Meta's Moat

It's not "network effects".

Disclosure: I own Meta’s shares and January 2025 $50 Call Options

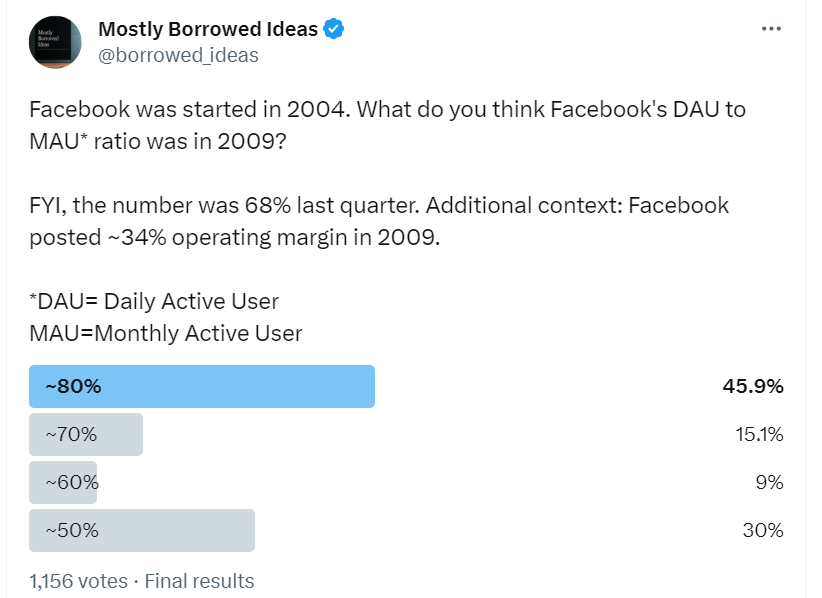

During the weekend, I asked my twitter followers: What do you think Facebook's DAU to MAU ratio was in 2009? The number that got the highest votes was ~80% even though I mentioned the most recent number was ~68%. I asked this question a couple of friends in real life too and they too picked the ~80% number.

I asked why they picked this number. Their explanation was, “well, Facebook used to be really cool back then. Everyone was using it and we were certainly oversharing stuffs that would make us cringe today. If DAU to MAU is ~68% now, it must have been higher back then.” I suspect most of my twitter followers had similar rationale in mind.

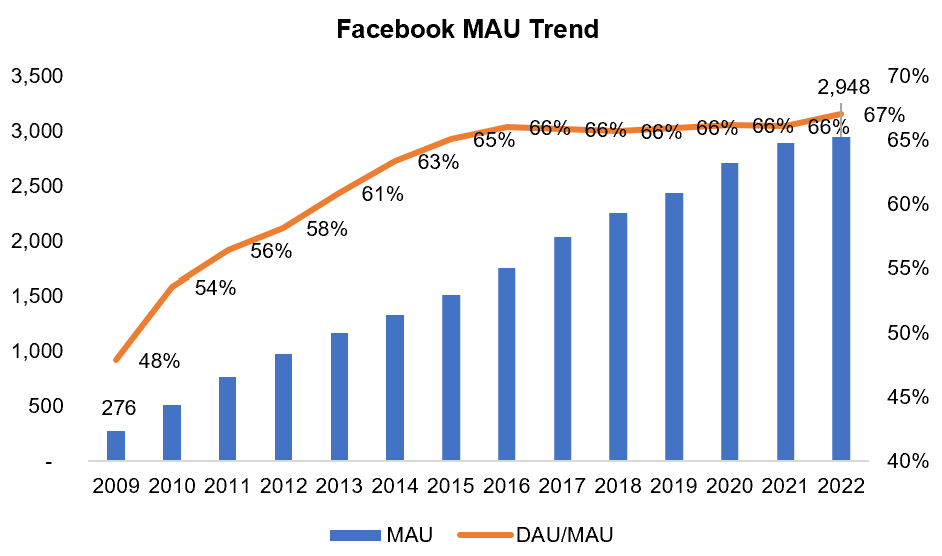

The actual number was 48%. While the DAU/MAU has hardly changed since 2016, the ratio rapidly increased from 48% in 2009 to 66% in 2016. As a result, while Facebook’s MAU increased by 10.7x in 2022 vs 2009, its DAU became 15x during the same time.

What did most of the respondents to the poll miss? Smartphone penetration. Global smartphone shipments increased from 173.5 Mn in 2009 to 1.2 Bn in 2022. Ironically, while transition to mobile was widely believed to potentially “kill” Facebook, Facebook turned out to be perhaps one of the largest beneficiaries (along with Apple and Google of course).

As I was discussing some of these aspects with a couple of friends, they mentioned why the expansion of DAU/MAU ratio isn’t surprising since thanks to network effects, the product is supposed to become stickier. That makes intuitive sense, but did it also happen in some of the other social apps such as Snap, Twitter, Reddit or Pinterest? Unfortunately, we don’t know the answer since Snap and Twitter don’t disclose MAU, and Pinterest doesn’t report DAU.

One of the things I think many people often misunderstand about network effects is people tend to think it only needs to be solved once as if once you get the flywheel going, you could just sit back and let the network grow on its own. While many investors can be susceptible to thinking in such simplistic terms, that’s not how it works in reality. Here’s a quote from Zuckerberg reminiscing Facebook’s challenges in growing their network in “early” years:

“Growth had plateaued around 90 million people, I remember people saying it’s not clear if it was ever going to get past a 100 million at that time. We basically hit a wall and we needed to focus on that.” (MBI note: Myspace at its peak had 75.9 Mn users)

The reality is that network effects need to cross several chasms to keep growing and those chasms don’t get solved on their own; people running the business need to take ingenious approaches to tackle the growth challenges. What complicates this even further is there are competing networks (i.e. other social apps) which makes speed a paramount importance, but at the same time, your tech infrastructure needs to be ready to facilitate such speed and retain the userbase after acquiring them. In other words, the moat derived from network effects can be short lived and what needs to follow after the initial spark is just relentless and near flawless execution by the people running the business.

But what does “execution” exactly mean? And of course, growing users is not much of a promised land either; you need to know how to monetize your users and you need to learn how to do it profitably.

Having interacted with many investors following social networking industry over the last few years, I suspect most investors deeply underestimate how much everyone else in this industry fell behind on the “execution” department. Instead of making qualitative statements, I intend to show this point quantitatively to contextualize what I am talking about.

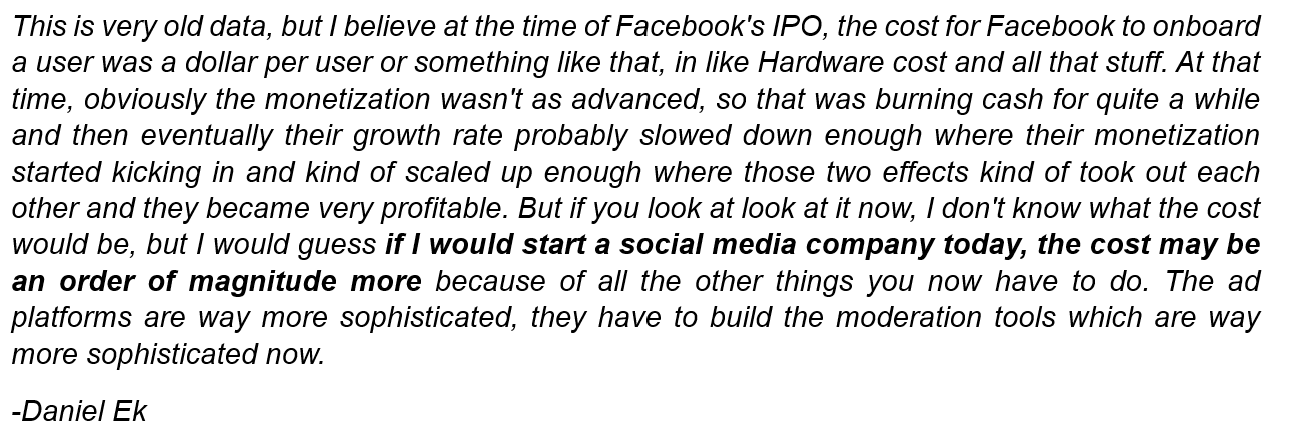

One of the things that made me dig deep into this is I myself started wondering why Meta posted 34% operating margin in 2009 but today’s crop of social networking companies are either unprofitable or barely profitable even at similar scale. Daniel Ek, Spotify’s CEO, indicated in a recent podcast the sea change in unit economics that likely occurred since Facebook’s IPO:

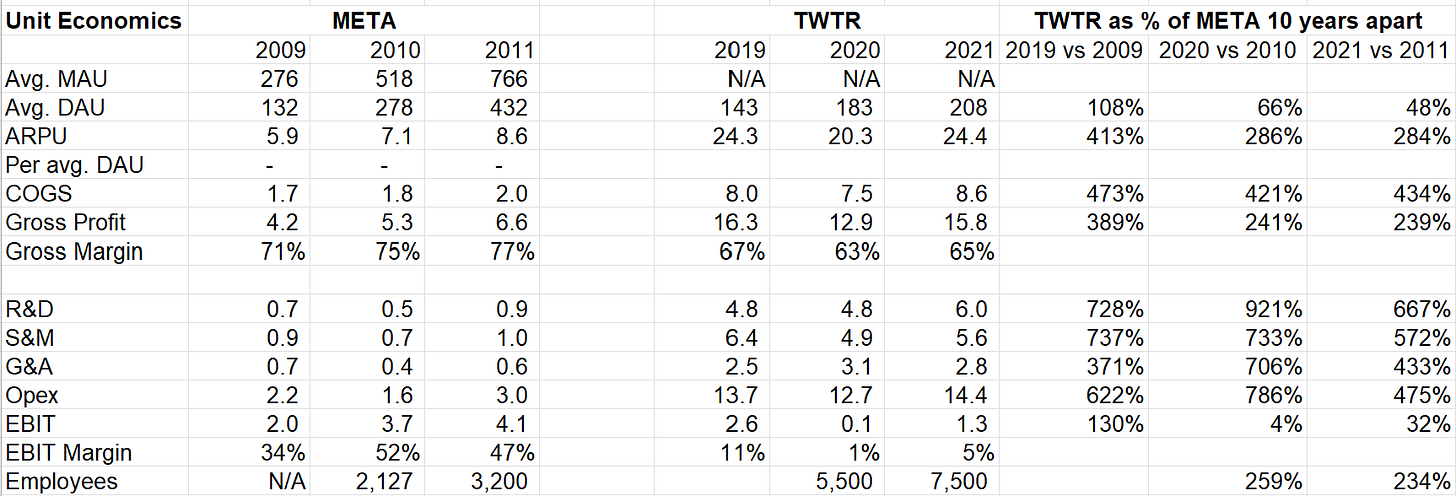

Here’s what I am going to do: I will show the unit economics of Meta (then Facebook; they also had just “Facebook” website/app back then) in 2009-11 and then show the unit economics of Snap, Pinterest, and Twitter in 2019-2021 period. Snap, Pinterest, and Twitter somewhat resemble Meta in terms of userbase 10 years apart and this exercise is indeed quite revealing to gauge what exactly is Meta’s moats against today’s and future set of competitors in their social networking business. I will briefly comment on TikTok later.

Meta vs Snap

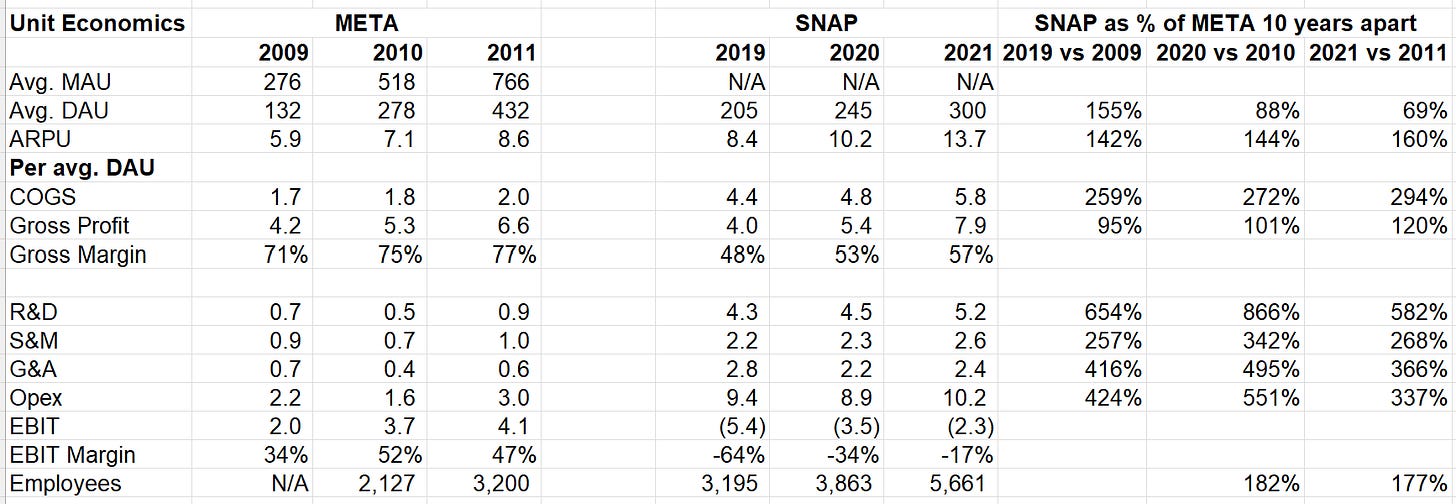

Seven years after Facebook, Snap was founded in 2011. In 2019, Snap had 155% of what Facebook’s DAU was in 2009. But by 2021, Snap came down to 69% of Facebook’s DAU in 2011.

Interestingly, while Snap’s Cost of revenue was ~3x higher than Meta’s 10 years ago, their Gross Profit (GP) is largely similar, thanks to much better monetization of the users by Snap and Facebook’s relatively primitive monetization/ad infrastructure back then by today’s standard. It’s the below the gross profit line where things start to diverge dramatically.

On a per DAU basis, Snap’s R&D was ~6-8x, S&M ~2.5-3x, and G&A ~3-5x of what Meta had 10 years ago at similar scale! Snap had almost double the employees Meta had and while neither company doesn’t exactly disclose salary related expenses, Opex (R&D+S&M+G&A) per average employee for Snap was $644k in 2021 vs Meta’s $493k in 2011.

One of the things that always somewhat surprised me about Snap is how so many people seem to rave about Evan Spiegel’s leaked email from 2014. When I first read it a couple of years ago, I was happy to ignore his macro prognostics but was alarmed to see his deeply flawed understanding of the elephant i.e. Facebook in the industry he is building his own business (see the below excerpt). Some of my friends tell me I’m being harsh on Spiegel since he was just 23 at that time. Unfortunately, capitalism doesn’t have any grace period related to age; in any case, when Google came after with all its might after Facebook by launching Google+ in 2011, Zuckerberg was just 27 years old. I know ZIRP world made it easy to forget, but capitalism tends to be sink or swim if you don’t know what you are doing. Ironically, even though Spiegel had a lot to say about Fed and interest rates, his company may be one of the largest beneficiaries of such environment as Snap IPO-ed in March 2017 at $24 Bn valuation despite the fact that they reported negative 11.7% gross margin and negative 128.7% operating margin (no typo here) in 2016.

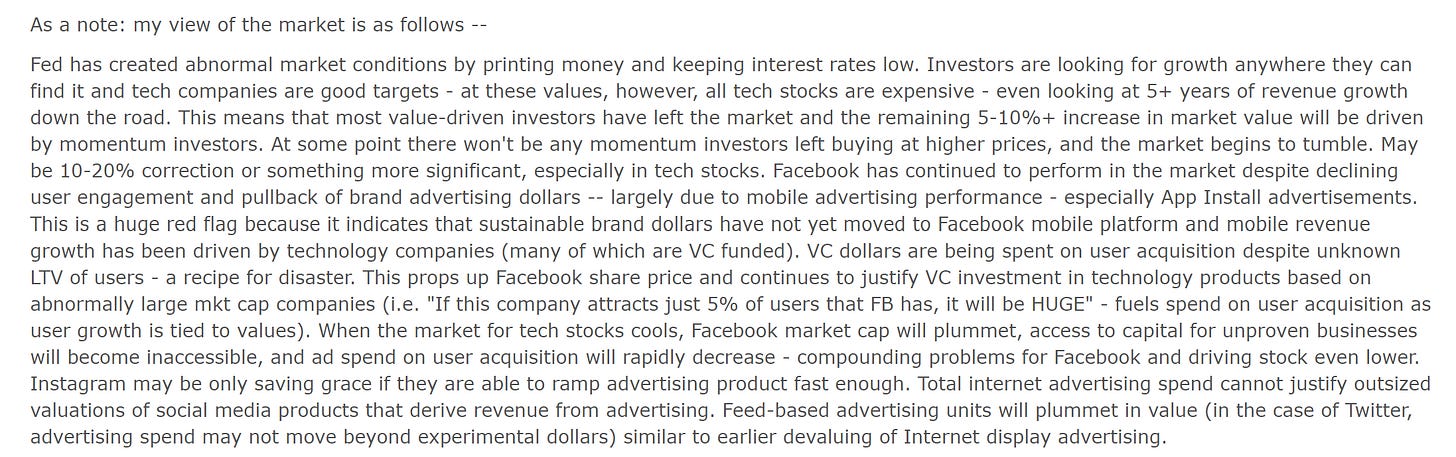

Meta vs Pinterest

Pinterest was founded in 2008. Similar to Snap, Pinterest had slightly better GP than Meta at similar scale although their path to slightly better GP per MAU was different to Snap’s. Both their ARPU and Cost of revenue was more or less similar to what Meta had 10 years ago. People likely spend less time on Pinterest than they used to on Facebook back then, so perhaps that’s why they have similar ARPU even with Facebook’s basic ad infrastructure during 2009-2011 period.

Since Pinterest IPO-ed in 2019, I am going to ignore 2019 vs 2009 comparison. On a per MAU basis, Pinterest’s R&D was ~3-5x, S&M ~2.5-3x, and G&A ~2-3.5x of what Meta had 10 years ago at similar scale! What’s interesting is Pinterest actually had similar number of employees to what Meta had back then. So why exactly Pinterest’s cost structure was still so wildly different?

There may be multiple factors at play. But average salary per employee almost certainly increased over time which may be the primary reason for such divergence. Again, as I have discussed before, there are only a handful of companies in Silicon Valley which built de-facto monopoly, and the primary “raw materials” to sustain their monopoly (using the word very loosely; FTC lawyers are encouraged to ignore my phrasings) is their pool of human capital. As you can expect, with their “monopoly” profits, they basically call shot in pricing the labor market and you have to play along even if you don’t have monopoly yourself. To say it differently, everyone in Tech at Silicon Valley or Seattle are rich thanks to a handful of monopolies regardless of whether they work at any of the monopolies themselves. If there were no monopolies in Silicon Valley/Seattle, labor market would likely go through a sea change to reflect the reality of the economics of many of the younger tech companies that were started close to GFC era.

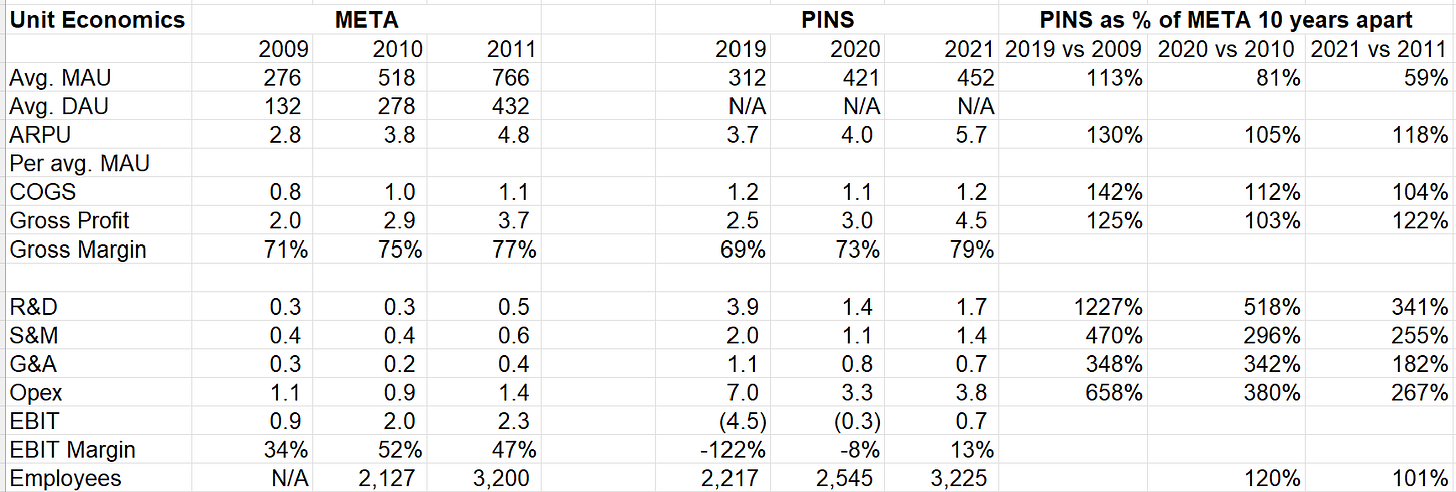

Meta vs Twitter

While Facebook was started in 2004, it became open to general public in 2006, the same year Twitter was founded. Therefore, these two companies are bit of a contemporary but their fates have diverged materially. Mark Zuckerberg had an apt quote about Twitter that gets repeated every now and then:

“Twitter is such as mess — it’s as if they drove a clown car into a gold mine and fell in.”

Despite being a contemporary, Twitter’s mDAU or “monetizable DAU” in 2019 (Twitter stopped disclosing DAU or MAU and used to report mDAU) was similar to what Facebook had in 2009. By 2021, Twitter’s mDAU was less than half of Facebook’s in 2011.

Twitter’s ARPU in 2019-21 was actually ~3-4x of Facebook’s 10 years ago which led to GP per DAU to be ~2.5-4x of Facebook’s. Anything below GP line, again, is just a sorry state of affairs.

On a per DAU basis, Twitter’s R&D was ~7-9x, S&M ~6-7x, and G&A ~4-7x of what Meta had 10 years ago at somewhat similar scale (perhaps these numbers are slightly overstated since I’m using mDAU as DAU for Twitter)! It is perhaps no surprise that Elon Musk got tempted to buy and right size the cost structure a bit, but it seems he had done that at the expense of ARPU so far, so the jury is still out there whether Twitter is in a better position pre or post acquisition by Musk.

The two other companies that are mostly talked about in social networking industry but yet to be public are Reddit and of course, TikTok (which isn’t necessarily “social”, but they are certainly Meta’s perhaps most potent competition). Reddit, another contemporary of Meta as it was founded in 2005, likely generated $350 Mn revenue in 2021 which is basically a day’s revenue of Meta today.

TikTok, on the other hand, generated $10 Bn revenue in 2022 which would put them closest to Meta in terms of revenue. If WSJ’s reporting is true that ByteDance, the owner of TikTok, posted $7.15 Bn losses in 2021, TikTok almost certainly had a pretty deep loss in 2021. Anecdotally speaking, TikTok pays a hefty premium to lure talent away from Big Tech; but even such premium wasn’t enough to convince a couple of my acquaintances to join TikTok since they were not confident that TikTok would be around in the US in 2-3 years. Therefore, while I don’t expect TikTok’s cost structure to resemble some of the public companies discussed here, it is still likely nowhere close to Meta’s unit economics.

What is my broad takeaway from digging into these numbers?

While it is tempting to blame management of one company or another (and they likely do deserve some criticisms), we probably should take a step back and wonder why is every single Meta’s competitors being managed so poorly? Why were they all spending money like drunken sailors without any clear sight to compelling economics in the near future?

I’m sure low interest rates and investors willingness to look past losses for the elusive economics at scale played their parts too, but I think the primary reason is the business of social media likely changed forever. On the surface level, social networking seems like an amazing business: once you manage to create network effects, the nodes of the network grow and the network just feeds on itself. Since your users generate all the content at zero marginal cost, and your job is basically to just aggregate demand to sell the network’s attention to advertisers vs paying for content in the legacy media business, this sounds like a great business model . Operating margin for such business was understandably expected to be at least ~30% and potentially much more (Meta’s highest ever operating margin was 52.3% in 2010 which likely contributed to such inflated expectations).

Why isn’t that happening at all? I already wrote about “raw material” inflation which may not reverse anytime soon. AI may help lowering the demand for software engineers in the medium to long-term, but even then as long as Big Tech have the profits, it shouldn’t be hard for them to maintain a persistent and increasing “inflation” for the talented pool of human capital. Attracting talent at reasonable cost itself would be a difficult challenge, but as societies around the world demand more data privacy, security, and moderations in these companies, it is creating the unintended benefit to the incumbent such as Meta (think ATT, GDPR etc.). So, today these two things: a) ability to attract and price talent, and b) regulatory capture are the primary moats of Meta.

But even beyond that, perhaps yet another challenge for these companies is their competitor is Meta. Tech may seem inherently a red queen’s race, but it may become more difficult to keep pace for everyone else if the company that is way ahead is also run by an operator who is so paranoid about durability of his business that he ends up running faster than everyone else. I would even argue most moats in tech are essentially “execution” moats (maybe also why Buffett mostly avoids them), and except maybe one or two, none of the tech companies can just sell products/services without perennially participating in the red queen’s race.

When Michael Nathanson asked the below question to Mark Zuckerberg in 2Q’22 earnings call, admittedly I found Zuckerberg’s response a bit lacking and thought the real answer that he’s not saying is Meta’s moats are evaporating. Not sure if it’s just the stock price that’s influencing me here, but I do think he indeed pointed out the moat Meta likely capitalized the most in its history (the network effects moat expired some time ago) and it’s their execution:

Michael Nathanson

Mark, I think going to one of the earlier questions about your advantages at Facebook. The previous moat, we would argue, was just the social graph of billions of people, families and friends. Do you think what you're building now with AI and from digital, how all those content is even a better moat, is a better business than the one you had before, which was a pretty high barrier to entry, just given the social effects of the network you built? (MBI: if it were so high barrier to entry, how could Snap, Pinterest, TikTok enter and gain massive userbase over time? It was always a very weak moat, yet there is almost no profit left for others to eat)

Mark Zuckerberg

In terms of building sustainable competitive advantages, in terms of the social graph, right, which you cited from before, people have been able to get that from phones for more than a decade now, right? So I don't really think that's been the thing for us. I think it's we're a serious technology company. We invest a lot in building infrastructure. And culturally, we focus on moving and learning faster than everyone else. And I think that those are sustainable advantages.

And so certainly, I think that the AI technology infrastructure that we're building, I think it can compound and be better than others in the industry and that will be an advantage and make the product better over time. But I think at the end of the day, what that really comes down to is just I try to push the company to be one that learns faster and just keeps iterating and moving faster than we did in the past and than others in the industry do. And I think if we can do that well, then we'll continue to succeed.

But I think the moment that we stop doing that, then we'll basically fall behind. It's a very competitive field and we need to keep on pushing ahead. But I think the reason why we have succeeded and seen so good results with Facebook, Instagram and the other social apps is because we basically focus pretty relentlessly on just pushing to constantly improve them.

Just as it didn’t satisfy me back then, Zuckerberg’s response may not feel convincing to many because it feels a bit fluffy and not the usual kind of moat we talk about. But if you look at Meta’s financials since 2009 and study carefully not only against other social companies but also other big tech, it is hard not to infer their execution has been almost unparalleled. Here’s what I wrote back in March this year:

“While investors have perennially wondered about the ghost of Myspace, FOA (Family of Apps) continued to reach new and unforeseen heights in the social media industry.

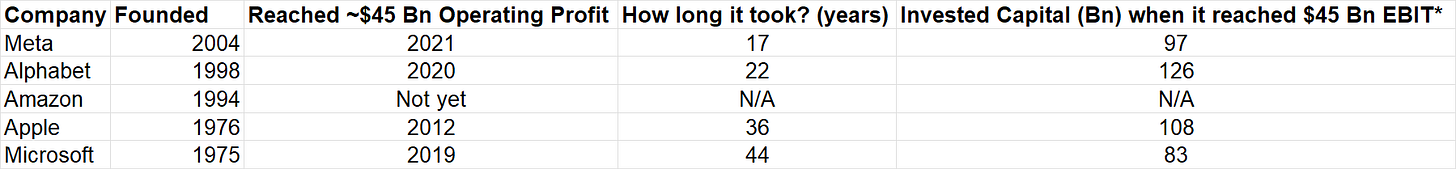

A 19-year old Mark Zuckerberg co-founded Facebook (currently Meta) in 2004 and it is hard not to be awestruck by what he did in less than couple of decades. Let me contextualize Zuckerberg's height of success with Facebook (now Meta).

17 years after being founded, Meta reached $95 Bn Gross Profit in 2021. To reach similar Gross Profit, Alphabet, Amazon, Apple, and Microsoft took 22, 24, 42, and 45 years respectively.

How about GAAP Operating Profit? Meta posted $45 Bn operating profit (including ~$10 Bn losses in Reality Labs) in 2021. To reach similar operating profit, Alphabet, Apple, and Microsoft took 22, 36, and 44 years respectively. To post such operating profit, only Microsoft required lower invested capital than Meta, so Meta was able to reach such profitability with incredible margins and ROIC. Perhaps the AGI will beat Zuckerberg's record by reaching $45 Bn operating profit faster. While Meta may have gotten a bit derailed in 2022, it would be unfair to not acknowledge, appreciate, and applaud what Zuckerberg and his team did in 2004-2021.”

If “execution” is the moat, what is the driver of such moats? It’s the people who have to execute the plan, and it’s the CEO who need to design the plan and recruit the right people to get the job done.

Of course, investing is inherently about the future, and what Meta did in 2004-2021 can prove to be just relics of history. But it is historical track record that is the bedrock to form our qualitative insights for the long-term.

I do admit Meta’s capital allocation in 2021-22 period was far from anything to be proud of (and Zuckerberg would probably not disagree either); I do want to point out that for most tech companies, capital allocation doesn’t start based on what FCF you generate, so I’m not just alluding to Meta’s ill-timed buybacks in 2021. It essentially starts at Gross Profit level; how much a tech company spends in R&D, S&M, and G&A are deeply integral to capital allocation framework. From this perspective, Zuckerberg made some very suboptimal decisions and committed mistakes by over hiring which he later needed to correct through a massive and painful series of layoffs. Overhiring is a mistake committed by many CEOs in 2021-22 period, but that’s not a defense for Meta or Zuckerberg because if “execution” is the primary moat, you better be switched on when everyone else is off.

At the end of the day, the real question about Meta’s “execution” moat is which “Zuckerberg” reflects closer to reality today going forward: is it 2004-21 Zuckerberg? or is 2021-22 one? Investors generally dislike personality based moats as they can be excruciatingly hard to assess/evaluate/track, and these personalities often tend to test your patience, but if you look at tech history and perhaps the most outlier successes, such personality driven (and not necessarily business driven moats), are not a rarity.

Even before the 2022-23 drama, I have always thought the Facebook or Meta’s long-term bull case revolves around Zuckerberg (see my 2020 thread). Imagine if someone told you in 2015 that by 2023, the most popular social formats would be “Stories” and “Short form videos”, both of which would be invented (and hence enjoy a material leg up) by Meta’s two closest competitors at the time, you would probably be worried whether Meta would remain relevant in just 8 years. When Meta was transitioning hard to mobile, operating margin fell from 47.3% in 2011 to 10.6% in 2012. Transitioning to Stories and Reels also required Meta to be willing to give up valuable surfaces or time spent on their apps to materially lower monetized features which create near-term earnings pressure. This is the kind of decisions which are not quite hard to take by a founder but can be quite tricky to pursue for hired management.

The social media of 2030-35 would probably be very, very different than what it is today. Any careful analysis of today’s business fundamentals may become obsolete and hence, your ability to be long-term owner of this business may be largely dependent on your opinion about the quality of management as the people running the business would likely need to go through a couple of format/feature shifts every decade or so (maybe OS too every 2-3 decades).

Considering almost constant negative press coverage and the difficulty of forecasting/underwriting social media businesses for 5-10 years, the stock may persistently trade at below market multiples. Despite +134% YTD, the stock still trades at ~17x NTM EV/EBIT which is ~8-10 turn lower compared to Nasdaq 100 (when you include SBC in EBIT calculation) and ~3-4 turn lower than S&P 500 (again, similar SBC adjustments to QQQ). To the extent my opinion about Meta’s management is correct is what will likely drive shareholders’ long-term return.

P.S. I know any piece on Meta’s moat may seem incomplete without any discussion on Metaverse or AR/VR segment. It is simply too early to form any rigid opinion there, but for curious readers, I encourage you to read this Benedict Evans piece which I thought was perhaps the most thoughtful piece on Vision Pro/Quest post WWDC.

You can also read a bit more detailed analysis on Meta here (March, 2023)

Disclaimer: All posts on “MBI Deep Dives” are for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.