Meta 4Q'22 Earnings Update

Disclosure: I own shares, and Jan 2025 call options of Meta

What a difference three months makes! Meta stock almost doubled from late October to today!

2023 is suddenly the "Year of Efficiency"! Zuck's tone was markedly different tonight.

Here's my highlights from tonight's earnings call.

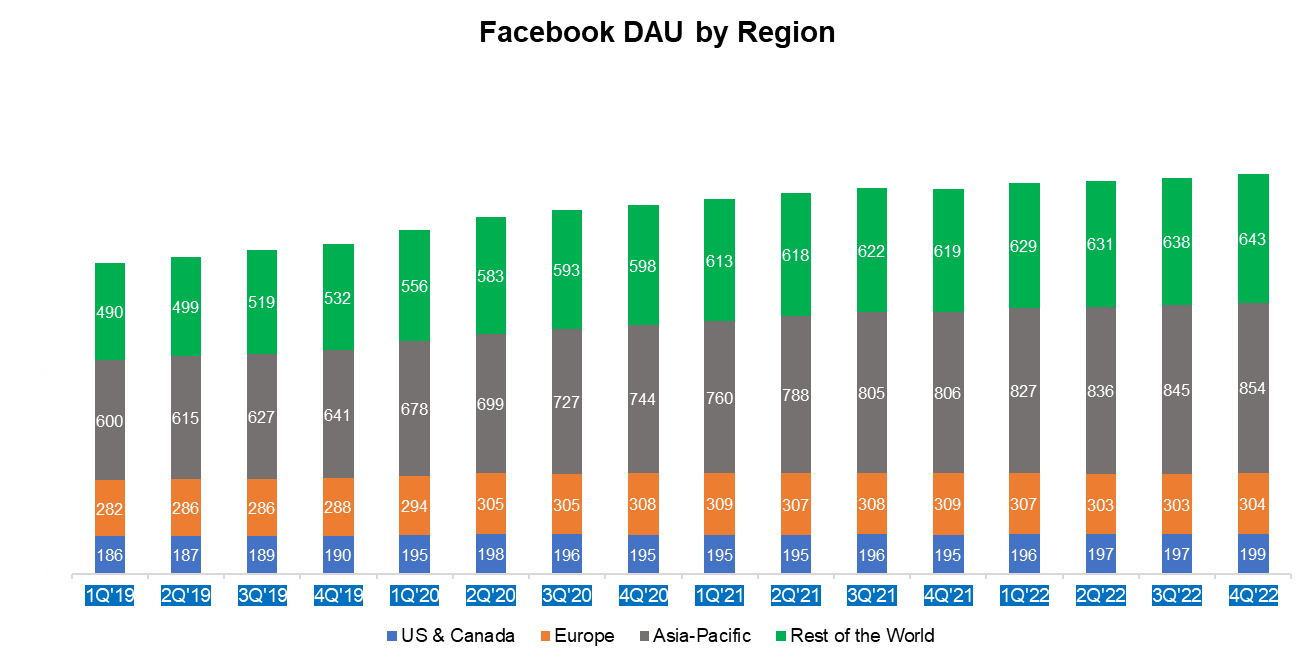

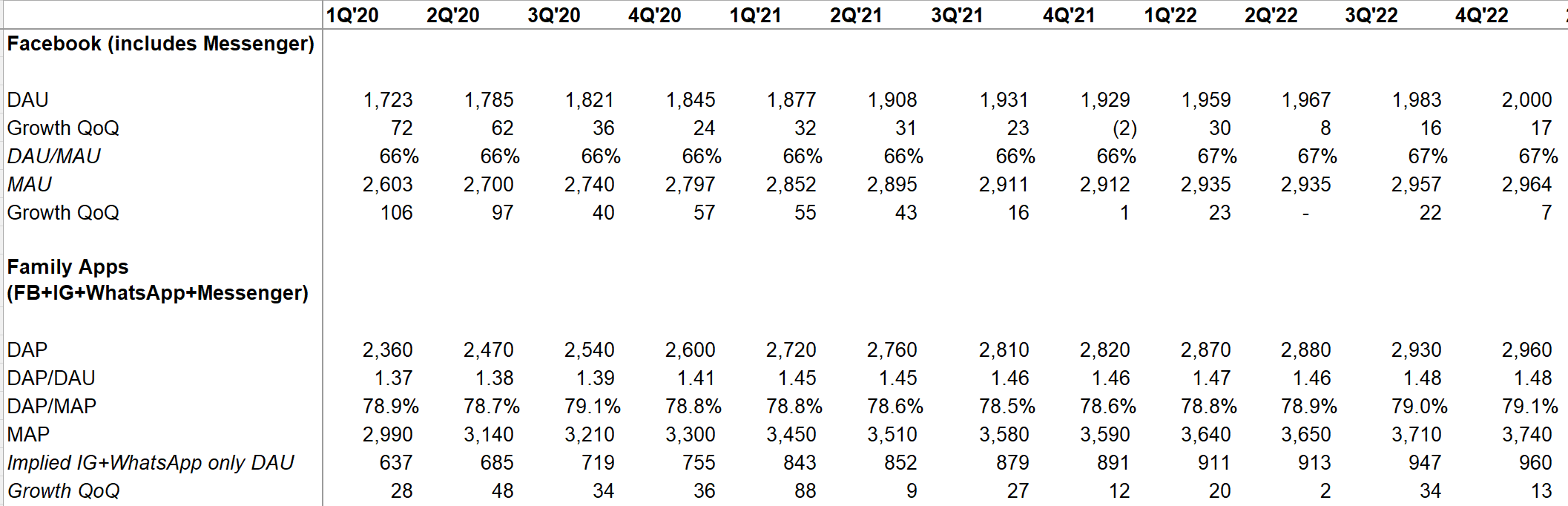

Users

Facebook DAU reached 2 Bn. But isn't it dying in the US?

Snapchat grew its DAU by 3 mn YoY in North America in 4Q'22. During the same time, Facebook's DAU in North America increased by 4 mn.

Engagement

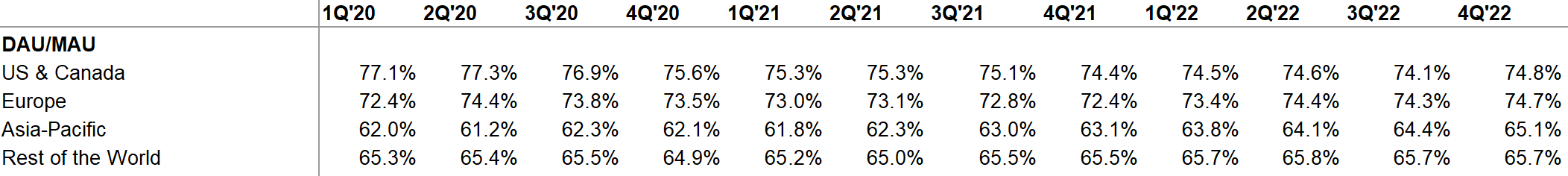

DAU/MAU increased incrementally QoQ and YoY across all regions.

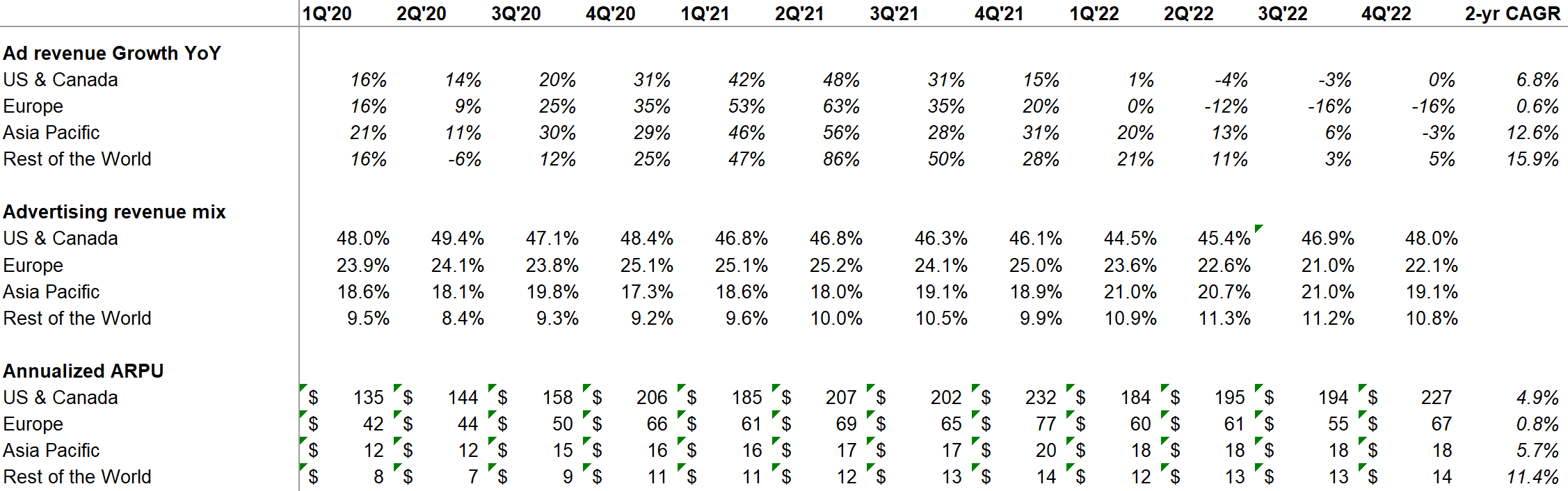

Ad revenues

In 4Q'22, Ad impression was +23% YoY, avg price/ad was -22%.

Impression growth was driven by APAC and RoW. Ad price decline was due to impression growth in lower monetizing surfaces and regions, lower advertiser demand and FX.

Growth was negative in online commerce and CPG but YoY decline in commerce slowed vs 3Q. Largest positive contributor was travel and healthcare (both smaller verticals for Meta).

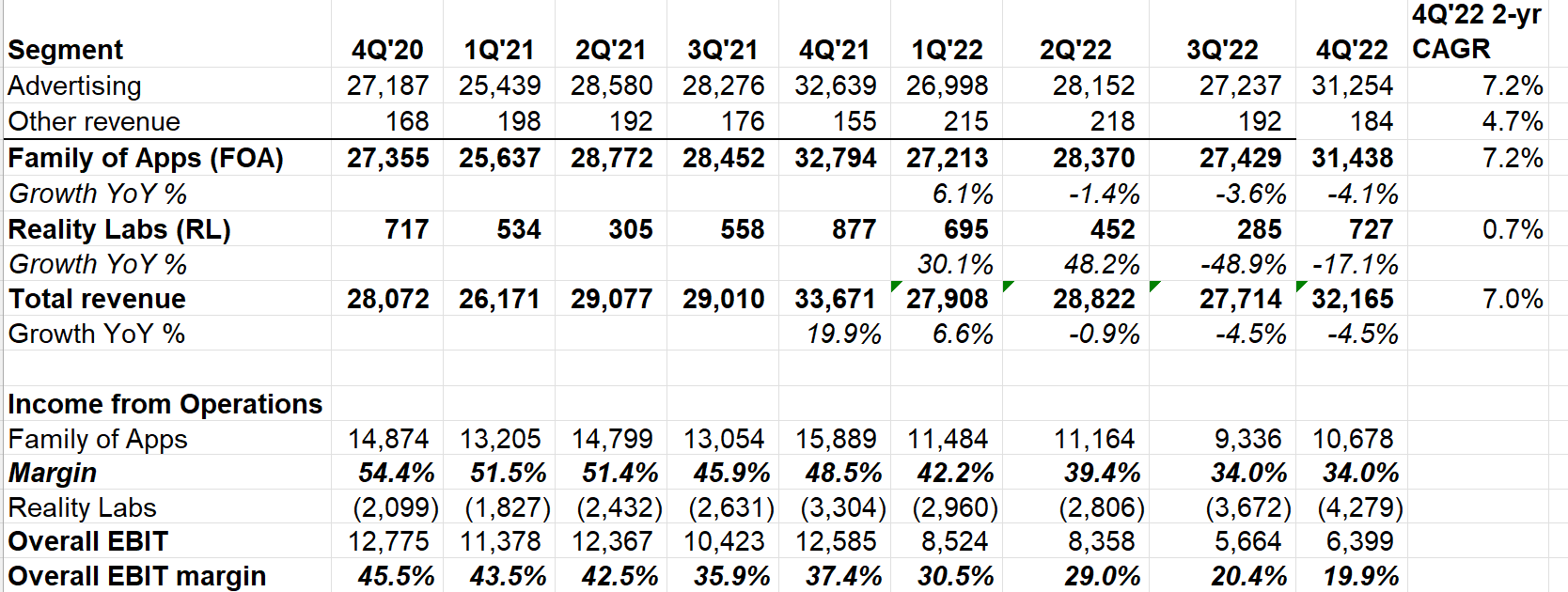

Segment reporting

FOA revenue as well as total revenue was down ~4% (+2% FXN).

Admittedly, it's bit shocking to see flat RL 2-yr CAGR growth despite launching Quest Pro this year. That should tell you how it's doing. That's not a S-curve, is it?

FOA's operating margin is down ~20 percentage points over last 2 years.

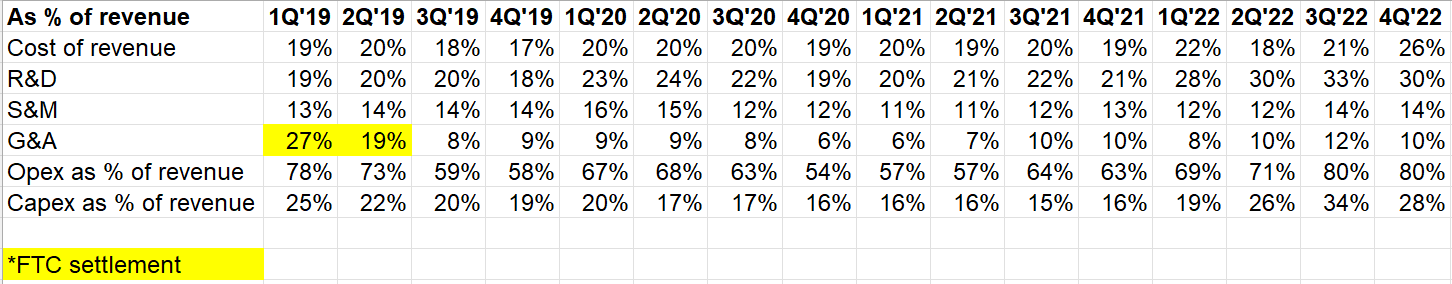

Opex

If we look more closely, Meta's Gross Margin deteriorated by 530 bps QoQ and 706 bps YoY. This used to be ~87% gross margin business in 2017! What's going on?

cost of revenue increased 31%, driven mostly by a write-down of certain data center assets

Plus, Meta likely sells RL products at negative gross margin. If we assume -10% GM for RL, FOA's GM was ~76% in 4Q'22. I'll keep a close eye on FOA's GM going forward.

Despite that write-down, it's perhaps fair to say the days of 87% gross margin may never come back! Discovery engine's AI-recommended content and Reels are just fundamentally lower gross margin business than text/photo based feeds. FYI, WSJ reported ByteDance's 2021 gross margin was 56%.

There was also $4.3 bn restructuring costs in Q4 (and another $1 Bn expected in 2023)

Reels and AI

Speaking of Reels, >40% advertisers are using Reels now. Meta is seeing progress in both Direct Response (DR) and brand ads within Reels.

By the end of 2023, recommended content will be ~30-40% of feed. Zuck's prepared remarks on Reels and AI is worth reading in full (emphasis mine):

The 2 major technological waves driving our road map are AI today, and over the longer term, the metaverse. So first, let's talk about our AI discovery engine. Facebook and Instagram are shifting from being organized solely around people and accounts you follow to increasingly showing more relevant content recommended by our AI systems. And this covers every content format, which is something that makes our services unique. But we're especially focused on short-form video since Reels is growing so quickly. And I'm really proud of our progress here. The Reels plays across Facebook and Instagram have more than doubled over the last year, while the social component of people resharing Reels has grown even faster and has more than doubled on both apps in just the last 6 months.

The next bottleneck that we're focused on to continue growing Reels is improving monetization efficiency or the revenue that's generated per minute of Reels watched. Currently, the monetization efficiency of Reels is much less than Feed. So the more that Reels grows, even though it adds engagement to the system overall, it takes some time away from Feed, and we actually lose money.

But people want to see more Reels though. So the key to unlocking that is improving our monetization efficiencies that way we can show more Reels without losing increasing amounts of money. We're making progress here, and our monetization efficiency on Facebook has doubled in the past 6 months.

In terms of the revenue headwind, we're still on track to be roughly neutral by the end of this year or maybe early next year. And then after that, we should be able to profitably grow Reels while keeping up with the demand that we see.

In our broader ads business, we're continuing to invest in AI, and we're seeing our efforts pay off here. In the last quarter, advertisers saw over 20% more conversions than in the year before. And combined with the decline in cost per acquisition, this has resulted in higher returns on ad spend.

AI, it's the foundation of our discovery engine and our ads business. And we also think that it's going to enable many new products and additional transformations in our apps. Generative AI is an extremely exciting new area with so many different applications. And one of my goals for Meta is to build on our research to become a leader in generative AI in addition to our leading work in recommendation AI.

Click-to-messaging ads

click-to-message ads is now the $10 billion run rate.

Shop ads (still on beta) has a revenue run rate in the hundreds of millions of dollars.

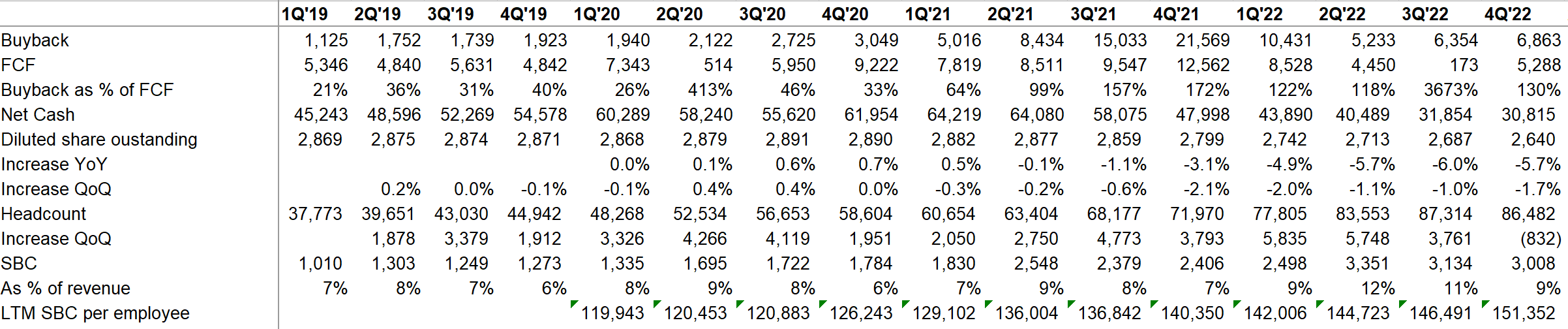

Capital Allocation

Meta bought back $6.8 Bn last quarter, ~130% of FCF. Diluted shares outstanding is down 5.7% YoY. The recent ~11k layoff is not reflected in 4Q'22 headcount.

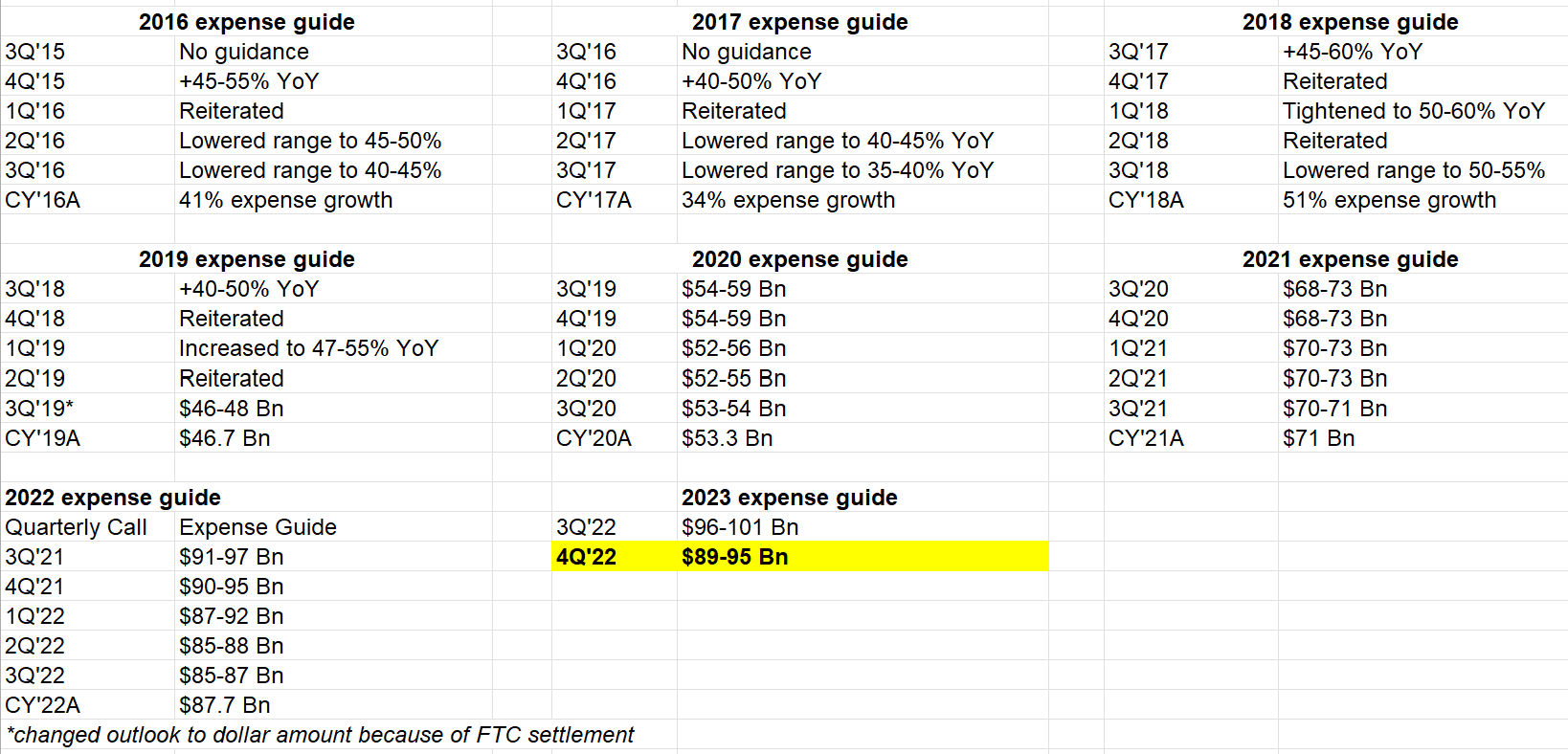

Opex+Capex guide

Meta clearly has an Opex problem which they're trying to address now. First of all, as expected, opex outlook came down from last quarter's guide. If we see last few years, full-year expense guide given in Q1 (next quarter) call is usually more spot on. So, opex guide may go down further.

Capex guide for 2023 is lowered from $34-37 Bn to $30-33 Bn.

The reduced outlook reflects our updated plans for lower data center construction spend in 2023 as we shift to a new data center architecture that is more cost efficient and can support both AI and non-AI workloads.

The key question is, of course, the long-term maintenance capex. Susan made some encouraging remarks:

In terms of longer-run capital intensity, we certainly expect that the lower CapEx outlook will have some incremental benefit to CapEx as a percent of revenue, and that's still really something that we are focused on over the longer term. The current surge in CapEx is really due to the building out of AI infrastructure, which we really began last year and are continuing into this year. We'll be measuring the ROI of these AI investments, and their returns will continue to inform our future spend. Our intention is still to bring CapEx as a percent of revenue down, but capital intensity in the nearest term is really going to depend, in part, on the revenue outlook and our needs to further build AI capacity for future demand.

Metaverse

There are now over 200 apps on our VR devices that have made more than $1 million in revenue. We're also continuing to make progress with the avatars. We just launched Avatars on WhatsApp last quarter, and more than 100 million people have already created avatars in the app. And of those, about 1 in 5 are using their avatar as their WhatsApp profile photo. I thought that, that was an interesting example of how the Family of Apps and Metaverse visions come together because even though most of our Reality Labs investment is going towards future computing platforms -- glasses, headsets and the software to run them -- as the technology develops, most people are going to experience the Metaverse for the first time on phones and then start building up their digital identities across our apps.

even though none of the signals that I've seen so far suggests that we should shift the Reality Lab strategy long term, we are constantly adjusting the specifics of how we adjust -- of how we execute this. So I think that we'll certainly look at that as part of the ongoing efficiency work.

Don't get your hopes up; base case still is 2023 losses will increase from $13.7 Bn RL losses in 2022.

On Reality Labs, we still expect our full year Reality Labs losses to increase in 2023, and we're going to continue to invest meaningfully in this area given the significant long-term opportunities that we see.

1Q'23 guide

1Q'23 topline is expected to be $26-28.5 Bn (2% FX headwind) which implies -7% to +2% YoY

Meta remains a tricky ship. It is far from dead as the stock was telling you at $90, but the underlying currents indeed went through a rapid change over the last few quarters.

The following quote by Zuck perfectly encapsulates this from today's call:

for the first 18 years, I think we grew at 20%, 30% compound or a lot more every year, right? And then obviously, that changed very dramatically in 2022, where our revenue was negative for the growth for the first time in the company's history. So that was a pretty big step down. And we don't anticipate that, that's going to continue, but I also don't think it's going to necessarily go back to the way it was before. So I do think this is a pretty rapid phase change there that I think just forced us to basically take a step back and say, okay, we can't just treat everything like it's hyper growth... I'm actually fairly optimistic that there are a pretty good road map of things that we can do that will just make us more efficient and actually better able to build the things that we want.

Not all of them will help save money, right? So for example, focusing on AI tools to help improve engineer productivity, it's not necessarily going to reduce costs. Although over the long term, maybe it will make it so we can have fewer -- we just hire less, right, and stay a smaller company for longer. But I do think things like reducing layers of management just make it so information flows better through the company and so you can make faster decisions. And I think, ultimately, that will help us not only make better products, but I think it will help us attract and retain the best people who want to work in a faster-moving environment.

And so that honestly was a little bit surprising, right, that as we started digging into this that the company would actually start to feel better to me. And I don't know how long that will -- like how long the road map is, if things that we can continue to do where that will be the case. But I do think we have a good amount of things like that. So that's why I'm really focused on this now. And I do want to continue to emphasize the dual goals here of making the company a better technology company and increasing our profitability. They're both important, but I think it's also really important to focus on the first one of just making it a better company because that way, even if we outperform our business goals this year, I just want to communicate, especially the people inside the company that we're going to stick with this, because I think it's just going to make us a better company over the long term. So I think that's it for now.

By no means, Meta is out of the woods yet! But Meta will probably become a better run company for all the pain it went through in last 18 months. We'll see!

(just experimenting with a new tool; no pressure!)

I will cover Google and Amazon earnings tomorrow!

More thoughts on Meta here.