Alphabet 4Q'25 Update

Alphabet came to this earnings with elevated expectations from investors. It delivered. The stock is down a bit post-earnings despite that, but it’s hard to imagine Alphabet shareholders not having a good sleep last night.

Here are my highlights from the earnings.

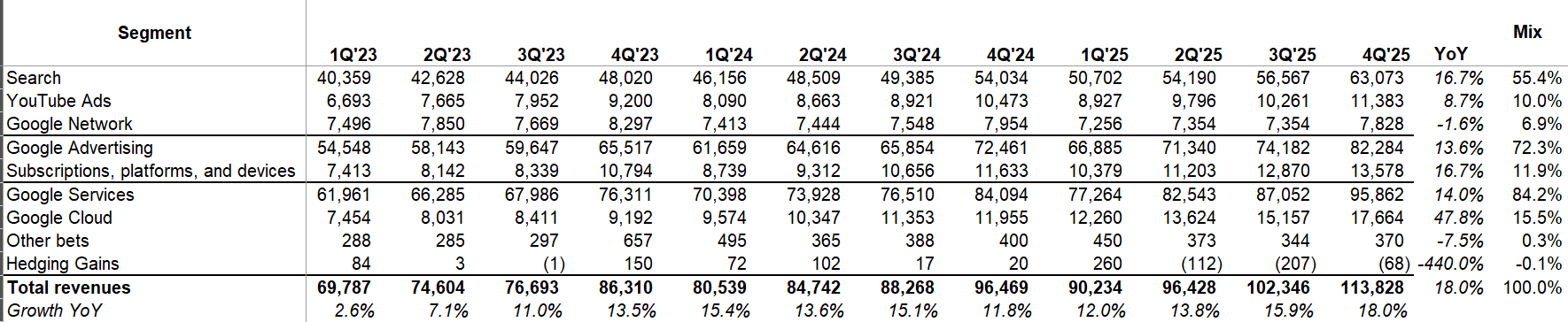

Revenue

Who amongst us really thought search revenue would be growing at high-teen rate three years after the asteroid named ChatGPT hit Google? While search is still the lynchpin in Alphabet, amazingly Google now has 14 different products that exceeds $1 Billion revenue!

While YouTube’s ad growth may look quite tepid, migration from ad-supported YouTube to YouTube Premium really makes the comparison increasingly misleading. YouTube is now $60 Billion business across ads and subscriptions.

After lagging behind Azure’s growth in recent quarters, Google Cloud is finally leading the growth among the hyperscalers with a material acceleration.

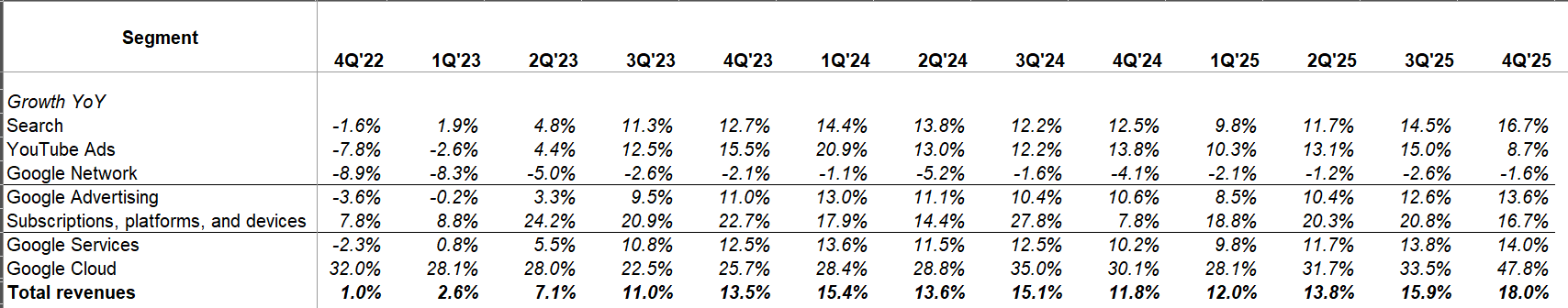

Take a look at growth rates by segment since 4Q’22:

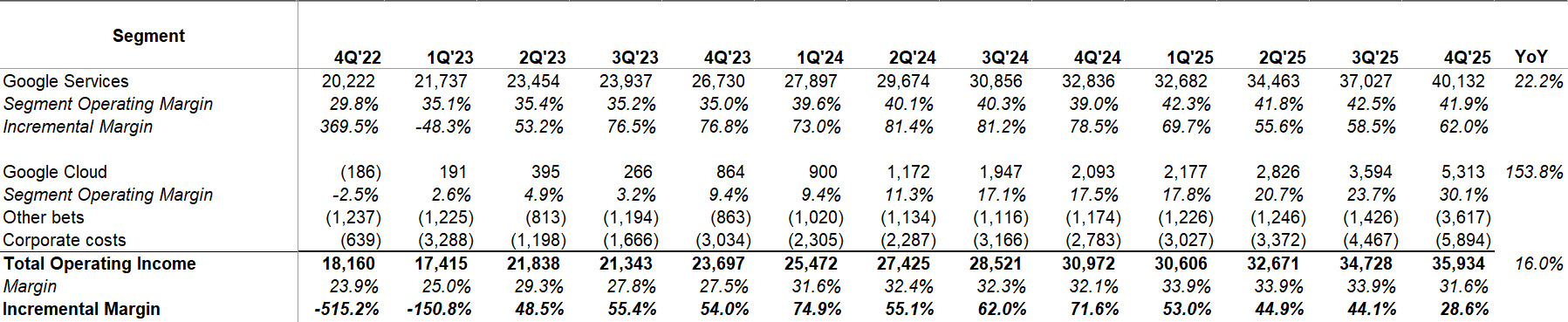

EBIT

Google Services continues to post >40% operating margin. The fact that for the last eleven quarters their incremental margins have been consistently above 50% (it was 62.0% in 4Q’25) indicates that we may still have room for further margin expansion.

The jaw dropping moment from the earnings release was, however, Google Cloud’s margin. Even in 2Q’20, Google Cloud had -47.4% operating margin. Yes, that’s negative. In 4Q’25, they posted +30.1% operating margin! I don’t think I have ever seen such a margin turnaround in my investing career. From a distant unprofitable laggard in hyperscaler race to reach a touching distance of the operating margin of AWS while simultaneously accelerating revenue growth to ~50% is nothing short of mind boggling.

I will discuss the rest of this update behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 64 Deep Dives here.