CoStar: The Art of Creating, Capturing, and Protecting Value

You can listen to this Deep Dive here

Jeff Bezos may be the most famous graduate from Princeton’s class of 1986, but the 1986 class had another graduate, Andy Florance, who also embodied a remarkable similarity in relentless ambition. They were, in fact, Physics lab partners at Princeton. After graduation, their path diverged; while Bezos worked for a couple of firms and then went to work for Wall Street before listening to his true calling- the Internet, Florance was already steeped into the entrepreneurship bug even before graduation. While he was at Princeton, Florance started his first data business: Cornerstone, which was a monthly leasing guide for commercial real estate. He later sold the business and after graduating at age 23, he started a new company named “Realty Information Group” in 1987 which later was renamed to be CoStar Group.

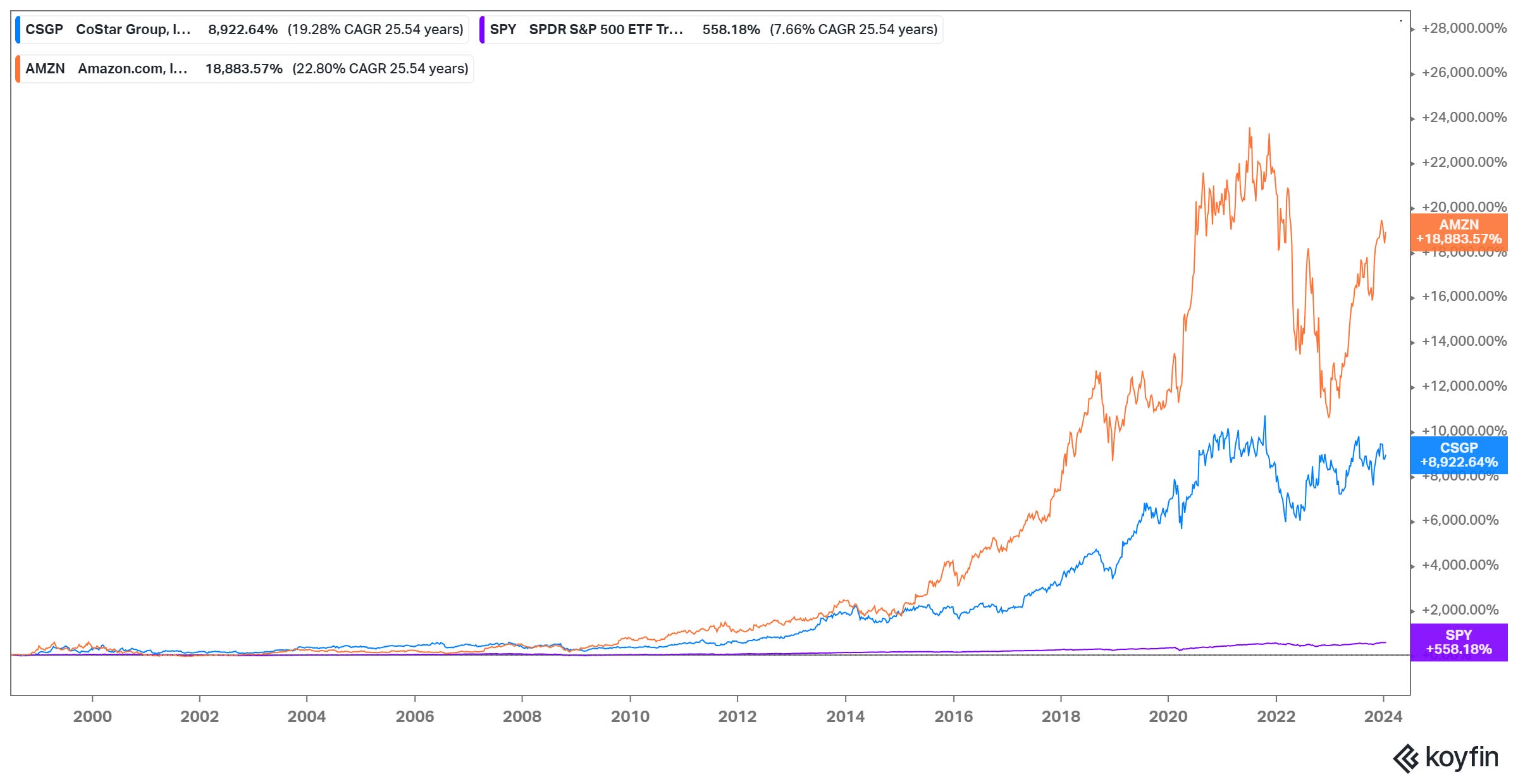

It may be hard to believe but after Florance took CoStar public in 1998, the stock’s performance was almost neck-on-neck with freaking Amazon up until January 2015. Then the “AWS IPO” happened, and Amazon stock jumped to a different universe!

CoStar (Ticker: CSGP) did, however, almost ~20% CAGR over 25-year period in public market. His Physics lab partner may have won this round, but Florance is clearly not too shabby either!

Although Florance’s father Coke Florance was a notable architect, Andy seemed to have quite a tumultuous childhood. His parents got separated and at age seven, he became homeless. Andy is, therefore, certainly no stranger to adversity and yet, by age eleven, he managed to make enough money to support himself. At twelve, he got into a music school in NYC; during his 2019 VCU Commencement speech, Andy shared a lesson he absorbed in music school that I thought was profound:

Getting closer to perfection is a joyous experience. And I hope it's something that you all strive for your entire lives.

It was in music school he came across computers (one of the few schools to have them at that time) and learned how to code which paved his way to Princeton. Florance was an Economics major at Princeton and he was puzzled that while you could easily follow the prices of stocks and bonds, real estate prices, a market larger than stocks and bonds combined, were quite opaque in nature. Florance’s big idea was to make the prices more transparent by digitizing information such as vacancy rates and rent of commercial real estate etc.

Florance clearly found a product market fit as just after a year of starting the company, he got an offer to sell his company for half a million dollar. As he was tempted to consummate the deal, he met a lawyer to help him. That lawyer was Michael Klein. Klein specialized in public securities during the Savings & Loan crisis and appreciated how a lack of high quality data contributed to the banks’ difficulty in providing risky commercial real estate loans.

After listening to what Florance’s business is about, Klein ended up convincing Florance not only to not sell the business, but also investing several million dollars by taking a second mortgage without telling his wife. After IPO, Klein owned 1.8 million shares of CoStar in 1999 which was ~14% of the company. After all these years, he still owns ~2 mn shares that are worth ~$170 Mn today (due to the stock splits and dilution, he owns just ~0.5% of CoStar now).

Ultimately, Florance not only built the “Bloomberg” for Commercial Real Estate (CRE) industry, CoStar also undertook some key acquisitions in the last 10-15 years that created a near impenetrable moat in their data/information service business in CRE. Thanks to his relentless ambition, Florance isn’t quite content by building a de-facto monopoly in CRE data business; his eyes are now set in residential real estate.

Co-Star’s growth persistence is nothing short of remarkable! The company recently posted its 50th consecutive double digit quarterly revenue growth. I’m not sure how many companies in the US were able to achieve a similar record, but I bet it’s a short list. CoStar does seem to be a special company!

It’s not just topline growth; after it became EBITDA profitable (given the acquisitive nature and low capex intensity, EBITDA is a decent metric here) in 2002, it has increased its margins from ~8% in 2002 to almost ~30% in recent years. The “actual” EBITDA margins on the core business is likely closer to ~40% which is currently masked by CoStar’s aggressive push towards building a marketplace in residential real estate.

As you can imagine, there’s a lot to unpack here. In this Deep Dive, I first discussed the whole business segment by segment. Then I outlined the CoStar’s economics, capital allocation, and management incentives. Finally, I showed what’s likely embedded into the stock price today and my concluding thoughts on CoStar.