Amazon's robot army

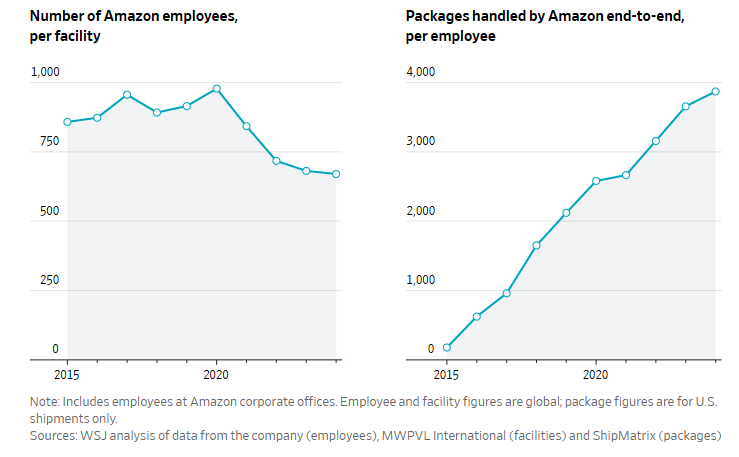

Back in June 2025, WSJ reported that while the average number of employees per Amazon facility continues to go down every year, the number of packages that Amazon ships per employee each year has increased from 175 in 2015 to almost 4,000 in 2025. This massive productivity gain largely came from Amazon’s deep investments in robotics in its facilities.

Then last week WSJ published another report highlighting Amazon’s further investments in robotics. Some excerpts from the WSJ piece:

“The retail giant unveiled a trio of new technologies Wednesday that it is testing or preparing to deploy in its warehouses and delivery vans. They include a robot arm called Blue Jay, designed to sort packages; an artificial-intelligence agent called Eluna, intended to help human managers deploy workers and avoid bottlenecks; and augmented-reality glasses to be worn by delivery drivers in the field.

The announcements are the latest in a yearslong effort by Amazon to automate more warehouse tasks, an effort that began with the company’s $775 million acquisition of Kiva Systems in 2012. Around three-quarters of Amazon’s deliveries are in some way assisted by robots, the company has said.”

Brady said the Shreveport facility, which is the model for Amazon’s ambitions, contains 10 times as many robots as a typical warehouse, allowing packages to move through 25% faster. “We plan to pass on that low cost to customers,” he said.

Amazon also published a blog post about Blue Jay last week:

Blue Jay is already being tested in production at one of our facilities in South Carolina, where it’s already able to pick, stow, and consolidate approximately 75% of all the various types of items we store at our sites. Over time, it will serve as a core technology helping power Amazon’s Same-Day sites. For customers, that means faster deliveries at low cost.

Retail is perhaps one of the most deceptively simple industries. We all visit stores, or just click a couple of buttons to order something, and voila, it shows up in a couple of hours or a day or two later. I say “deceptively simple” because the supply chain operations behind the scene is excruciatingly challenging to execute.

