Alphabet 3Q'25 Update

Alphabet is a $3.4 Trillion company. Yet, the stock is up almost ~50% since 2Q’25 earnings. The stock has largely shredded the initial search related jittery post-ChatGPT and is now firmly seen as one of the key winners in AI. 3Q’25 call only bolstered this view.

Here are my highlights from the earnings.

Revenue

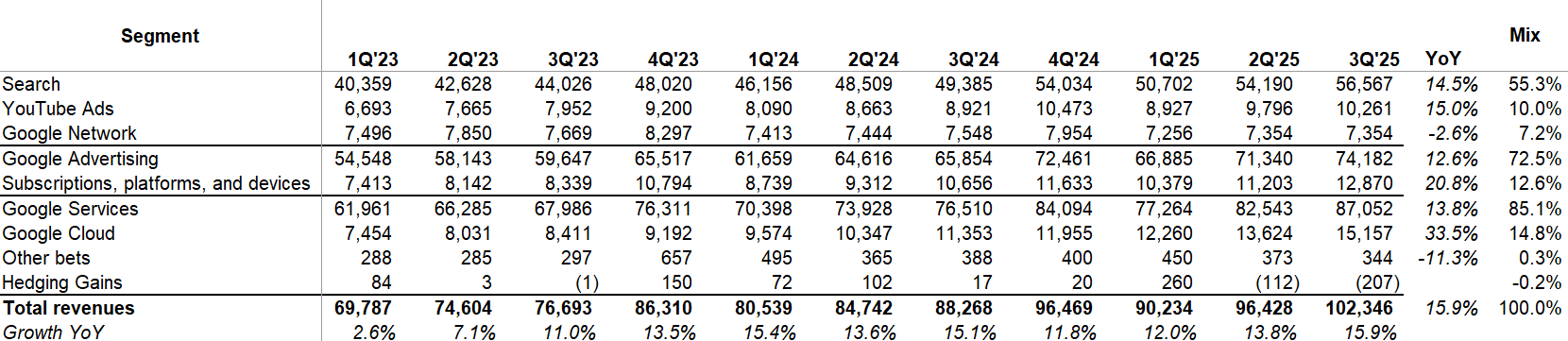

Alphabet revenue accelerated to 15.9%, its highest growth since 1Q’22!

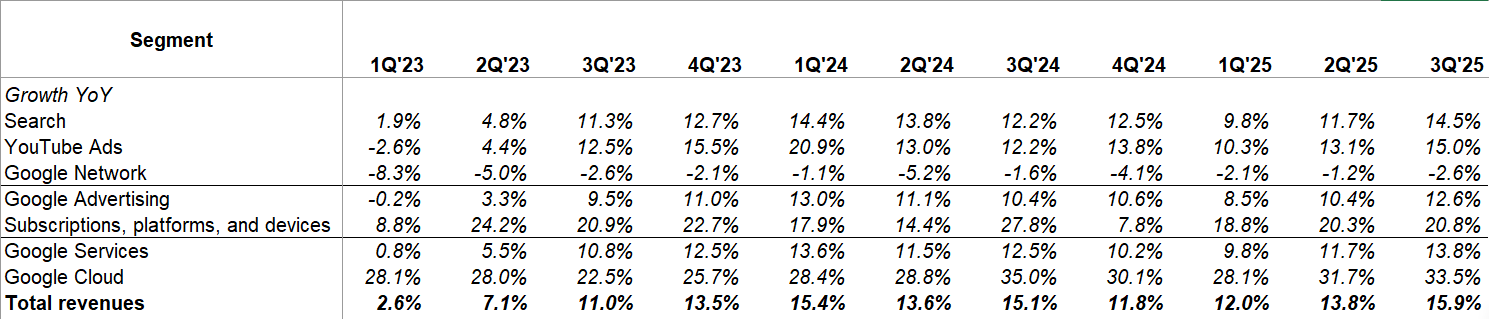

For the 13th consecutive quarters, Google network’s revenue went down. Everything except the network business grew at a healthy double digit rate.

Google Cloud is now at $60.6 Billion revenue run-rate, growing at ~34% YoY in 3Q’25.

Take a look at growth rates by segment since 1Q’23:

EBIT

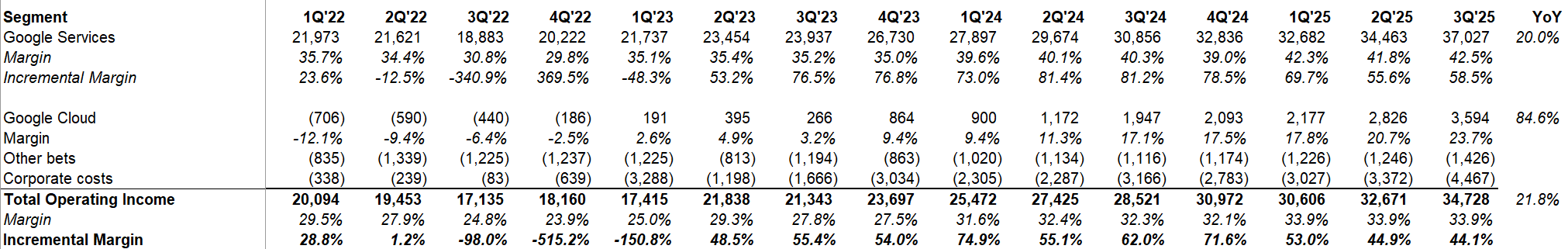

Alphabet had $3.5 billion charge related to European Commission (EC) fine. I have adjusted their earnings by subtracting this charge. Frankly speaking, given how recurring EC’s fines are, perhaps I shouldn’t have adjusted it.

Anyways, adjusting for EC fines, Google Services had 42.5% operating margin in 3Q’25, which was their highest ever! Covering Alphabet’s earnings is bit of a humbling exercise for me every quarter these days as I wondered Alphabet may have reached peak margin in 2021 (40% in 3Q’21)! Google Services incremental operating margins stayed above 50% for last 10 quarters now!

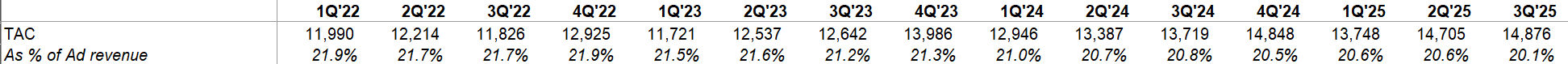

As the low margin network business continues to go down, it is a natural tailwind for margins; Traffic Acquisition Cost (TAC) as % of ad revenue went down from 21.9% in 1Q’22 to 20.1% in 3Q’25. It likely also helps that half of all codes are now generated by AI at Google, so higher productivity is also likely a tailwind for margins.

Google Cloud’s margin ramp up continues at an unbelievable pace. From -47.4% operating margin in 2Q’20 to +23.7% in 3Q’25…if you told me such margin ramp up potential 5 years ago, I don’t think I would have believed you!

I will discuss the rest of this update behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 64 Deep Dives here.