Amazon 2Q'22 Earnings Update

Disclosure: I own shares of Amazon

Amazon may be the first and the last ~$1.5 Tn market cap company to report negative Trailing Twelve Months (TTM) FCF (-$23.5 Bn to be exact).

It is quite incredible how Amazon management gained credibility and earned trust to ride through two of the most secular growth markets for multiple decades: e-commerce and cloud. Competitors must envy Amazon for its lack of burden of posting profits!

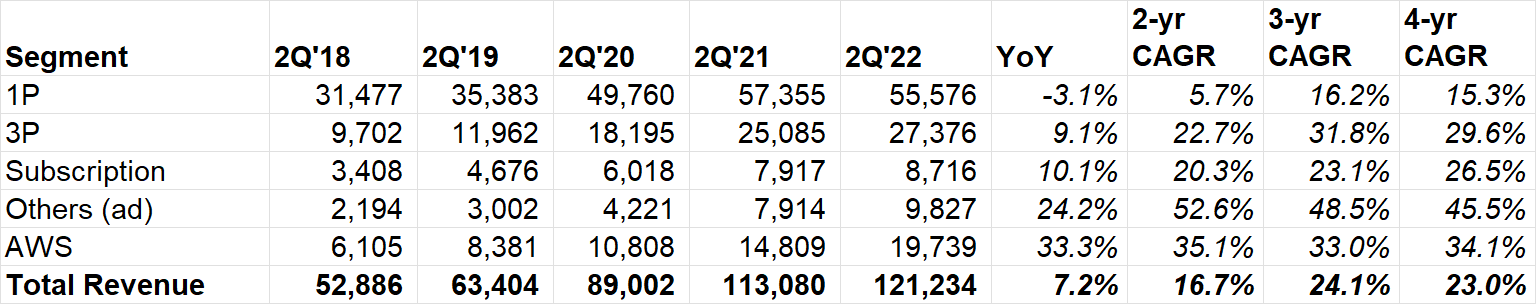

Segment-wise reporting

For the second consecutive quarters, 1P posted negative growth. Revenue mix continues to lean to services as 1P declined from ~60% in 2018 to ~45% in 2022.

AWS maintains >30% growth momentum even in this scale.

~320 bps FX headwind, so revenue growth was +10% FX neutral

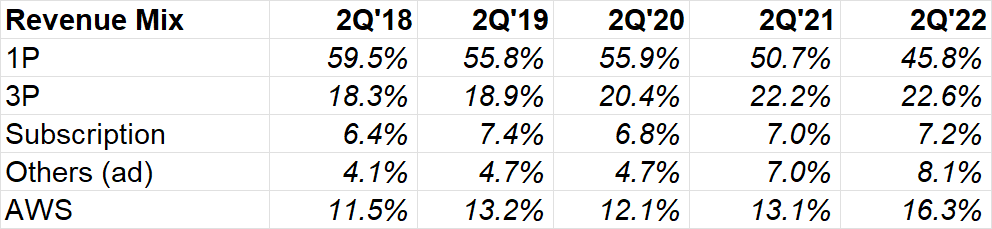

One metric I like to keep track in e-commerce is Amazon vs Shopify GMV. Shopify again seems impressive in the context of overall reality in e-commerce this year.

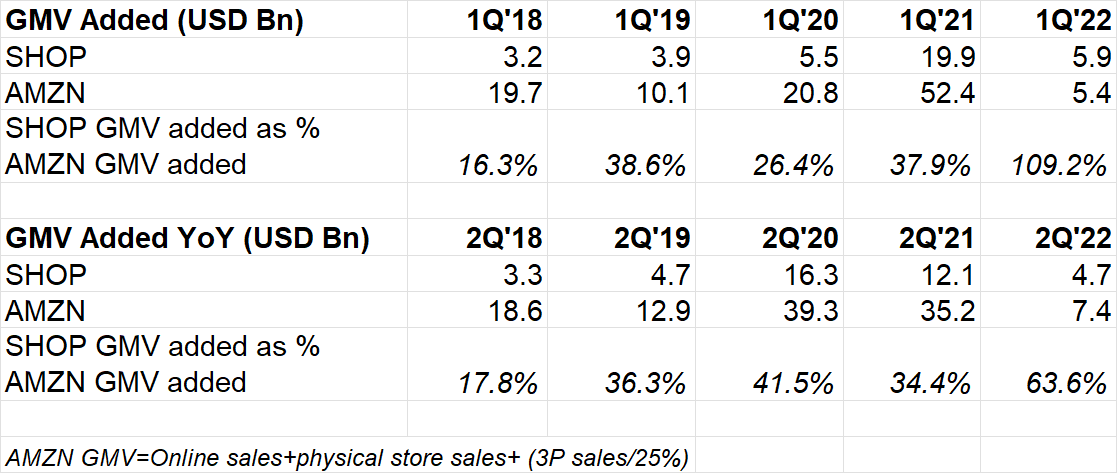

Operating Margin

For the fourth consecutive quarter, Amazon, ex AWS posted negative operating margin.

AWS margins fell from 35% in 1Q'22 to 29% in 2Q'22. Why?

"The margin rate is going to fluctuate in this business. It's going to be always a factor of new investment and things like the sales force and new regions and infrastructure capacity, offset by infrastructure efficiency gains that we see, pricing issues as we extend contracts. We've seen really good progress with our customer base, longer and longer commitments, really committing to the cloud, some of that comes with credits to help them make their conversion to the cloud. And you said that the revenue pattern can be -- and the margin on that revenue can fluctuate quite a bit quarter-to-quarter."

AWS backlog was +65% YoY in 2Q'22 (vs 68% YoY in 1Q'22). Weighted avg remaining life of long-term commitments in 2Q'22 was 3.9 years (vs 3.8 years in 1Q'22)

AWS run-rate is $79 Bn and still growing like weed. When AWS had $4.6 Bn revenue in 2014, Bezos wrote in his letter, "I believe AWS is market-size unconstrained."

I remember that sentence every quarter I look at AWS numbers!

Retail

"we're not seeing some of the pressures that other people are seeing right now. Our macroeconomic issues are principally on inflation, and we've been pretty transparent on that."

3P

"Third-party sellers represented 57% of all units sold on Amazon in Q2, the highest percentage ever."

"So on the seller fee, again, we added that fee grudgingly in May to compensate for some of the inflationary pressures we're seeing. I don't want to give you the idea that either of those fee increases came close to covering our costs. You can see from our operating results, some of it's internal related, but a lot of it's external factors that there -- we are not passing through that at 100% to external groups. And it's -- we've got to work our way out of the condition we're in. And we're making good progress in Q2 and expect to keep pressing on that in the second half of the year. But we saw strength in the seller results in Q2, as we mentioned on the percentage mix. So I think sellers are -- sellers business remains strong and an integral part of our customer offering."

Advertising

Unlike David Wehner who blamed macroeconomy for soft advertising, Amazon sounds pretty optimistic on ads:

"...you're probably wondering again about softness -- potential for softness in that or macroeconomic factors. Right now, we still see strong advertising growth. Again, it's got to be a positive both for the customer and for the brand. I think our advantage is that we have highly efficient advertising. People are advertising at the point where customers have their credit cards out and are ready to make a purchase. It's also very measurable. And when people are looking -- if companies are looking to potentially streamline or optimize their advertising spend, we think our products compete very well in that regard, in addition to maybe longer-term things like brand building and brings new selection to bear in front of customers."

This sounds intriguing but not smart enough to know whether this is material:

“AWS and Amazon Ads launched Amazon Marketing Cloud (AMC) Insights on AWS. The new solution helps advertisers and agencies easily use AWS services when running Amazon Ads campaigns to analyze and generate reporting from the Amazon Marketing Cloud API, reducing their development time from weeks to hours. With a few clicks, AMC users can monitor ongoing ad campaign performance across reach, frequency, geography, audience, and device type to better understand how to maximize ad spend.”

International markets

"..In our established international locations, U.K., Germany, Japan, over time, we've continued to improve the profitability"

"In our emerging locations, there's a healthy amount of investment we've done to drive expansion, and we expect to continue to do that given the strong competition across many of these markets."

Prime

"Prime member membership and retention is still strong. I think that change has been above our expectations positively."

Expenses

inflationary costs, fulfillment network productivity and fixed cost deleverage added $4 Bn incremental cost in 2Q'22 (as expected) vs $6 Bn in 1Q'22.

"There are 2 main drivers when talking about fixed cost leverage. First is the unfavorable comparison to very high holiday-level utilization rates that we saw in the first half of 2021; and second is the normal step down in volumes off of our Q4 peak that we saw in the first half of 2022.

On the first point, we expect this challenging year-over-year comp will have ended in Q2. On the second point, we expect fixed cost leverage to improve in the second half of the year as we continue to grow into our capacity. We have also taken steps to slow future network capacity additions."

Capex

In 2021, Amazon spent $60 Bn in capex. 2022 capex will be slightly higher, but the composition of capex will change to more investment in technology infrastructure (50% in '22 vs 40% in '21).

Alexa

“Amazon now has over 1 million registered developers, brands, and device makers building with Alexa.”

Drone Delivery

“Amazon announced that later this year, Amazon customers in Lockeford, California, and College Station, Texas, will be among the first to receive Prime Air drone deliveries in the U.S. Customers will have the option to receive free and fast drone delivery on thousands of everyday items”

Guidance

3Q'22 topline guidance $125-130 Bn, +13-17%. Pretty impressive guide, but please note Prime Day was in 2Q last year but was in 3Q this year, so slightly easier comp in 3Q'22

Expects to see $1.5 Bn sequential cost improvement in fulfillment which will be offset by more investment in AWS and Prime content

Operating income guidance for 3Q'22 is $0-3.5 Bn (vs $4.9 Bn in 3Q'21)

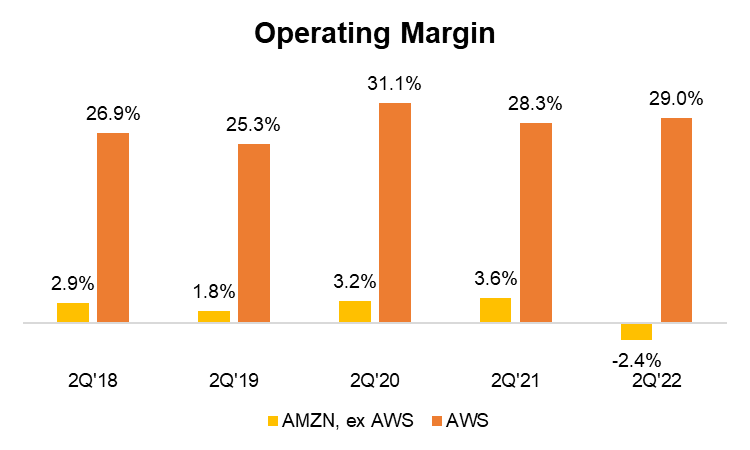

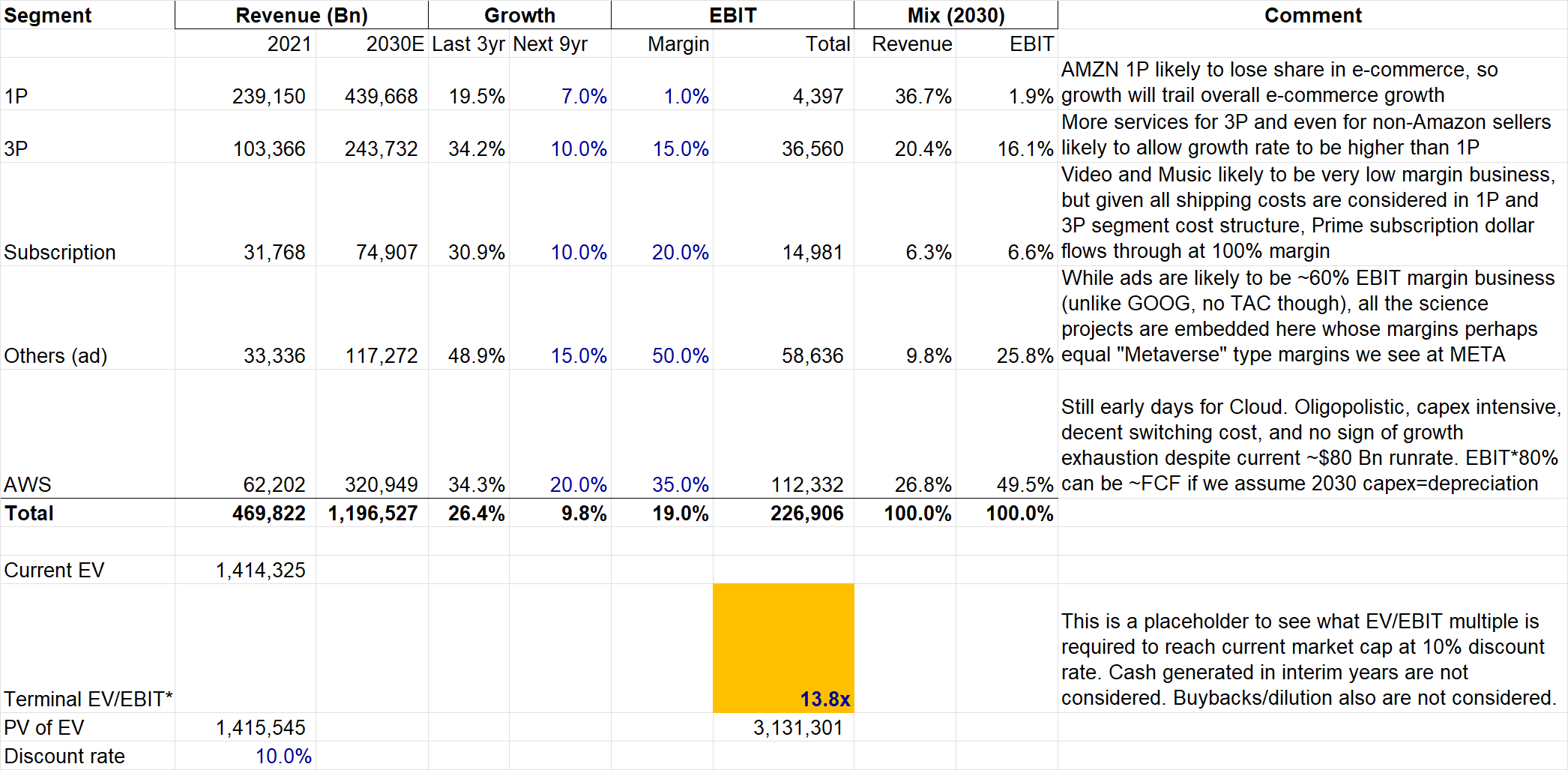

Valuation

I do this back-of-the-envelope exercise every quarter to see what's embedded. If Amazon can post this EBIT, terminal EBIT multiple required to generate ~10% IRR is <14x (excluding impact from interim cash). For context, META, despite terminal value concerns, currently trades at ~14-15x NTM EV/EBIT.

You can browse Amazon's earlier earnings quarters here: 2Q'20, 3Q'20, 4Q'20, 1Q'21, 2Q'21, 3Q'21, 4Q'21, 1Q'22

I will cover Block (formerly known as Square) next week!