CoStar 2Q'25 Update

CoStar may not be a widely followed company (you can read my Deep Dive here if you’re unfamiliar), but it’s one of the earnings calls that I enjoy the most listening every quarter, primarily because CEO Andy Florance always comes up with new reasons to take a dig at competitors. Many actually seem to detest these antics, but I personally find humorous elements in these constant jabs at CoStar’s competitors. 2Q’25 call was no different.

Here are my highlights from the call.

Revenue

It almost seems too good to be true, but 2Q’25 was CoStar’s 57th consecutive quarter of double digit growth! CoStar also had its highest quarterly net new bookings in CoStar Group's history.

CoStar suite and LoopNet’s revenue growth accelerated. Just keep in mind how terrible the overall environment was for Commercial Real Estate (CRE) industry last few years and yet, CoStar suite showed incredible resilience during this period.

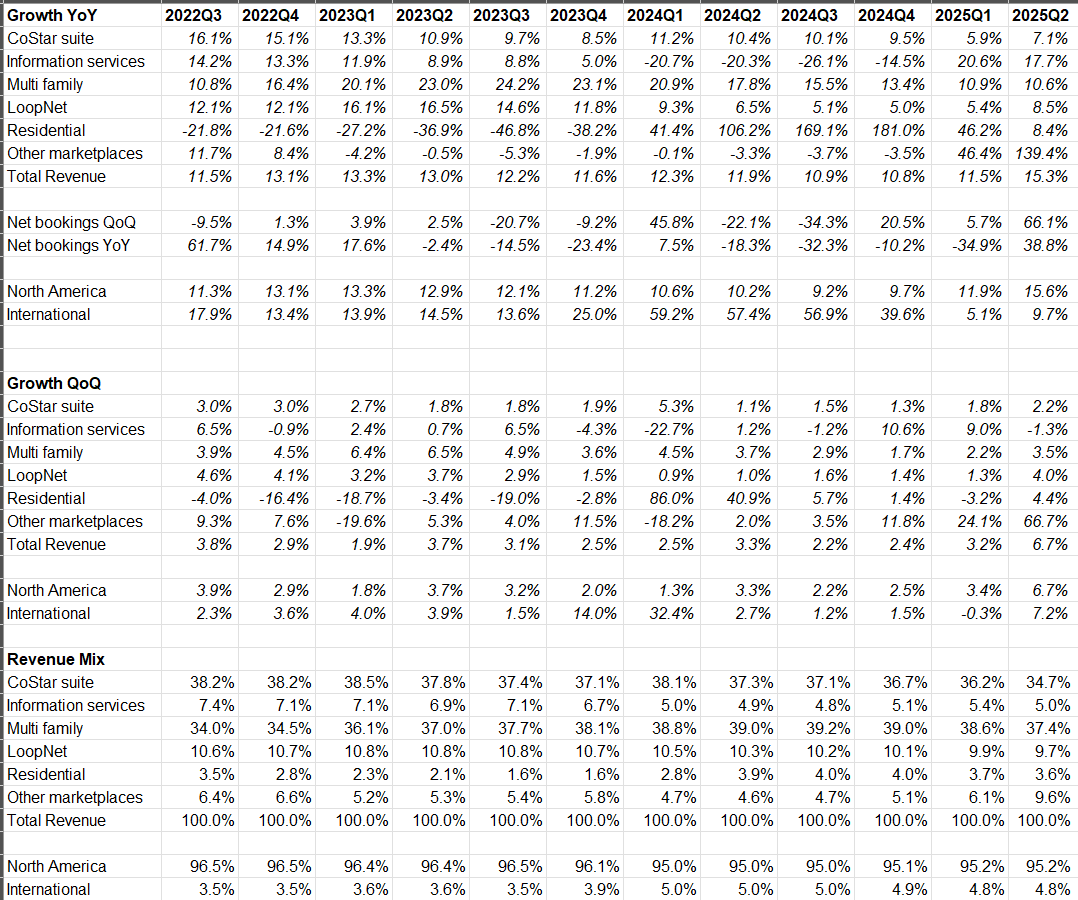

More detailed revenue growth trajectory by segment and region are shown below both from YoY and QoQ perspective.

Margins

Anytime I post about CoStar, I usually receive at least one DM/email/reply asking me about why I am even looking at a company trading at stratospheric valuation multiples. So, let me clarify the point here.

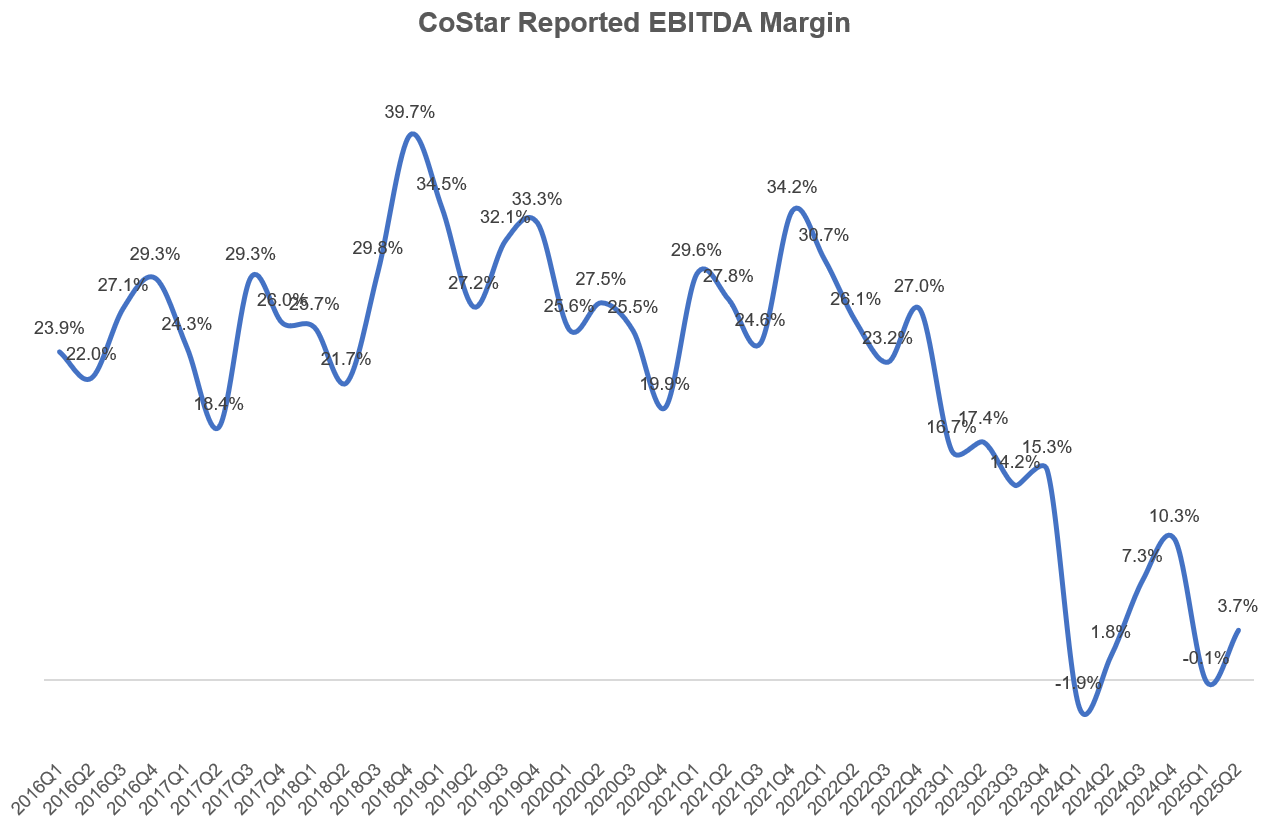

CoStar’s reported margins are saddled with and weighed down materially by their massive investments in residential segment. Back in 2019, they reported ~32% EBITDA margin, and yet reported only MSD EBITDA margin in 2024.

At first glance, it may seem CoStar’s EBITDA margin was only 3.7% in 2Q’25. But in reality, their core EBITDA margin was 43% in both 1Q’25 and 2Q’25. This not only shows how much margins have expanded since 2019, but also reminds just how massive CoStar’s investments are in Homes i.e. residential segment.

So, while CoStar’s reported EBITDA appears meager and hence multiples appear stratospheric in any data platform providers such as Bloomber/CapIQ/KoyFin, the reality is their current annualized core (ex-residential and Matterport) EBITDA is ~$1.2 Billion.

Let’s look at segment by segment now.

CoStar Suite

CoStar subscribers increased to 275k, +19% YoY primarily driven by the ongoing migration of STR users into CoStar and the addition of new STR subscribers to the CoStar platform. Renewal rate remained at 93%.

The worst for CRE is likely behind them which could be a slight tailwind for CoStar suite going forward. From the call:

“The CRE market continues to face difficulties, particularly in the office segment with persistently high vacancy rates, though moderating and slightly worsening negative net absorption rates. We're seeing a sharp decline in new deliveries, which should help stabilize the office market in the near future. Transaction volumes have maintained a positive seasonal trend, with Q2 up 43% year-over-year.”

LoopNet

LoopNet generated more net new business in 1H’25 than the entirety of 2024. As a result, CoStar now expects revenue growth to exceed 10% in 2H’25.

Multifamily

Multifamily (mostly apartments.com) saw $45 million in net new bookings, which was +20% YoY and the fourth highest quarter ever for net new bookings. They are also increasing their sales team to 500 in 2025.

As of 2Q’25, 83k multifamily communities are advertising on CoStar’s platform. This increased from 62k in 4Q’22, 71k in 4Q’23, and 75k in 4Q’24. Just in 1H’25, CoStar added 7.6k new apartment communities, more than what they added throughout all of 2024 (and they highlighted they did so without steep discounting). So, clearly there is a strong momentum here.

There have been some concerns that Zillow has been closing the gap with CoStar in multifamily segment. Naturally, Florance took some shots at Zillow. From the call:

“Apartments.com continues to deliver more leads and nearly twice as many leases as our 2 closest competitors combined according to Entrata data.

I think we're conflating 2 different things here. Obviously, the product is extremely strong with very high NPS, renewal rates, growing bookings, robust sales bookings, growing ASP. And that's been conflated a little bit with looking at a lot of purchasing clients by our competitor paying top dollar to buy share from Redfin and from Realtor. That's relatively low quality advertisers coming in.

The ASP on those properties is dramatically below the ASP on Apartments.com. So I would say we feel that we're in a very strong competitive position and nothing is changing.”

CoStar’s CFO tried to lower the temperature by reminding investors that both Zillow and CoStar can coexist. From the call:

“the greenfield TAM in this industry is still massive. And so this concept of wallet share taking wallet share really isn't applicable here given how large the TAM are. We're both competing and there's massive TAM.”

Matterport

Matterport is the recent $1.6 Billion acquisition by CoStar. It generated $44 million revenue in 2Q’25, but they’re closing some non-core operations in Matterport which generated $14 million annual revenue but posted $10 million losses. So, their revenue will decline a bit in the next quarter or two but profitability will have a tailwind after shutting down the non-core elements.

Management reminded Matterport’s value proposition to CoStar’s businesses:

40% of apartment seekers look for communities in different cities and 41% are willing to rent site unseen if you provide high-quality imagery. Significantly, 53%, they'll say they will stop considering a rental unit without detailed imagery. Consumers love the Matterport experience on Apartments.com. In Q2, they viewed Matterports 67 million times, up 193% over the same period last year, spending 71% more time on listing detailed pages with the Matterport 3D tour. Listings with the Matterport 3D tour received 23x more leads than those without.

Here too CoStar and Zillow have two contrasting approaches. Here’s what Zillow CEO said in an interview with Ben Thompson last year:

So a traditional listing, which a photographer goes out and shoots 25 to 50 photos of each room, and then you write a description and you put a beds, bath, and price and you upload it to MLS and that’s okay circa 2006. But as you just said, we all want to really virtually tour our house as much as possible before we can, you have to capture a little bit more data to do that.

There was a bunch of technology coming that was super high-end, dedicated hardware, set it up in every room and it would kind of do a whole bunch of really high-res panos, and you could do this kind of virtual tour thing. The problem with that is that in real estate, no one’s going to spend the money on the capture, you have to make the capture free fast and easy, you have to get to the level of like a hundred dollars 360 camera or even the new iPhone camera. That’s what we’ve spent a bunch of time working on, is you can now create the showcase listings with just an iPhone and with just grabbing a few panos in each room and then we do a bunch of photo location.

We do a bunch of AI human-in-the-loop assisted annotation for the floor plan and you end up with what you’re describing is an interactive floor plan where all the photos are on the floor plan, and you can see on each photo which way it’s pointing in the room, and you can walk through the house and generative AI stitches all that together to make it feel like it’s a 3D walkthrough.

CoStar, on the other hand, is betting real estate industry will choose to spend money. From the call:

We intend to shift Matterport towards a business-to-business or B2B approach. The Matterport Pro 3 camera delivers a superior capture experience and a very superior display experience compared to mobile devices. Customers using the Pro 3 camera have an 85% renewal rate for our SaaS services, while those using an Android phone only have a 40% renewal rate. We plan to invest time and capital in developing even more advanced cameras, appropriately named the Matterport Pro 4 and the Pro 4 Ultra specs to be revealed one day.

While Zillow’s approach is more capital efficient, I do wonder if CoStar’s approach yields better results that CoStar can quantitatively show to its customers, there’s no reason why customers wouldn’t pay for such capture. But I think the real question is whether the results can stay dramatically ahead of what you can capture through your phone.

Homes

Finally, Homes.com or what I like to call CoStar’s “Metaverse” bet i.e. just as Meta shareholders have to pinch themselves every year that Zuck is indeed plowing $20 Billion losses every year in Reality Labs for years without much to show for so far, CoStar is sort of making similar bet with Homes. Even worse, the “investments” in Homes are so large that it has been almost devouring all of the core EBITDA.

The update here is CoStar is doubling down on Homes. Homes.com sales force is increasing to 750 by the end of 2025 (vs 230 in 2024).

To be fair, there is some glimmer of hope as the expanding sales force drove 5% MoM growth in May and 15% in June. They 6,300 net new members, +56% increase in membership during the quarter.

Some more encouraging quotes from the call related to Homes:

Member agents listings on Homes.com achieved 22x greater reach compared to nonmembers, significantly enhancing consumer engagement.

Unaided awareness has grown from 4% at the launch in 2024 to over 36% in Q2.

Listings from members received 7x more detailed views, 4x more favorites and 6x more shares, resulting in faster sales and higher selling prices. Leveraging these marketing advantages, Homes.com members secured 62% more listings than nonmembers with an outstanding return on investment. Especially given the average new listing commission value of $15,000 against a monthly membership fee under $500.

Our NPS grew from a modest 3 in Q4 of 2024 to 9 in Q1 of '25. And then it jumped substantially to 38 in Q2, marking a 340% quarter-over-quarter increase.

The newly launched Boost product has been successful. Boost provides sellers and their agents with a flexible marketing option, allowing single property listings to be boosted on Homes.com to benefit from membership level marketing. Since Q2 launch, we sold 1,270 Boosts. Boosted listings reach over 14,000 homebuyers with an average of 32 views per buyer making boosted listings 25% more likely to go under contract within 10 days.

These are all great, but any optimism definitely gets shot a bit when you look at revenue which was just $28.4 million last quarter. CoStar now expects residential revenue to grow 20% to $120 million in 2025. Given that they’re spending $1 Billion per year for the last couple of years make it…not good enough. With 750 sales people, we better see more than 20% growth in residential in 2026 or the investments here need to be rationalized appropriately.

One particular point by Florance that was interesting is he mentioned “One of the beauties of our business model is that unlike our competitors that can only really sell to 5% of the market, our business model can sell to 60%, 70%, 80% of the market, which is why we love it and why investors should too.”

Since CoStar doesn’t “divert” consumer inquiries away from the listing agent; it connects buyers directly with the seller’s agent. If you target listing agents and brokerages this way, you can, in principle, sell to a very large share of active agents who take listings. CoStar mentioned they size this opportunity to be 500-750K active agents. Given the current average membership fee is $500, that makes $3 to 4.5 Billion revenue opportunity. I’m not sure such an opportunity deserves $1 Billion investments per year, especially given the probability of success here is certainly not high.

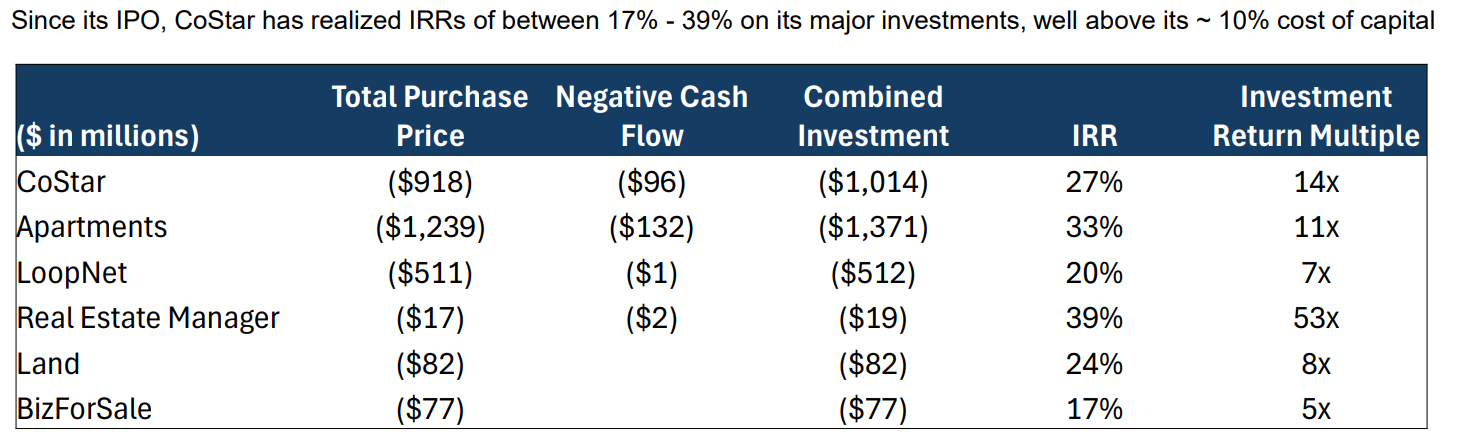

CoStar management has been battling these strident remarks on their Homes investments from investors for the last few quarters, so perhaps that propelled them to share a new slide in last quarter. They’re basically saying to investors “hey buddy, we know what we are doing. Just chill a bit”.

Fair enough, Mr. Florance. But you may not want to coast on past glories for too long! I will share some thoughts on current valuation behind the paywall.

In addition to "Daily Dose" like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 61 Deep Dives here.

Prices for new subscribers will increase to $30/month or $250/year from August 01, 2025. Anyone who joins on or before July 31, 2025 will keep today’s pricing of $20/month or $200/year.