Alphabet 2Q'25, Corpay M&A, Portfolio Changes

Alphabet had another fantastic quarter. Admittedly, I am a bit surprised that the stock didn’t react even more positively.

Here’s my highlights from the earnings.

Revenue

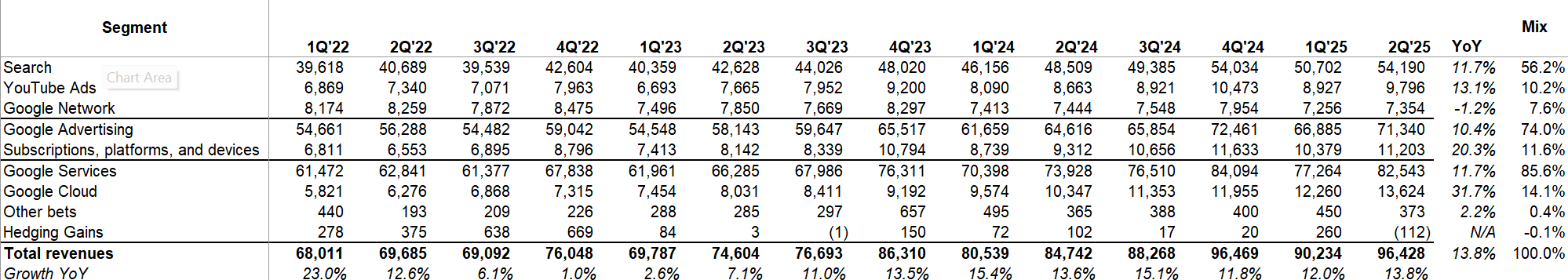

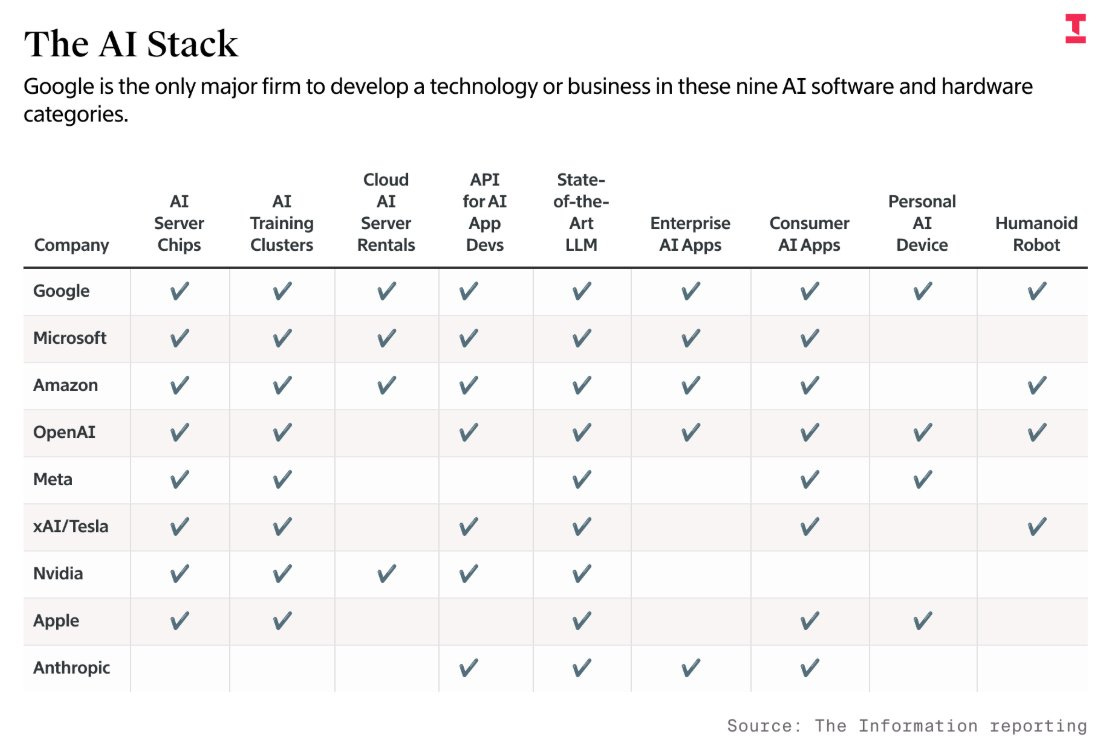

On an FX adjusted basis, Alphabet increased its revenue by 13% in 2Q’25 (~100 bps tailwind from FX).

