The Changing Healthcare Landscape

Last month, JP Morgan published a very interesting healthcare piece titled “Sick as a Dog” which I read yesterday. They also published a podcast on this piece, but I think you would enjoy reading the piece instead.

I would like to highlight some interesting points from the piece.

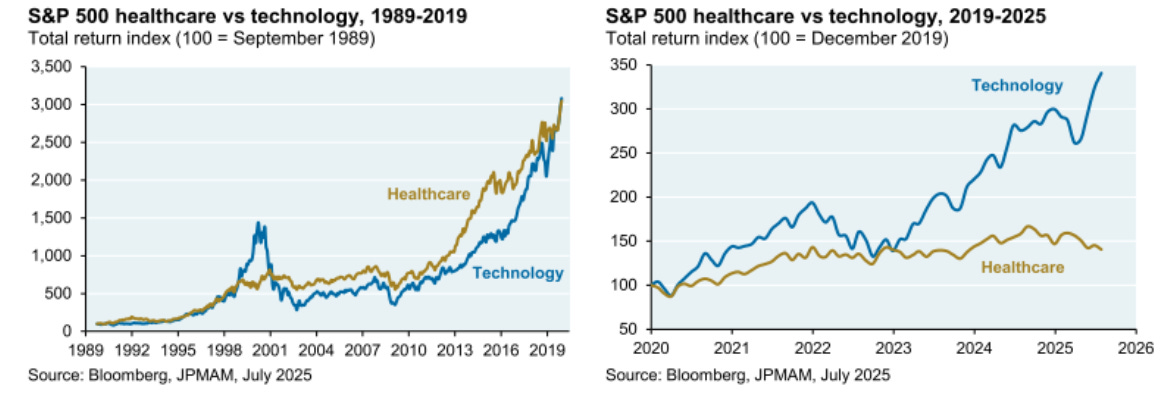

One of the startling data points for me was healthcare pretty much matched technology sector’s return from 1989 to 2019 period with dramatically lower volatility (15% vs 24%). Imagine how much the world has changed thanks to technology during this period and yet, if you put your money in healthcare, you would not only have a much better sleep but also enjoyed just as good a return as tech investors.

Well, even if you did that, your sound sleep has been abruptly disrupted since 2019. While tech’s run has continued unabated, healthcare sector has been limping around since then.

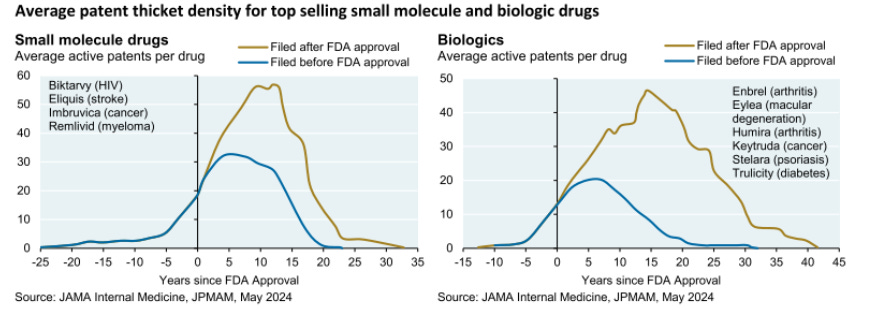

Another topic that surprised me is the data related to patent thickets, an idea which I originally came across from this Lina Khan’s tweet. Patent thicket happens when so many overlapping patents exist in one area that it becomes hard to make or sell something new without running into legal trouble. While I did know the idea, I didn’t know “almost 75% of all patents granted and all patent applications were filed after FDA approval”. From the report:

Multiple overlapping patents for a given drug are known as “patent thickets”, and typically must all expire or be settled with manufacturers before generic and biosimilar drugs can be sold. Regardless of a patent’s strength or validity, patent thickets can deter competition by raising the perceived litigation cost of entry. A 2024 JAMA article analyzed patent thickets for the 10 brand name drugs with the highest US sales. The authors found that patents filed after FDA approval, most of which were unrelated to each drug’s active ingredient, can substantially lengthen the effective period of patent protection and delay the impact of generic and biosimilar drugs. For the ten small molecule and biologic drugs in the JAMA analysis, almost 75% of all patents granted and all patent applications were filed after FDA approval

Patent reform has the potential to substantially impact US drug prices. While the US has the highest generic drug utilization rate in the world at 90% by volume, generic drug consumption represents just 17.5% of total drug spending. The remaining 10% of all drug prescriptions account for the other 82.5% of drug spending. These figures are remarkable; in other words, the issue is not that patients aren’t using generic drugs; it’s that the branded drug market remains heavily impacted by increasingly “creative” patent thickets that may exceed the original goal of protecting intellectual property investments in pharmaceuticals.

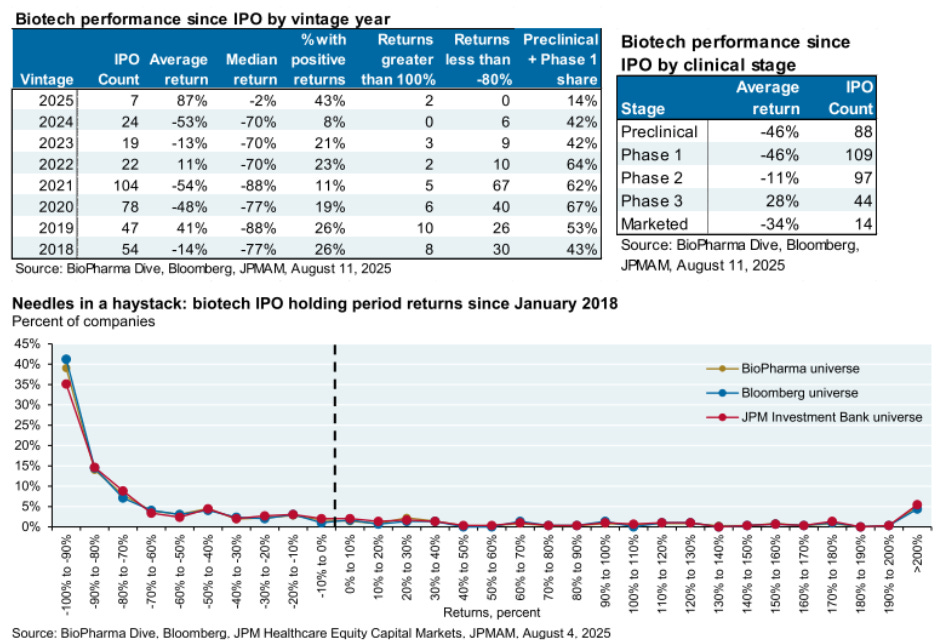

I knew biotech investors have suffered a lot in the last few years, but it still shocked me to know that “since 2018, half of all biotech IPOs have lost 80%+ of their value, and only 20% had positive holding period returns.”

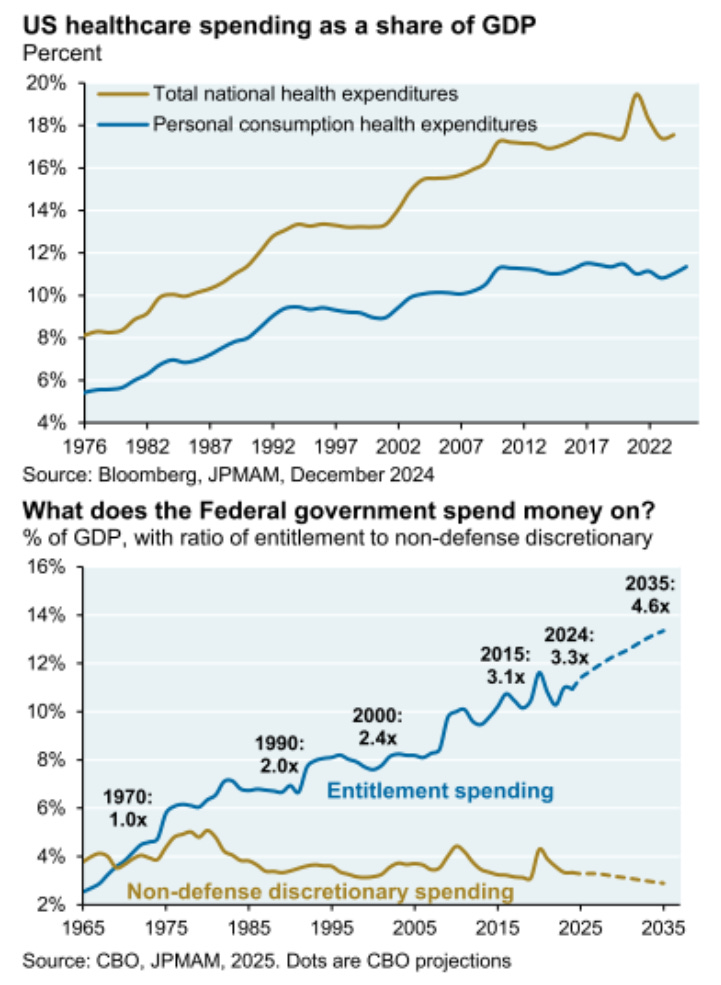

There are some interesting issues raised near the end of the report. Aging population driving healthcare spending has been a secular thesis among most healthcare investors, but we may have hit some sort of ceilings on healthcare spending. From the report:

“…personal consumption spending on healthcare as a share of GDP rose from 5% in 1976 to 11% by 2008 but has flatlined since 2008; the same trend is true for national health expenditures.

The cost of Medicare and Medicaid entitlements relative to non-defense discretionary spending shown in the last chart is continuing to rise. I believe we’re getting closer to an informal national referendum to narrow this gap, rather than taking steps to keep increasing it.

Healthcare is obviously a very heated political topic in the US. I will admit that some of the healthcare related debates have been bit of a cultural shock to me when I moved to the US in 2017. While growing up in Bangladesh, I have basically never known anyone with health insurance. All of our healthcare related spending were out-of-pocket expenses. If you couldn’t afford private healthcare, you could go to government hospitals which are always overflowing with patients. Therefore, your access to proper healthcare was pretty much directly tied to your wealth.

To my surprise, most of the western countries, including the US has largely eliminated your need to be wealthy to access proper healthcare, and yet, it remained such a thorny political topic. People seem to deeply underappreciate how close almost all the western countries are to the “utopia” of equality when it comes to access to quality healthcare.

The reality is it is nearly impossible for private health insurance companies to be popular because most people do not consume healthcare and vastly “overpay” to subsidize the chronically ill, old, and poor people of the society in the West. If you look at these numbers below, it should be clear why health insurance companies will always structurally have hard time gaining any popularity anytime soon:

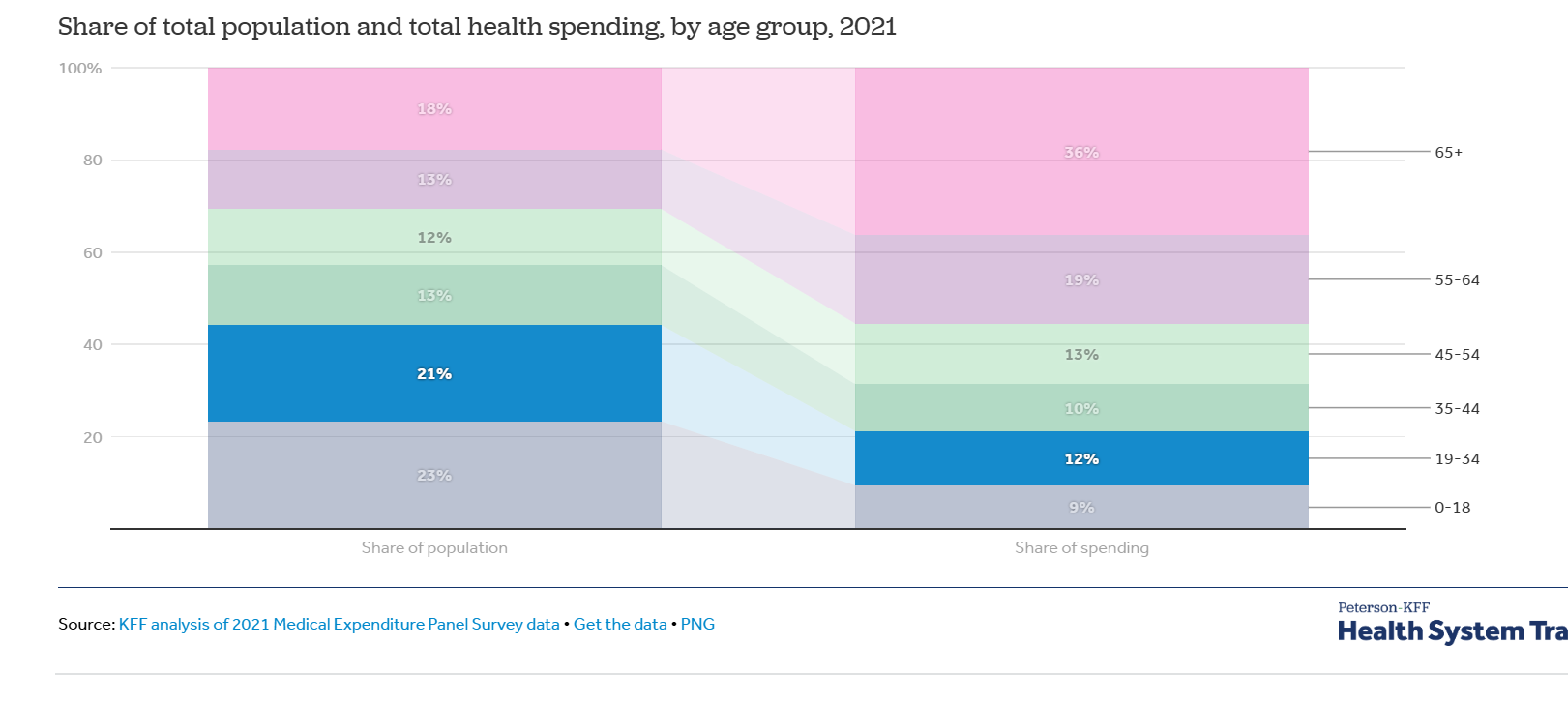

In 2021, 5% of the population accounted for nearly half of all health spending…At the other end of the spectrum, the 50% of the population with lowest total health spending accounted for only 3% of all health spending…Roughly 14% of the population had $0 in health expenditures in 2021.

I suspect the reason nationalized healthcare seems to be more popular is it abstracts away the way it is funded and many people feel like they are accessing healthcare for “free”. Of course, there is no free lunch.

If someone asked me “what’s the conspiracy theory you think is true”, I am not sure I have a good answer today. But when I look at how skewed the data is in healthcare spending, sometimes I wonder if the western governments will be highly incentivized in the future to make it socially popular (or even desirable) for the chronically ill and/or very old people to choose assisted suicides. Take a look at the age distribution and spending mix of healthcare in the US below. Considering the fertility rate, the population mix will be increasingly dominated by older and older population for the next few decades. Given the broader social consensus around uniform access to healthcare in most western countries, these trends can lead to pretty uncomfortable political conundrums. To be clear, I personally do not want a broader social consensus to form to make it more desirable to choose assisted suicides, but frankly speaking, societies do have history of taking nearly unfathomable or cruel policies to solve an anticipated problem (e.g. one child policy in China). Perhaps we do need AGI to usher us in an accelerating growth to make these pesky problems go away!

In addition to "Daily Dose" (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 62 Deep Dives here.

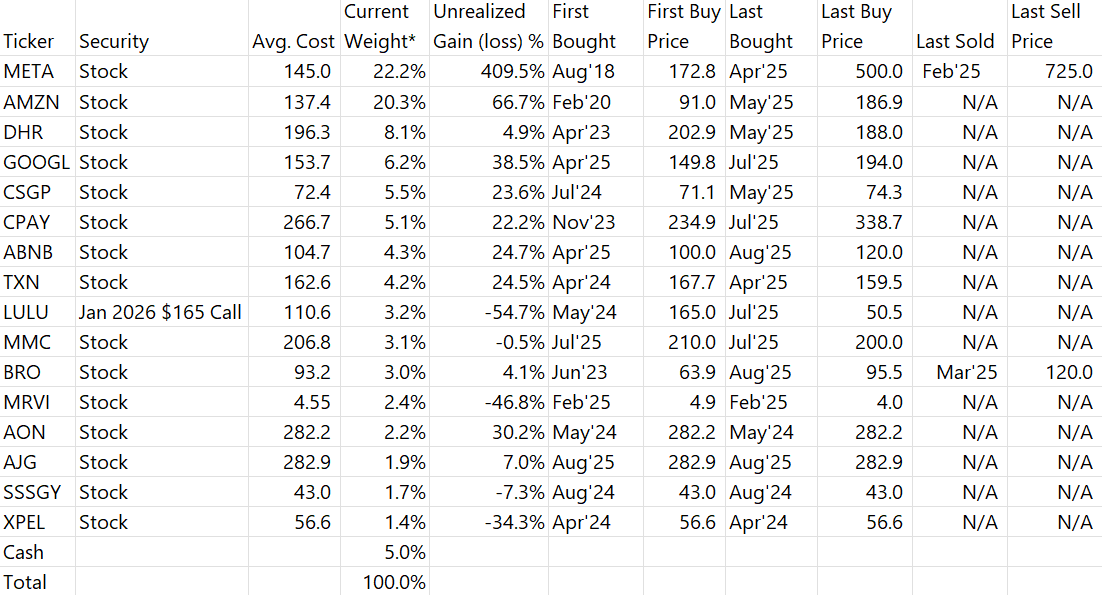

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below:

*Based on closing prices as of August 30, 2025 (time-weighted YTD: +6.7%); Since inception (August 24, 2018) time-weighted annualized return +17.3%

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.