Shopify 2Q'22 Earnings Update

Disclosure: I own shares of Shopify

“2022 will be different, more of a transition year in which e-commerce is largely reset to the pre-COVID trend line and is now pressured by persistent high inflation.”

Let's dive into this "transition year"!

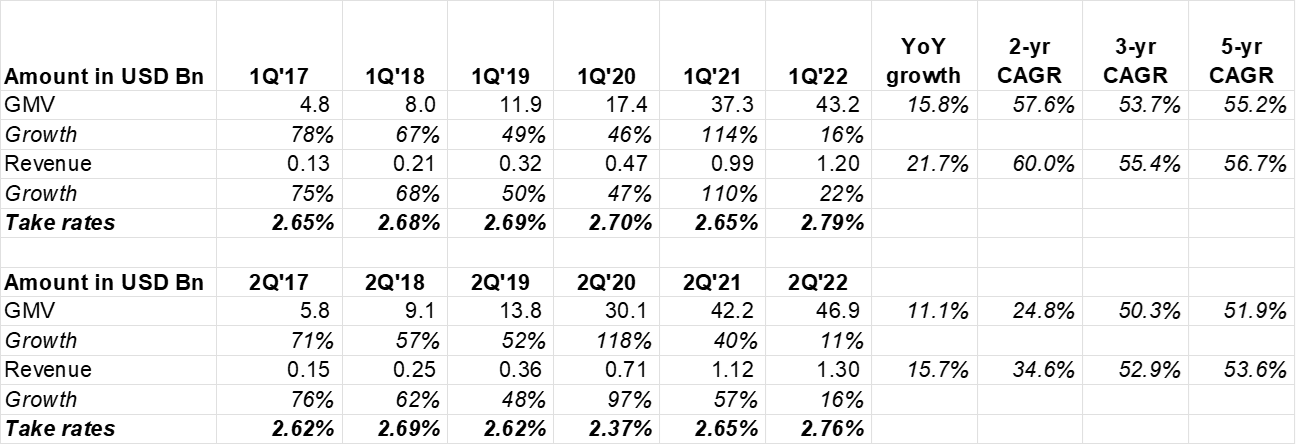

While Shopify still maintains >50% GMV and topline CAGR over 3-yr and 5-yr period, growth has come down to a lackluster level, given the reality of current e-commerce trends. Take rates continues to be on the right direction.

Shopify expects take rates to keep increasing going forward as merchants use more and more of their products.

Revenue Mix

Merchant Solutions was 71.7% of overall revenue in 2Q'22 vs 70.1% in 2Q'21.

While total revenue was impacted by 1.5% for FX, FX headwind for Merchant Solutions was 2%.

Shop Pay

Shop Pay penetration was 53.1% of GMV in 2Q’22 vs 48.0% in 2Q’21. Although Shop Pay penetration has accelerated in recent quarters, we need to track this metric closely once "Buy With Prime" enters the market with its full force.

Shopify Plus

Shopify Plus as % of total MRR was 31% in 2Q’22 vs 26% in 2Q’21

“In May, we introduced localized subscription pricing plans over 200 countries to better reflect this country's purchasing power and lower the financial barrier to access Shopify.”

Why Shopify Plus has been successful:

“I think some people have missed this often, but the reason that I think Plus has been successful is not just because it is the best place for existing brands to either go direct to consumer for the first time or scale or modernize their retail operations. I mentioned some big household names on -- in my opening remarks. But it's also because we have an unfair advantage that Shopify is where people go to start businesses and those that are successful, and in some cases, very successful. They migrate up to Plus and stay with us indefinitely.”

GMV through Social

“While still a relatively small percentage of overall GMV, GMV through key partner services, including our native checkout integrations on Facebook, Google and Instagram, grew 5x over Q2 last year.”

Last time, they mentioned 4x YoY growth, so things are picking up on social commerce. Shopify also recently partnered with Twitter and YouTube.

“shoppers can round out a great shopping experience in YouTube by quickly checking out with Shop Pay"

Gross margin

Gross margin declined by 484 bps YoY. Why?

“…adjusted gross profit was affected by a greater mix of our lower-margin Merchant Solutions revenue, lower margins in Shopify Payments due to merchant and card mix shifts and increased investments in our cloud infrastructure.”

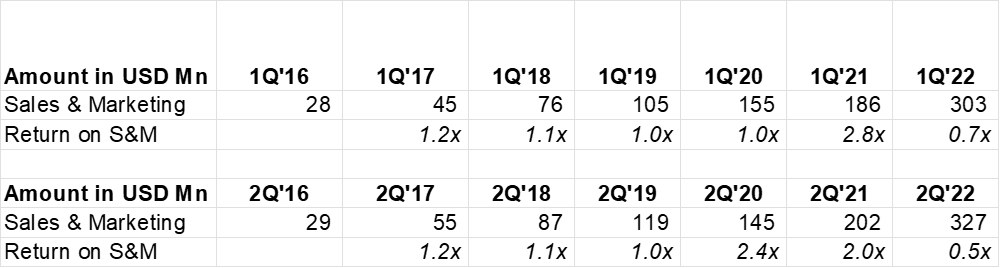

S&M question marks?

Shopify laid off 10% of its workforce yesterday. It's easy to understand why once you take a look at how much the S&M efficiency went down in the last two quarters.

Shopify Audiences

As the tectonic shift following ATT continues, Shopify launched Shopify Audiences. Here's how it works:

“Shopify Audiences is a tool that helps merchants find new customers. It's essentially a 3-step process. A Shopify Plus merchant selects the product they want to sell more of. Machine learning algorithms build an audience of high-intent buyers tailored for that product, and the audience list is directly and securely exported to the merchant's ad network of choice, which we are launching first with Facebook and Instagram.

Merchants are finding that audiences makes a real difference. They are seeing a meaningful increase in conversion rates and return on ad spend. For example, early access merchant, BlenderBottle, has seen its return on ad spend increasing as high as 6x. Another fast-growing merchant, L'AMARUE, saw a 48% uptick in its click-through rates, a 2.5x return on ad spend on its targeted campaign, and 73% of revenue from paid acquisition attributed to Shopify Audiences. All this, plus a 26% decline in customer acquisition costs. Audiences is off to a very promising start, and we're excited to see what it will do for merchants, especially ahead of the holiday selling season.”

Logistics

Three challenges in logistics: Freight, Distribution, and Delivery. Shopify expanded on each of these three steps and its plans:

Freight

“Let's start with freight. Inbounding inventory from suppliers is incredibly difficult for independent merchants to handle on their own. Today, merchants who manufacture abroad have to work with upwards of 10 vendors to receive inventory from suppliers, ship across the ocean and receive it at ports. Even if a merchant centralizes this through a freight forwarder, many of the processes are manual and fractured, designed for big businesses with large volumes and consistent demand.

To help with this, SFN has launched a pilot program with Flexport so merchants can more easily and cost effectively inbound freight. It enables merchants to ship inventory at the pallet level versus container level, and have just-in-time access to prebook containers that deliver goods directly to an SFN hub. This prevents tying up our merchants' excess capital and inventory and allows them to remain nimble to changing buyer trends. Early pilot runs have shown that SFN merchants can expect service from origin ports up to 50% faster, with cost per pallet much less expensive than average.”

Distribution

“Through Deliverr, we are accelerating the simplification of the distribution phase. Using software and machine learning, these SFN hubs, leveraging Deliverr's capabilities, will unpack, scan and inspect all inventory, then compare against metadata in Shopify's back office throughout the goods to merchants' various distribution channels as well as forward position inventory into SFN's spoke direct-to-consumer fulfillment centers based on expected buyer demand. With this software-based approach, Deliverr is helping us expand 2-day delivery across SFN.

Deliverr already fulfills more than 1 million orders per month, and its asset-light, technology-driven service is trusted by thousands of merchants across the U.S.”

Delivery

“Affordable and timely fulfillment has been nearly impossible for independent businesses to do on their own, but it is important. Just getting buyers' confidence that an order will arrive when promised, even if it's 3 or 4 days, is enough to increase conversion.

By leveraging Deliverr software in SFN hubs and SFN's spoke partner warehouses all equipped with Six River Systems technology, we can forward position merchants inventory to support timely fulfillment with a minimal inventory commitment for merchants.

We've also continued our early access to Shop Promise, which lets merchants offer 2-day delivery promises across online storefronts and channels like Google, Facebook and Instagram. Deliverr data suggests that as Shop Promise reaches scale, many merchants will be able to increase average conversion rates by more than 30%.”

Ryan Petersen tweeted this:

Flexport's fulfillment partnerships are coming together, including getting featured in Shopify's earnings call today. https://t.co/SeMDCYWEZN pic.twitter.com/K9TTZllIiZ

— Ryan Petersen (@typesfast) July 27, 2022

Outlook

GMV growth will outperform broader retail market

Merchant solutions revenue as % of GMV will increase i.e. higher take rates.

# of new merchants joining Shopify in 2H’22 will be higher than 1H’22.

Because of larger of Merchant solution and Deliverr acquisition, Gross profit will trail revenue growth.

Expects operating losses in 2H’22 even after excluding severance costs; Q3 losses to be higher than Q2 but “Q4 losses to be significantly smaller than Q3” once expense significantly decelerates

Valuation

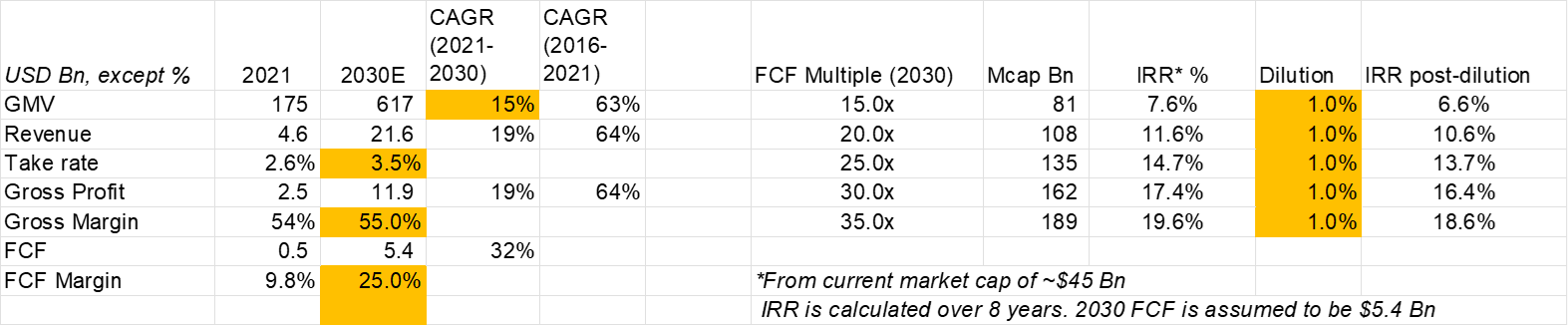

Despite ~80% drawdown, Shopify's valuation remains largely dependent on the story you tell yourself about the potential it can reach over the long-term. Here is one such story:

You can read my Shopify Deep Dive here.

Shopify's previous quarterly earnings recap: 4Q'21, 1Q'22

I will cover Meta's earnings in the evening.