For the 12th consecutive quarters, Google network’s revenue went down. I’m kidding of course, but at this rate, open web may die faster than regulators decide Google’s fate in this business!

Everything except the network business grew at a healthy double digit rate.

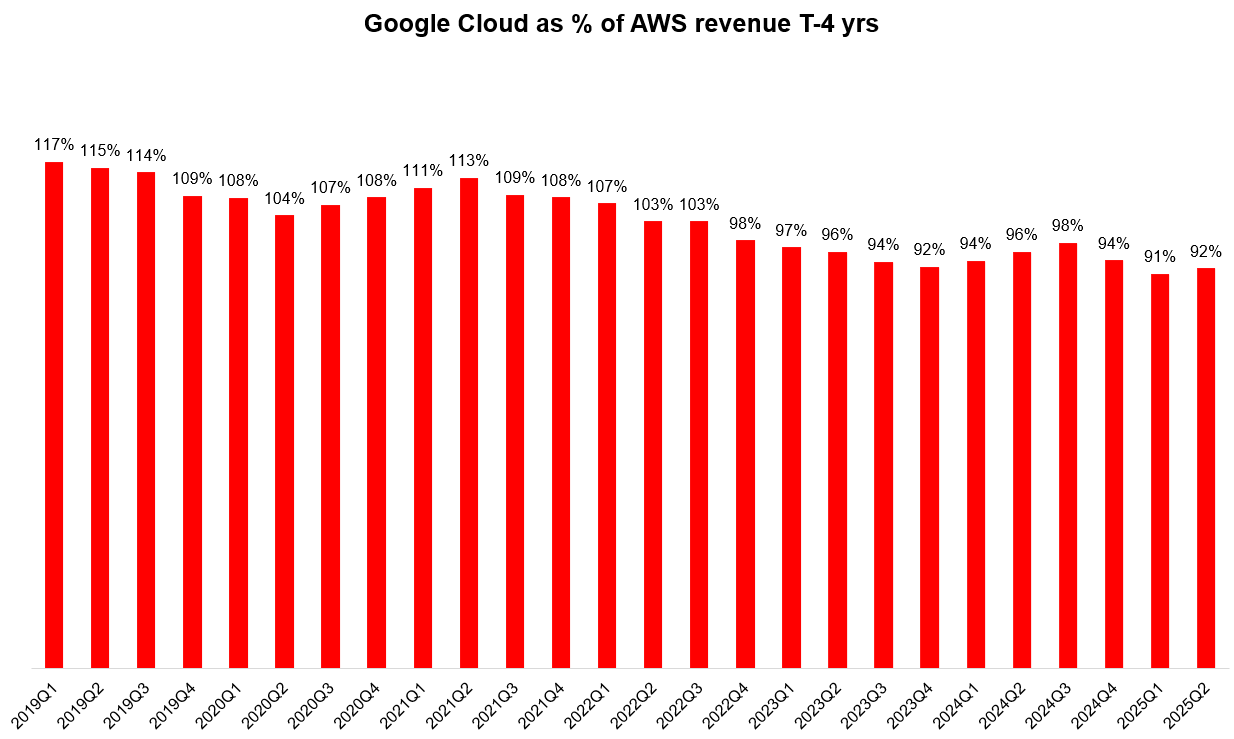

Google Cloud is now at $54.5 Billion revenue run-rate, growing at an incredible ~32% YoY in 2Q’25, a 362 bps acceleration in growth from 1Q’25.

