The cult of Lululemon is alive and kicking

(Update: Please see May'22 deep dive for latest thoughts)

In November 2020, I published my deep dive on Lululemon. On this update, I will mostly skip why I like the business since I have adequately covered it in my earlier deep dive which I encourage you to read here. Even though I liked the business fundamentals, I thought the valuation was too rich and highlighted some concerns that I had which I felt market was underestimating. Since I published my deep dive, the stock has been mostly flat, and has underperformed S&P 500 by ~25 percentage points. I don’t think I can take any “credit” for that as I believe the data points following my deep dive indicate most of my skepticism is not perhaps warranted.

I believe Lulu is more than reasonably priced and I started a small position (~3% of the portfolio) this week which I can increase to ~5% (max) if price remains in the vicinity of current level in the next couple of months. I will first outline some key points that made me re-think my position and then will discuss the updated model.

Three reasons I changed my mind

Post-Covid Lulu’s market has likely expanded: Let me directly quote myself from my earlier deep dive and specify where I was wrong and what led me to change my position:

“Although its DTC business almost doubled in 2021 fiscal year so far, overall revenue declined 6.6% in the first two quarters because of the store closure and acute lack of productivity even when they were re-opened. The revenue decline clearly indicates that while most sales just moved from stores to online, overall market did not expand for Lulu.

…If the pandemic’s impact greatly subsides soon, I would be surprised if the DTC segment grows at all in the next fiscal year… In a no-pandemic scenario, it looks optimistic to assume Lulu will not see its DTC business decline next year. Again, the current year’s revenue numbers don’t indicate Lulu’s potential market size dramatically increased because of the pandemic; the sales mostly just shifted channel from stores to online.”

Not only did Lulu end up growing revenue 23.1% YoY on the latter half of FY’21 (Lulu’s fiscal year ends in January 31), its topline guidance for FY’22 implies 32.3% to 34.1% growth. While I doubted DTC (e-commerce) segment will grow at all in the post-pandemic year, management just guided high single digit growth rate for DTC after doubling DTC revenue last year. Moreover, store productivity already improved to 88% of 2019 level. It is pretty clear to me that I underestimated the power of Lulu’s brand. It wasn’t just channel shift from store to DTC; Lulu’s market did expand during the pandemic after the initial hiccup in the early days of Covid-19.

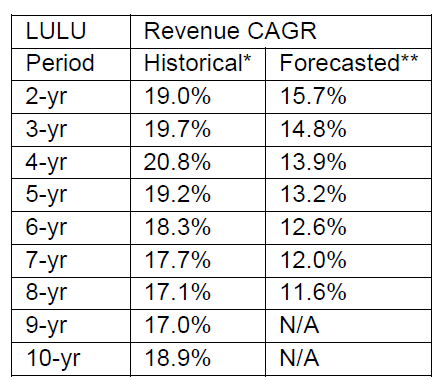

What I find particularly impressive is Lulu’s topline growth is showing sign of acceleration, as shown below. Please note that I have excluded Mirror’s sales to make it apple-to-apple historical comparison of the core Lulu brand. Looking at the last 10 years, as you can see, topline growth has accelerated from high teen to consistently posting ~20% growth. In the age of retail obituaries and Amazon’s utter dominance, it is indeed a thing of beauty to see a retail brand post ~20% topline growth in the last 10 years. Despite such momentum, there is hardly any sign of brand dilution or exhaustion anywhere around. Lulu has successfully expanded their brand from North America to International markets, especially China, and from yoga pants to women’s tops and increasingly to men’s segment as well.

What makes me excited is my reverse DCF (discussed later) implies a material deceleration of growth going forward even though there is hardly any indication of deceleration in our eyesight. Let me elaborate why I think material deceleration seems unlikely.

*Calculated based on high end of guidance of current fiscal year (FY’22), excluding $275 mn revenue guidance for Mirror so that it’s more apple-to-apple historical comparison for the core Lulu brand. I wanted to use FY’22 since FY’21 is marred by pandemic which hides the true and underlying growth of Lulu

**Forecasted revenue CAGR (FY’23-FY’30) is estimated based on my reverse DCF model explained later. Denominator for all forecasted revenue CAGR calculation is FY 2022’s revenue.

International segment likely to have long runway: In my earlier deep dive, I mentioned how Lulu’s store base was not really growing in most of the countries they operate in. While that fact has not changed, I may have materially underestimated how China itself can drive the international growth runway for Lulu possibly for years.

Mainland China has seen a whopping 90% 2-year revenue CAGR in 1Q’21. In the recent quarter, management increased new store guidance from 40-50 to 45-55, which will be primarily driven by 35-40 stores in international markets. Although management has not clearly mentioned it, I think it is fair to assume that ~90% of this store expansion will happen in China.

