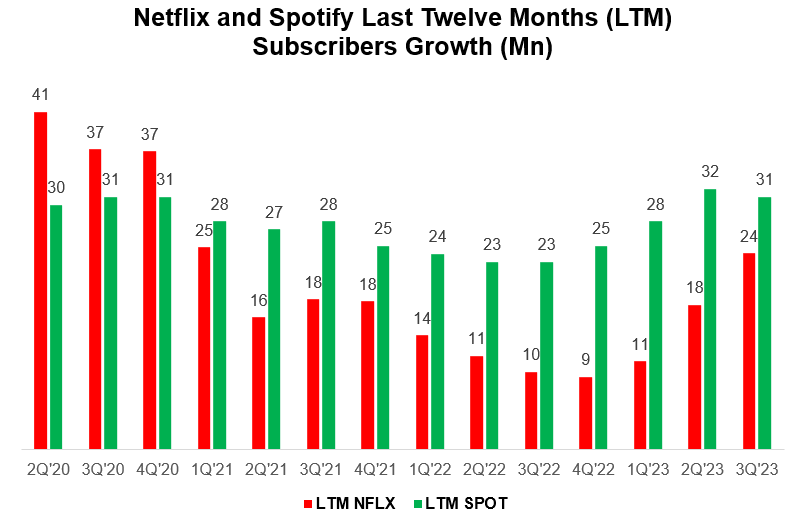

Netflix vs Spotify

This is something I track every quarter. After significantly lagging Spotify for a while, Netflix is not narrowing the gap at a pretty fast clip.

I should mention that definition of subscriber of NFLX and SPOT is not apple-to-apple, so I would caution not to infer more than what this data can tell us.

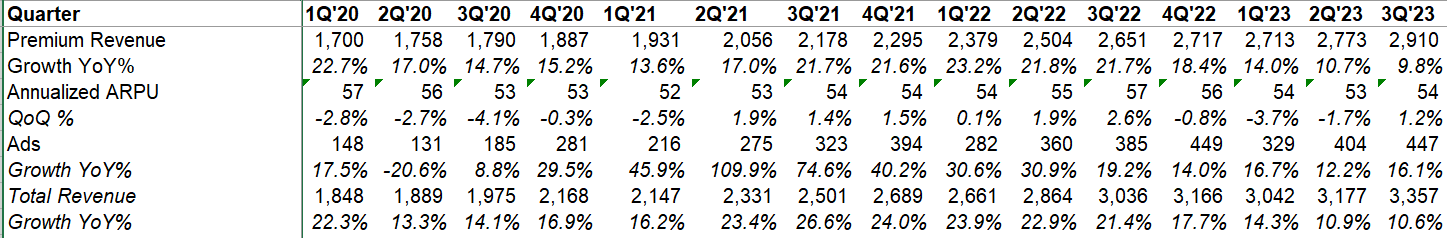

Revenue

While overall reported revenue was +10.6% YoY, it was actually +17% YoY. FXN which was ~300 bps QoQ acceleration. Ads was even better with +24% YoY FXN growth.

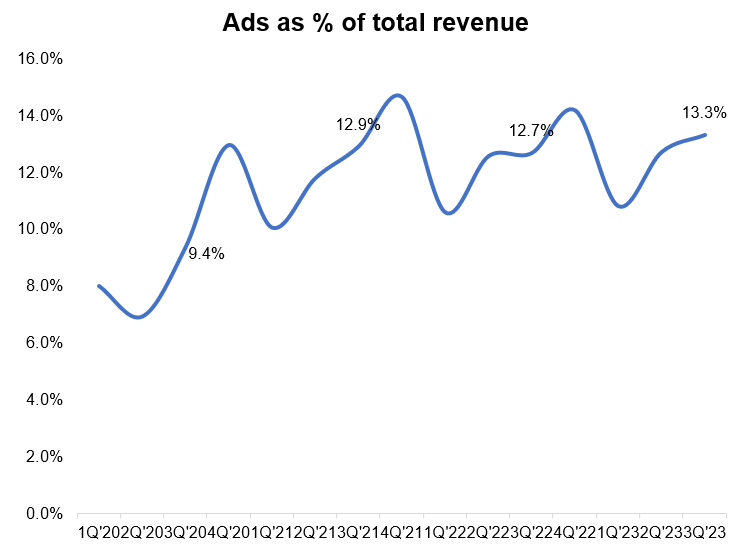

Ads as % of revenue kept going up gradually. It was 13.3% of revenue in 3Q’23 (vs 12.7% in 2Q’23).

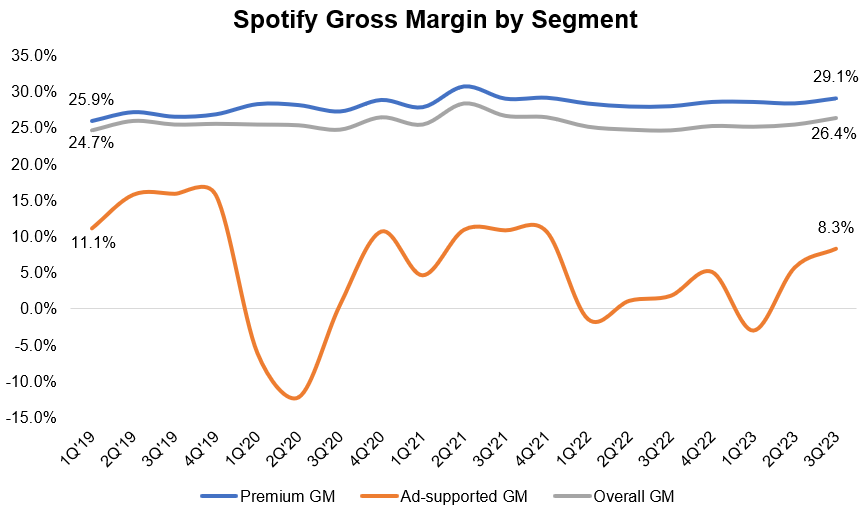

Gross margin (GM)

Overall reported GM was +26.4% (~40 bps higher than guided)

As you look into 2024, we expect to see a continued improvement in our gross margin trends and a continued improvement in our operating income trends as well.

Music GM was +29.1%. Marketplace continues to be a tailwind to margins:

we're offering more and more products to people on the marketplace side, which is seeing better and better results relative to all the other marketing spend that labels and artists teams are encountering, which, of course, is a great testament for – meaning more and more artists will keep on investing with us there.

Moreover, ads segment GM was +8.3%, higher than past 6 quarters. Expect more margin improvement here:

we've seen the improvements in the podcasting business, and we talked about how that's been a drag on our gross margins, and we expect it to soon reach breakeven and then become something that's actually additive to gross profit. So we're on track on the podcasting side there, and that should continue to be helpful into 2024. Same with the music side in terms of incremental gross margins there as well.

Will the launch of audiobooks pour cold water to GM expectations in 2024? While Spotify didn’t share much details about margin structure on audiobooks, they specifically outlined 2024 GM to be higher than 2023:

When you think about the audiobooks side of it, there's obviously some investment anytime you launch a new business. But again, as I said earlier, we feel really good about continuing to have a nice progression in gross margins into 2024.

…we are expecting gross margins to be improved in 2024.

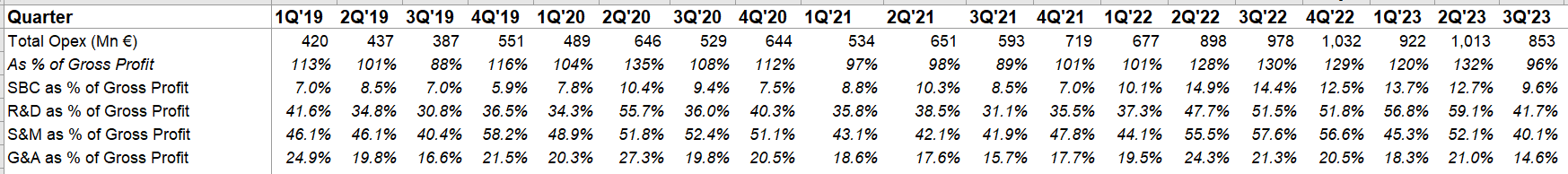

Opex

Despite lots of efficiency promises in the past, it does seem the efficiency train is finally here.

the new part of the Spotify modus operandi is our focus on efficiencies…you should expect us to continue to look for more improvements going forward because that's just our modus operandi.

…our expectations are now that we will consistently be in the black moving forward… we've hit an inflection point with respect to profitability of the business.

The numbers look very encouraging. In 3Q’22, Spotify spent €432 Mn in S&M and added 23 Mn MAU and 7 mn subscribers in that quarter. In contrast, they spent 18% YoY lower in S&M to drive basically similar outcome.

G&A was also down 19% YoY. R&D was -4% YoY. You can finally smell some “efficiency” here.

AI

GenAI should be pretty neat in lowering cost of ad creatives and creating new demands:

what generative AI has the promise to do is, of course, to allow for that creative cost to come down. But not only that, but it allows you to scale that creative in unimaginable ways. So you can translate whatever creative you had lots of different languages. You can use the same voice actor, but instead of producing 1 or 2 ads, you can have 1,000 or 10,000 or even 100,000 ads that are individually created to each user that gets to hear this.

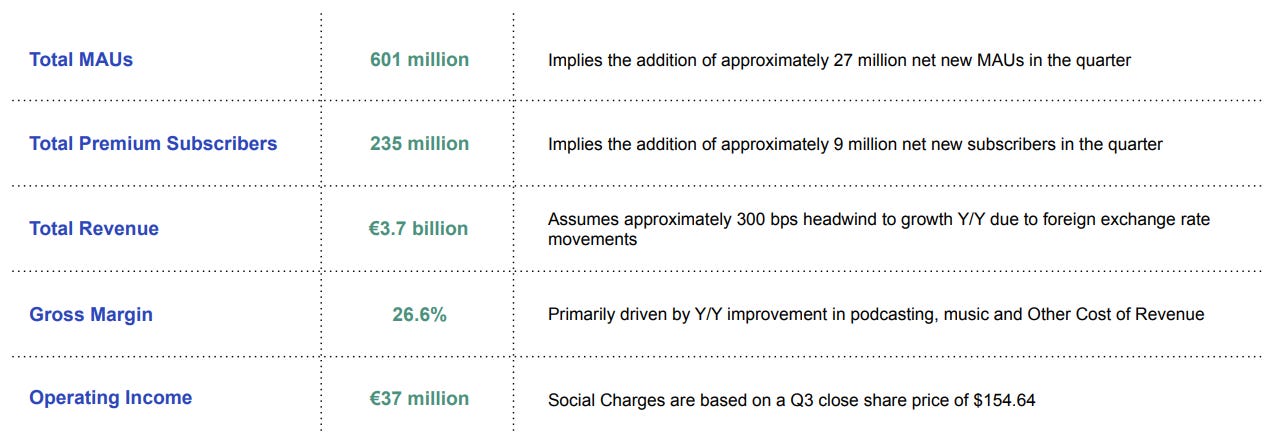

Outlook for 4Q'23

While Spotify faces competition from perhaps the most potent set of competitors in the world (Google, Amazon, and Apple), it has surprised (including me) how it reaccelerated its user growth at scale. Spotify reminded 2023 will be their highest year for net MAU add:

2023 should finish with the highest net additions for MAUs and the second largest for subscribers in company history, but actually the largest if you exclude the impact of Russia

4Q’23 topline is expected to +20% YoY FXN. Impressive quarter, but probably need a couple of those to truly convince investors that things are different now. The stock doubled this year so far, so perhaps many investors already updated their views on Spotify.

You can read my Spotify Deep Dive (December, 2021) here

I will cover Alphabet’s earnings tonight!