Amazon 4Q'22 Earnings Update

Disclosure: I own shares, and Jan 2025 call options of Amazon

..it's important to remember that over the last few years, we took a fulfillment center footprint that we've built over 25 years and doubled it in just a couple of years. And then we, at the same time, built out a transportation network for last mile roughly the size of UPS in a couple of years

-Andy Jassy (4Q'22 Earnings Call)

Here's my highlights from the call.

Revenue

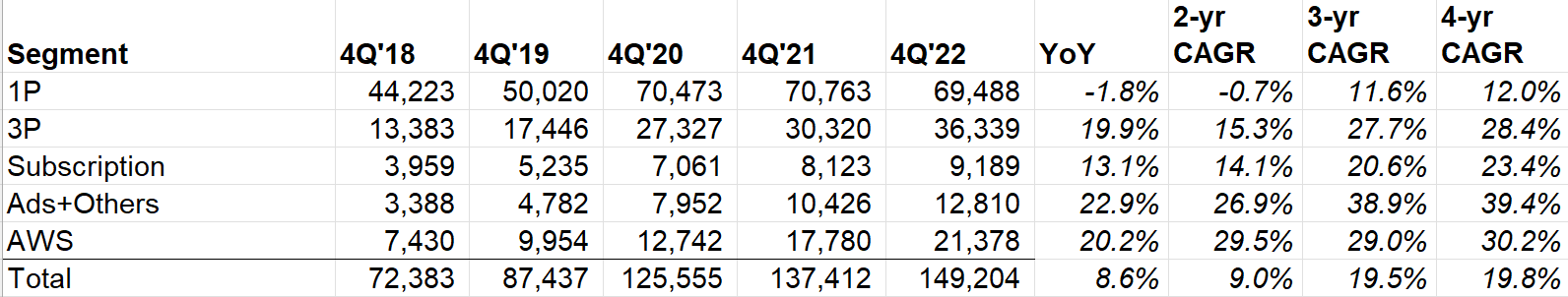

Overall topline was +8.6% YoY despite 360 bps FX headwind

In Q4, sellers was 59% of overall unit sales.

AWS was understandably a major focus on this call, so let me spend more time there.

AWS

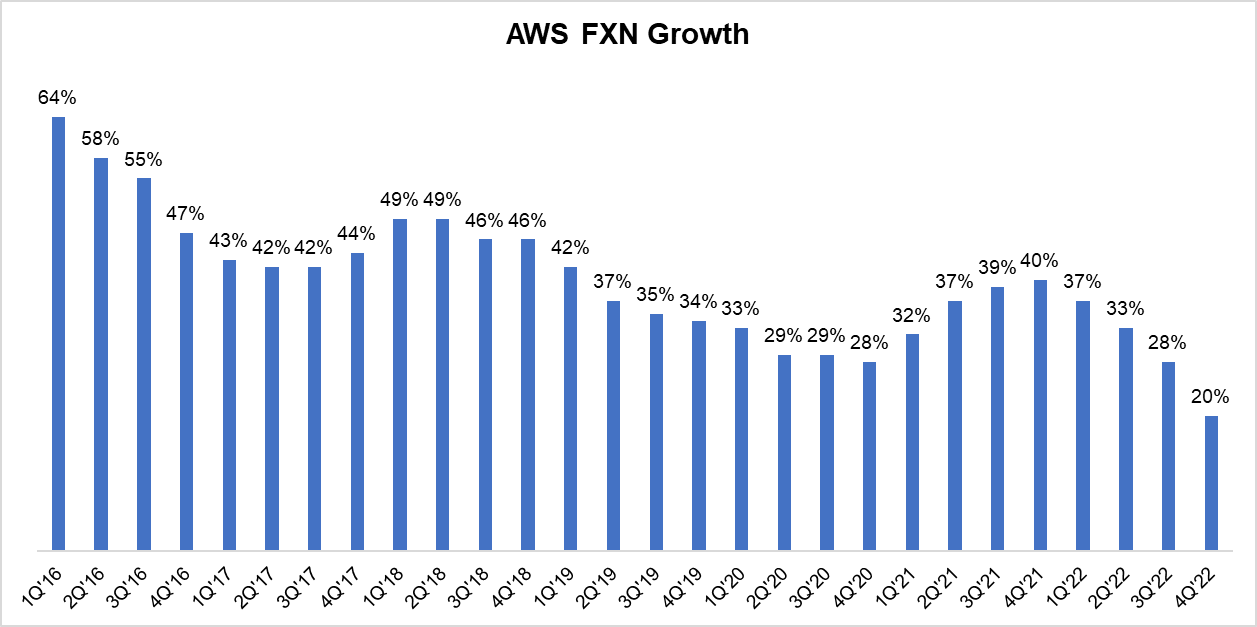

AWS continued its rapid deceleration from 40% in 4Q'21 to 37% in 1Q'22, 33% in 2Q'22, 28% in 3Q'22, and 20% in 4Q'22.