Take a look at growth rates by segment over the last 14 quarters.

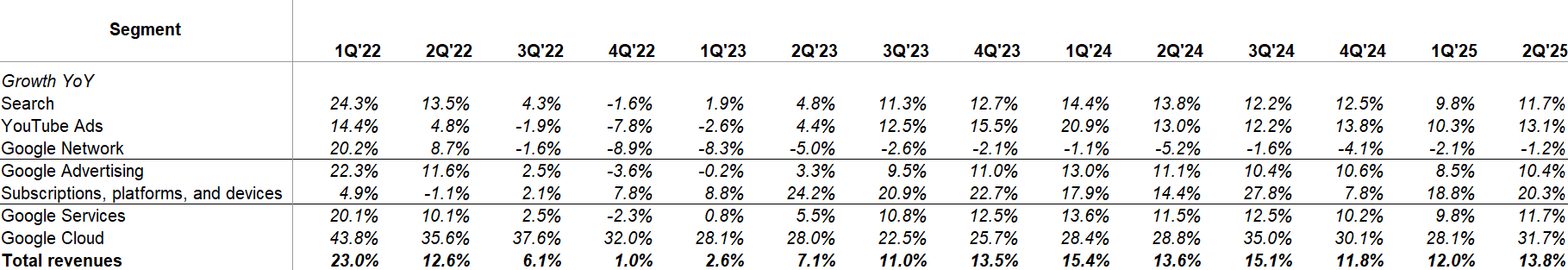

EBIT

After 8 consecutive quarters of incremental operating margin of ~50%+, Google service’s incremental and reported operating margin was somewhat similar at ~40% in 2Q’25. However they did have $1.4 Billion legal charge, so margin would be slightly higher if you adjust for that. These legal expenses may be recurring enough for Google that it may even make sense to not adjust it (only half-joking).

Google Cloud’s margin ramp up over the last 5 years is indeed a thing of beauty. From -47.4% operating margin in 2Q’20 to +20.7% in 2Q’25, I am not sure I have ever seen such margin expansion in just five years.

Search

Most investors (including yours truly) are understandably concerned about search, and thankfully, there were lot of positive data points on search from the call.

AI overviews now reach 2 billion MAU (vs 1.5 billion mentioned in 1Q’25 call) across more than 200 countries and territories and 40 languages. AI overviews now drive 10% more queries globally for the types of queries that show them. AI mode has been rolling out in the US and India, and currently has 100 million MAU.

Google Lens search grew 70% YoY which they again reminded investors that majority of lens search are incremental. More importantly, they’re seeing healthy growth for shopping queries using lens which are obviously more commercial queries in nature.

Both overall queries and commercial queries on Search grew year-over-year, but they didn’t specify the exact number. Paid click grew 4% YoY. (vs 2% in 1Q’25). Given the commotion around paid click number last quarter, Google management tried to downplay the importance of this number. From the call:

“we manage the business to drive great outcomes for our users and an attractive ROI for our advertisers. We actually don't manage to pay clicks and CPC targets. Some of the product and policy changes we make actually drive better monetization at the expense of paid clicks.”

I’m not sure if the market would be too generous if paid clicks growth turns flat or negative. In fact, if this number is not so helpful in gauging the health of the business, it may make sense for Google to stop disclosing it. Investors may react negatively at first but then would learn to live without the data.

Two interesting data points that Google shared for advertisers are: a) advertisers that activate AI Max and Search campaigns typically see 14% more conversions, and b) campaigns using Smart Bidding Exploration see a 19% increase in conversions on average. Moreover, more than 2 million advertisers now use Google's AI powered asset generation tools to run ads, a 50% increase YoY. Those AI investments are coming handy!

