CSX: The Old School "Monopoly"

You can listen to the Deep Dive here

Warren Buffett isn’t quite fond of making bold predictions, so I certainly took note when he mentioned the following in 2021 shareholder letter:

“I’ll venture a rare prediction: BNSF will be a key asset for Berkshire and our country a century from now.”

Buffett started buying Burlington Northern Santa Fe i.e. BNSF Railway in 2006 and accumulated 22.5% of BNSF’s shares by early 2009. But in November 2009, Berkshire announced to buy the whole company. Delving deep into BNSF transaction is bit of beyond the scope for this piece, but let’s just say it has been a home run for Buffett. And after a decade of owning BNSF, Buffett still felt pretty good about BNSF’s chances for the next hundred years!

It’s not just Buffett; Soroban Capital’s Eric Mandelblatt also shared similar sentiment on a podcast in March 2022:

…given how developed the country is at this point, Union Pacific can't raise their hands and say, "Hey, we'd love to run a railroad track through downtown Houston." It doesn't work like that. So the tracks are the tracks. We're not laying new tracks here. And at my old firm we used to talk about what are the businesses we'd be comfortable buying a 100-year bond from? Because it's almost the definition of incumbency, barriers to entry longevity. To me, the railroads are my number one. When I think about what's a business I know a hundred years from now, that business is going to be around, it's going to be cash flowing. Very hard to say that, very hard to look 100 years in the future. To me, railroads are the definition of the 100-year asset. And by the way, they're one of the very few 100-year bond issuers in the United States market.

The steam locomotive was invented in 1797 and three decades later, the first railroad in North America was introduced. Railroads had a monumental impact in capitalism. When transcontinental railroad was built in the 1860s, one could travel from the east coast to the west coast of the US in three days that used to take three weeks before the railroads came to the scene! In fact, in the beginning of the 20th century, railroads contributed ~63% of the US and ~50% of the UK total stock market capitalization. Today, it is less than 1%.

While one may be tempted to think railroads are on the brink of irrelevance in our current world, the reality is a bit different. Even though the industry went through a dizzying number of M&A over the last couple of centuries, the last players standing today are in an enviable position.

As of 2022, Surface Transportation Board (STB) defines Class I railroad companies as having operating revenues of, or exceeding, $1 Bn per year, and there are only 6 class I railroad companies today: BNSF Railway (owned by Berkshire), Union Pacific (Ticker: UNP), CSX Corporation (Ticker: CSX), Norfolk Southern (Ticker: NSC), Canadian National (Ticker: CNI), and Canadian Pacific Kansas City (Ticker: CP). The class I railroads contain ~67% of the industry’s mileage, ~87% of its employees, and ~94% of its freight revenue.

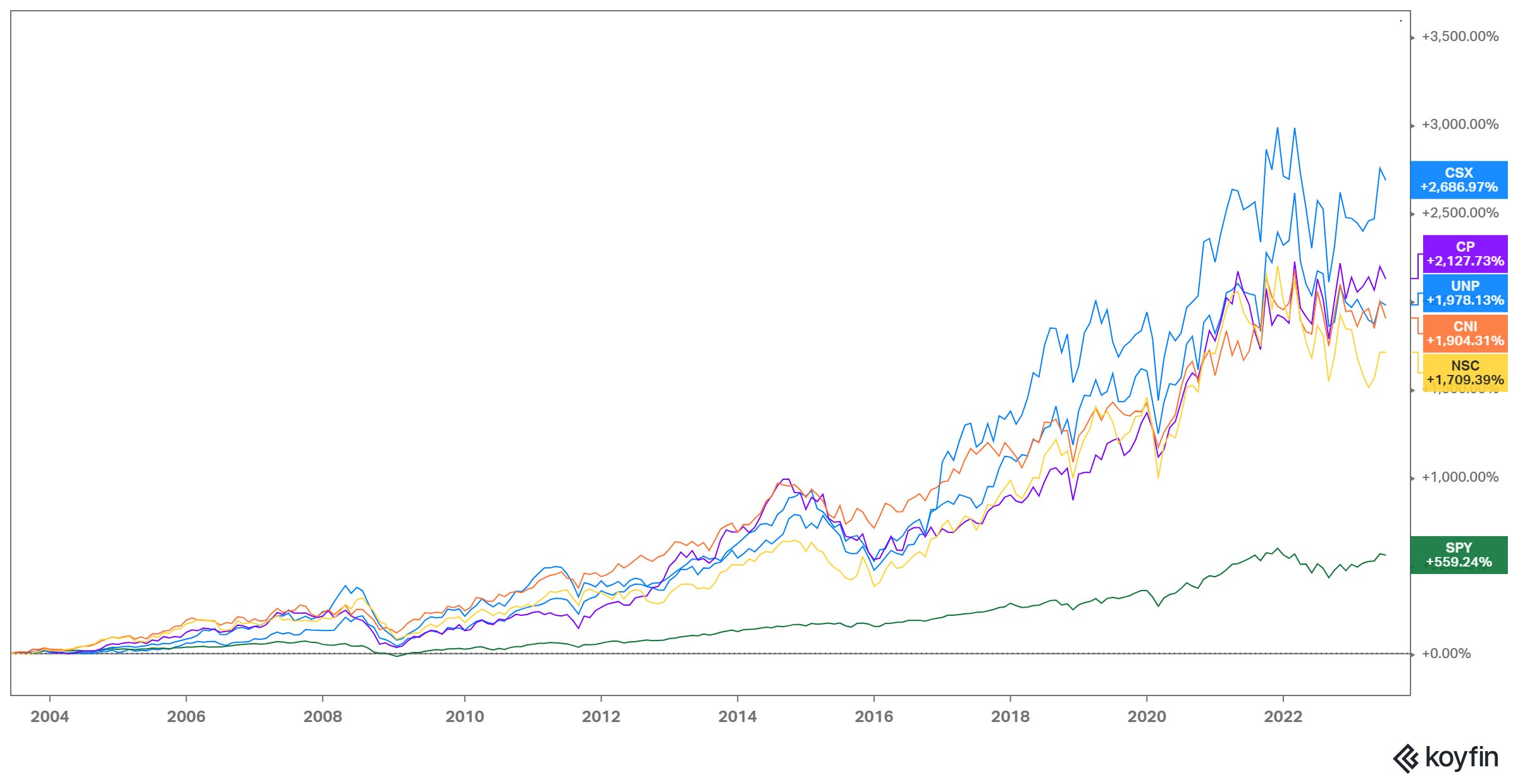

The utter dominance of class I railroads, as well as their significance in broader supply chain in North America, has consistently been somewhat underappreciated by the market as every single one of them materially outperformed the S&P 500 Index. While S&P 500 only increased ~6x over the last two decades, shareholders of North American railroad companies enjoyed somewhere between ~17-27x return during the same time.

Here’s the outline for this month’s Deep Dive:

Section 1 Understanding Railroad Industry: This section provides a brief history of North American railroad industry, how a railroad business operates, geographical segmentation of North American railroad industry, and some basic concepts in the industry such as intermodal shipping, Precision Scheduled Railroading (PSR) etc.

Section 2 CSX’s Business: Following the discussion on overall industry, I outlined how CSX makes money as well as its operating cost structure.

Section 3 Bull-bear Debate: I presented both sides’ arguments and mentioned which way I tend to lean on some of these key debates between bulls and bears.

Section 4 Management and Capital Allocation: CSX, as well as other publicly listed North American Class I railroads, capital allocation history over the last two decades and CSX’s current incentive structure is highlighted here.

Section 5 Valuation/Model Assumptions: Model/implied expectations are analyzed here.

Section 6 Final Words: Concluding remarks on CSX, and disclosure of my overall portfolio.