What perhaps surprised (shocked?) investors is the following quote:

Starting back in the middle of the third quarter of 2022, we saw our year-over-year growth rates slow as enterprises of all sizes evaluated ways to optimize their cloud spending in response to the tough macroeconomic conditions. As expected, these optimization efforts continued into the fourth quarter.

we expect these optimization efforts will continue to be a headwind to AWS growth in at least the next couple of quarters. So far in the first month of the year, AWS year-over-year revenue growth is in the mid-teens. That said, stepping back, our new customer pipeline remains healthy and robust, and there are many customers continuing to put plans in place to migrate to the cloud and commit to AWS over the long term.

If AWS ends 1Q'23 at ~15% YoY growth, we will see AWS reporting its first ever QoQ revenue decline.

Okay, how about beyond the couple of quarters?

In the AWS growth rate, I'm not sure I can forecast for you with any level of certainty what is going to happen beyond this quarter. You kind of -- this is a bit uncharted territories economically.

AWS sales declining QoQ wasn't certainly on my bingo card, but one of the core value propositions of cloud (vs on-prem) is the ability to scale up or down based on demand. So, some cyclical component is natural, but I personally expected secular to beat cyclical nature of cloud in 2023.

AWS isn't trying to optimize for the quarter though:

the way that we've built all our businesses, but AWS in this particular instance, is that we're going to help our customers find a way to spend less money. We are not focused on trying to optimize in any one quarter or any one year, we're trying to build a set of relationships in business that outlast all of us. And so if it's good for our customers to find a way to be more cost effective in an uncertain economy, our team is going to spend a lot of cycles doing that.

It's deeply annoying that Google Cloud and Azure don't report their cloud specific numbers. Sounds like Amazon is a bit annoyed too:

we're the only ones that really break out our cloud numbers in a more specific way. So it's always a little bit hard to answer your question about what we see. But we, to our best estimations, when we look at the absolute dollar growth year-over-year, we still have significantly more absolute dollar growth than anybody else we see in this space.

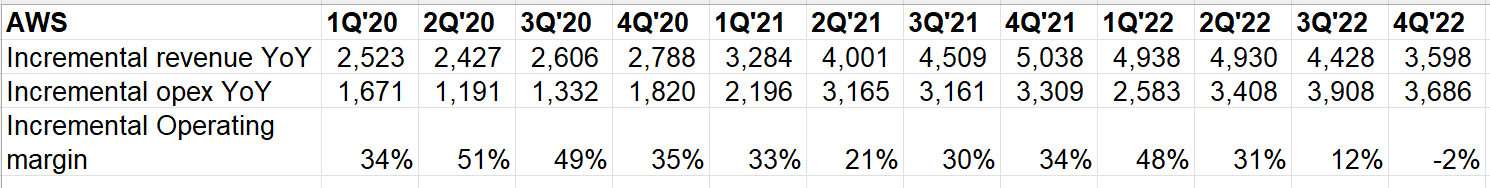

Just as Amazon made forecasting errors in e-commerce demand and overbuilt warehouses/FCs, it does seem their cost structure in AWS also needs some right sizing. Their incremental opex YoY exceeded incremental revenue in 4Q'22.

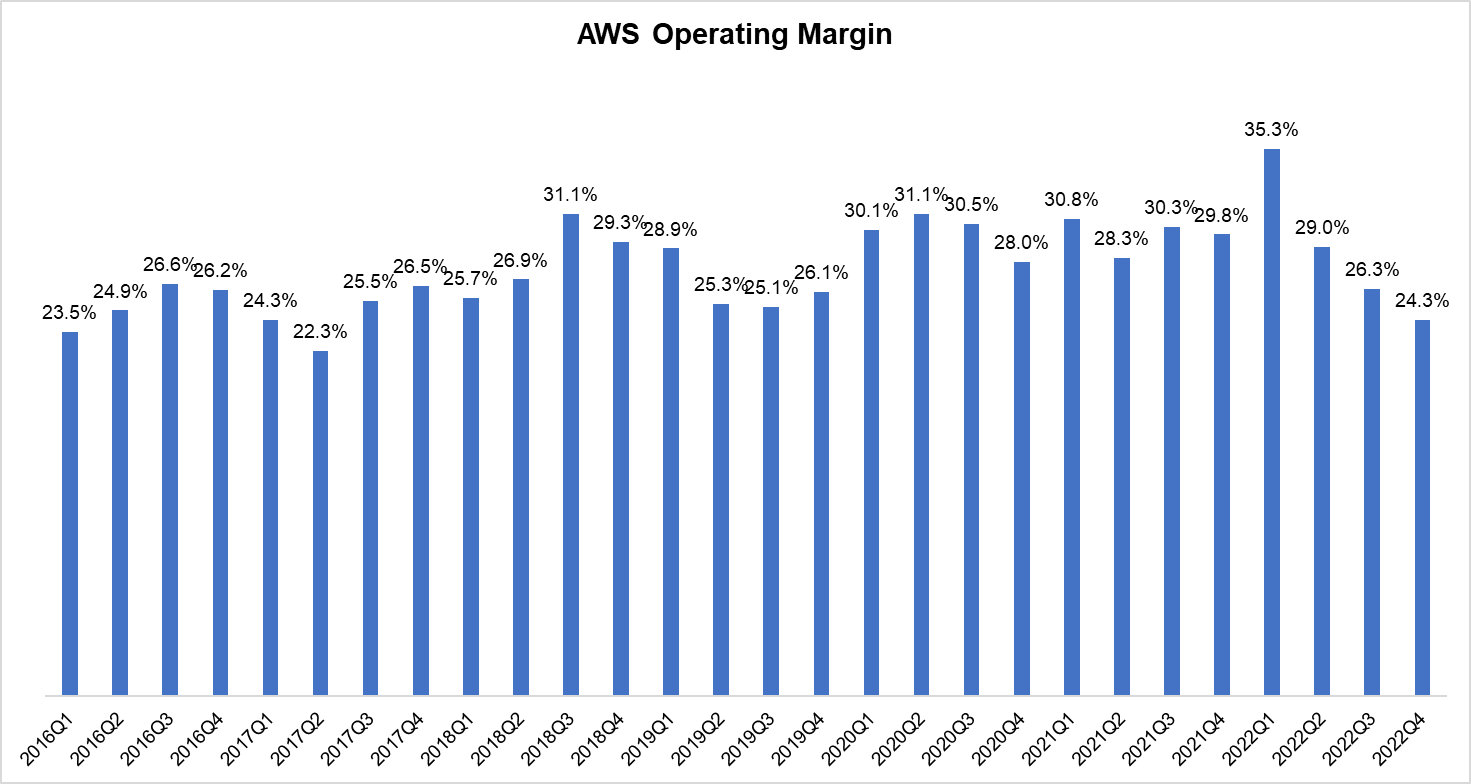

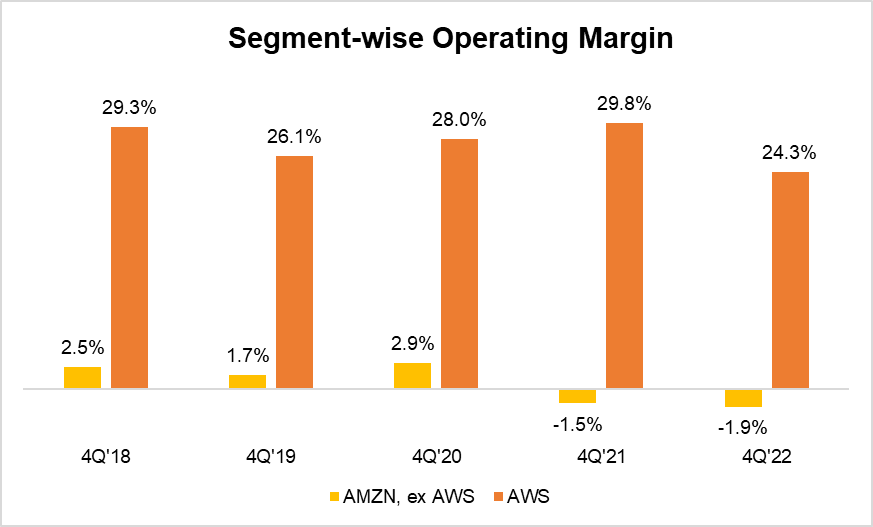

AWS reported 35.3% operating margin in 1Q'22 whereas in 4Q'22, it came down to 24.3%! The last time they reported such low margin was back in 2Q'17.

Andy Jassy has big shoes to fill in. And it's fair to say now he's had a rough start.

Amazon, ex AWS margins are also in the wrong direction.

While Amazon reported $2.7 Bn operating income in 4Q'22, there was $2.7 Bn one-off charges. Excluding those, operating income would be $5.4 Bn in 4Q'22.

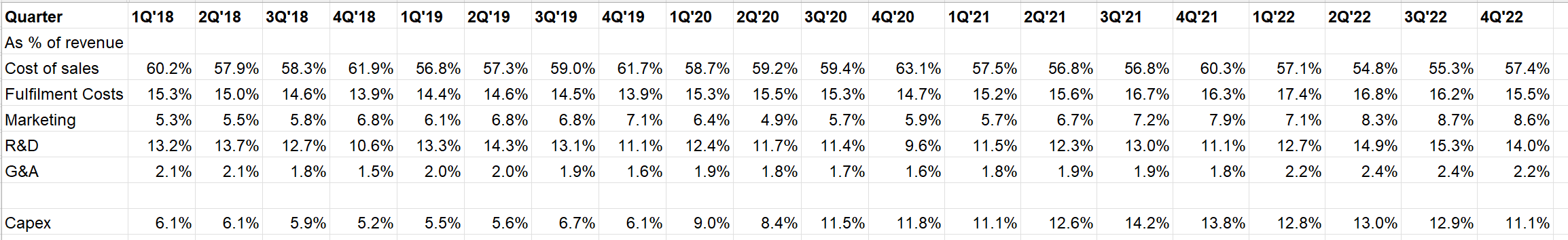

Amazon added $281 Bn revenue in 2022 vs 2018, and yet none of the operating cost line items shows any operating leverage (cost of sales is mostly mix shift from product to service sales). They even managed to increase marketing cost from ~5% in 2018 as % of revenue to ~8% in 2022.

Capex intensity almost doubled over the last 5 years. That's "probably" okay; I say "probably" because they don't disclose how much they're spending on other bets and we don't have much of a clue about economics of any of their other bets.

Prime Video

Amazon asserts they do rigorous ROI analysis on their spending on content (probably take it with a grain of salt):

The Rings of Power, the most watched Amazon original series in every region of the world, reaching over 100 million viewers and driving more Prime sign-ups worldwide during its launch window than any previous Prime Video content.

We also finished our inaugural season as the exclusive home of Thursday Night Football, reaching the youngest median age audience of any NFL broadcast package since 2013 and increasing viewership by 11% from last year among hard-to-reach 18- to 34-year-olds.

In aggregate, we invested approximately $7 billion in 2022 across Amazon Originals, live sports and licensed third-party video content included with Prime. That's up from about $5 billion in 2021. As a reminder, these digital video content costs are included in cost of sales on our income statement. We regularly evaluate the return on the spend and continue to be encouraged by what we see, as video has proven to be a strong driver of Prime member engagement and new Prime member acquisition.

Amazon International

International remains a challenging segment for Amazon, but Jassy shared some encouraging stats, but I would love to hear how they're doing in India:

if you look at the compounded annual growth rate from 2019 to '21, in the U.K., it was over 30%; in Germany, it was 26%; in Japan, it was 21%. And the fact that we haven't given back that growth, and these are all net of FX, but if you look at even the last couple of quarters where we're continuing to grow and we haven't given back some of that growth, a meaningful amount of market segment share has shifted to our global established e-commerce territories, and we're excited about that.

Andy Jassy, in his first call with the analysts, also depicted how Amazon is thinking strategically on their big bets:

when we think about big areas to invest in, we ask ourselves a few questions. We ask, if we were successful, could it really be big and move the needle at Amazon, which is a high bar at a place like Amazon? Do we think it's being well served today? Do we have a differentiated approach? And do we have some competence in those areas? And if we don't, can we acquire them quickly? And if we like the answers to those questions, we will invest.

when we look at the answers to those 4 questions, we are very enthusiastic about our investments in streaming entertainment devices, our low Earth orbit satellite and Kuiper, health care and a few other things. And I think that do I think every one of our new investments will be successful? History would say that, that would be a long shot. However, it only takes one or two of them becoming the fourth pillar for Amazon for us to be a very different company over time.

This was perhaps Amazon's the most underwhelming quarter in the last four years of my Amazon coverage.

(feel free to dip your toes in the tip jar if you find these updates useful; thank you so much in advance)

I'll cover Shopify and IAC in a couple of weeks.