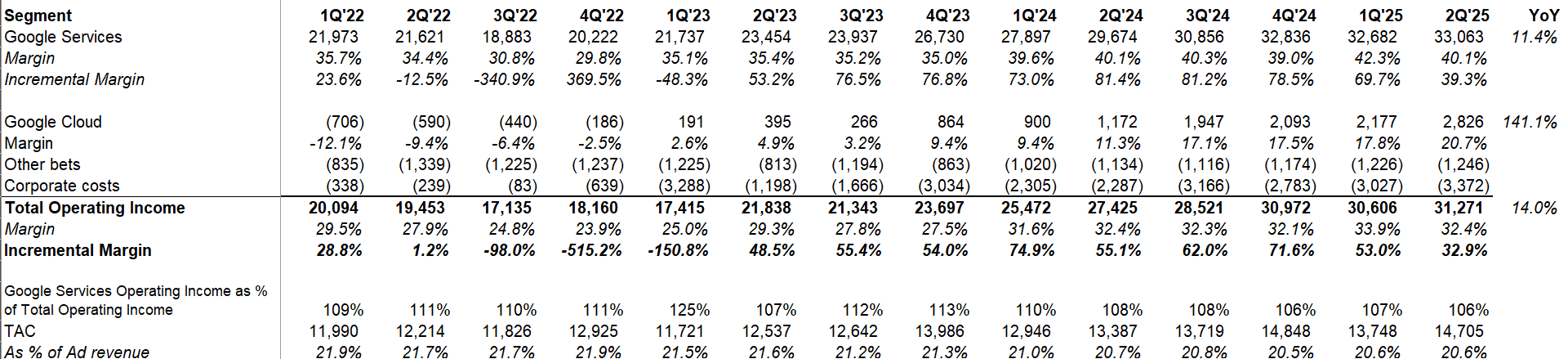

Speaking of AI investments, Google laid out its case why they are ahead of the pack in the AI race. From the call:

“We are seeing significant demand for our comprehensive AI product portfolio. Of course, this is all possible because of the long-term investments we have made in our differentiated full stack approach to AI. This spans AI infrastructure, world-class research, models and tooling and our products and platforms that brings AI to people all over the world.

We have some of the best models available today at every price point. Our 2.5 models have been a catalyst for growth and 9 million developers have now built with Gemini. I also want to mention Veo 3, our state-of-the-art video generation model. It's been a viral hit with people sharing clips created in the Gemini app and with our new AI filmmaking tool Flow. Since May, over 70 million videos have been generated using Veo 3.

At IO in May, we announced that we processed 480 trillion monthly tokens across our surfaces. Since then, we have doubled that number, now processing over 980 trillion monthly tokens, a remarkable increase. The Gemini app now has more than 450 million monthly active users, and we continue to see strong growth in engagement with daily requests growing over 50% from Q1. In June alone, over 50 million people used AI-powered meeting notes in Google Meet. And powered by Veo 3, our new short video product in Workspace called Google Vids reached nearly 1 million monthly active users.

There's definitely exciting progress, including in the models we haven't fully released yet…I expect 2026 to be the year in which people kind of use agentic experiences more broadly

I would not have guessed Gemini app has ~450 million MAUs. This is more impressive than Meta’s “Meta AI” MAU data because I’m assuming people had to download the app and use it to be counted in the MAU for Gemini app.

Google is one of those rare companies that even its shareholders like to snicker on the management every once in a while. But when I take a step back, I find it hard to share that feeling. I mean Google bought the entire DeepMind at a price Zuck is probably paying a single accomplished AI researcher. While Nadella gets all the adulation for turning Microsoft around (he should because it’s pretty damn impressive), it’s hard to deny that he completely missed the boat on AI and got lucky with their investments in OpenAI (TBD how lucky given the deal with OpenAI seems rockier by the day; it’s hard to ever feel comfortable if your fate is tied to Sam Altman). Unlike Nadella, Zuck definitely marched ahead on investing in AI long before it was cool, but it was Google which seemed to have prevailed much better in building the AI stack. Tim Cook probably was way behind the ball and still is in AI.

Given that context, I really don’t see the reason to participate in a recurring call for Pichai’s resignation every once in a while whenever people are looking for a scapegoat. Pichai did seem to be a bit more forceful than usual in getting the message across in recent calls, and I do want to note that Pichai tweeted the below image yesterday:

YouTube

We knew it already that shorts now earn as much revenue per watch hour as traditional in-stream on YouTube, but Google mentioned that in some countries, it now even exceeds in-stream's rate.

Google Cloud

There was a slight error in the below chart I shared a few days ago. As mentioned earlier, Google Cloud’s revenue seems to track reasonably well to AWS 16 quarters apart.

Some interesting quotes on Google Cloud from the call:

“the number of deals over $250 million, doubling year-over-year…in the first half of 2025, we signed the same number of deals over $1 billion that we did in all of 2024.

the number of new GCP customers increased by nearly 28% quarter-over-quarter

more than 85,000 enterprises, including LVMH, Salesforce and Singapore's DBS Bank now build with Gemini, driving a 35x growth in Gemini usage year-over-year.

Google Cloud backlog increased 18% sequentially in Q2 and 38% year-over-year, reaching $106 billion at the end of the quarter. This growth was driven by strong demand for our products and services from both new and existing customers”

Waymo

Some Waymo update in the call:

“Last month, Waymo launched in Atlanta, more than doubled its Austin service territory and expanded its Los Angeles and San Francisco Bay Area territories by approximately 50%. Waymo also launched teen accounts, starting with riders aged 14 to 17 in Phoenix. Overall, great momentum here. The Waymo driver has now autonomously driven over 100 million miles on public roads. And the team is testing across more than 10 cities this year, including New York and Philadelphia.”

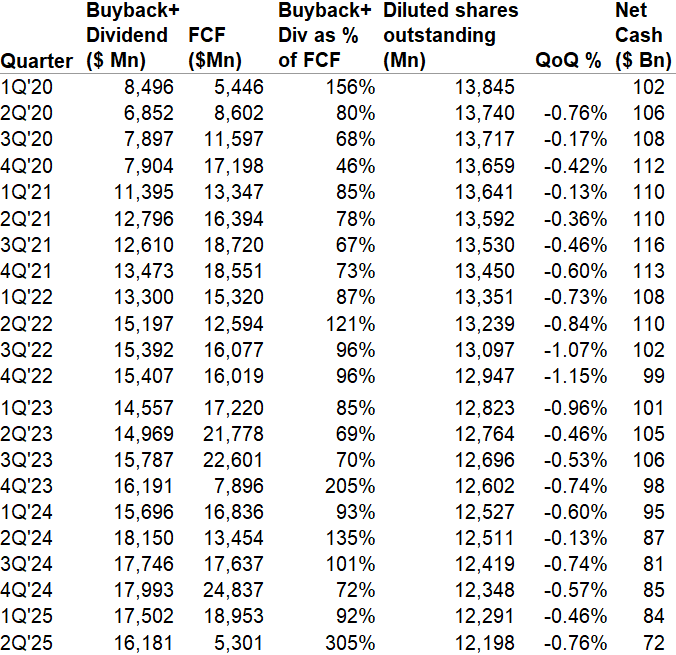

Capital Allocation

In 2Q’25, Google returned 3x their FCF to shareholders through buyback and dividend which declined net cash position from $84 Billion to $72 Billion. Given the capex intensity, we may be heading towards zero net cash position (or even net debt?) by the end of this decade.

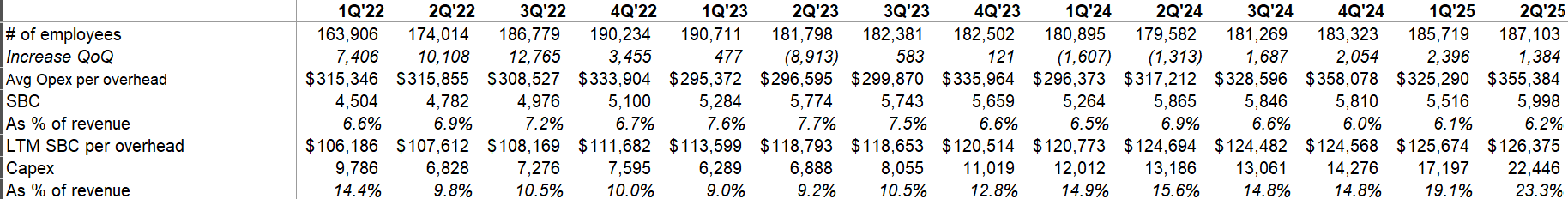

Capex and Opex

Google raised capex from $75 Billion to $85 Billion in 2025. Market initially seemed to take it negatively, but eventually brushed off the concerns because in the call they again highlighted that they expect to remain in a tight demand supply environment going into 2026 which means 2026 capex is also going to be higher than anticipated. Google also mentioned the vast majority of the capex was invested in technical infrastructure with approximately 2/3 of investments in servers and 1/3 in data centers and networking equipment.

I am not that worried about capex increases especially when the increase is driven by tight demand-supply environment. Even if Google overinvests for a year or two, they can easily absorb it for the next few years given the breadth of their own products and services that require similar infrastructure.

Of course, depreciation is ramping up. It increased by 35% in 2Q’25 and management highlighted they expect depreciation to accelerate further in Q3.

Valuation

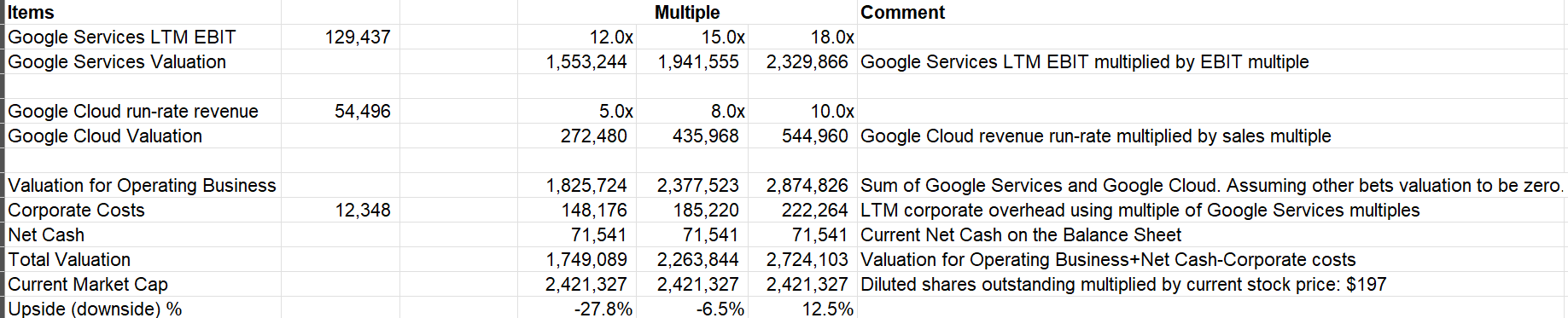

Since 3Q'22, I share the following valuation framework every quarter. The Services business seems to be currently priced at ~18x LTM EBIT, and Google Cloud at ~8x run-rate revenue.

I will discuss Corpay’s M&A deal and my portfolio changes behind the paywall.

In addition to "Daily Dose" like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 61 Deep Dives here.

Prices for new subscribers will increase to $30/month or $250/year from August 01, 2025. Anyone who joins on or before July 31, 2025 will keep today’s pricing of $20/month or $200/year.