China's Rise in Innovation Ladder and Questions for ASML

JP Morgan in its recent “2026 Eye on the Market Outlook” discussed four specific “What Could Go Wrong” for the market over the medium term. One that caught my attention is a section titled “China scales the moat with its own lithography-semiconductor technology…when, not if”.

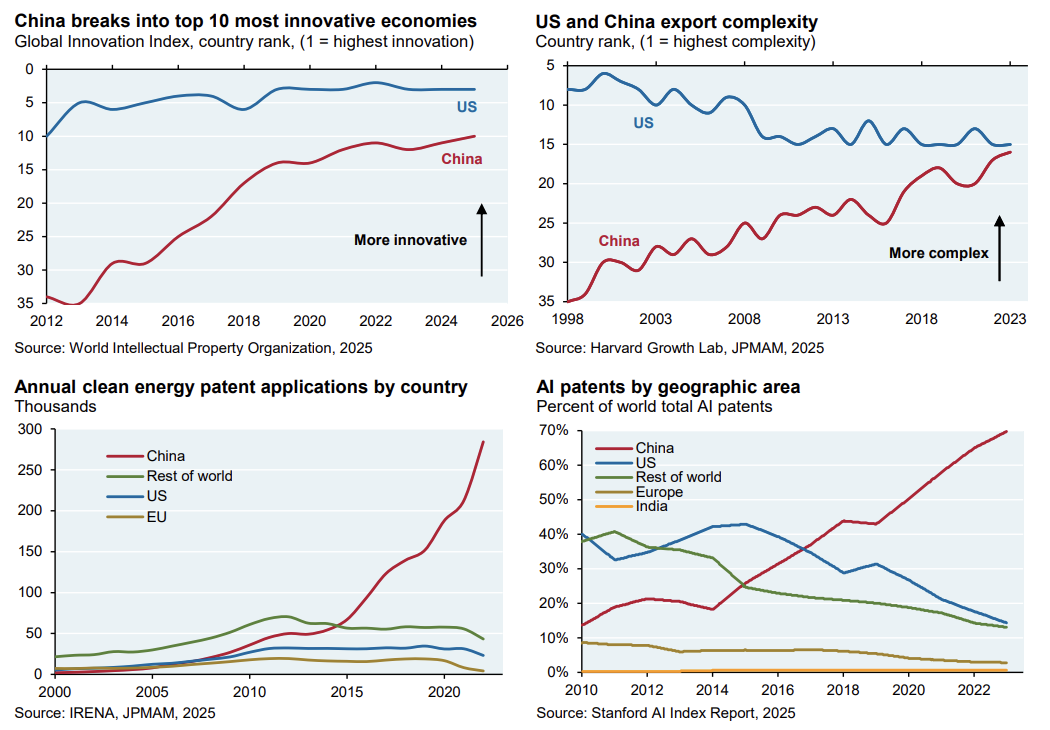

The section starts with the following paragraph and accompanied the below striking graphs:

“Let’s start with a basic premise: China has been steadily climbing the innovation food chain across a range of industries. The first chart shows China breaking into the top ten on innovation, while the second shows China and the US converging with respect to the complexity of exported products. China has also been outpacing the rest of the world on clean energy patents, AI patents and nuclear engineering research.”

How did China manage to radically close the gap and in some instances surpass the US by a significant margin?

Dan Wang in his recent letter had a very lucid explanation of how many people in the West fundamentally misunderstand China’s rise in innovation ladder (emphasis mine):

“…western elites keep citing the wrong reasons for China’s success. When members of Congress get around to acknowledging China’s tech advancements, they do not fail to attribute causes to either industrial subsidies (also known as cheating) or IP theft (that is, stealing). These are legitimate claims, but China’s advantages extend far beyond them. That’s the creation of deep infrastructure as well as extensive industrial ecosystems that I describe above.

Probably the most underrated part of the Chinese system is the ferocity of market competition. It’s excusable not to see that, given that the party espouses so much Marxism. I would argue that China embodies both greater capitalist competition and greater capitalist excess than America does today. Part of the reason that China’s stock market trends sideways is that everyone’s profits are competed away.

…western elites keep holding on to a distinction between “innovation,” which is mostly the remit of the west, and “scaling,” which they accept that China can do. I want to dissolve that distinction. Chinese workers innovate every day on the factory floor. By being the site of production, they have a keen sense of how to make technical improvements all the time. American scientists may be world leaders in dreaming up new ideas. But American manufacturers have been poor at building industries around these ideas. The history books point out that Bell Labs invented the first solar cell in 1957; today, the lab no longer exists while the solar industry moved to Germany and then to China. While Chinese universities have grown more capable at producing new ideas, it’s not clear that the American manufacturing base has grown stronger at commercializing new inventions.

I sometimes hear that the US will save manufacturers through automation. The truth is that Chinese factories tend to be ahead on automation: that’s a big part of the reason that Chinese Tesla workers are more productive than California Tesla workers. China regularly installs as many robots as the rest of the world put together. They are also able to provide greater amounts of training data for AI. We have to be careful not to let automation, like superintelligence, become an excuse for magical thinking rather than doing the hard work of capacity building.”

Speaking of capacity building, perhaps nothing exemplifies the divergence between China and the rest of the world than what has transpired in power generation since 2019. JPM mentioned that since 2019, power generation changes was +2,500 TWh in China, only +221 TWh in the US, and an outright embarrassing -110 TWh (yes, negative) in Europe. Now that we know power is a key bottleneck in the current AI race, this trend is even more worrisome for the entire Western hemisphere. Ben Thompson interviewed a couple of analysts from Semianalysis recently who made the case that the power bottleneck in the US may not be as dire as many people imagine; nonetheless, the trend since 2019 is a sobering reminder that the West needs to pick up the speed if they don’t want to be laggards.

Having said that, as Dan Wang noted, there are still two particular sectors in which China remained noticeably behind the West: aviation, and semiconductors. Within semiconductors, one particular bottleneck is advanced lithography. A recurring topic between ASML bulls and bears is if, when, or how China may catch up in lithography to put a dent on ASML’s outright monopoly in EUV. There is an interesting angle to this debate which I will discuss more behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 65 Deep Dives here