CoStar 3Q'25 Update

CoStar had a decent quarter, but the stock is down 15% post-earnings. To be quite frank, the market reaction is quite perplexing to me as I couldn’t quite find anything that would warrant such a drop.

Here are my highlights from the call.

Revenue

CoStar acquired Domain for $1.9 Billion on August 27 which contributed $25 million revenue, 90% of which was residential and the rest 10% was split between commercial marketplaces and information services.

Excluding Domain, CoStar’s revenue was $808 million in 3Q’25 which exceeded their high end of the guidance.

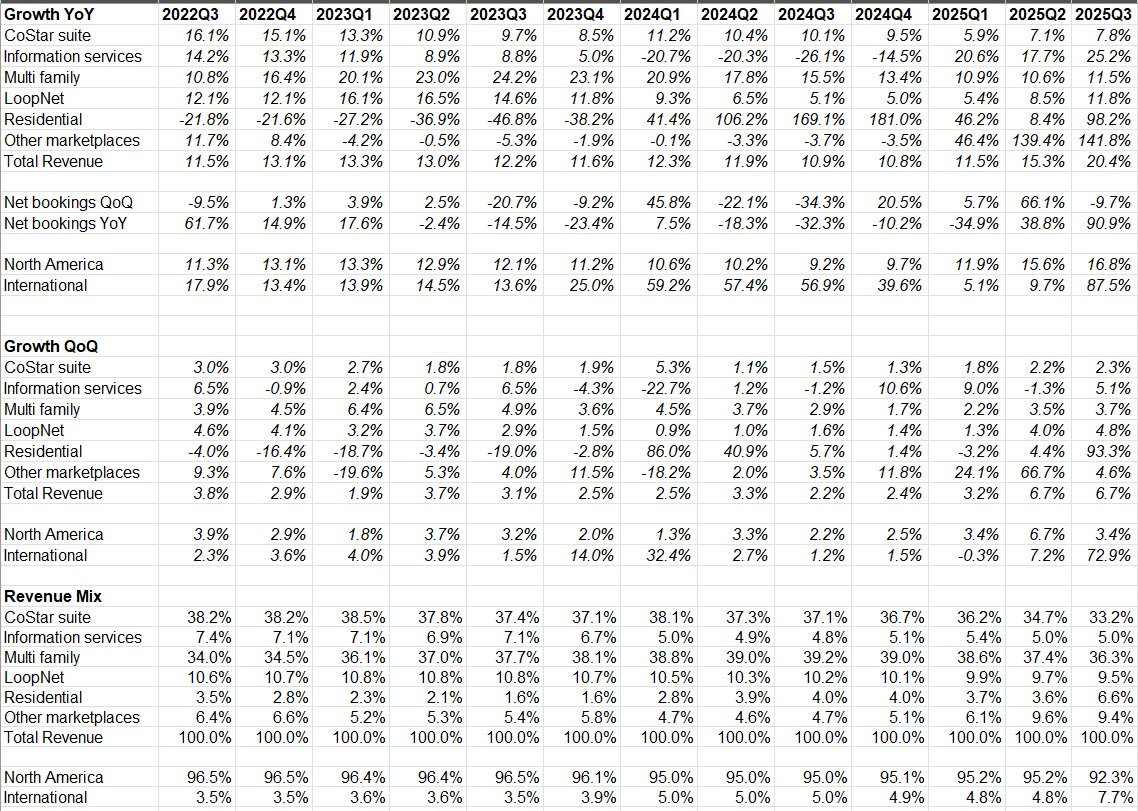

More detailed revenue growth trajectory by segment and region are shown below both from YoY and QoQ perspective.

Margins

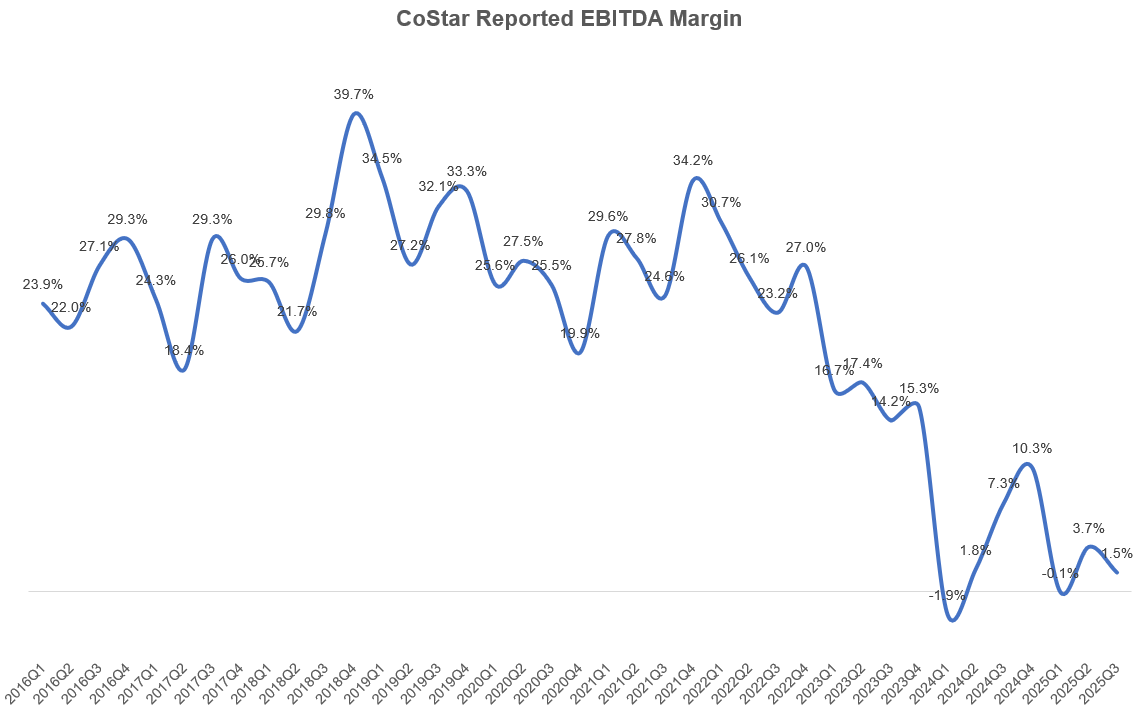

While CoStar used to report ~30% EBITDA margins during 2016 to 2021 period, their reported margins don’t really depict their underlying profitability anymore given their massive investments in Homes.com.

In fact, their core adjusted EBITDA margins continued to go higher as it reached 47% in 3Q’25 (vs 43% in both 2Q’25, and 3Q’24)! When I say core margins, it refers to their commercial information and marketplace businesses which exclude the impact of Homes.com, OnTheMarket, Domain, and Matterport.

Management also mentioned that they expect their marketplace businesses (Apartments.com, Homes.com, Domain, OnTheMarket) to reach ~40% adjusted EBITDA margins. For context, in aggregate, these marketplace businesses are posting negative EBITDA even though Apartments.com is obviously very profitable. However, they didn’t provide any timeframe to get there. Andy Florance basically pointed out companies such as Rightmove, REA Group, Idealista, or SeLoger are posting 40% to 70% EBITDA margins at scale, so given their similarity of business model, there is no compelling reason for them to get there over time.

One key differences I think these scaled marketplaces have vs some of marketplace CoStar owns ex Apartments.com is they are not market leaders. Given the increasing return on scale phenomenon, there can be significant differences in margins for the second or third tier marketplaces compared to the market leader. So, I wouldn’t be too eager to model ~40% EBITDA margins for CoStar’s marketplaces business in terminal year just yet!

Let’s look at segment by segment now which I will discuss behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 64 Deep Dives here.

CoStar Suite