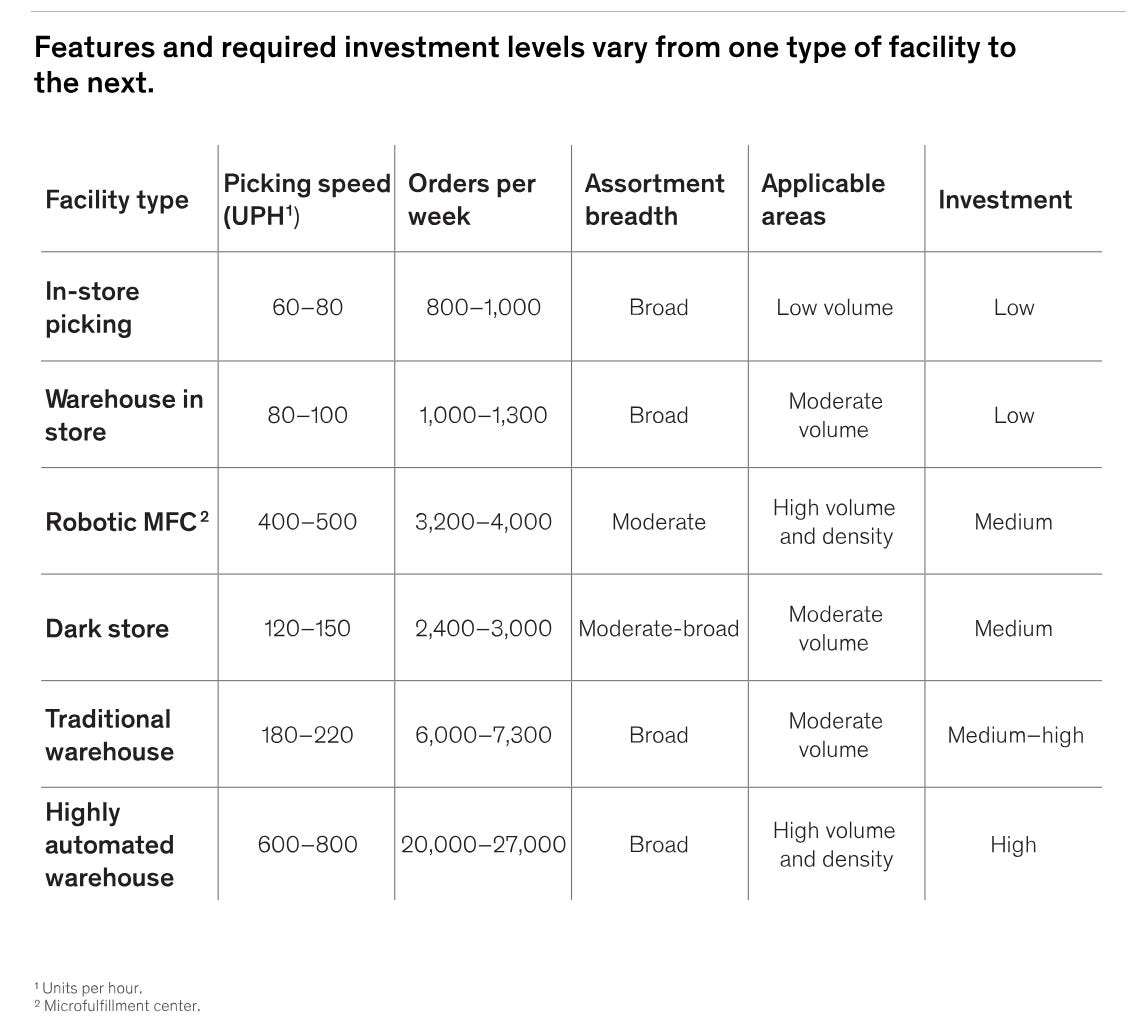

In my most recent Deep Dive on Instacart, I mentioned that one of the things that I think many people may underappreciate is how much technological investments that may be required to operate the best-in-class grocery delivery experience. Of course, this is true for not just grocery delivery, but any e-commerce delivery operations as well. Speed of delivery is increasingly the key differentiating factor and robots are the key conduit for ever increasing efficiency in retail operations. I mentioned this McKinsey report in my Instacart Deep Dive, but I think is worth highlighting how much the pick-up speed itself can be a major contributing factor to increasing efficiency and lowering costs:

“Picking costs typically represent the greatest aggregate cost for online fulfillment. The average grocery basket contains about 30 items. Assuming a pick speed of 60 UPH (unit per hour), the 30 minutes spent picking a single order translates to about $8 to $10 an hour. This total includes the labor costs associated with picking as well as order consolidation, staging, customer contact, and handover.

Grocers can take advantage of a range of picking options with different degrees of centralization, capacity, and automation. Grocers need to build a portfolio of fulfillment options by geography, with the mix varying by the density of current and projected demand and their fundamental online value proposition (for example, cost or speed of delivery).”

Given the massive technology investments required, I think the US retail industry is going to be even more consolidated in the next couple of decades. Retail is a low margin industry, and perhaps only a handful of the players can afford to make such long-term sizable bets to stay at the productivity and efficiency frontier.

One consequence of this massive investments in robotics is Amazon will require fewer headcount for incremental growth. Another piece by NYT last week corroborated that Amazon intends to hire fewer people as they expect to enjoy efficiency gains through their investments in robotics:

“Amazon’s U.S. work force has more than tripled since 2018 to almost 1.2 million. But Amazon’s automation team expects the company can avoid hiring more than 160,000 people in the United States it would otherwise need by 2027. That would save about 30 cents on each item that Amazon picks, packs and delivers to customers.

Executives told Amazon’s board last year that they hoped robotic automation would allow the company to continue to avoid adding to its U.S. work force in the coming years, even though they expect to sell twice as many products by 2033. That would translate to more than 600,000 people whom Amazon didn’t need to hire.

Amazon plans to copy the Shreveport design in about 40 facilities by the end of 2027, starting with a massive warehouse that just opened in Virginia Beach. And it has begun overhauling old facilities, including one in Stone Mountain near Atlanta.

That facility currently has roughly 4,000 workers. But once the robotic systems are installed, it is projected to process 10 percent more items but need as many as 1,200 fewer employees, according to an internal analysis.”

Of course, there are some predictable concerns from some political corners about potentially lower employment opportunities. I am not unsympathetic to such concerns (haven’t we all wondered about obsolescence of our livelihood post-AI), but the following Milton Friedman anecdote can be clarifying why such concerns are unlikely to withstand in a capitalistic society:

“At one of our dinners, Milton recalled traveling to an Asian country in the 1960s and visiting a worksite where a new canal was being built. He was shocked to see that, instead of modern tractors and earth movers, the workers had shovels. He asked why there were so few machines. The government bureaucrat explained: “You don’t understand. This is a jobs program.” To which Milton replied: “Oh, I thought you were trying to build a canal. If it’s jobs you want, then you should give these workers spoons, not shovels.”

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 64 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: