Shopify 3Q'22 Earnings Update

Disclosure: I own shares of Shopify

By and large, things are in the right direction for Shopify. Here are my highlights from the latest earnings.

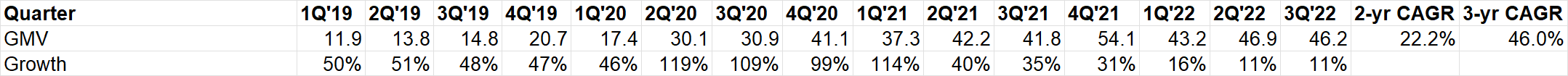

GMV

GMV grew 11% YoY, ~15% FXN. 2-yr CAGR and 3-yr CAGR were ~22% and 46% (52% FXN) respectively which lets you peek beyond the tough comp.

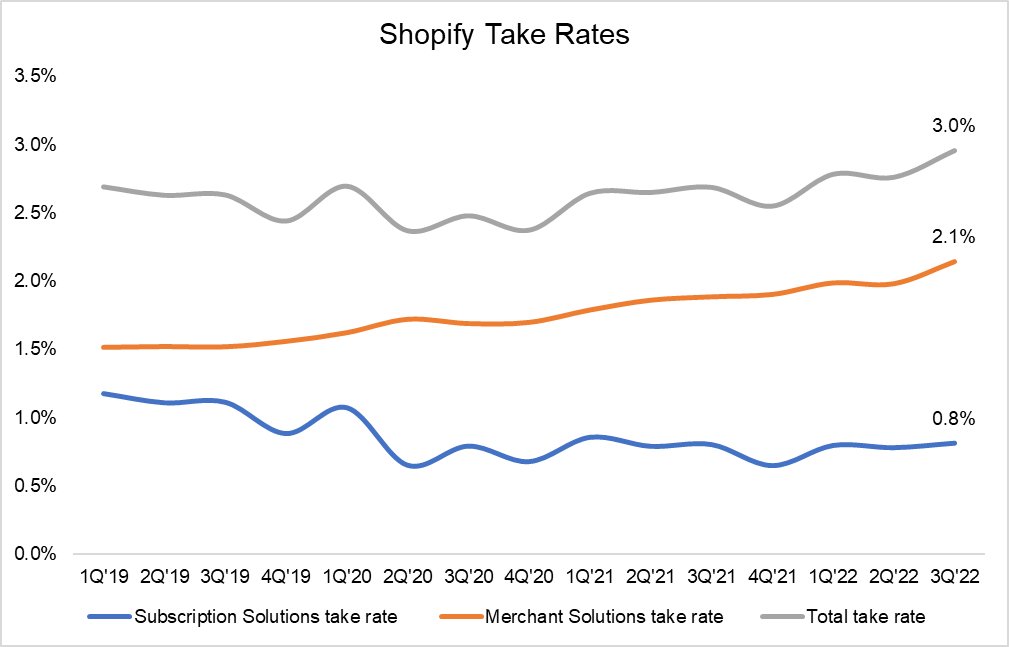

Take rates

Shopify posted its highest ever take rates in the last quarter, primarily driven by Merchant solutions.

Most Shopify plans are fixed plans, so take rates are probably not the best metric for subscription solutions. However, Shopify Plus pricing is $2,000/month or 0.25% of GMV whichever is higher with the maximum price being $40,000/month. Shopify Plus merchants were 33% of MRR in 3Q'22 (vs 28% in 3Q'21).

It is the Merchant Solutions that can and will grow commensurately with GMV. As Shopify builds more and more products for Merchants to address their problems, the attach rates is likely to go higher. Take rates for Merchant solutions increased from 1.5% in 1Q'19 to 2.1% in 3Q'21. Deliverr added 8 bps to the take rate.

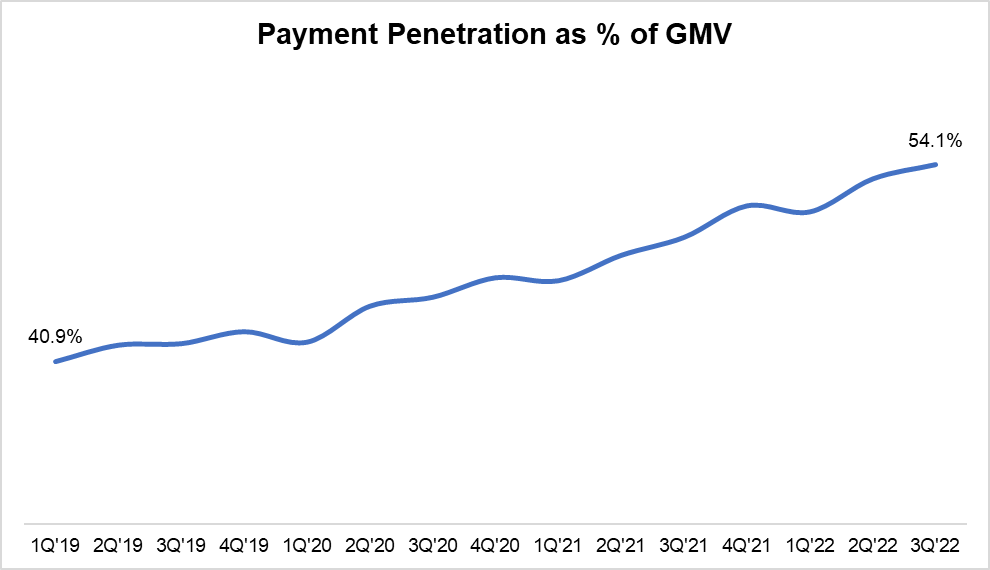

Payment penetration

The primary driver of Merchant Solutions take rates is Shopify's payment penetration. Payment penetration keeps going higher every quarter and went from 40.9% in 1Q'19 to 54.1% in 3Q'22 (vs 49.2% in 3Q'21).

I am going to keep a close eye on this metric to gauge whether "Buy with Prime" is making any inroads with Shopify Merchants. Since it's very early days with "Buy with Prime", there's not much signal here yet, but expect it be under the scanner in 2023-2024 when "Buy with Prime" is rolled out more widely.

Despite the public rhetoric, I expect Shopify to be quite protective of this revenue source since Merchant solutions is now ~72% of total revenue, majority of which is driven by payments. Shopify is simply not in a position to let Amazon "steal" this revenue from them.

"we were talking to Amazon about how we implement this in the right way."

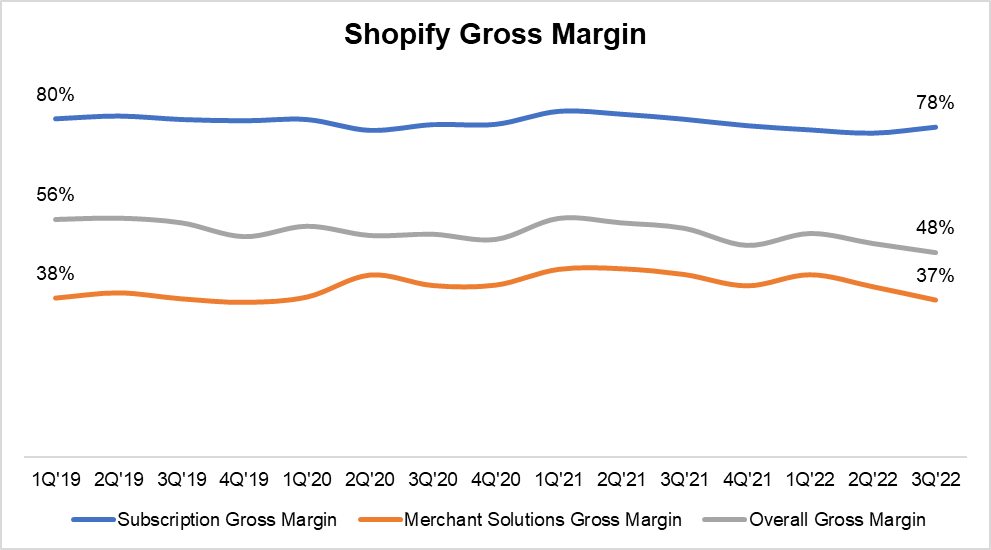

Gross Margin

As merchant solutions, which is lower gross margin, grow much faster than higher margin subscription solutions revenue, overall gross margin continue to go down over time (+typical FX caveat).

Offline Retail

Shopify maintained its recent ramp up beyond online retail infrastructure; 8 new merchants with >20 locations (one with 175 locations) became Point-of-Sale (POS) customers. Shopify Plus merchants were 35% of POS sales in 3Q'22 (vs 14% in 3Q'21). Offline GMV grew 35% YoY (41% FXN)

Since the beginning of 2021, over half of the rapid adoption of point-of-sale Pro is being driven by new SMB retailers coming to Shopify to get their start as a new omnichannel business. Additionally, over 1/3 are from established offline retailers who are entirely new to e-commerce or selling only on point of sale.

Social Commerce

While still very nascent, GMV through native checkout integrations on key partner services such as Facebook, Instagram and Google, more than tripled from Q3 last year.

Product

Shopify's product initiatives make me optimistic that over time, they can expand Merchant Solutions take rates, which as I will explain later, may be essential for shareholders to make money.

Shopify Collabs

Another marketing tool that we launched in early access in mid-August is Shopify Collabs, which brings brands and creators together. It has generated approximately 50 million organic impressions across social channels in less than 2 months. Collabs allows creators to monetize their talents by discovering and partnering with independent brands and sharing their favorite products with their followers. This gives merchants yet another new channel to grow their brand reach and find new customers.

Shopify Markets

We're also investing in our merchants' ability to grow by helping them go global. Shopify Markets, which launched in Q1 allows merchants to identify, set up, launch, optimize and manage their international markets from a single storefront. To date, more than 175,000 merchants across the world have used markets to help launch their international businesses.

By reducing the barriers to international selling, U.S. merchants utilizing Markets now sell into an average of 14 additional countries. Shopify Markets Pro, which debuted in mid-September in early access, is our cross-border solution built on top of Markets. By combining global use features with markets capabilities such as the Translate and Adapt app, Markets Pro makes it easier for merchants to accelerate their global expansion to over 150 countries overnight without increasing their operational costs, risks or complexity.

International retailers outside of North America continued to grow our overall merchant mix, comprising 45% of all merchants in Q3 and demonstrating the continued success of our investments.

Shopify Capital

At the end of August of this year, capital broke another record. We've provided cumulative funding of $4 billion since inception to our merchants.

SFN

In Q3, we completed the rollout of Shop Promise to all SFN merchants. Shop Promise is a consumer-facing badge indicating fast and reliable delivery across Shopify's online store and other popular direct-to-consumer channels. Shop Promise has already significantly boosted sales as participating merchants increased buyer conversion by up to 9% during the initial rollout.

In September alone, SFN saw over 2/3 of domestic packages delivered within 2 business days, an exponential increase from less than 2% predicted delivery before SFN's software update in early 2022. All new SFN merchants are now automatically qualified to display the Shop Promise badge out of the box. We are confident that Shop Promise's impact on merchant value will continue to increase as it evolves and matures. And we believe that SFN has the opportunity to become the de facto fulfillment solution for independent merchants in the consumer packaged goods and apparel categories.

We're already increasing the number of SFN orders with predicted delivery of 2 days or less, from -- to over 65%. And so we're on track to hit over 75% by the end of the year.

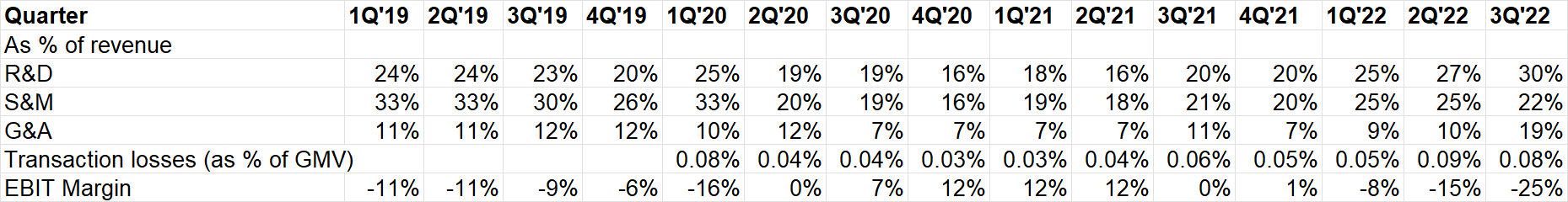

Cost structure

Like other tech companies, Shopify's cost structure skyrocketed from 2021. R&D as % of sales went from ~18-20% in 2021 to ~30% last quarter. S&M went down as % of revenue sequentially QoQ.

Shopify had ~$97 Mn one-off expenses (including $30 Mn severance expense) last quarter. Excluding this, G&A would be 12% of revenue in 3Q'22.

New comp structure

As part of opting into this new compensation system, employees received a single total compensation number and had the choice to allocate their pay between cash and newly granted equity in the form of restricted stock units and/or stock options. In addition, previously granted unvested equity was canceled, and the new quarterly equity grants will vest monthly.

Employees will be able to change their allocation between cash and equity each quarter as their personal preferences change. We link Flex Comp tightly to our mission and long-term vision of building a 100-year company. So for those employees who elected extra equity above the default settings, they were given an additional 5% bonus on that equity amount.

Outlook

Shopify expects merchant solutions to grow more than double that of Subscription solutions in 2022. Gross profit dollar growth will continue trail revenue growth. Operating expense growth YoY in Q4 will sequentially decelerate from Q3.

From an adjusted operating loss perspective, we continue to expect a loss for the full year. For Q4, based on our updated outlook, we now expect an adjusted operating loss dollar amount that will be fairly comparable to the adjusted operating loss in Q3. Finally, the full year estimates of stock-based compensation and related payroll taxes, CapEx and amortization of acquired intangibles are now $575 million, $125 million and $55 million, respectively.

Valuation

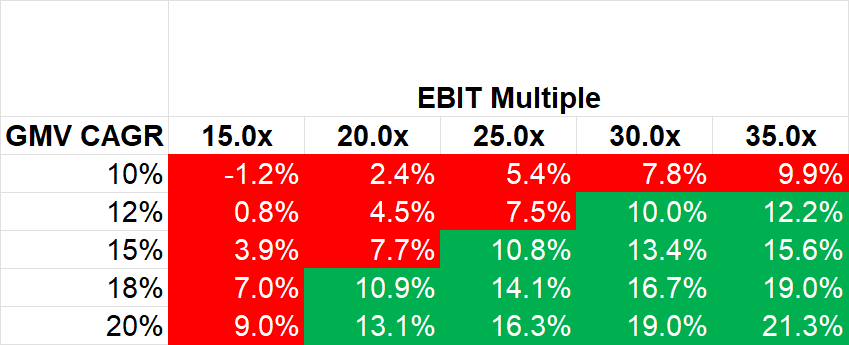

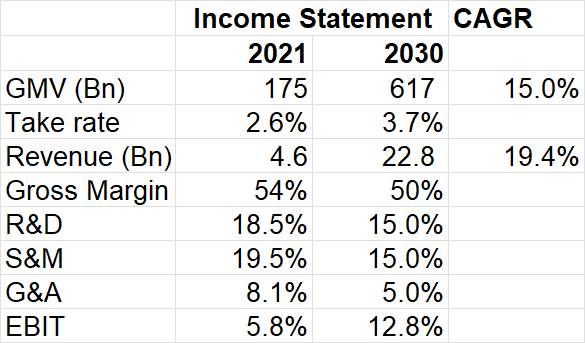

Shopify is down almost ~80% from its All-Time High (ATH). However, you still need to assume ~15% GMV CAGR (2021-2030), ~13% GAAP EBIT margin, and 25x terminal EV/EBIT multiple to make ~10% IRR.

Here's a scenario analysis (keeping other variables such as EBIT margin constant):

How to get to ~13% GAAP EBIT Margin?

If take rates expand by ~100 bps over the next 8 years, Shopify should not find it difficult to manage its cost structure to reach ~12-15% EBIT margin in 2030. Of course, as we have seen with Amazon, they may not post such margin even in 2030 if they can manage to grow GMV and gross profit at ~20% or higher with attractive ROIC. Therefore, ROIC may be more important driver than terminal margins in this case.

Speaking of Amazon, I will cover their earnings tonight.