Booking on the Offense

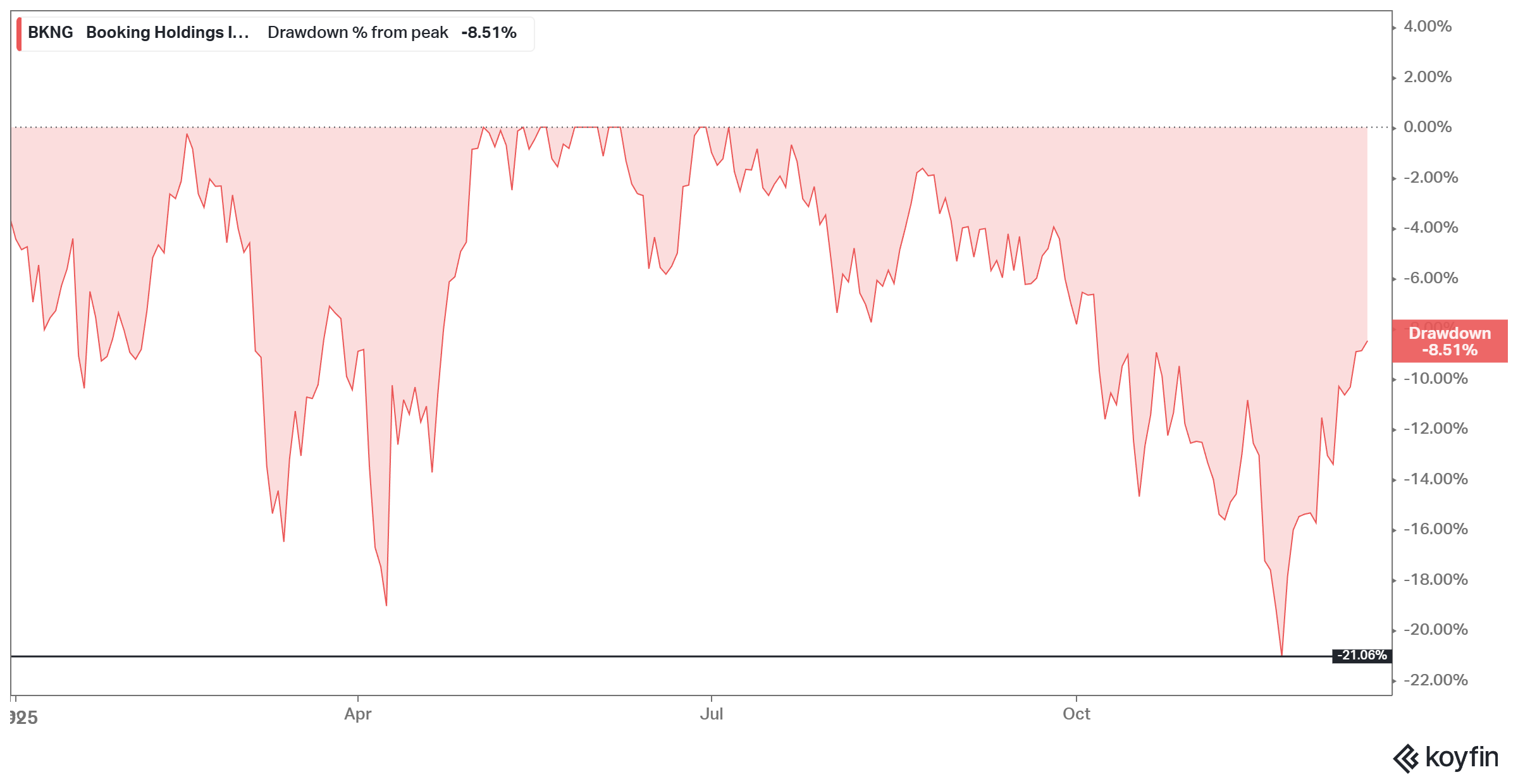

Last week, Booking’s CFO Ewout Steenbergen attended Nasdaq Morgan Stanley London TMT Conference. Booking’s CFO re-iterated their “8-8-15” algorithm for the “next few years”. For the uninitiated, “8-8-15” stands for 8% gross bookings growth, 8% revenue growth, and 15% EPS growth. I also really liked how the CFO framed their buyback framework, and given the stock was in a 20% drawdown in late November, the CFO wasn’t really shy about disclosing what they were doing:

“When there is a dislocation of the share price, according to the grid that we put in place, there is really quite a large increase in the daily buyback volume. So one can assume that, that is happening now at this moment in the fourth quarter.”

There's a reason I called them "shareholder friendly OTA King"!

Of course, the meat of the discussion revolved around Booking’s approach to AI agents which I will discuss behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 65 Deep Dives here.