Danaher 3Q'25 Update

Following Sartorius 3Q’25 call, I mentioned in my update that I am actually a bit surprised that Danaher stock didn’t react more positively. Well, Danaher stock did pop ~8% after confirming bioprocessing’s continued growth and an initial 2026 guide that outlined HSD earnings growth even in a conservative topline growth scenario.

Let me recap the business performance of 3Q’25.

Overall Danaher

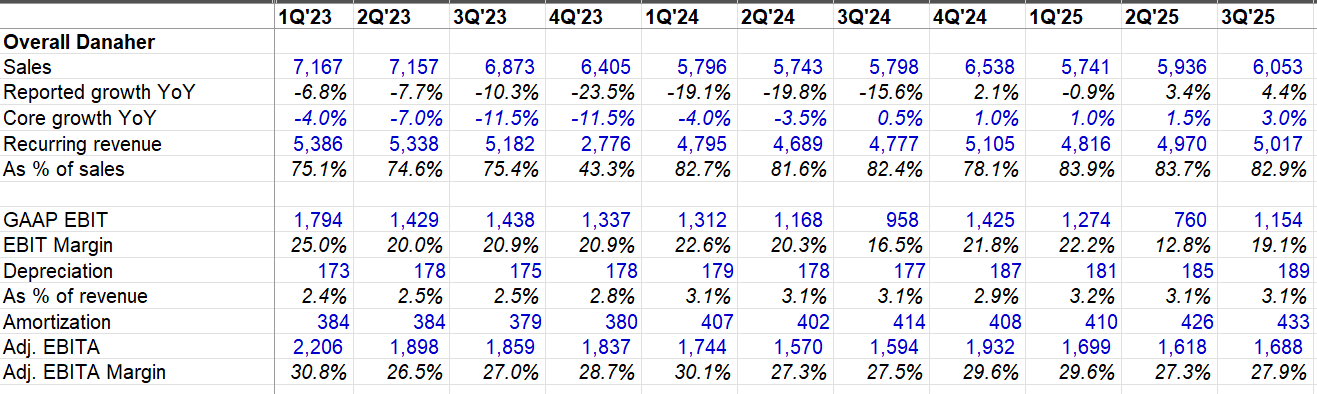

Danaher’s revenue slightly accelerated QoQ last quarter from 3.4% in 2Q’25 to 4.4% in 3Q’25.

Danaher reports its business in three broad segments: a) Biotechnology, b) Life Sciences, and c) Diagnostics. Majority of revenue in all three segments come from recurring revenue through consumables that are spec’d into regulated process or the specific equipment Danaher sells to the customers. This recurring portion of revenue gradually increased from 75.4% in 3Q’23 to 82.9% in 3Q’25.

In terms of profitability, overall adj. EBITA margin improved both from QoQ and YoY perspective.

I will discuss the quarter segment by segment behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 63 Deep Dives here.

Biotechnology