Dollar Store Earnings 3Q'25

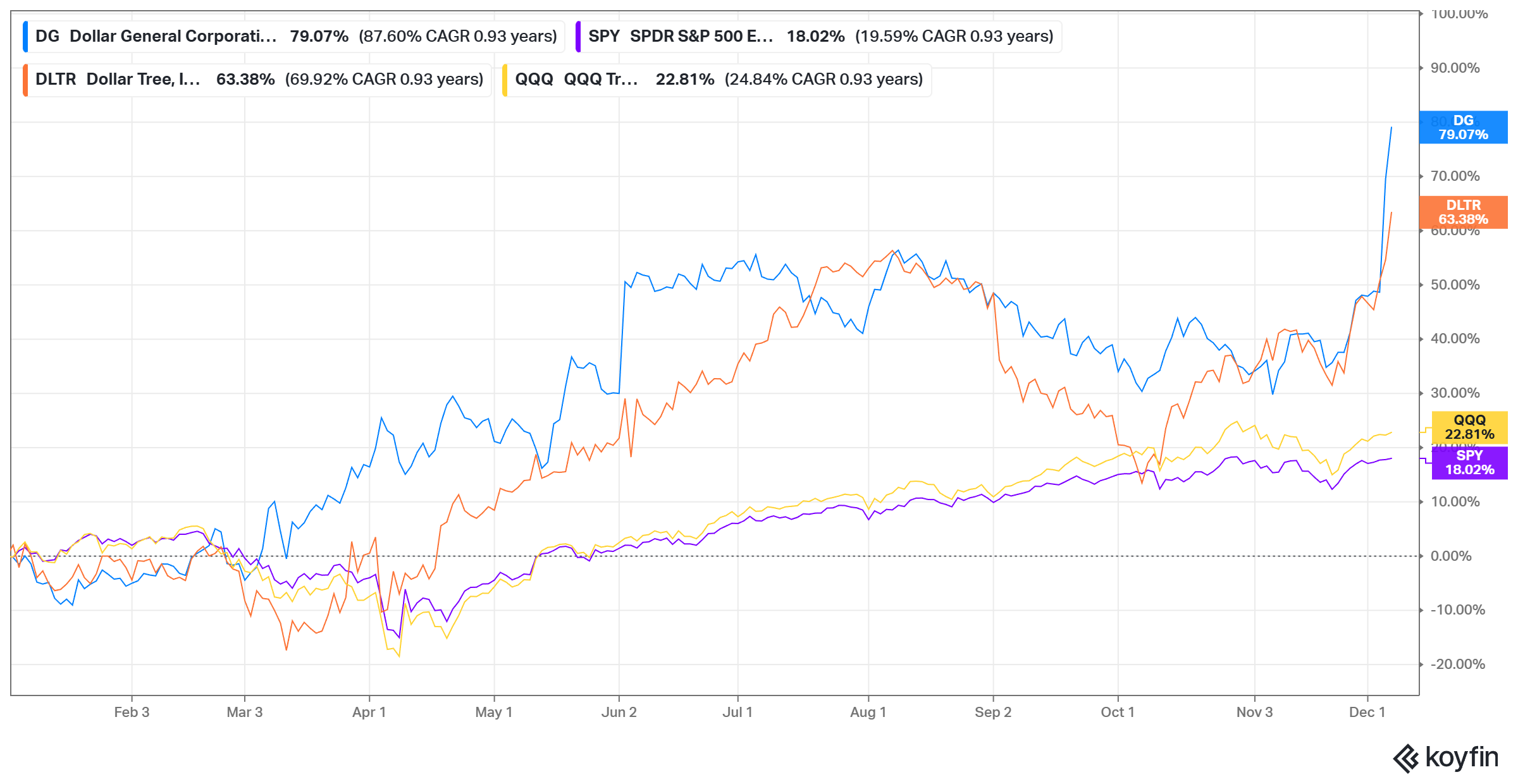

We have all heard about the “K-shaped” economy, and looking at how dollar stores’ stocks i.e. Dollar Tree (DLTR), and Dollar General (DG) fared so far this year certainly seems to give credence to such theory.

