The "humorless" and timeless machine of Booking Holdings, Portfolio Change

Almost three years ago, my friend Scuttleblurb described Booking in a way that I believe truly encapsulated the essence of the company:

Booking is metrics – it iterates on performance marketing game mechanics and humorlessly monitors every bit of performance down the hour.

Indeed, I doubt there is any better company out there which perhaps turned every art of performance marketing into its most “scientific” form. Therefore, how they invest their precious ad dollars often piques my interest. Their most recent earnings call left some clues how they think about it.

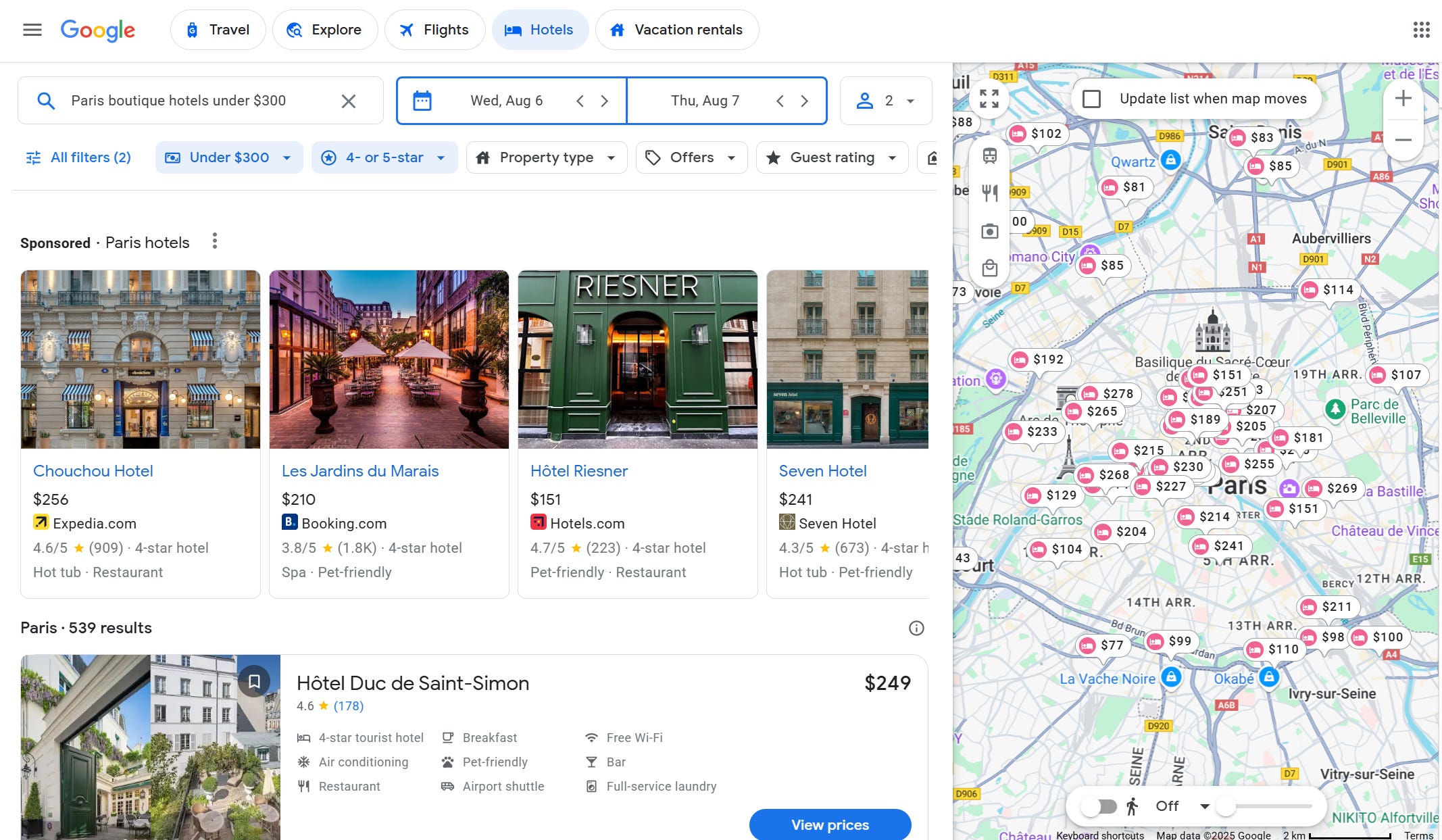

Performance search remains the travel industry’s most durable acquisition engine because it captures the moment of highest commercial intent. Google now lets a traveler move from “Paris boutique hotels under $300” to price-filtered results, reviews, and a booking call-to-action without ever leaving the search environment. Take reviews for example. Some studies show 88% of travelers filter out hotels with an average star rating below three, and Google captures majority of the reviews written on the internet.

A vast majority of hotel decisions still start with a search, underscoring how embedded this habit is in the purchase journey. Google is also stimulating instead of cannibalizing that habit through its AI features in search, effectively enlarging the funnel that performance marketers such as Booking can bid on. Against that backdrop it is less surprising that Booking’s Q2 call noted its Google clicks “continue to hold up quite well” and are still growing YoY for accommodations:

…if you look at the performance marketing channels, it's actually, to some extent, interesting that the Google clicks continue to hold up quite well. Actually, they're still growing for accommodations, slightly still period-over-period. So we don't see yet a decline in that.

Booking’s deep connectivity gives it near-real-time rates and room types, so its quality score on Google stays high and CPC inflation is kept in check. Moreover, attribution still favors last-click channels. Even when users browse on social or in an AI assistant, many may finish the transaction on Google, where Booking’s brand-bidding strategy secures the converting click. As long as these mechanics persist, Google will keep delivering predictable, high-margin traffic.

If search wins on intent, social wins on inspiration and that part of the funnel continues to gain momentum. From the call:

But we would like to, of course, really diversify our performance marketing channels to other channels like we are doing with social media. Just to give you another data point there, actually, the spend in social media channels was up this quarter, 25% compared to the second quarter of last year.

OpenAI’s new ChatGPT Agent mode already prototypes a world where a user says “find a 5-star hotel in Mexico City” and the assistant fetches live rates, compares hotels, and completes the reservation, using Booking.com inventory. In the medium term, that shift could turn agents into the new meta-layer of distribution. Traffic that arrives via an agent will likely be priced on a cost-per-action or revenue-share basis rather than a CPC auction. If agents scale, Booking’s marketing mix may tilt toward variable commissions and away from unpredictable bid markets, potentially smoothing ROAS. One can wonder if current search performance marketing requires a lot of skill in which Booking is better than its competitors, an agent dominated world may make it a simpler world for everyone, including its competitors which may put pressure on take rates. But I think there will still be plenty of complexities left even in agent dominated world.

The assistant abstracts away the UI, so loyalty has to live in service quality, and breadth of supply. Booking’s deep inventory, reviews corpus, and payments stack may give it defensibility, but only if those assets remain the agent’s easiest way to fulfill a request. Agents will expect structured, real-time availability feeds and semantically rich content. The OTAs that invest earliest in API performance, room-level attributes, and adjacent travel products (ground, experiences, insurance etc.) will train the agent to default to them, reinforcing share. Winning may come down to who can guarantee the agent’s promise e.g. instant confirmation, no rate parity conflicts, and reliable customer support at the lowest latency.

Booking reminded investors that they intend to be quite ready for however the future of travel accommodation unfolds:

So also there, we're continuing to learn and experiment finding new modern channels that travelers are using to get inspired for travel and finding ways to ultimately book and then also, as you know, we are very actively working together with all the hyperscalers and what they are doing with respect to their agent development. So for example, we're very proud that we were mentioned as one of the key partners for ChatGPT agent mode and Booking.com was clearly highlighted in the demos that they showed a couple of days ago. So a little bit overall, still too early to say. But what you should take away, I think, main point is we are really trying to expand to learn and the more channels we can use, the better it is for the company in the future.

For now, Booking’s strategy is pragmatic: keep milking high-intent search while redirecting incremental budget to whichever new channels (social video today, AI agents tomorrow) show additive economics. The longer agents take to mainstream, the more cash flow Booking can recycle into inventory breadth and tech infrastructure, positioning it as a default plug-in when or if conversational booking finally hits scale.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

I made some changes in my portfolio yesterday which I will discuss behind the paywall.