Veeva Update

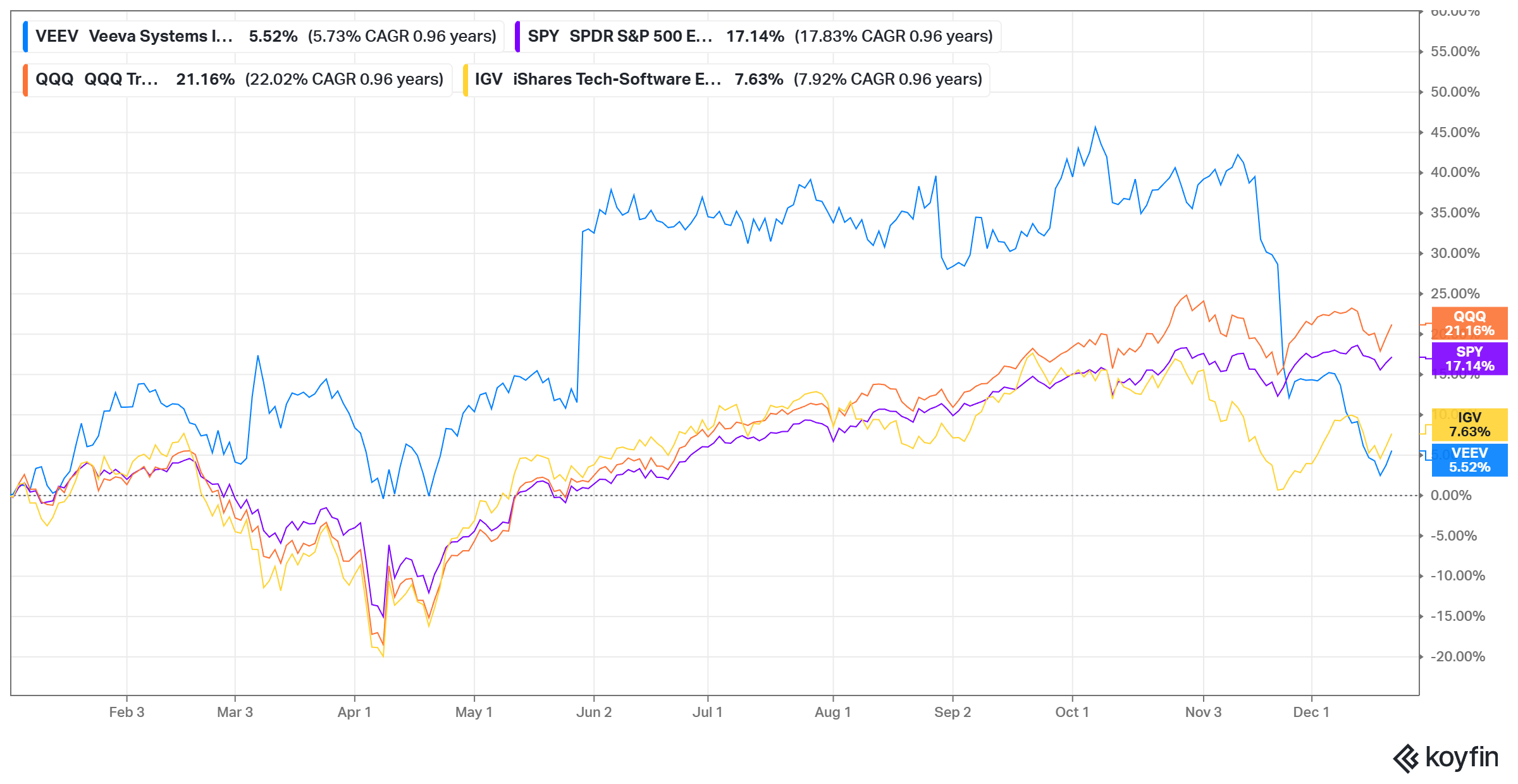

Most software stocks are in bit of a tough spot in 2025. Even till late October this year, IGV (tech-software ETF) was slightly trailing both SPY and QQQ, but today its YTD is lagging SPY and QQQ by ~10 and ~14 percentage points respectively. Veeva has experienced a more dramatic version of this route as it went from +45% YTD in late October to just +5% YTD now.

I have explained before how I try to pay attention to potential dislocation in stock prices, and it did catch my attention that while I was modeling ~$3.13 Billion revenue for Veeva in FY’26, they guided for ~$3.17 Billion revenue in FY’26. More interestingly, I was only modeling $780 Million GAAP EBIT in FY’26. However, their LTM GAAP EBIT is already $859 Million, thanks to their operating margin running ~400 bps higher than what I was modeling. Their actual EBIT in FY’26 may turn out to be ~15% higher than my estimates even though the stock is largely flat since my Deep Dive. That is usually a good set up for me to dig a little deeper to assess whether the stock is now sufficiently attractive.

So, I did go through their October Investor Day as well recent earnings and sell-side transcripts to gauge more recent developments and contexts. I will elaborate my findings as well as my current thoughts on the stock behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 65 Deep Dives here