Meta 4Q'25 Update

Admittedly, I was confused looking at the initial reaction of Meta’s earnings when the stock went down. Mr. Market promptly corrected its “mistake” later.

One of the reasons I think some may have reacted negatively is the ever burgeoning capex outlook by Meta which inevitably exerts pressure on FCF. I suspect a good fraction of investor base has a very mechanical understanding of FCF i.e. they understand that more FCF is better, but what many seem to find relatively harder to internalize is if a company has rich reinvestment opportunity, the optimal FCF should be as low as possible, especially if you have a strong balance sheet. This shouldn’t be controversial, but I suspect it is among many investors.

It is, however, fair to debate whether the reinvestment opportunity is attractive or whether there is a rapidly diminishing return as the scale of capex becomes larger. While it’s reasonable to wonder about these questions, I come away from 4Q’25 call feeling quite optimistic about Meta’s reinvestment runway.

Let’s get into 4Q’25 earnings highlights.

Engagement and Advertising

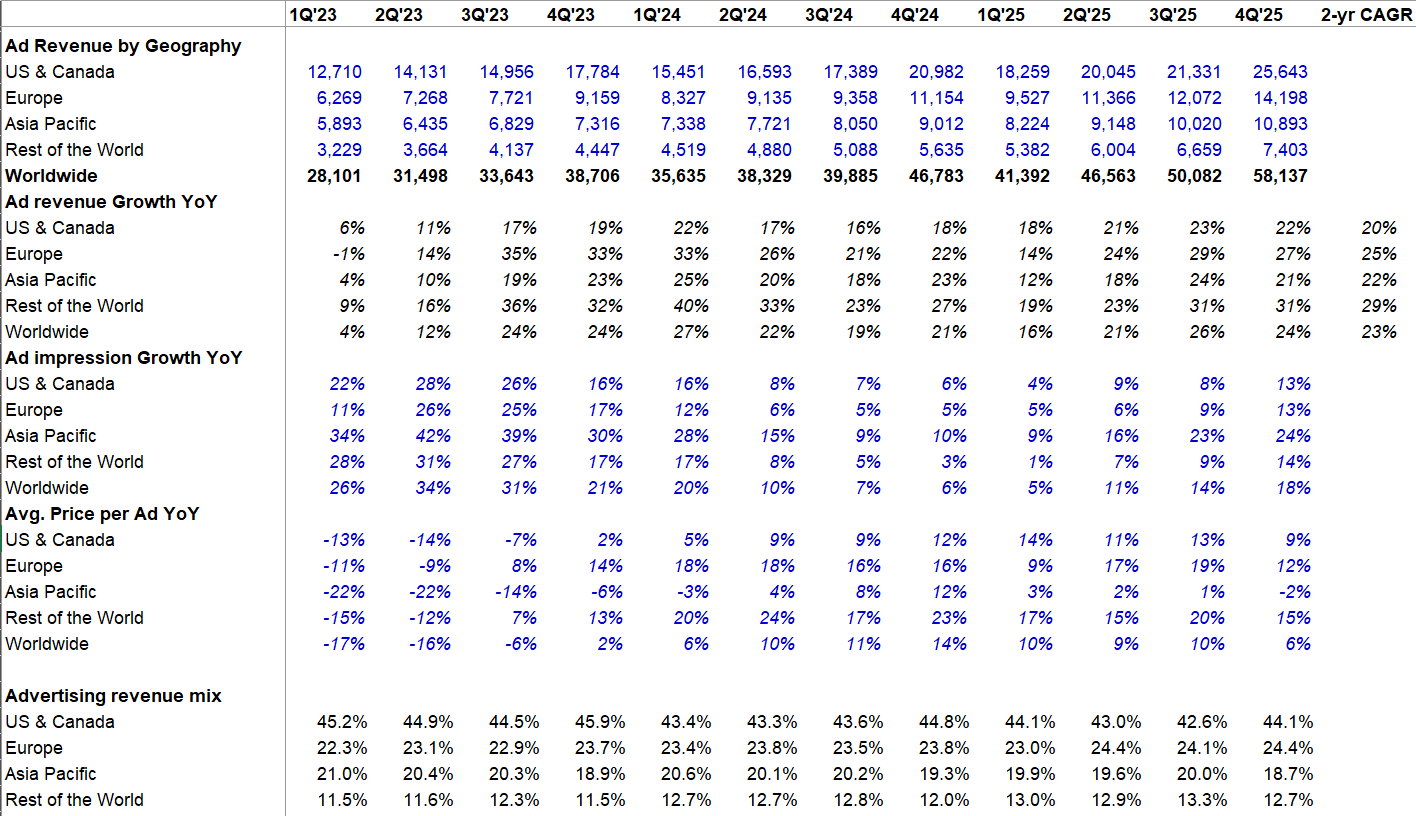

Historically, Meta’s ad prices and ad impressions tend to go in opposite directions. While in 3Q’25 both ad prices and number of ad impressions grew simultaneously, 4Q’25 saw the familiar pattern again: accelerating ad impression but lower ad prices. Investors tend to prefer accelerating ad impression as it implies further headroom for ad prices to catch up over time.

Ad revenue grew higher than 20% in every region. These are quite incredible growth numbers at this scale.

While some wonder whether AI slop will hurt UGC content platforms such as Meta, I recently explained why I not only reject such hypothesis but also investors are likely still underestimating the true bull case of AI assisted or generated content on UGC platforms. This call essentially validated some of the points I mentioned. The fact that IG Reels watch time was +30% in 4Q’25 YoY in the US whereas Netflix watch time was +2% in 2H’25 YoY (I know apples and oranges, but directionally likely accurate) should give anyone at least a pause about the hypothesis that AI will incentivize users to find refuge in Netflix content. As I have mentioned in my piece, the core “job to do” for Meta is to surface engaging content in front of you. If you don’t seem to like AI content, the algorithm simply won’t show it to you.

Some key excerpts that highlighted the engagement improvement in Meta’s apps:

we’re continuing to drive incremental engagement from ranking and product improvements. Instagram Reels had another strong quarter with watch time up more than 30% year-over-year in the U.S. Engagement is benefiting from several optimizations we made to improve the quality of recommendations including simplifying our ranking architecture to enable more efficient model scaling. This unlocks the ability for our systems to consider longer interaction histories to better identify a person’s interests.

On Facebook, video time continued to grow double digits year-over-year in the U.S., and we’re seeing strong results from our ranking and product efforts on both feed and video surfaces. The optimizations we made in Q4 drove a 7% lift in views of organic feed and video posts on Facebook, resulting in the largest quarterly revenue impact from Facebook product launches in the past two years.

We’re continuing to increase the freshness and originality of content recommendations as well. On Facebook, our systems are surfacing over 25% more reels published that day than the prior quarter. On Instagram, we grew the prevalence of original content in the U.S. by 10 percentage points in Q4 with 75% of recommendations now coming from original posts. Threads is also seeing strong momentum again, benefiting from recommendation improvements. The optimizations we made in Q4 drove a 20% lift in threads time spent.

Turning to 2026. We see a lot of opportunity to drive additional gains. This includes scaling the complexity and amount of training data we use in our models while continuing to make our systems more responsive to people’s real-time interest. We’re also focused on incorporating LLMs to understand content more deeply across our platform, which will enable more personalized recommendations.

One area we’re already seeing promise is with AI dubbing of videos into local languages. We are now supporting 9 different languages with hundreds of millions of people watching AI translated videos every day. This is already driving incremental time spent on Instagram, and we plan to launch support for more languages over the course of this year.

Nearly 10% of the reels people view each day are now created in our Edits app, almost tripling from last quarter. Within Meta AI, the number of daily actives generating media tripled year-over-year in Q4.

Okay, so engagement is great as AI is surfacing the relevant content in front of you. At the same time, users are using AI to generate more content. Win-win for Meta.

Now let’s look at the other side of the equation: advertisers which I found, frankly speaking, to be even more bullish for Meta. I will discuss rest of this piece behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 64 Deep Dives here.