Amazon 3Q'22 Earnings Update

Disclosure: I own shares of Amazon

When faced with an uncertain economy or some kind of discontinuous event, customers tend to double down on companies that they believe have the best customer experience and that take care of them the best

As Bezos said, long-term shareholders and customers interests are aligned. We'll see.

Here are my highlights from 3Q'22.

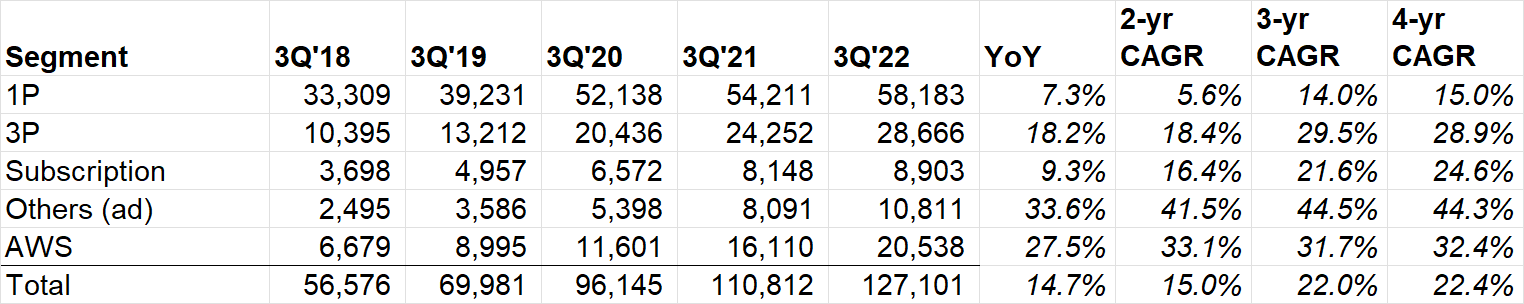

Revenue

Topline had 460 bps FX headwind (vs guidance assumed 390 bps). Unlike in most companies, FX impact is higher for topline than bottom-line for Amazon.

FX is a bigger issue for us on our revenue growth in dollars than it is on our income. It actually has a slight favorability due to the investments we're making internationally.

2,3,4-yr CAGR still look pretty healthy across most segments.

Retail

3P seller unit mix 58% in 3Q'22 (vs 56% in 3Q'21)

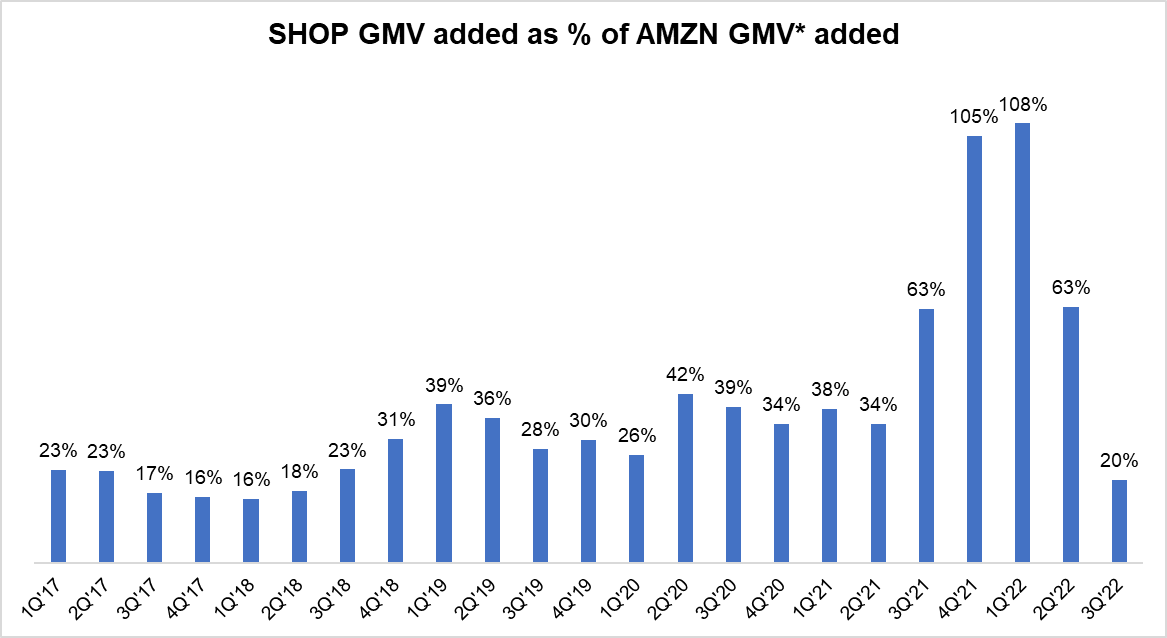

While Retail growth may look unimpressive at first glance, it looks much better in comparison with Shopify last quarter although Amazon's numbers probably got extra boost because of Prime Day.

Prime

Prime day drove 400 bps growth YoY in 3Q'22 (Prime Day was in 2Q last year).

Rings of Power and NFL's TNF drove Prime subscriber growth:

"The Rings of Power attracted more than 25 million global viewers on its first day. And in the first 2 months since its launch, Rings of Power has driven more Prime sign-ups globally than any other Amazon Original."

NFL's Thursday Night Football also premiered in September, averaging more than 15 million viewers during its first broadcast, and driving the 3 biggest hours of U.S. Prime sign-ups in the history of Amazon.

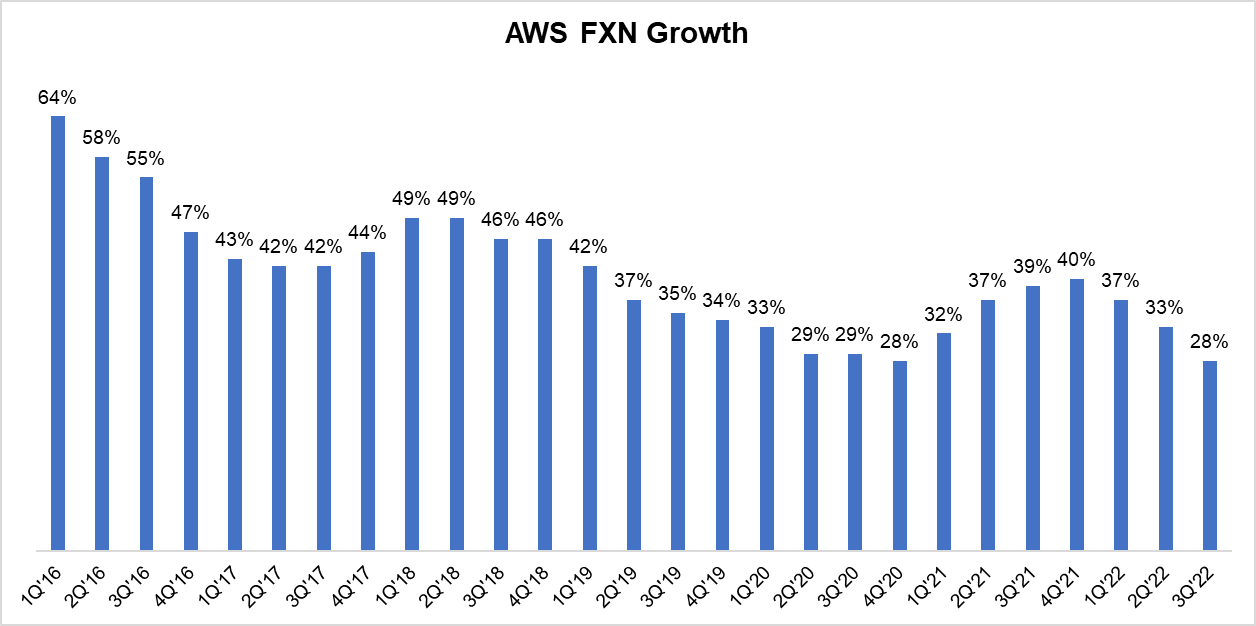

AWS

AWS run-rate $82 Bn. Backlog $104 Bn (+57% YoY)

Although AWS grew +28% YoY FXN, 3Q'22 ended with mid-20s growth, indicating some slowdown in cloud.

The last time AWS saw high 20s growth in 2Q'20-4Q'20, it was able to reaccelerate later. It seems a bit tough to do that again in the next few quarters given the macro situation.

With the ongoing macroeconomic uncertainties, we've seen an uptick in AWS customers focused on controlling costs. And we're proactively working to help customers' cost optimize, just as we've done throughout AWS' history, especially in periods of economic uncertainty. The breadth and depth of our service offerings enable us to help them do things like move storage to lower-priced tiers options and shift workloads to our Graviton chips.

Graviton3 processors delivered 40% better price performance than comparable x86-based instances.

Even though growth is likely to decelerate, value proposition of shifting to cloud may become clearer during economic downturn:

I would say this is one that real valuable points about cloud computing is that it's turning fixed cost into variable for many of our customers, and we help them save money either through alternative services or Graviton3 chips. There's many ways that we have to help them lower their spending and still get great cost performance ratios.

Financial Services, mortgage business, crypto are down which have affected AWS growth.

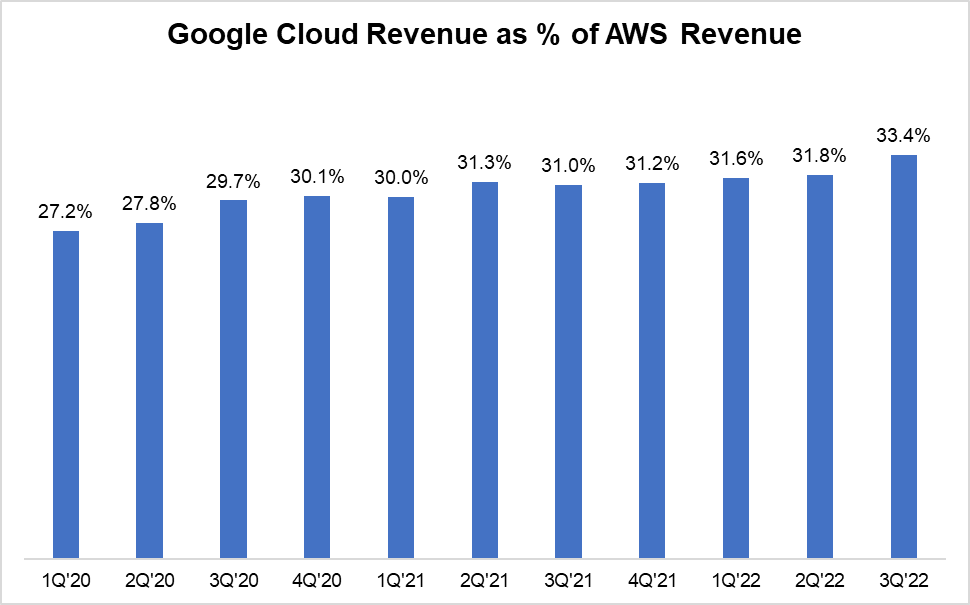

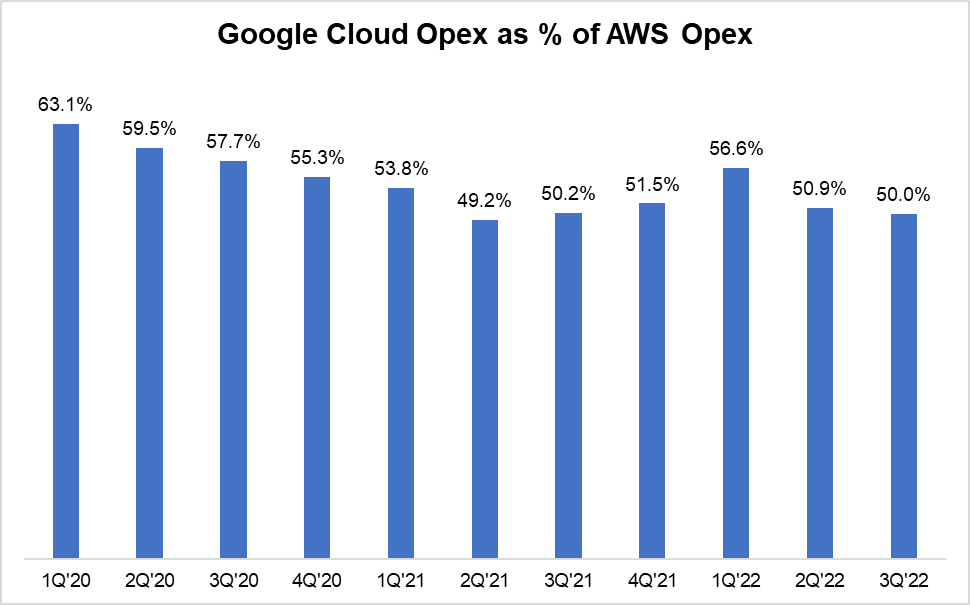

Now that we have AWS results, it makes Google Cloud look a bit better, especially given the hiring ramp-up Google did for GCP over the last few quarters. It makes me optimistic that by 2024, GCP may make some serious improvement in margins.

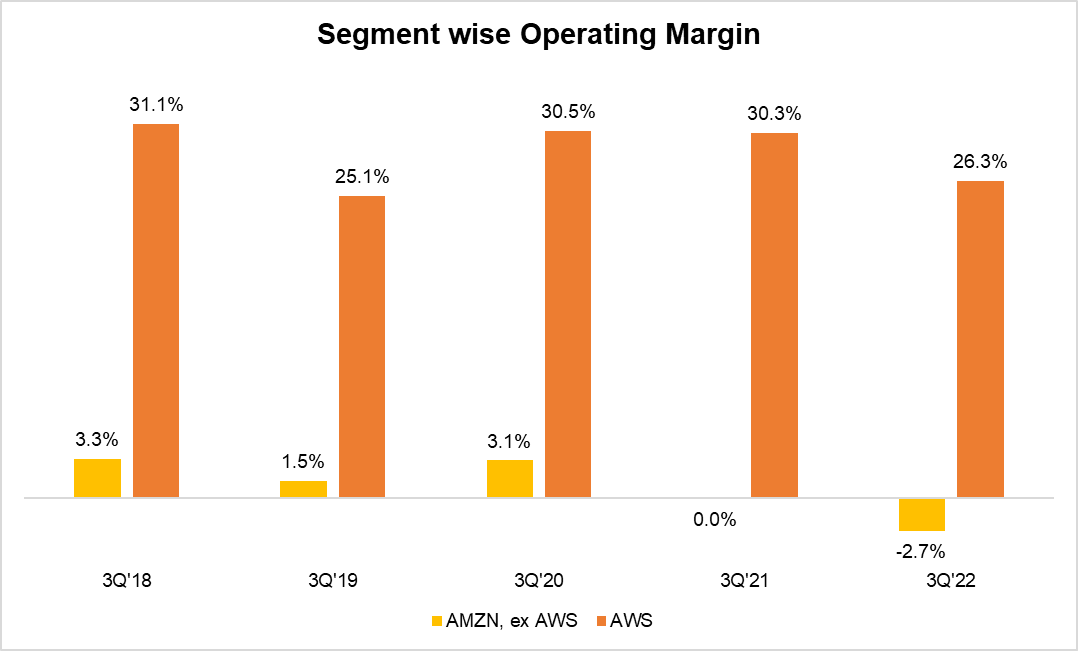

Speaking of margins, AWS EBIT margin went down to 26.3% in 3Q'22. Why?

I'd say what's happening lately is, yes, the stock-based comp. There's -- we have seen inflation in our wages this year and particularly on our check employees is heavily concentrated in AWS. So that's one element of it. We're also seeing energy costs that are materially higher than they had than pre-pandemic electricity and the impact of natural gas pricing. So those prices up more than 2x over the last couple of years and contribute to about 200 basis point degradation versus 2 years ago.

Ex-AWS, rest of Amazon posted -2.7% EBIT margin (2Q'22 was -2.4%). Amazon did take some non-recurring charges this quarter by closing Amazon Care, Fabric.com, and Amazon Explorer.

Some more explanations here:

On international, international is always a mix of profitability in more established countries of Europe and Japan, offset by emerging countries and investments in Prime benefits. I think the biggest issue quarter-over-quarter, the increase in losses versus Q2 was tied to some additional operating costs in Europe. We've seen higher fuel costs there, just even more certain in the United States. And Prime Day is always a bit of -- has lesser profitability because there's just a lot of deals. And it's a bit of margin from Prime Day in both North America and international.

So we also had a big -- a big part of that is device sales. And again, we sell a lot of devices during our Prime Day events. We don't make money on the device. We make money on the use of the device. So that always can end up hurting profitability in the quarter.

Of course, we can always find "reasonable explanations", but let me ask some tough questions. Before I ask the questions, let me give some data.

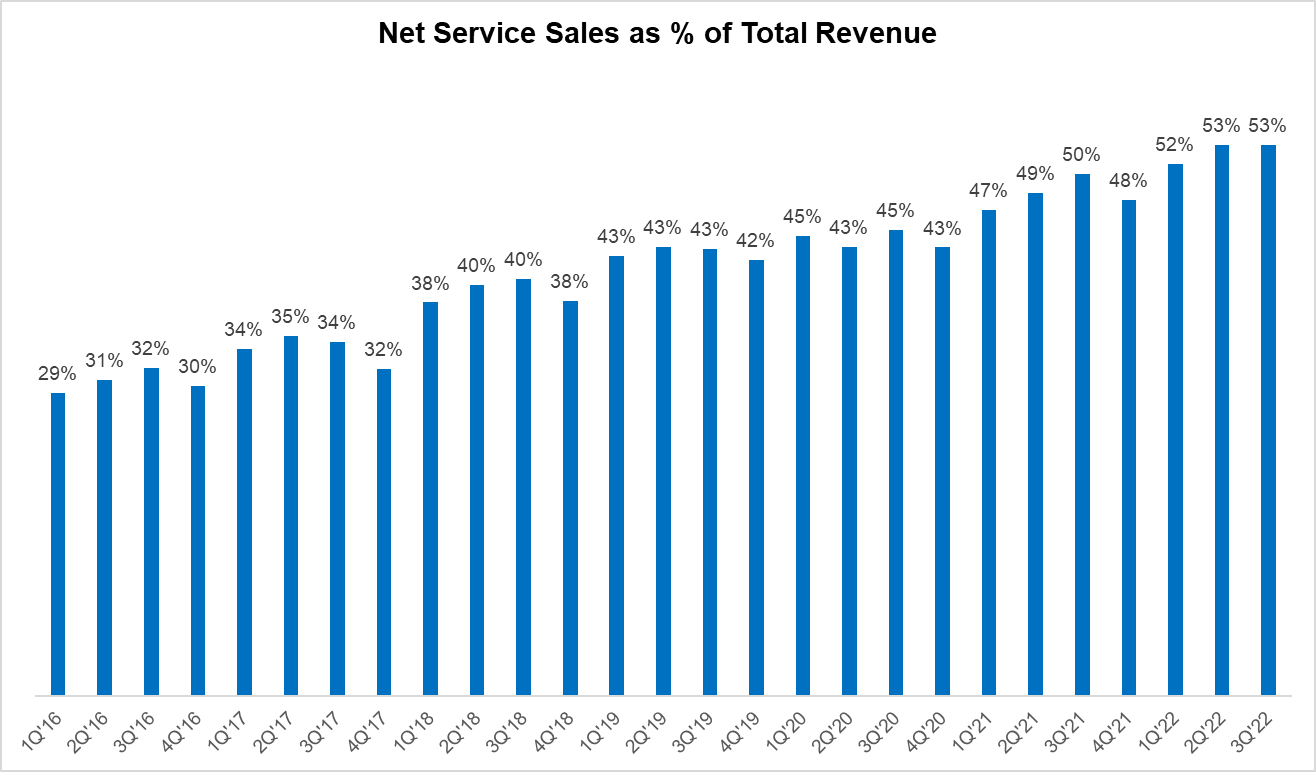

Net Service Sales as % of Total revenue went from ~30% in 2016 to ~53% in 2022. Service is higher gross margin business than product sales.

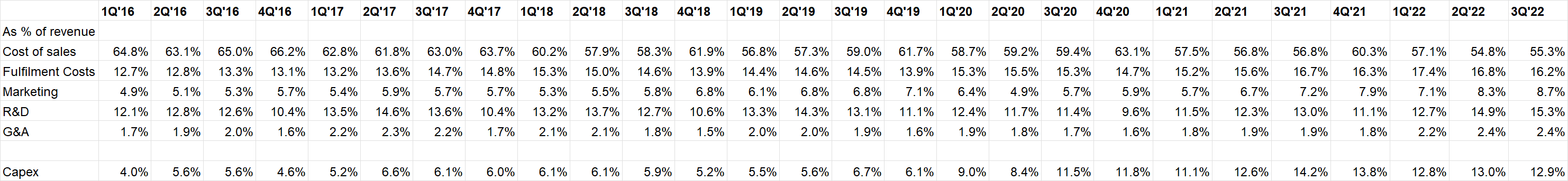

Now let's look at Amazon's cost structure from 1Q'16-3Q'22. Please note in 2016, Amazon's average quarterly topline in first three quarters was ~$30 Bn compared to ~$120 Bn in 2022.

What's surprising is apart from cost of sales (which was just a benefit for mix shift to service), every single cost line item deteriorated over time. One would imagine adding $90 Bn topline would lead to at least some scale benefits, but well, not at Amazon!

3P and advertising are likely to be pretty high margin segments. Clearly, there are some "Metaverse" hidden in this income statement.

I am curious whether investors will be able to force Amazon to disclose its "other bets" losses. Let's see whether investors do have any voice on a company without the dual class shareholder structure.

Unlike Meta, Amazon, however, is quite adept at communicating with shareholders. Amazon sounded like an adult when it reminded that they cut about 1/3 of their budget from what they originally thought for 2022.

While that sounds good, also as a reminder, this is their capex+ leases spend over the years:

2015: $9.0 Bn

2016: $13.5 Bn

2017: $14.6 Bn

2018: $22.9 Bn

2019: $23.6 Bn

2020: $54.3 Bn

2021: $68.1 Bn

2022*: ~$60 Bn

*not including leases

I'll be very curious about their 2023 capex outlook, especially ex-AWS.

Outlook

4Q topline guide $140-148 Bn, implying ~2-8% YoY growth (assumes 460 bps FX headwind)

This has been a draining week. Take care, everyone!