Lululemon's Succession

Regular readers are likely aware that I have lost my shirt by investing in Lululemon. To add further salt to my injury, the stock started going up a bit only after I sold it. Joking (or lamenting) aside, Lulu’s board came to the same conclusion I did three months ago: Calvin McDonald should not remain CEO of Lululemon!

McDonald became CEO of Lululemon back in August 20, 2018. I’ll first let McDonald summarize his tenure at Lulu:

“Since 2018, lululemon tripled its annual revenue, and we expect to generate $11 billion this fiscal year.

We have broadened our global reach from 18 to over 30 geographies and grown the company’s China Mainland business into our second largest market. We expanded the horizon for what’s possible for lululemon, quadrupling our international business, growing our men’s business as well as our online channel and extending into new categories and activities. And I am proud we are the #1 women’s active apparel brand in the United States. We have done this while increasing our profitability.

Based on our guidance for 2025, we will achieve a compound annual growth rate in EPS of approximately 20% from 2018 to 2025. And the company has strong cash flow and a balance sheet with $1 billion in cash and no debt.”

To be fair, that is indeed very impressive! So, shareholders must have done really well under McDonald’s leadership, right? RIGHT?

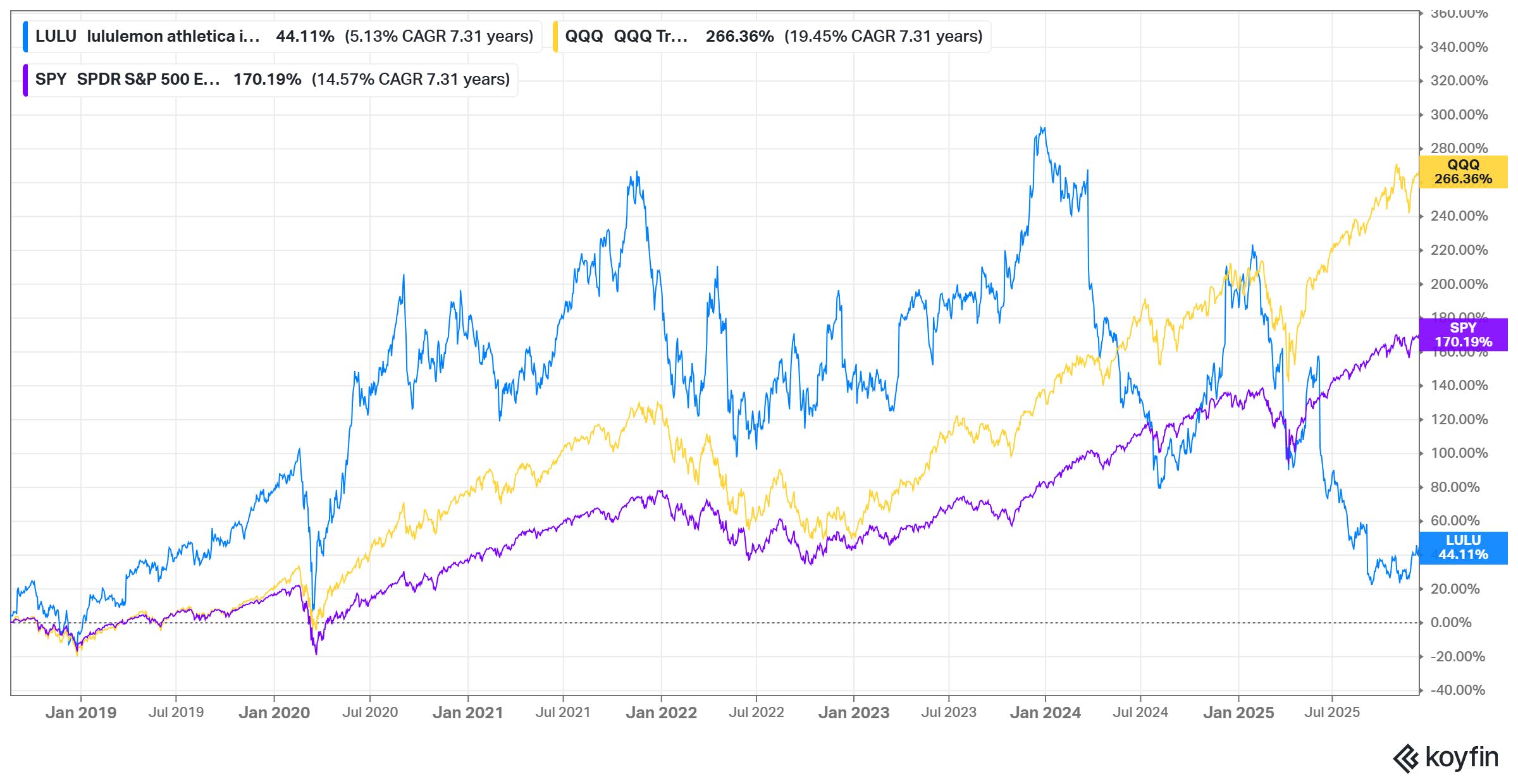

The answer would be different if you asked the question a year ago! For almost the entire period between August 2018 to early 2025, Lululemon’s stock outperformed both the S&P 500 and QQQ. But when McDonald announced to step down as CEO, the stock only managed to do ~5% CAGR during his tenure.

When McDonald became CEO, the stock was trading at ~40x P/E whereas the stock is currently trading at ~15x P/E. So, McDonald had bit of a “Ballmer” fate here, but that would mask a sense of real erosion of the brand in the last couple of years under his leadership.

Take a look at this tweet, for example: Lulu’s lack of consistency even for its logo perhaps encapsulates how lost they seem to be to rekindle growth in North America. Perhaps my biggest frustration was McDonald was not “consistently candid” with investors for the last couple of years. For example, Lululemon, as far as I (or the couple of AI models I asked) can tell, never mentioned about consumers “trading down” affecting their performance until yesterday:

“We held share in premium athletic and lost some slight share in the performance apparel as we see guest behavior and trading down.”

Then when asked a question about “trade down”, management claimed they have seen such behavior throughout 2025. Management didn’t bother to share such information before. Moreover, Lulu mentioned several points yesterday that bolster the case that Lulu management did not do many basics that were under their control. From the call:

We know that our current merchandising mix, particularly in North America does not fully reflect the go-forward vision we have for our brand.

We’ve let product life cycles run too long within some of our key franchises. And we have not inspired our high-value guests to purchase as we had in the past.

Our mainline product development process currently runs 18 to 24 months, and we are working to reduce it to 12 to 14 months.

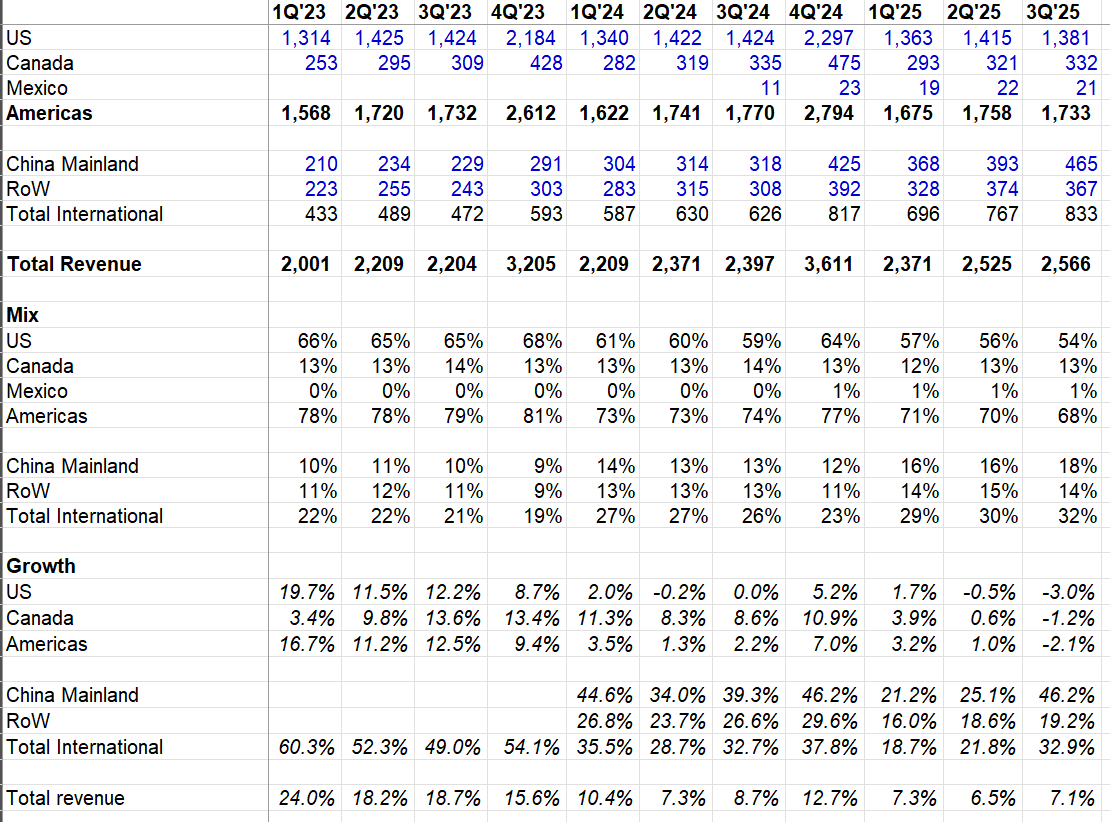

Given this context, it is less of a surprise that for the first time both the US and Canada experienced revenue decline YoY. International markets, especially China still maintained its momentum, but unless North America business reaccelerates to MSD level over time, the question of brand saturation will eventually arise for those regions as well which will exert pressure on the valuation multiples.

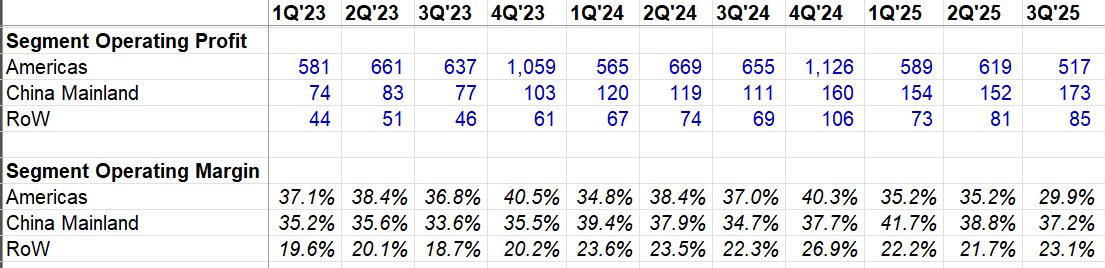

Lulu’s operating margin in Americas was below 30% even though it used to be consistently mid to high 30s. Admittedly, Lulu was quite unfortunate here as the regulation around de minimis and tariff are the primary culprit here. Their overall gross margin went down by ~290 bps YoY. Moreover, they expect tariffs and de minimis to have 410 bps impact on margins. On top of that, they now expect 100 bps higher markdown than 2024.

Management reminded that 2026 will face margin headwinds as well:

“In terms of 2026 operating margin it is fair to assume that the negatives will outweigh a positive. The margin push though will be a multiyear effort... It will be our first full year of tariffs.”

Following McDonald’s departure, Andre Maestrini (Chief Commercial Officer) and Meghan Frank (CFO) will be Co-CEOs until the board hires a new CEO for the company. Whoever the new CEO may be, I think he or she will have a difficult hand in compounding this business given the competitive dynamics today. At least, he or she will have a much more reasonable P/E to start with!

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 65 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: