Meta 2Q'22 Earnings Update

Disclosure: I own shares of Meta

“…we seem to have entered an economic downturn that will have a broad impact on the digital advertising business. And it's always hard to predict how deep or how long these cycles will be, but I'd say that the situation seems worse than it did a quarter ago.”

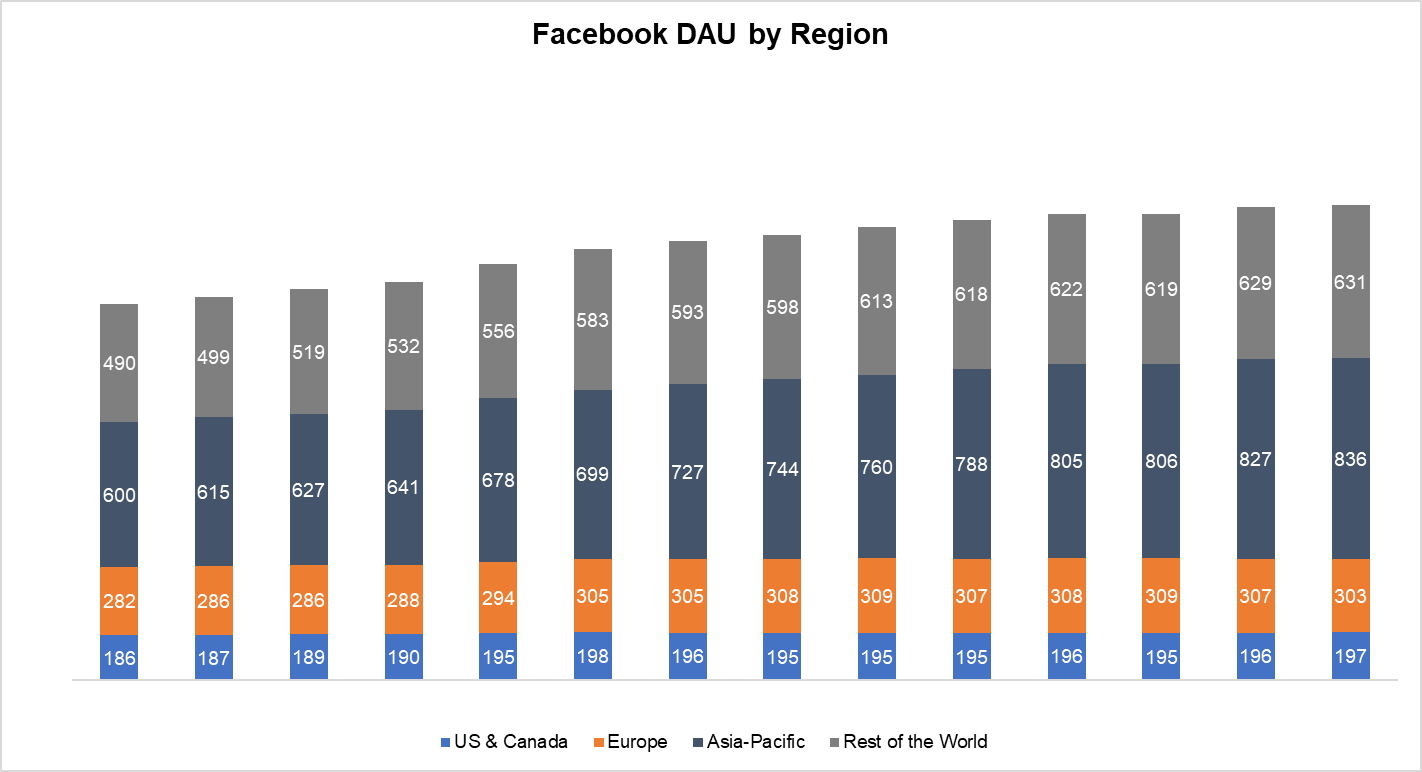

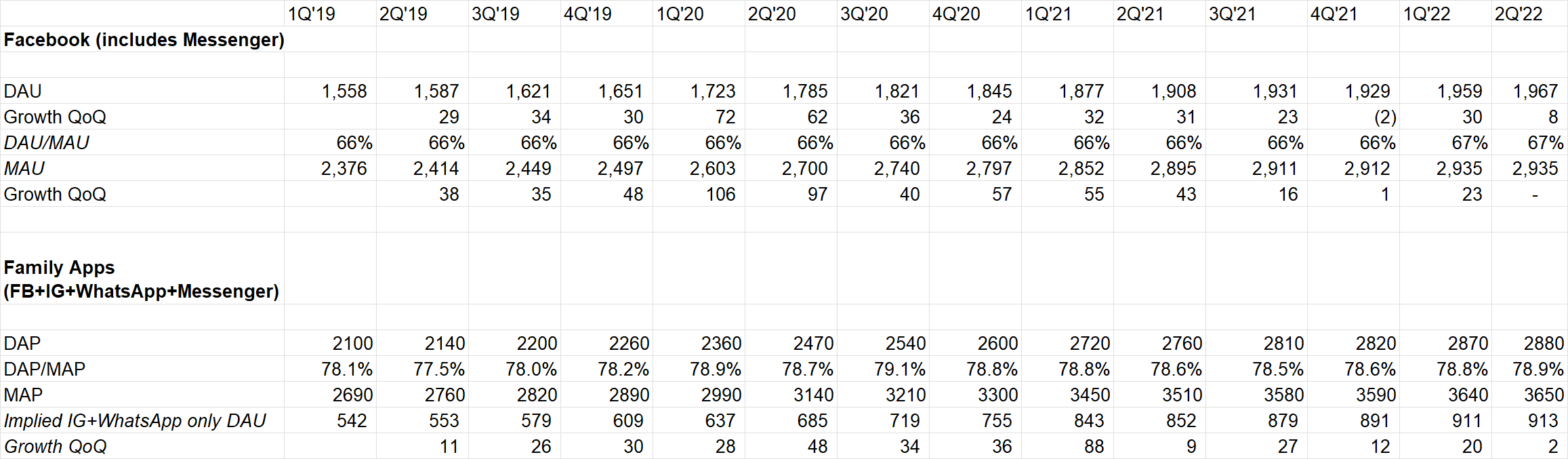

Users

While Meta globally had +8 Mn DAU QoQ, MAU was flat QoQ (as guided) which was driven by Europe (-11 Mn MAU QoQ) because of the loss of Russian users.

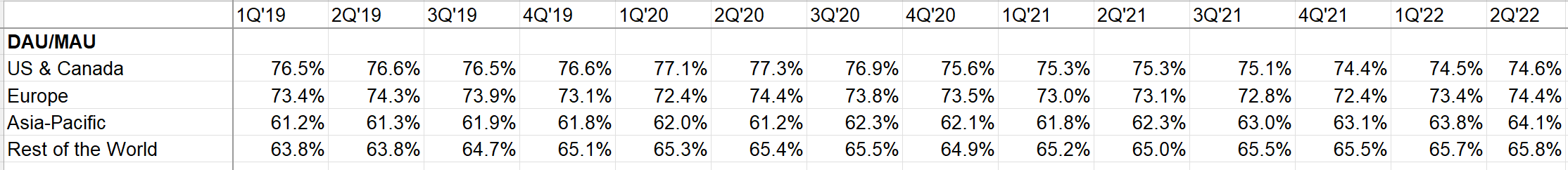

DAU/MAU improved across the regions QoQ, so better engagement.

Revenue

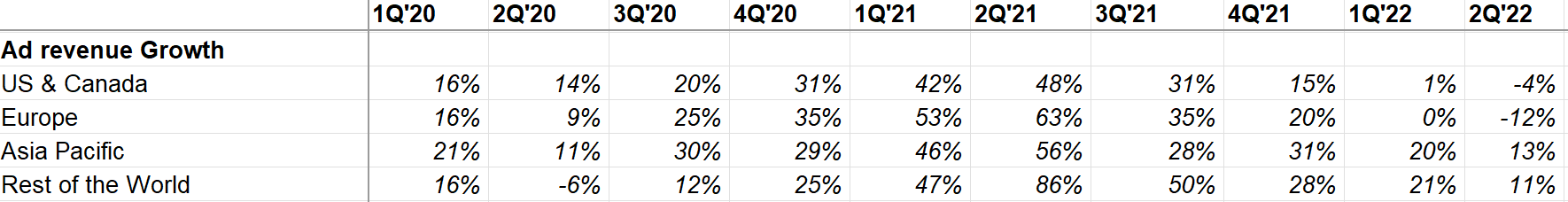

Ad revenue growth continues to be anemic in North America and Europe.

# of ad impressions +15% whereas avg. price per ad -14%

Overall revenue declined 1% YoY, but +3% FX neutral

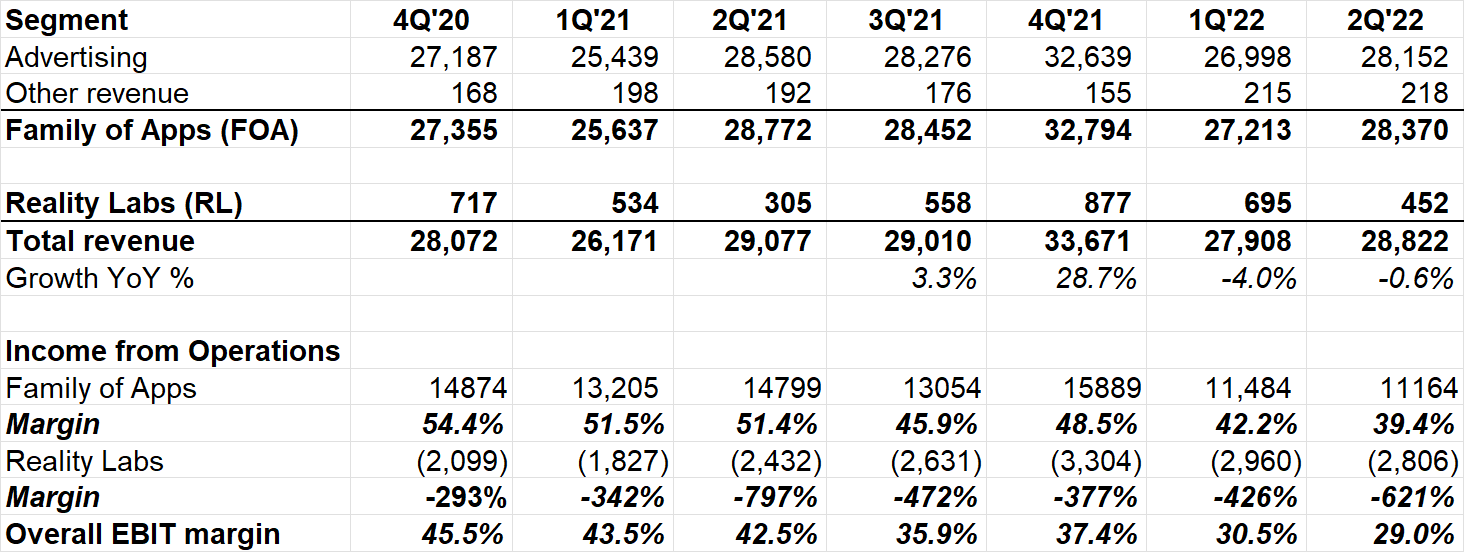

Segment Reporting

FOA margins continue to slide from mid-50s in 4Q'20 to high 30s in 2Q'22. RL remains a money losing behemoth (and it could have been worse)!

“cost of revenue decreased 4% as growth in core infrastructure investments and content-related costs were more than offset by a reduction in Reality Labs loss reserves as a result of the announced price increase of Quest 2.”

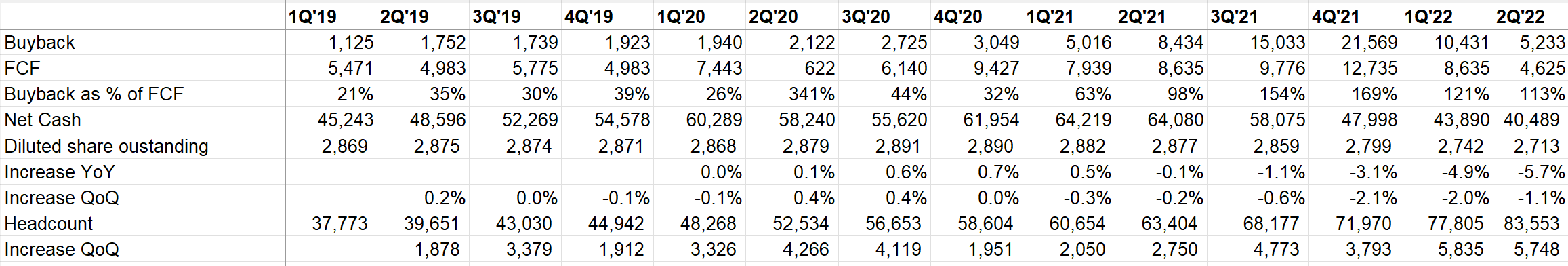

Buyback

Meta repurchased $5 Bn shares, lowest in the last 4 quarters. While it's higher than FCF they generated, buyback as % of FCF was lower than last 3 quarters.

As much as I hate looking at the scaling back of buybacks after ~60% drawdown, I sympathize. Meta's business is in tough spot. The stock will work with or without the buybacks if they can turn around FOA business (and vice versa). Dividend or buyback yield, unfortunately, cannot save shareholders.

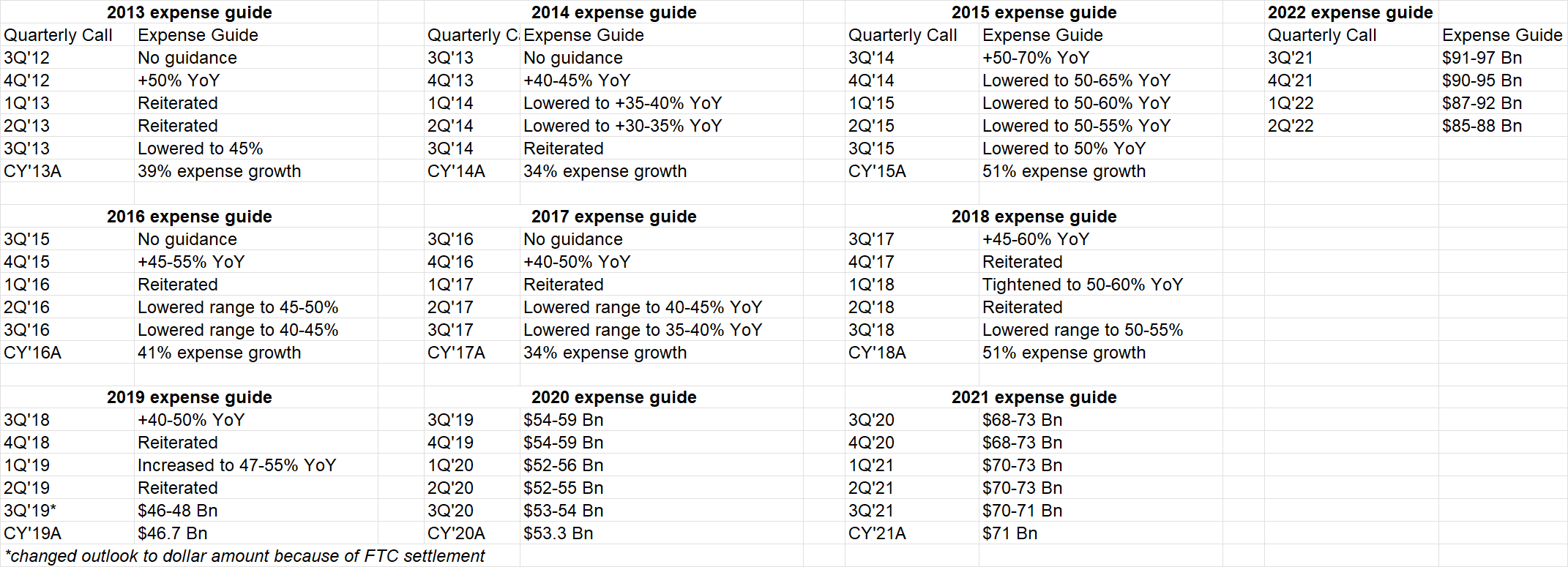

Expense Guide

Despite the planned slowdown in hiring, headcount growth will be substantial YoY next few quarters but will decline over time.

“Now this is a period that demands more intensity, and I expect us to get more done with fewer resources.”

Expense guide is predictably going downward.

Zuck repeatedly called out the significance of AI in the call.

“…there are 2 major technological waves that we're riding in our business. The first wave of driving our business today is AI, and then the second longer-term wave is the emergence of the metaverse.”

Reels

Lots of interesting data and quotes on Reels.

“Right now, about 15% of content in a person's Facebook feed and a little more than that of their Instagram feed is recommended by our AI, from people, groups or accounts that you don't follow. And we expect these numbers to more than double by the end of next year. As our AI finds additional content that people will find interesting, that increases engagement and the quality of our feeds. And since we're already efficient in monetizing most of these formats, this should increase our business opportunity over that period as well.”

“I shared last quarter that Reels already made up 20% of the time that people spend on Instagram. This quarter, we saw a more than 30% increase in the time that people spent engaging with Reels across Facebook and Instagram. AI advances are driving a lot of these improvements. And 1 example is that after launching a new large AI model for recommendations, we saw a 15% increase in watch time in the Reels video player on Facebook alone.”

“In Instagram, for example, we see that Reels makes up more than half of content reshared into messages. So our strategy isn't about public versus social content and interaction. It's really about enabling a flywheel that compounds both.”

“Reels doesn't yet monetize at the same rate as Feed or Stories. So in the near term, the faster that Reels grows, the more revenue that actually displaces from higher monetizing surfaces. Now in theory, we could mitigate the short-term headwind by pushing less hard on growing Reels, but that would be worse for our products and business longer term since we're confident that Reels will grow engagement overall and quality and will eventually monetize closer to Feed.”

“We've now crossed a $1 billion annual revenue run rate for Reels ads, and Reels also has a higher revenue run rate than Stories did at identical times post launch.”

“Reels is additive to time spent. But obviously, it does have a cannibalistic impact as well but the net impact is positive.”

While Stories ads was launched in 2018, it only reached parity on monetization this year.

Click to messaging ads

It is multibillion dollar business growing double digit; it’s the fastest ad format business for Meta. 40% advertisers already use this format.

Transition

This was Sheryl’s last call, but she'll sit at Meta's board. Dave Wehner is taking a new role within Meta: Chief Strategy Officer. New CFO is Susan Li who was VP of Finance at Meta.

Outlook

Revenue guide is $26-28.5 Bn (mid-point is -6% YoY; since FX headwind is assumed to be 6%, guide is essentially flat). Capex $30-34 Bn (prior $29-34 Bn)

To me, it’s a very disappointing guide given Q3 was supposed to be easy comp as we are lapping ATT next quarter. Meta mostly blamed macro and resultant softness in advertising market for this. Stock probably would be down lot more if it were already not in the gutter.

What is Meta's competitive advantage?

“…culturally, we focus on moving and learning faster than everyone else. And I think that those are sustainable advantages.”

As a long-term shareholder, I do think Meta left a lot to be desired in the last few quarters in terms of "moving and learning faster than everyone else".

I certainly hope they'll operate with much more intensity in the next few quarters.

I will cover Amazon tomorrow.

Browse earlier quarters of Meta here: 2Q'20, 3Q'20, 4Q'20, 1Q'21, 2Q'21, 3Q'21, 4Q'21, 1Q'22)