Lulu mentioned they expect international revenue to match North America’s revenue sometime in future. Currently, revenue outside North America is just ~14% of total revenue. I wondered earlier how big the market for $100 leggings can be in international markets and whether affordability in international market will be a question mark for Lulu to continue to grow at a rapid rate.

For the growth momentum in international markets, it was silly of me not to focus a little more on China instead of focusing on all the other international markets where Lulu’s store base was largely stagnant for the last few years. Nike in the first 9 months of current fiscal year posted $6.4 Bn sales in China. While Lulu does not report specifically its revenue in China, given its international revenue of $624 mn in FY’21 and China is ~40% of international store base, it is highly likely that Lulu’s revenue from China was <$300 Mn in FY’21 which is less than 4.5% of Nike’s revenue in China. For context, Lulu’s revenue in North America is ~25% of Nike’s in the region. I think it is highly likely that Lulu is still in a very, very early stage in China.

Moreover, there were some concerns about faltering growth of men’s segment last year. Before the pandemic year, men’s segment grew at 31.1% and 34.3% vs women’s segment at 23.4% and 18.6% in FY’19 and FY’20 respectively. In FY’21, revenue from women’s segment increased 10.2% while men’s grew a paltry 2.8%. During the Q4 call, management explained they think the faltering growth in men’s segment is primarily behavioral in nature as men shop more in stores vs women. Management appears to be right as in 1Q’FY 22, men’s segment outpaced women’s both on 1-yr and 2-yr CAGR basis. On 2-yr CAGR basis, men’s revenue increased 27% vs 23% in women’s segment.

Lulu appears to have bought Mirror at “dirt cheap” prices: When Lulu acquired Mirror for $500 mn in June 2020, it expected Mirror to generate ~$100 mn sales in FY’21. Mirror ended up posting $175 mn sales in FY’21 and management just guided $250-275 mn sales this year. I was initially concerned whether at-home fitness is just a pandemic phenomenon and the durability of the trend I thought was far from certain. Looking at the ~50% (mid-point) topline growth guidance on top of pandemic driven growth last year, it is fair to say Mirror is proving to be lot more durable than I presumed.

Therefore, while Lulu appeared to have bought Mirror at ~5x sales when it acquired Mirror, it turns out Lulu essentially bought a DTC brand growing at ~50% rate at ~2x NTM sales. In today’s valuation world, this is almost “deep value investing” (only half-kidding).

I cannot help but think that Lulu’s 7 million customers, their data points, and distribution have helped Mirror enormously to generate further momentum. I receive Lulu’s marketing emails, and I have noticed emails from Lulu highlighting Mirror time to time. Because of the pandemic, Lulu couldn’t quite leverage its store distribution to sell Mirror. They will ramp up those initiatives this year in the US and it will most certainly be extrapolated to international markets as well in 2022 and beyond. Management explained their strategy with Mirror in the latest earnings call:

“We continue to leverage the lululemon ecosystem, and by the middle of this month, MIRROR will be featured in nearly 90 lululemon locations in the United States. We're well on our way to 200 shop-in-shops in time for the holidays later this year.

In addition, we now have dedicated MIRROR specialists among our educators in each of these stores, and the early sales results are encouraging.”

Overall, it does not seem like quite a leap to think Mirror is worth many multiples of $500 mn that Lulu paid.

Lulu is uniquely positioned and can afford to be somewhat agnostic in retail strategy given their robust omni-channel presence. Its real estate footprint has real purpose, thanks to its store-based activities organized by its store ambassadors which help maintain Lulu’s status as a brand. Sales from company operated stores were growing at 20.3% CAGR during FY 2010-2020 (pre-pandemic).

In addition to its purposeful real estate footprint, it has simultaneously built world class DTC brand in the last 10 years. From FY 2011-2021, DTC sales grew at an astounding 44.6% rate. Sure, this was abnormally boosted by the doubling of DTC revenues last year, but even if we look at FY 2011-2020 (pre-pandemic) numbers, sales grew at 34.8% during that time.

Lulu’s distribution and cult status will likely allow them to extend their franchise from women’s bottoms to “head to toe”. They have made successful inroads to women’s tops and will introduce footwear in early ’22. Lulu also has longer term ambition in selfcare segment such as deodorant, dry shampoo, lip balm, facial moisturizer etc. Calvin McDonald was CEO of Americas at Sephora before joining Lulu, so he definitely has the pedigree to manage this product expansion. I am certainly not assuming success by default in all of these areas, but I think the way McDonald has run the company so far, I am much more optimistic about Lulu’s chances for a homerun in at least few of these product expansions. Lulu’s recent patent filings also indicate its broader ambition.

If you look pre and post-McDoland era, Lulu clearly has transformed for the better. From FY’14 to FY’18, Lulu used to be a mid-teen topline grower whereas McDonald made it a consistent >20% topline grower during his tenure. Founder Chip Wilson also had positive things to say about McDonald. One thing that worried me in the past was whether Lulu can turn out to be fad. While this probability is certainly NOT zero, especially in an age of rising DTC brands such as Rhone, Gymshark, and many others, Lulu has been around for more than two decades. More importantly, the brand survived a seriously underwhelming CEO in Laurent Potdevin during 2014-2018, frequent management clashes between Christine Day (CEO during 2008-2013) and Chip Wilson (Founder and Chairperson During Day’s tenure), and multiple controversies of Chip Wilson over the years. Frankly speaking, Lulu’s numbers are doubly impressive when you consider how the brand thrived almost on an auto pilot mode during those turbulent years. It almost makes you wonder what the brand can possibly achieve with an able leadership at the helm.

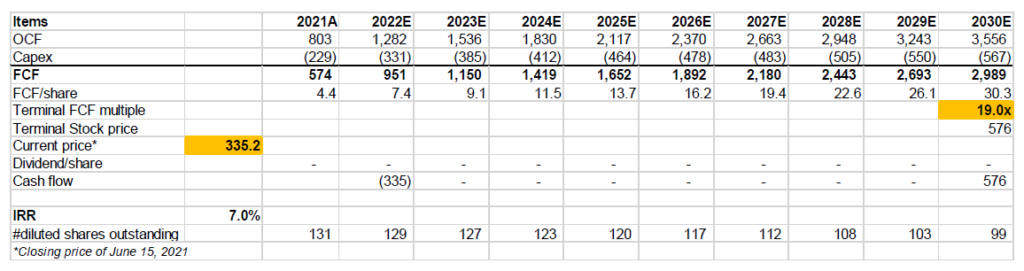

Valuation/Model assumptions: If you are reading my work for the first time, I encourage you to read my piece on “approach to valuation”. I follow an “expectations investing” or reverse DCF approach and try to figure out what I need to assume to generate a decent IRR from an investment (in this case ~7%). Then I glance through the model and ask myself how comfortable I am with these assumptions. As always, I encourage subscribers to download the model and build your own narrative and forecast as you see fit to come to your own conclusion.

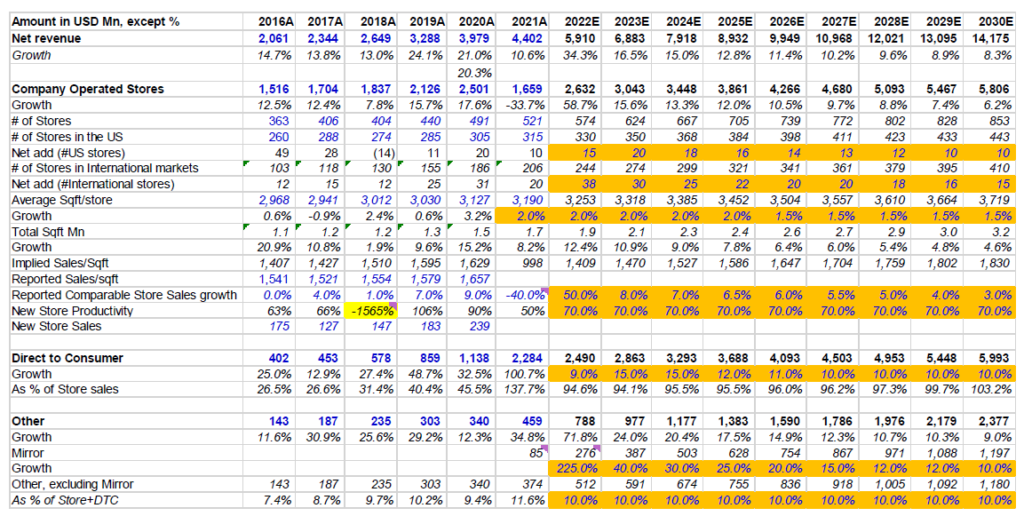

As you can see below, I have consistently decelerated Same Store Sales (SSS) growth going forward and ended the decade at 3% SSS growth compared to high single digit growth Lulu experienced during McDonald era (excluding Covid). For DTC, I have assumed low double-digit growth from current level. DTC/e-commerce is a powerful secular force which I believe has still a significant runway that will continue to allow Lulu to reach a wider customer base.

The “other” segment consists of sales from Mirror as well as outlets and warehouse sales etc. I have broken down the other segment further to segregate Mirror sales.

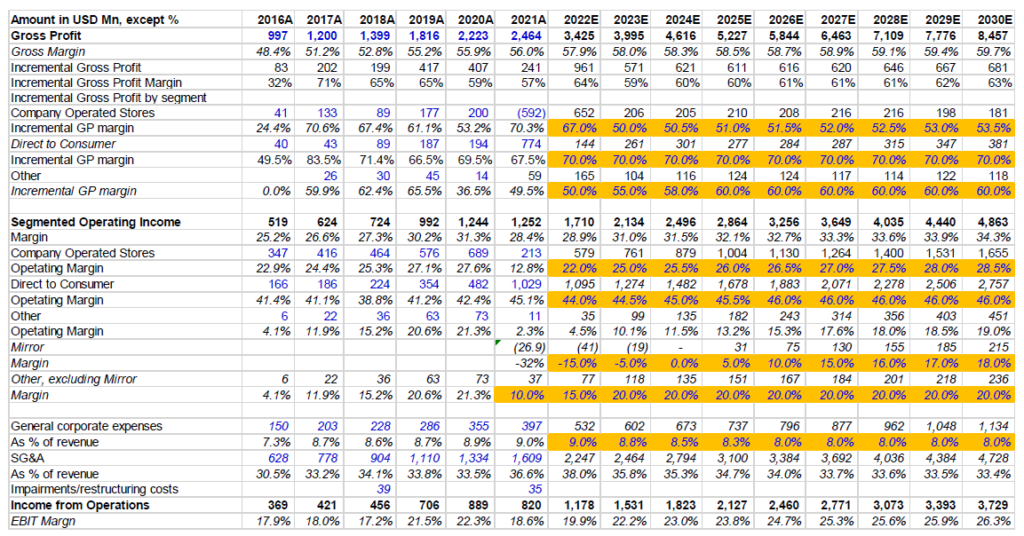

Lulu guided 150-200 bps gross margin expansion over 2020 despite 50 bps negative impact of freight costs in current year. I have not assumed any significant SG&A leverage in out years. For example, store operating margin in 2030 is modeled at 28.5%; Lulu’s stores posted 27.6% operating margin before the pandemic. In DTC, its 2030 operating margin is assumed to be 46% while it posted 45.1% operating margin last year.

Let me elaborate a bit more on Other/Mirror segment. I have tried to segregate Mirror and everything else in other segment. Given the pandemic, I assumed lower profitability in “other, excluding Mirror” category compared to the previous two years. With that assumption, we can see the implied operating margin for Mirror was -32% last year. Lulu also guided 3-5% earnings dilution because of Mirror’s losses this year which implies -15% operating margin for Mirror this year. I assumed break even in FY’24. Lulu clearly senses the opportunity in Mirror and is going to aggressively invest through SG&A to capitalize on the growing interest in at-home fitness. Interestingly, Lulu initially mentioned Mirror would “break even or be slightly profitable in 2021” when it acquired Mirror. I think it makes enormous sense not to focus on profitability now and rather elevate the brand awareness of the product for the next couple of years.

As you can see below, I needed to use 19x FCF multiple in 2030 to generate ~7% IRR. I believe Lulu’s operating performance can surprise to the upside compared to what has been modeled here AND the terminal multiple itself can potentially prove to be conservative. At 25-30x terminal multiple, shareholders will generate ~11-13% IRR (ceteris paribus). If Lulu can post better operating performance, it can potentially be mid-teen IRR investment from current prices.

I do have a couple of concerns: a) the thesis on international growth is almost entirely driven by expansion in China. While I do feel there is plenty of growth runway left, any hiccups in China for whatever reason will taint the growth runway, and b) the next decade will see an ever-blurring line between social media and e-commerce. With hundreds of thousands of influencers around the world and the power of DTC channel, the overall retail scene can be quite different a decade from now. While I do like Lulu’s chances in this fluid environment given their soulful store footprint, robust DTC platform, and a ~7-million cult-like customer base growing over two decades, it is highly likely that any period of weak execution (like Lulu had between 2016 and 2018) will be punished much more severely in the next decade. As a result, I would like to keep my position ~3-5% of overall portfolio. Always consider my write-up as my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

I have uploaded an updated Etsy model which subscribers can find here.

If you are not a subscriber, please consider subscribing to my work. You can read my sample deep dives (Uber, Etsy, Lululemon) as well as my research process and approach to valuation before subscribing. As a subscriber, you will receive one deep dive every month (and some infrequent updates like this) as well as earlier published deep dives of ANGI, ANSS, CPRT, ADSK, SHOP, OTIS, and CRWD. Please note MBI Deep Dives is NOT a stock picking service, but an independent investment research service. If you are curious, you can find more details about me here.

I will cover ROKU next month. Thank you for reading.

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.