Microsoft in the "Dance Floor"

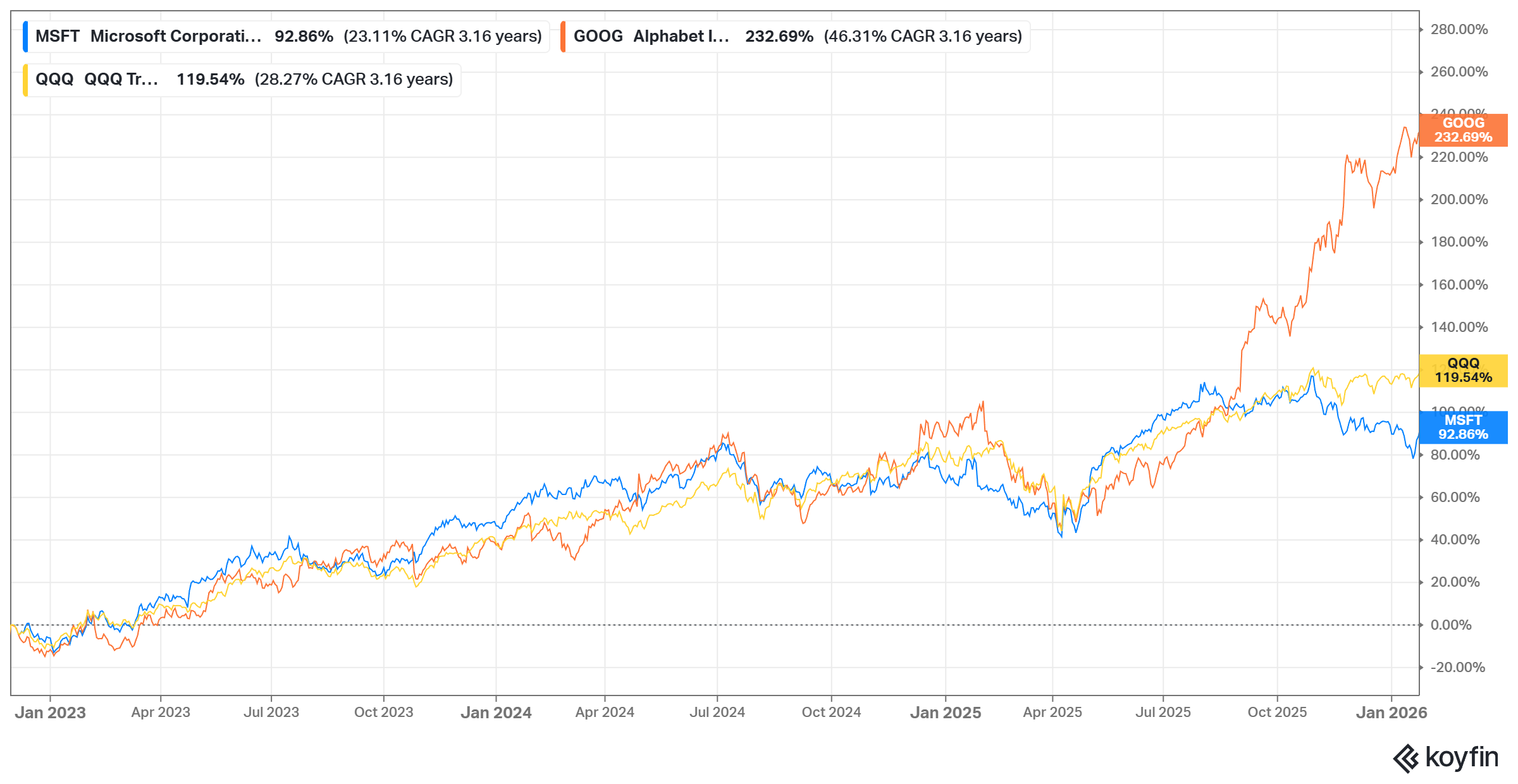

If you need any reminder how challenging active investing is, it can be humbling to know that if you bought Microsoft the day ChatGPT was launched, you would not only underperform QQQ but also underperform Alphabet (the very company the consensus assumed to be the primary “victim” of ChatGPT) by a whopping 140 percentage points in the next three years.

After wanting to make Google dance, it is Satya’s Microsoft that is now in the dance floor!

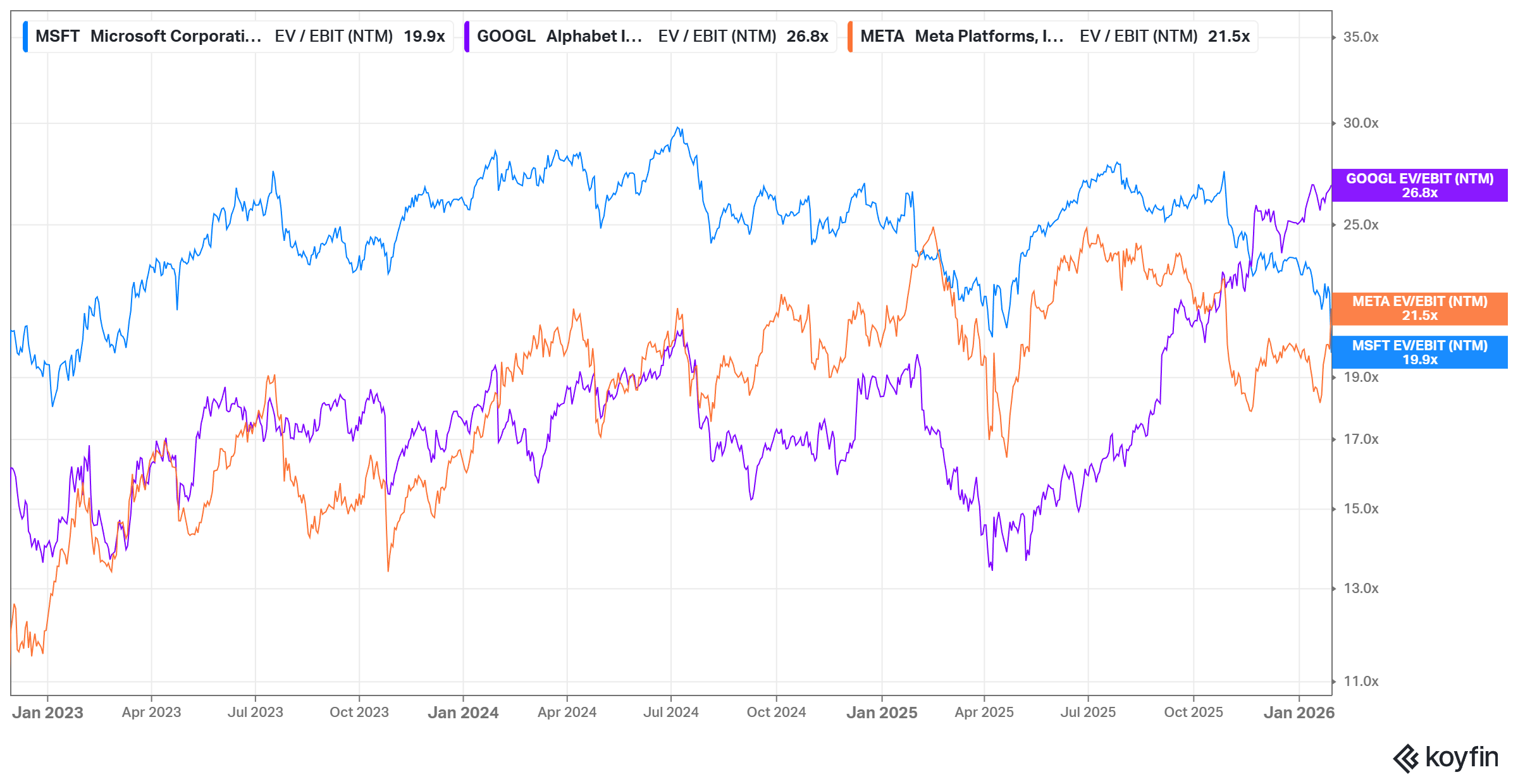

I briefly owned Microsoft when I bought the stock during the “liberation day” carnage, but sold the stock as the valuation seemed quite full by August 2025. Interestingly, when I sold the stock, the consensus estimates for 2030 revenue and operating income were $501 Billion and $239 Billion respectively. As of today, consensus estimates for 2030 since then actually moved up to $579 Billion and $279 Billion respectively. As a result, while out-year estimates for operating income increased by ~17% in the last 6 months, the stock went down ~20% which makes this an interesting set up.

In fact, after trading comfortably above Alphabet and Meta’s multiples almost consistently since ChatGPT’s launch, the company is now trading now at a material discount to Alphabet and even a slight discount to Meta. So, I went through their earnings call yesterday to understand the concerns a bit more closely which I will discuss behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 66 Deep Dives here.