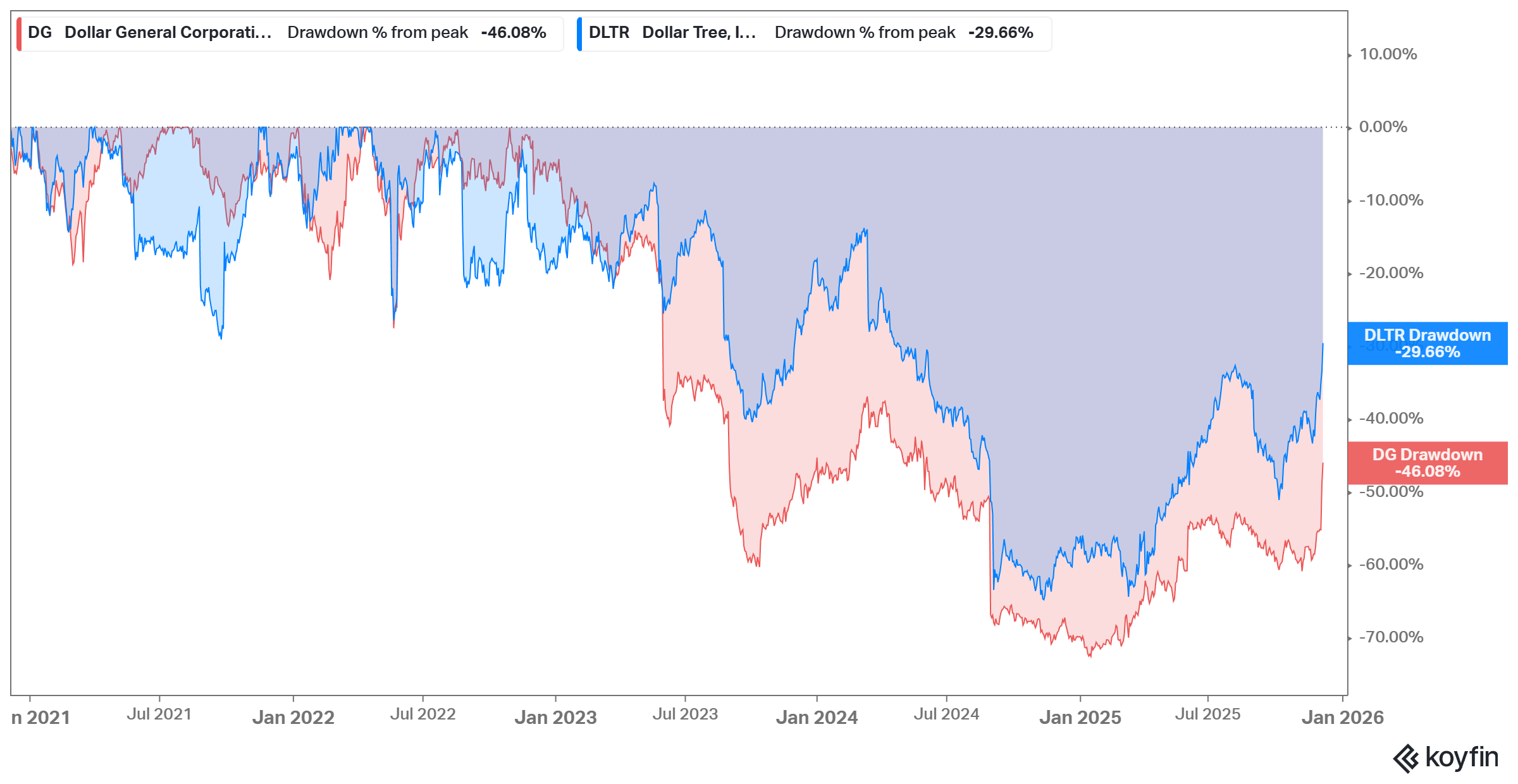

Nonetheless, it is important to contextualize the current year performance as these stocks were in the gutter while entering 2025. Despite such massive outperformance this year, DG and DLTR are still down ~46% and ~30% from their respective peaks in 2021!

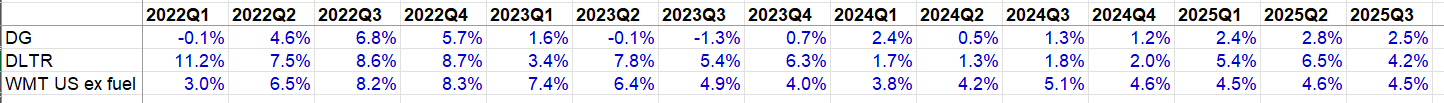

DG and DLTR had 2.5% and 4.2% Same Store Sales (SSS) growth respectively in 3Q’25. They both make Walmart’s (WMT) SSS number look even better as WMT reported 4.5% SSS in 3Q’25 despite being ~17x the size of DG.

Interestingly, DG and DLTR had very different drivers for SSS in 3Q’25. While DLTR experienced negative traffic, DG’s SSS was entirely driven by traffic.

Both retailers mentioned about being beneficiary of increasing trade downs. DLTR highlighted that they gained 3 million incremental households in the last 12 months, 60% of which makes over $100k, 30% make $60-100k, and only 10% making below $60k.

While they did gain more higher income households, last quarter’s growth was driven more by lower income households. From the DLTR call:

“At the same time, higher income households are trading into Dollar Tree, lower-income households are depending on us more than ever. For example, the average spend for lower-income households grew more than twice as fast in the third quarter as the average spend for higher income households.”

Similarly, DG highlighted that their core customer feels “more pressured”, and they’re also enjoying some trade down effects. From DG call:

This traffic and basket composition is consistent with what we have historically observed when our core customer feels more pressured on their spending as they come in more often but have smaller basket sizes.

we’re pleased to see growth once again in our total customer count with disproportionate growth coming from higher income households.

In terms of margin, DG’s gross margin improved by 107 bps YoY even though it was below 30%. Gross margin improved primarily from higher inventory markups and a 90 bps benefit from reduced shrink, partially offset by LIFO. DG mentioned that shrink continues to improve at a much higher and faster rate compared to the expectations implied in their long-term financial framework, and they expect continued improvement over time. Merchandise inventory was also down 6.5% YoY.

Operating margin also improved from 3.2% in 3Q’24 to 4.0% in 3Q’25. To contextualize, the average operating margin in 3Q for DG between 2017 and 2022 was 7.7%. It was 7.0% even if we exclude the post-pandemic numbers. So, despite the recent improvement, their operating margin is still substantially lower than what they used to report.

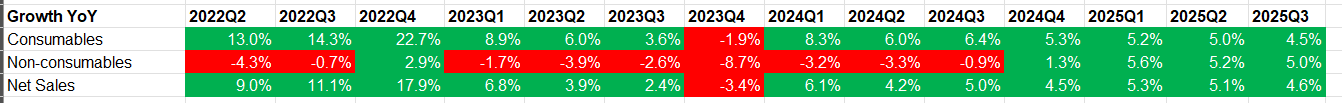

One key driver for recent margin improvement for DG is the return to growth in non-consumables segment. For the last three consecutive quarters, non-consumables has outpaced consumables growth. Given non-consumables tend to be higher margin segment, it is a tailwind for the overall margin.

Just like DG, DLTR’s non-consumables also outpaced consumables growth in 3Q’25. Moving to multi-price segment (above $1) has proved to be the real gamechanger here. Management had a good detailed discussion on how multi-price can have a profoundly positive impact on profitability by explaining what they witnessed in Halloween assortment:

“This year, our Halloween assortment generated over $200 million in sales, an all-time record. But to see the full impact of multi-price, let’s go back to Halloween 2022 when multi-price was still in its infancy. That year, multi-price represented about 3% of units sold, 10% of sales and 7% of merchandise gross margin across our full Halloween assortment. Fast forward to 2025 on a 25% larger base of sales where multi-price accounted for roughly 1/4 of our total Halloween sales and merchandise gross margin but only 8% of Halloween units sold.

Across Halloween this year, each multi-price item that we sold generated 3.5x more profit than each non-multi-price item we sold. This is a full turn higher than Halloween 2022. By combining this increase per unit profitability with a higher multi-price mix, we were able to generate approximately 25% more margin dollars from our Halloween assortment this year compared to 2022 while selling approximately 10% fewer units. And this is just the positive impact on merchandise margin. It doesn’t take into consideration any labor or distribution cost savings that come from handling fewer units. Looking at it this way, multi-price is a powerful growth and profitability driver.”

Despite all the multi-price moves, DLTR mentioned 85% of sales dollars are still at $2 or below, insisting the value perception is intact.

One interesting discussion in DG call was their assessment on delivery and how it strengthens their convenience moats. From the call:

“with 80% of our stores in those small towns across America, very, very difficult to replicate, whether it be brick-and-mortar or whether it be on a digital basis. And again, we didn’t sit back. We moved swiftly once we saw that our core consumer was starting to venture into her digital journey. We’ve always said our core customer, she’s a fast follower. She’ll get there, and she’s starting to move that way. So we move that way.

And the great thing is we move that way with a lot of intentionality and that intentionality was really centered around rural America and be able to deliver that customer an hour or less where no one else can touch that at this point.”

DG highlighted that delivery orders via DoorDash/Uber/DG Delivery are ~70% incremental, carry larger baskets, and 75%+ are delivered in under an hour. To my surprise, DG also mentioned that these deliveries are “profit accretive”.

DoorDash or Uber doesn’t do delivery in my area for DG yet, so I cannot quite test it yet. Their website or app is also not quite rich with information about this service. I can, however, see that they charge $1 fee per order if you want delivery under an hour. This website mentioned $3.49 - $7.49 Service Fee (depends on the size of your order) that customers pay. Given typical DG basket size, $5-7 can actually be a material percentage of the overall basket size. With enough volume, I can see how it can be profit accretive for DG.

But if a significant fraction of DG’s customers are willing to pay these potentially exorbitant fees, I still do suspect that many of these customers may eventually shift to Walmart or Amazon given their much greater selection and better value once they inevitably narrow the delivery speed over time. If you have to wait 30 minutes longer but can get it cheaper on Walmart, wouldn’t many of DG’s customers opt for that?

I have always thought the core moat for DG is their convenient locations, but as the consumer behavior and expectation is changing in how they shop, this moat may be gradually eroding. It may be too early for DG to declare victory by looking at early cohort data.

While I do wonder about these businesses’ long-term relevance given the changing retail landscape, they do seem well positioned in the near term as the K-shaped economy runs its course. DLTR, in fact, guided for 4-6% SSS growth next quarter and re-iterated ~12-15% EPS growth CAGR till 2028. It certainly helped that they bought back 8% shares outstanding so far this year at $90/share (stock is currently at $122).

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 65 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: