Block 2Q'22 Earnings Update

Disclosure: I own shares of Block/Square

"...we recognize the importance of exercising discipline with our investments as we enter a period of potential uncertainty."

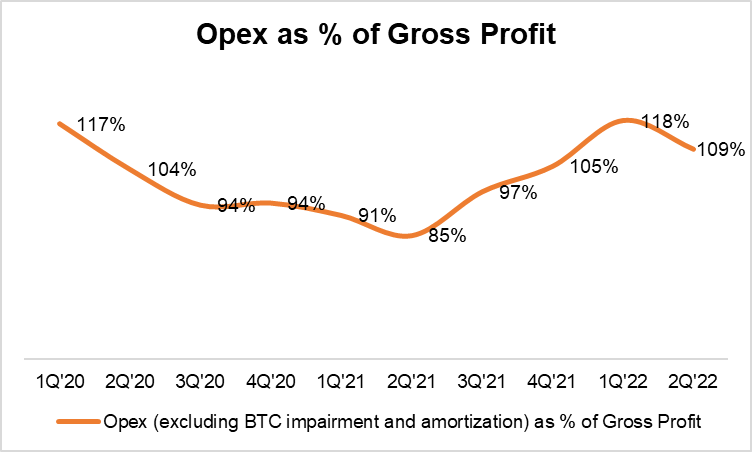

Unfortunately, total opex continues to exceed gross profit, and given the focus on non-GAAP opex, actual opex may remain ignored.

Let's dig in segment by segment.

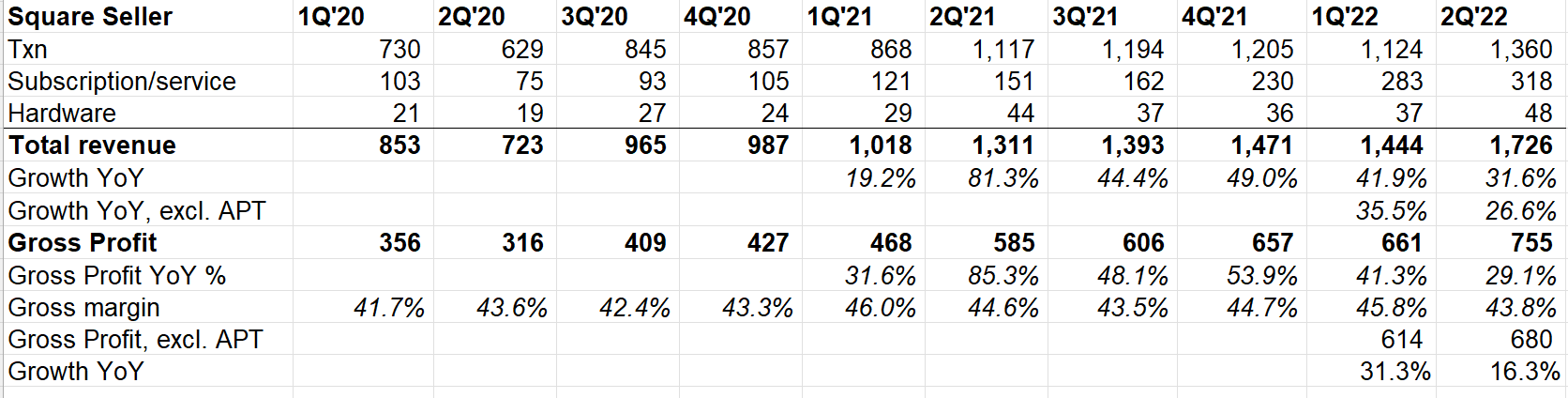

Square Seller

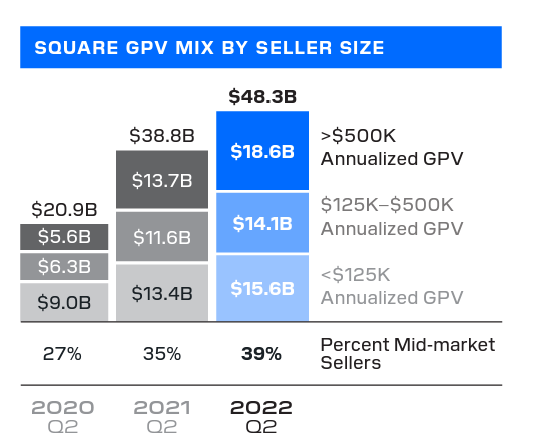

Square seller GP, excluding APT grew 16% YoY, but 3-year CAGR was +40%. Gross Margin was slightly below mid-40s. Mid-market sellers continue to dominate GPV.

Square for Restaurants gained quite the momentum:

"Through the first half of the year, GTVs from Square for Restaurants sellers more than doubled year-over-year, with these sellers using an average of 4 monetized products during the second quarter."

"...40% of Square GPV comes from a range of services verticals in 2021. The remaining 60% is across some of those discretionary areas like food and beverage, retail and other smaller but growing verticals"

APT is also being integrated for Square Sellers:

"Within our Square ecosystem, in May, we announced the in-person integration of Afterpay for Square sellers in the U.S. and Australia, adding to the online capabilities we announced earlier this year with more products to come."

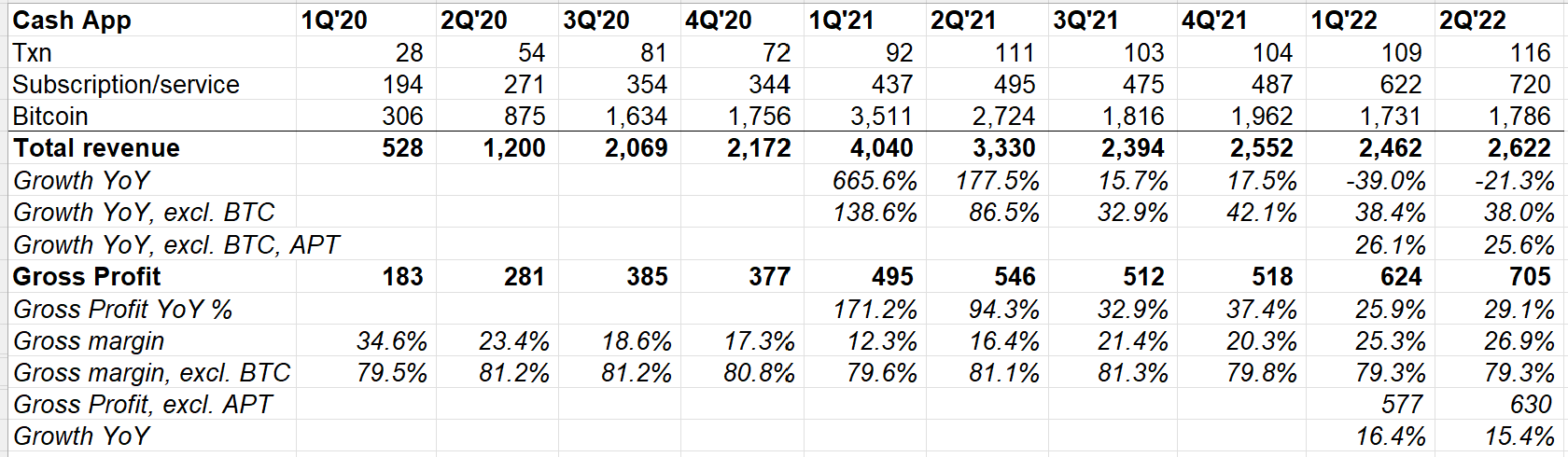

Cash App

Cash App Gross Profit was +29% in 2Q'22 YoY, but +15% excluding AfterPay (APT). 3-year CAGR of +82% reflects how much the business has grown. Gross margin, excluding Bitcoin (BTC) hovers around ~80%.

APT is finally being integrated:

"We're rolling out a new Discover tab to the main navigation, making it easier for customers to find and use brands and products that can save on with Boost and paying with installments with Afterpay."

"You can find it within Cash App by looking for the magnifying glass at the bottom of your navigation. We intend this to be a place where you can find everything related to what you might want within Cash App, be it sending money to people like your friends or buying products or services for merchants around your -- across the Internet. So that is a big part of our focus and a big aspect of what we believe is important about this acquisition."

Cash App had highest ever quarterly inflows in 2Q'22; overall inflows increased both QoQ and YoY

Monthly actives was 47 Mn in June (vs 44 mn in Dec'21) which is +18% YoY; weekly and daily actives are growing faster.

Inflows per active averaged $1,048 in 2Q'22, which was relatively stable qoq but -11% YoY primarily due to government disbursements last year.

Cash App Borrow (first credit product) had 1 mn monthly actives. Avg loan size is <$200 with avg tenor is 1 month. Loss rates is <3% which is similar to Square loans for sellers. Unit economics is profitable. Given the macro backdrop, Block remains cautious:

"While we've seen strength so far, we are also being mindful of the environment. This is a short duration product where we determine eligibility based on unique data signals, which we believe enables us to pivot quickly. As with the rest of our business, we are tracking trends in real-time to monitor any changes, and we intend on acting conservatively with each of our credit products as the macro environment evolves."

AfterPay

GMV was $5.3 Bn, +13% YoY or 65% 3-year CAGR. (FX headwind 5%).

Revenue +6% YoY. Losses as % of GMV 1.02% (vs 1.17% in 1Q’22). 90-95% of installments paid on time.

Growth in Australia held up better, but slowed more in North America.

Outlook

Based on the trends so far, SQ expects the following in July:

Gross Profit +35% YoY. Excluding APT, +22% YoY

CashApp GP +32% YoY

Square Seller GP +14% YoY, GPV +18% YoY

BNPL +12%, GP +1%

Block has reduced its expense outlook:

"While gross profit trends have been healthy through July, we recognize the importance of exercising discipline with our investments as we enter a period of potential uncertainty. As a result, we are reducing our planned investments for the full year 2022 by $250 million. We pulled back on experimental and less efficient go-to-market spend, adjusted risk loss estimates based on more current trends and slowed the pace of hiring. In total, we have now reduced our non-GAAP operating expense plan by a total of $450 million since the start of the year, which is 20% of what we initially guided for the step-up in 2022."

"For 2022, we now expect to increase overall non-GAAP operating expenses by $1.85 billion compared to 2021, roughly 10% less than what we shared last quarter. Within this, we now expect Afterpay's operating expense base to be approximately $750 million this year. And excluding Afterpay, we expect to grow overall non-GAAP operating expenses by 30% year-over-year or $1.1 billion."

It seems SQ's GP may grow in tandem with non-GAAP opex this year, but talking about non-GAAP opex today seemed a bit tone-deaf to me. Shareholders will find it hard to make money if non-GAAP opex is all what SQ focuses on!

You can read my Deep Dive on Block/Square here. Earlier quarterly recaps on SQ are here: 3Q'21, 4Q'21, 1Q'22

I will cover IAC and ANGI next week.