ChatGPT's value capture problem

Consider a thought experiment. Imagine traveling back to February 2023, the moment OpenAI introduced the ChatGPT Plus subscription for $20 per month.

At the time, ChatGPT felt revolutionary despite its profuse hallucinations. There was no deep research (which would be launched two years later); it couldn’t access real-time information beyond its training data cutoff; and it often struggled with the sustained reasoning required for truly complex tasks (reasoning models were launched in September 2024).

Now, imagine if OpenAI had simultaneously revealed a snapshot of their 2025 product, a model equipped with sophisticated search integration, vastly improved computational bandwidth for nuanced problems, and deep research capabilities. If asked to predict the price of that future product, given the $20 baseline for the nascent 2023 version, I bet many people would likely have estimated a noticeably higher price than $20/month for the “2025 version” of ChatGPT.

The leap in utility is clearly astronomical compared to what we could get back in February 2023. And yet, here we are in 2025, and the subscription cost remains exactly $20.

This price stagnation presents a paradox in the economics of innovation. There is no question that ChatGPT, and AI tools generally, have created immense value for consumers. But the key debate is about value capture.

It is tempting to attribute this stable pricing solely to technological efficiency i.e. the idea that token prices and operational costs have decreased significantly. While efficiency gains are part of the equation, the true governor on pricing power is the competitive landscape. In a market where innovation is quickly commoditized and substitutes are a click away, the ability to raise prices is severely constrained, regardless of the improvements made. Value capture is ultimately, more often than not, a function of industry structure and competitive dynamics.

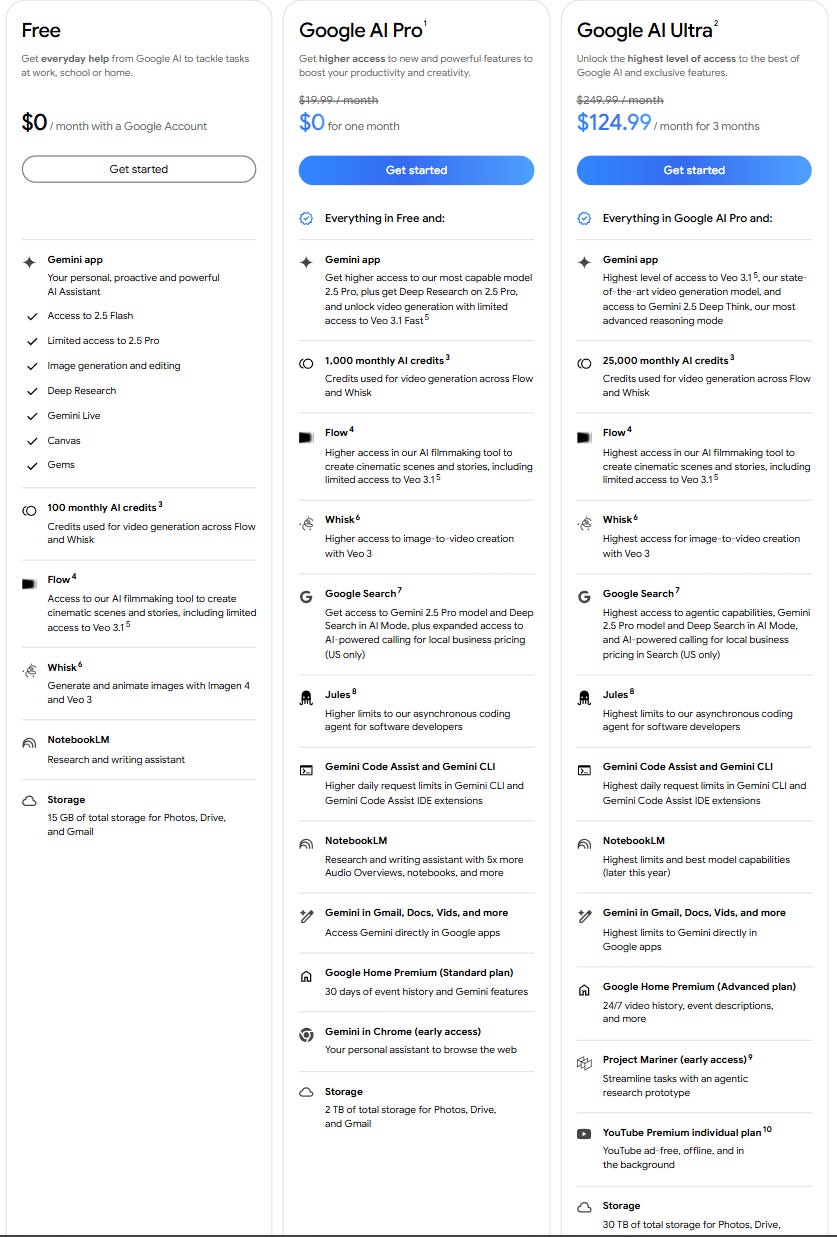

Notice how Google’s AI plan gets cross‑sold with storage and Workspace. In that environment, raising price is self‑sabotage unless you some sort of lock‑in. Of course, most of the existing ChatGPT users do perhaps already feel some sort of habitual lock-in, but the real battle between Gemini and ChatGPT is not for ChatGPT’s existing DAUs, rather it’s the next 500 million to 1 billion DAUs.

A couple of weeks ago, Greg Brockman mentioned if OpenAI had 10x more compute, they could likely 5x their revenue. I am skeptical that compute is the only constraint for OpenAI to capture value. Brockman then mentioned how “Pulse” is such a great product but they had to limit it only for Pro subscribers ($200/month) due to compute constraints. I’m sure many Plus subscribers would love to have “Pulse” feature, but I don’t think even 10% of Plus subscribers would pay additional $1/month to have “Pulse” feature. Feature velocity can be become a very good retention tool, but unlikely to be a pricing lever.

Of course, almost for any other case, poking at a stable subscription prices when subscriber numbers keep increasing at a healthy rate would be non-sensical especially in a world where aggregating demand is the key to the castle. ChatGPT is a bit different because of OpenAI’s exceptional burn rate. Nonetheless, OpenAI perhaps will have no problem in raising money from VCs or from public market in current environment.

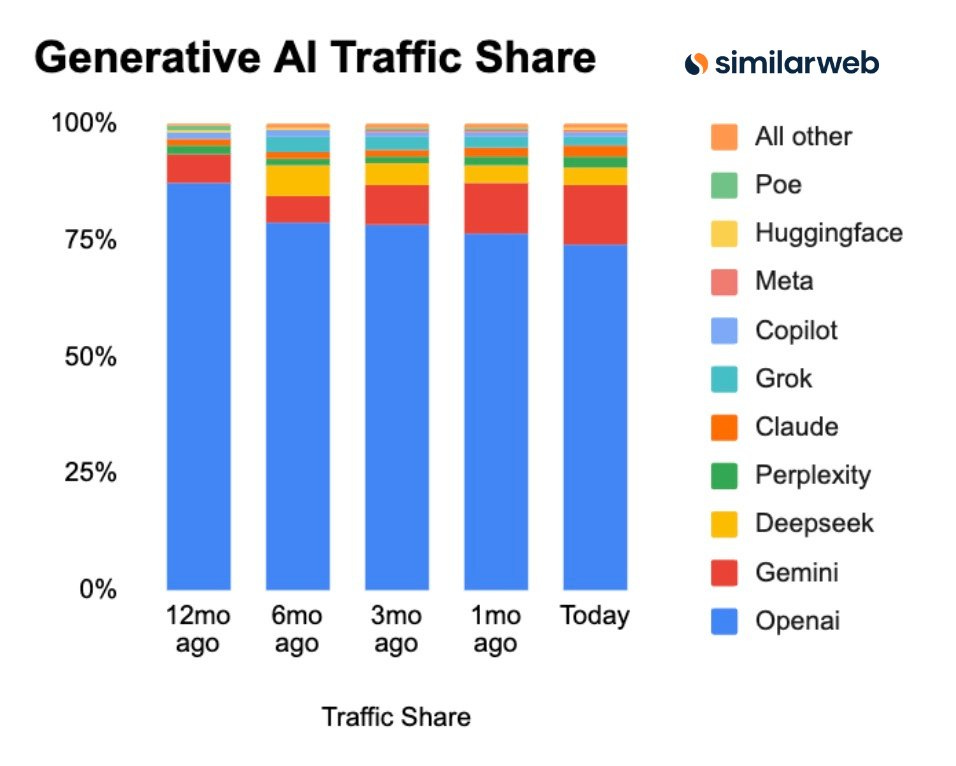

Things can, however, become dicey depending on how Gemini 3.0 fares later this year, especially given that OpenAI won’t launch GPT-6 this year. ChatGPT’s traffic share in GenAI went from 87.1% a year ago to 74.1% now whereas Gemini went from 6.4% to 12.9% during the same time. Of course, when you invent a category, you tend to lose market share over time as your success inevitably attracts others.

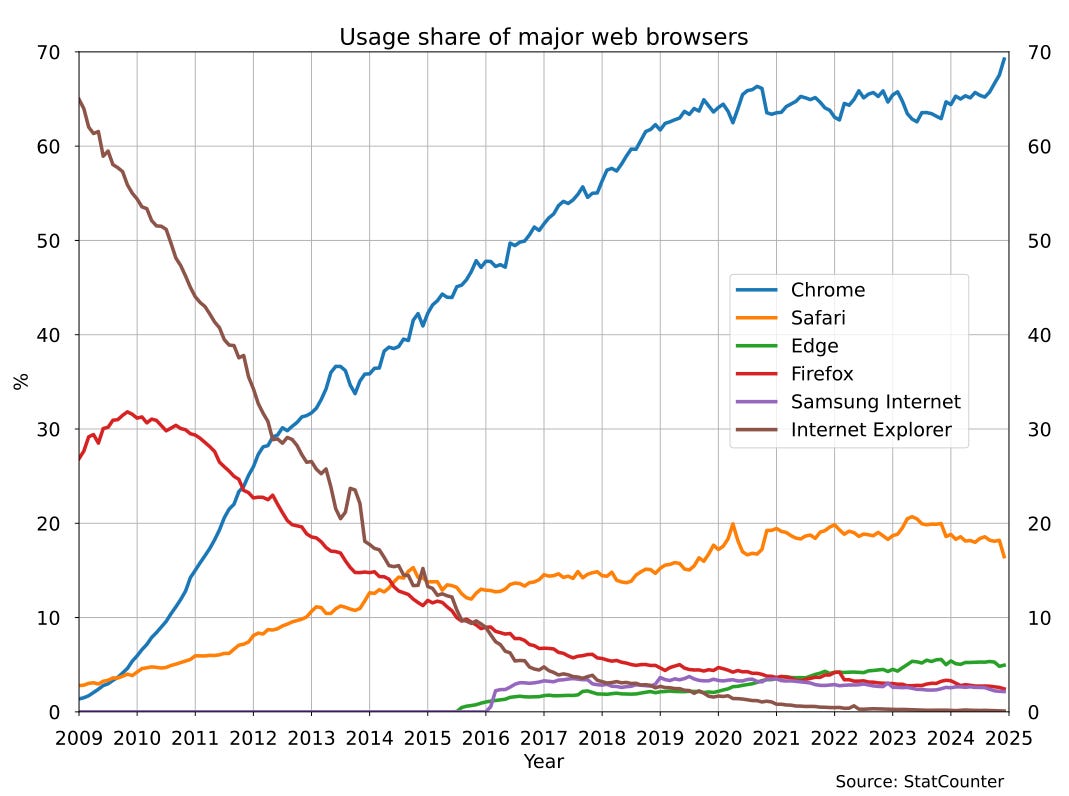

Nonetheless, if Gemini 3.0 receives a very warm reception in December 2025 and Gemini’s market share accelerates, I wonder if OpenAI will start feeling a bit nervous. Chrome entered the browser market pretty late, and it took them just four years to win the browser war.

Ironically, I wonder if at least some part of the “AI trade” can potentially experience a jolt if Gemini 3.0 hits it out of the park. Ultimately, ChatGPT will almost certainly continue to create value primarily through enormous consumer surplus; but the ecosystem its competitors have may continue to succeed at capping how much of such value can be captured by OpenAI.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 63 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: