Lululemon 1Q'25 Update

Disclosure: I own January 2026 $165 Call Options

While the quarter looks mostly okay, Lulu’s guide is the primary culprit for the stock to be down 20%+ after-hours today. Before we get into that, let me recap the quarter first and then I will share some highlights from the call.

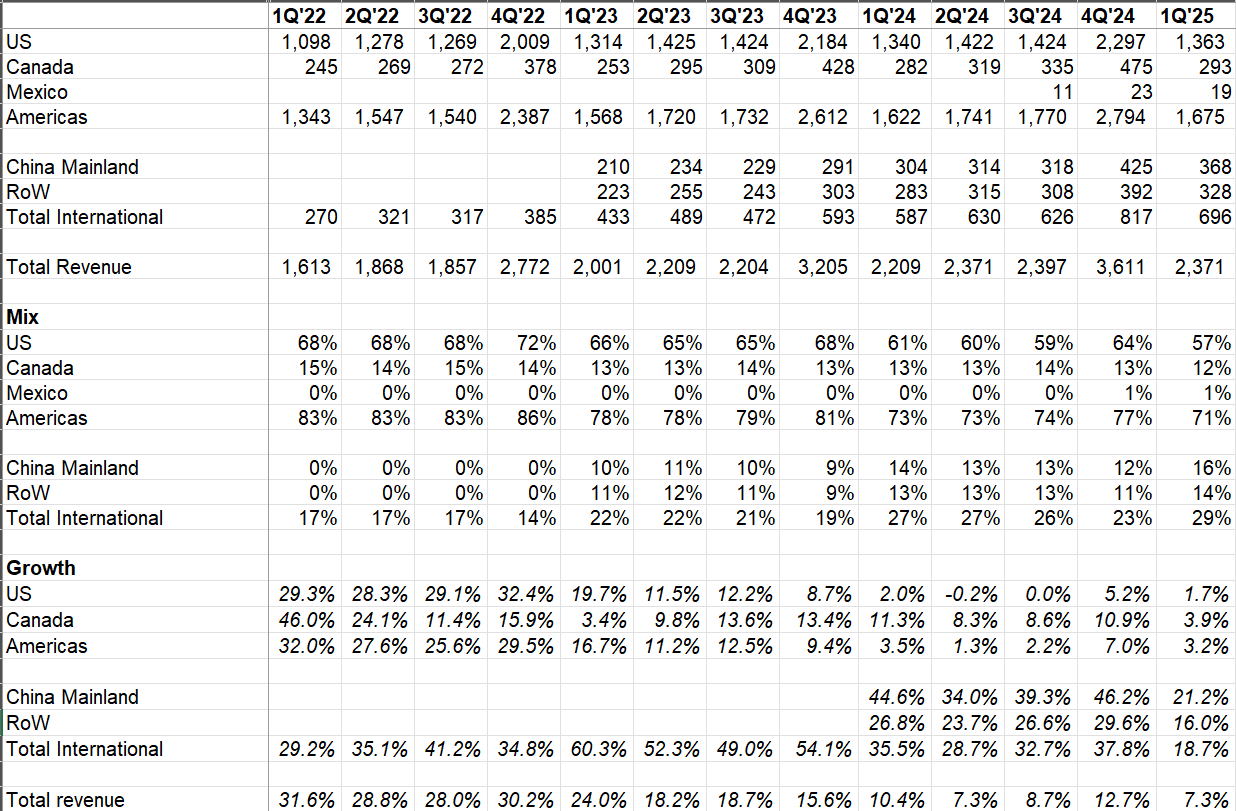

Sales by Region

Lulu is again back to LSD growth in the US; what makes it more disappointing is they actually had a somewhat easier comparison since 1Q’24 growth was just 2%. Canada, despite a low double digit growth in 1Q’24, again had higher growth than the US this quarter.

China and Rest of the World (RoW) maintained healthy growth rates but growth has materially decelerated. However, due to the timing of Chinese New Year, Lulu’s China growth was impacted by four points.

Given US is still the majority of the business (albeit declining in overall mix; US as % of overall mix has been trending downward for a while: 68% in 1Q’22, 66% in 1Q’23, 61% in 1Q’24, and 57% in 1Q’25), the main focus is still around the anemic growth in the US.

What explains the struggle in the US? Management mostly blamed “macro uncertainty” and “consumer confidence” as the key reasons which led to traffic decline in stores. They mentioned conversion remains mostly consistent and average order value actually increased YoY.

While most management teams typically like to shift the blame to macro, I wonder if the real challenge here is the broader athleisure segment which definitely took plenty of share in overall apparel industry in the last few years post-Covid and now may be ceding some of the shares. The reason I suspect this may be at least partly the case is Athleta’s persistent struggle as well which posted 1Q’25 revenue that was ~15% lower than what they did in 1Q’22. In contrast, Lulu’s revenue in the US was actually +24% during that same period.

In fact, Lulu management highlighted that they believe they continue to take share in the US:

When I look at our performance vs the market, we gained market share in the premium activewear. We had strong performance gains vs our peers in this segment of the market where we compete…We're definitely not happy where the growth is in the U. S. But relative to the market and our performance vs others, we are pleased that we're putting on share

Of course, we cannot track some of the key competitors such as Alo or Vuori since they aren’t public companies. Moreover, if the broader Athleisure segment is under pressure, we may see increased promotional activity or increased markdown in the US. Lulu management did confirm that they suspect the back half of the year is likely to experience that:

from a competitive perspective, there's nothing we're seeing globally on a price promotional play other than in the U.S., where I would say we continue to monitor that closely because we do see ongoing promotional activity across the market, across the competitors as we've seen the certain consumer the more cautious.

We know that to lever other pulls and we continue to monitor it and quite frankly, anticipating a bit of a spike in the back half if the macro headwinds continue. But we are a full price business, and we'll lead with innovation and our core assortment, we'll continue to play that. But we are seeing and do anticipate probably a dynamic competitive market. in the U.S.

Lulu’s markdown so far is down 10 bps compared to last year, but they expect it to increase over the course of the year by 10-20 bps YoY. Management thinks traffic is the leading indicator when it comes to markdown and given the declining trend in traffic in the US (traffic hasn’t improved in QTD as well), they assume overall markdown will rise in 2025 vs 2024.

Lack of newness was mentioned as the key reason for last year’s lackluster growth in the US, but they seem to have corrected the newness mix and plan to rollout some of the recently launched styles over the course of the year (which was launched in just limited number of stores so far):

In terms of the composition of our merchandise mix, we are back at our newness percentages…I think the way the guest is reacting and responding within that newness, she is reacting very positively to the new core or intended core silhouette styles that she has not seen before… Align no line, the Daydrift, to Be Calm to name just a few, and there's a number of those.

Those as a percentage of our newness mix, we are increasing in the back half so that we're reacting to what the guest is responding to, and as a result, we are shifting some of the seasonal colors, patterns and graphics in the remaining core to maintain that sort of ratio that we're seeing. But as I look to the back half, the percentage of newness remains strong above historical as we lean into a little bit of these areas where the guest has really responded well, and we weren't at full store distribution.

One good thing, however, is that management mentioned unaided brand awareness in the US increased from mid-30s in 4Q’24 to 40% in 1Q’25. Of course, we are not seeing such positivity in the financials yet, but this unaided brand awareness is critical for Lulu to eventually get back to healthy growth rates in their US business.

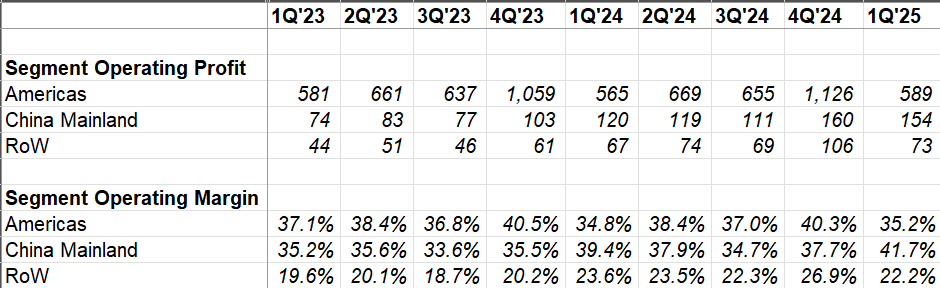

Operating Margin

In both the Americas and in China, Lulu’s operating margin improved YoY.

I will discuss tariff more in the outlook section, but Lulu thinks they can absorb some of these increased costs and likely pass some to consumers given the “elasticity” of their consumer base:

We have an industry leading operating margin. This allows us to continue investing across our strategic road map to enable long term growth while managing any increased cost associated with tariffs.

our premium positioning in the performance athletic apparel category yields different elasticity for our products relative to fashion oriented brands.

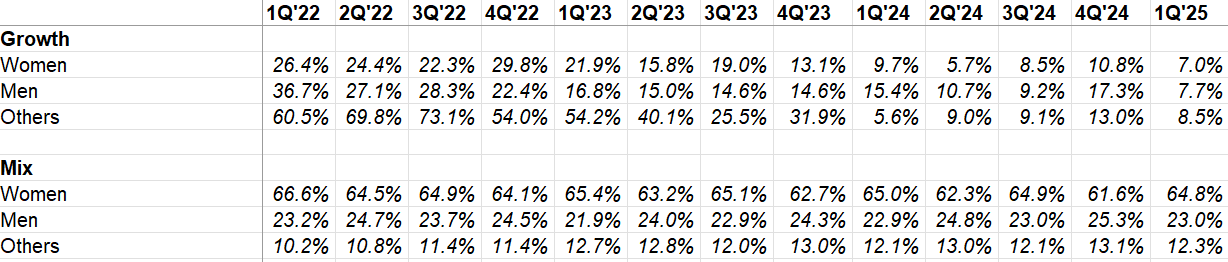

Sales by Gender

All three segments grew at largely similar rates in 1Q’25

Inventory

In 4Q’24 call, Lulu guided inventory to grow at high-teens as they chase the newness mix but inventory actually grew by 23%. However, management indicated this was mostly due to FX and tariff; when considering inventory in terms of units, it increased by 16% which was more in line with the guide.

When looking at inventory, we expect units to increase in the low double digits in Q2, with dollar inventories up in the low 20s and due in large part to the impact of higher tariff rates and foreign exchange. We expect a similar dynamic in inventory growth for the remainder of the year.

Capital Allocation

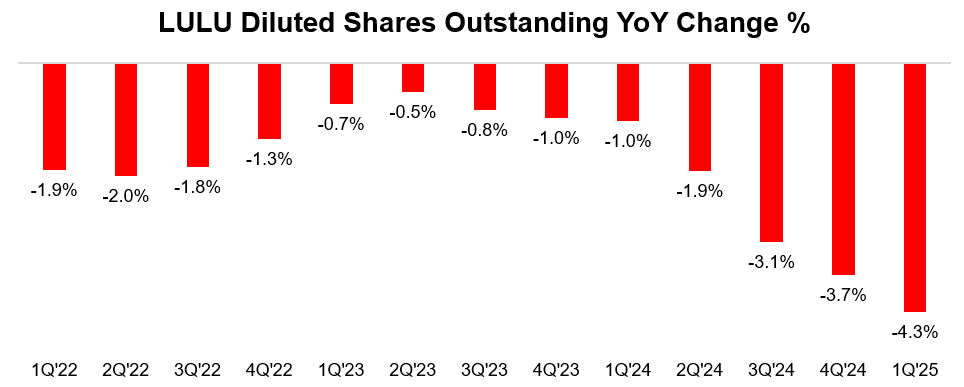

Lulu maintained their buyback intensity throughout last quarter. They bought back $430 mn shares at $316/share (vs $332 Mn in 4Q’24 and $297 Mn in 1Q’24).

As a result, Lulu’s shares outstanding declined by 4.3% YoY in 1Q’25. Management’s buyback activity at the face of headwinds faced by business does seem to project confidence about the long-term health of the business. Given they still have $1.3 Billion cash on balance sheet and the stock price reaction to this earnings, I expect them to remain quite active in buying back shares.

Outlook

For 2025, topline guide remains unchanged $11.15-11.3 Bn, implying ~5-7% YoY growth. If you exclude the 53rd week impact, this implies ~7-8% growth.

However, they lowered the EPS guide for 2025 from $14.95-15.15 to $14.58 to $14.78 (vs $14.64 in 2024). Why was EPS guided lower despite keeping the topline guide?

For the full year, we now expect gross margin to decrease approximately 110 basis points versus 2024. Relative to our prior guidance for a 60 basis point decrease, we expect the additional 50 basis points of deleverage to be driven predominantly by increased tariffs, offset somewhat by our enterprise-wide efforts to mitigate these costs and slightly higher markdowns. When looking specifically at tariffs, the assumptions we've made regarding rates include 30% incremental tariffs on China and an incremental 10% on the remaining countries where we source.

From a mitigation standpoint, as Calvin said, we've looked across the enterprise and have identified several levers which will help offset much of the impact of these higher rates. Based on our implementation strategies, we expect our mitigation efforts to be most impactful in the second half of the year.

Turning to SG&A for the full year. We expect deleverage of approximately 50 basis points versus 2024, relatively in line with our prior guidance, driven by FX headwinds and ongoing investments into our Power 3x 2 road map, including investments in marketing and brand building aimed at increasing our awareness and acquiring new guests, investments to support our international growth and market expansion and continued investment in technology.

Looking at operating margin for the full year 2025, we now expect a decrease of approximately 160 basis points versus 2024

So, basically additional ~50 bps pressure in the gross margin due to tariffs than what was communicated in 4Q’24 call; tariff was already assumed to be ~20 bps headwind during 4Q’24 call, but of course that was before the broad based tariff that Trump later imposed. They do expect to raise price a little in some assortments to minimize this impact but nonetheless will take some margin hit.

When we think about the tariff impact to mitigation actions, I'd highlight, one would be pricing. We are planning to take strategic price increases looking item by item across our assortment as we typically do, and it will be price increases on a small portion of our assortment, and they will be modest in nature.

And then on the sourcing side, we are also pursuing some efficiency actions there, some of which will impact the second half of this year, and then we are also focused on that into '26 as well.

Final Words

I bought Lulu in April 2024; so I clearly underestimated the challenges Lulu has been facing in the US. While it is possible that Lulu has been gaining share, there is lot of noise in verifying such claim given I don’t have data related to Alo/Vuori etc.

In any case, gaining share is no panacea if the segment itself is facing headwind. The reality is without persistent MSD-HSD growth in the US, Lulu will find it very difficult to get back mid-20s P/E multiple (or higher). It current trades at ~17x P/E (based on high end of their current 2025 EPS guide). I have mentioned last quarter that I don’t intend to add to my position unless Lulu trades at ~10x NTM EBIT which is basically another 20% down from current price in after-hours.

Given that I think Lulu will likely still manage to grow at MSD+ rate over the next 3-5 years even in the scenario that US remains stuck in LSD growth, it is sufficiently attractive for me to start adding if the stock experiences 20% drawdown from here.

Thank you for reading.