ChatGPT's Edge, Tech Talent Retention

GPT-5 had bit of a mixed reaction. I was initially excited about the much cleaner UI (no more selecting models; to be fair, I was using o3 for 95% of my queries anyway). However, it didn’t take me too long to realize GPT-5 is “thinking” considerably less than o3 in most of my queries as it started making some rookie mistakes.

Given my personal preference for o3 and reasoning’s apparent superiority to non-reasoning models, I was a bit surprised to read the following tweet from Sam Altman yesterday:

"the percentage of users using reasoning models each day is significantly increasing; for example, for free users we went from <1% to 7%, and for plus users from 7% to 24%.

i expect use of reasoning to greatly increase over time, so rate limit increases are important."

I am seeing two things at once in that tweet. First, there is clear latent demand for deeper “reasoning” once people bump into tasks that need it. Second, the product has gained a massive adoption without it.

Most day-to-day jobs to be done are simple asks, lookups, rewrites, and summaries. If a free user can get value from that shallow band of use, they form a habit around the entry point, not the model class. The mental shortcut becomes “open ChatGPT” rather than “pick the best model.” Good enough wins the default, and if we know anything from Google’s history, the “default” compounds over time.

ChatGPT already has a giant top of funnel, a known UX, and months of chat history, saved prompts, and personal setup that is quietly raising switching costs purely from customer habit perspective. Even if a challenger ships a model that benchmarks better, the gap must be large and obvious in everyday tasks to overcome habit, trust, and distribution. Most consumers will not A/B test models. They will notice whether the answer appears quickly, sounds right, and does not break.

As rate limits rise and reasoning improves, users push heavier work into the same front door instead of seeking a new one. That pulls more of the market into ChatGPT’s gravitational field and raises the threshold a rival must clear. If ChatGPT ever falls behind on raw quality, the brand buys time, and time can prove to be enough to close the gap because users default to the place that already works for their lighter tasks.

Big tech today pay a premium to stay on the frontier because it buys independence and a shot at the next default surface. That premium has a limit. If the probability-weighted value of winning a new interface or agent layer drops, or if OS-level distribution and enterprise bundling make displacement unlikely, the option is overpriced. At that point it may be more rational to ride fast-follower strategies.

When rivals can replicate 95% of capability with smaller models and better orchestration, super-linear capex may just buy bragging rights rather than cash flow. The capex ceiling will arrive at different levels for each firm. Hyperscalers can amortize capex across customers, so their limit may be higher. Consumer platforms with mostly internal monetization may hit diminishing returns sooner. The constraint may not be “can we dislodge ChatGPT in consumer chat,” rather it may be “does the next tranche unlock a step-change use case or structural cost edge.” When the answer becomes no, rational CFOs should taper frontier capex and shift spend to utilization, inference efficiency, and productization.

It certainly feels like the clock is ticking for Big Tech. It will be very hard to divert existing ChatGPT users to a new model, but it may be still be fair game at least in consumer use cases for the incremental users. I have mentioned TikTok-Meta saga before; TikTok didn’t really lose the existing user base to Reels. It’s just their growth trajectory slowed down as by the time Reels became a pretty decent product for IG’s existing userbase, they didn’t need to install another app to get more or less a similar thing. It’s also why OpenAI may not quite be out of the woods yet, especially if their model quality lags behind big tech.

GPT-5’s reaction so far has likely been underwhelming and if the future incremental users notice the consensus opinion is shifting to ChatGPT is behind in model quality compared to Google/anyone else’s AI offerings, ChatGPT can still face potent competition in consumer space even if the current existing users remain loyal. Ultimately, there are still far more AI DAUs up for grabs than the DAUs ChatGPT has today.

Enterprise users can prove to be much more “rational” and less beholden to “habits”. Hence, the competitive dynamics can evolve there for much longer than we may see in consumer. To say it differently, if you want to put a dent in ChatGPT’s adoption for consumer use cases, you probably have max 2-3 years left before the train may permanently leave the station, but the fight for market share in enterprise use cases can remain open.

Tech Talent Retention

SignalFire published some interesting data around tech talent retention. One of the metrics they mentioned is “hiring-to-attrition ratio” which tracks how many engineers a company hires for every one who leaves. From the report:

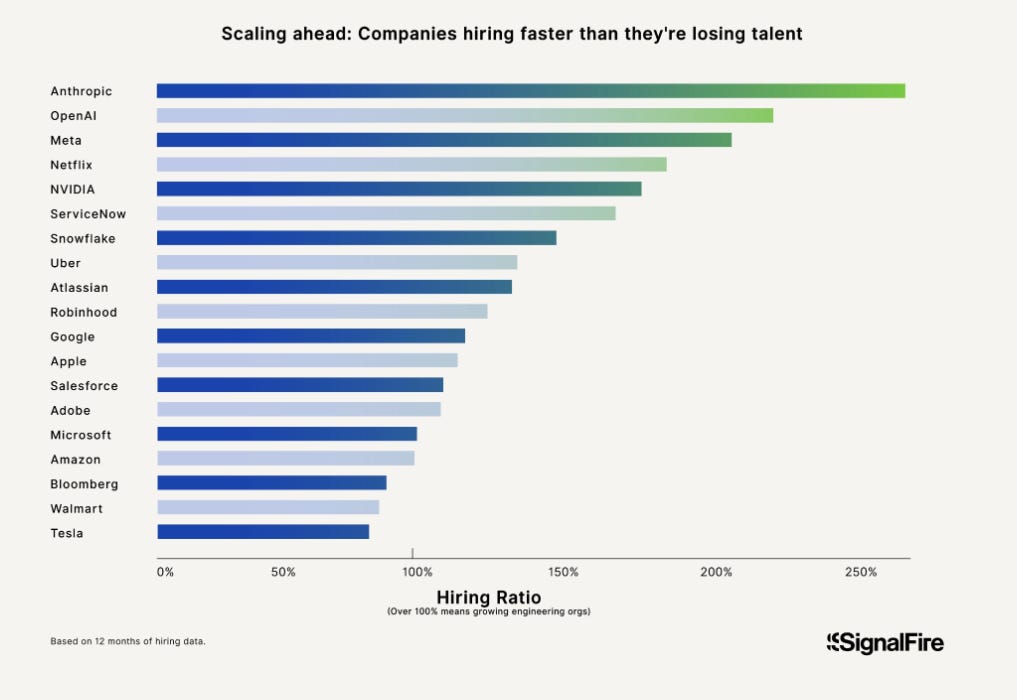

The chart below highlights who’s pulling ahead. These companies are successfully scaling engineering headcount by hiring faster than they’re losing talent.

Anthropic, OpenAI, and Meta are growing engineering teams 2-3x faster than they’re losing them, while Tesla, Bloomberg, and Walmart are losing talent faster than they can hire.

Companies above the 100 mark are retaining and scaling sustainably, while those below are backfilling losses or burning out their teams.

Of course, Anthropic and OpenAI are relatively new companies, so I’m not sure how comparable they are relative to the incumbents on this list. I used to hear how Meta’s employer “brand” is damaged in Silicon Valley 3-4 years ago, but I guess a rising stock price can heal most things.

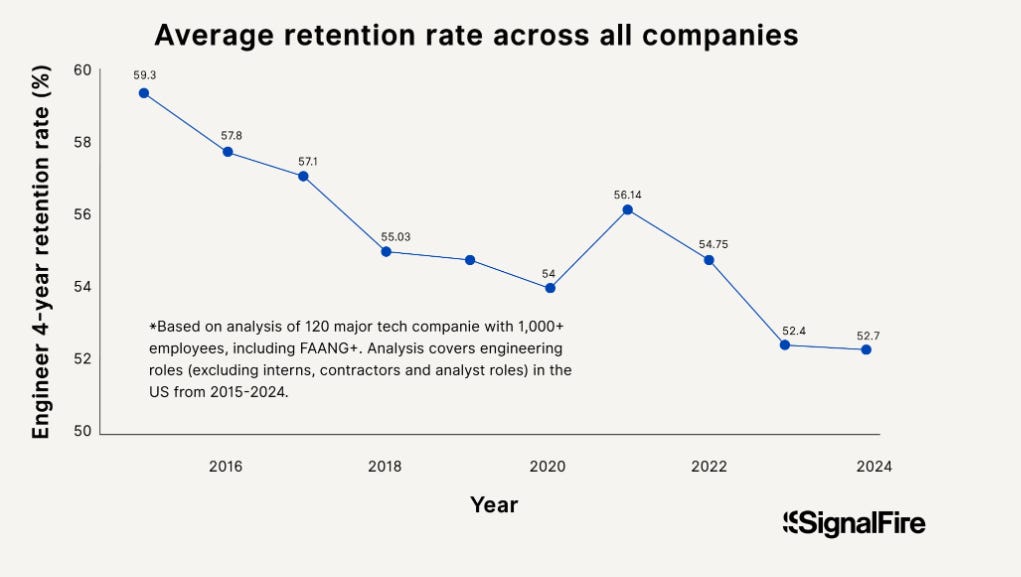

Long-term (4-year) retention in tech companies has gradually fallen over the last decade; still, more than half of the engineers stay at the same company for four years. The report also highlighted the recent falling retention rate may just be more of a function of what we experienced in the last five years instead of a secular theme:

Considering the last five years of chaos with a global pandemic, remote-work shifts, return-to-office whiplash, layoffs, reorgs, and now the AI gold rush, that’s surprisingly stable. It points to a deeper truth: strong engineering cultures still stick. The best teams are holding onto top talent, even as the market churns.

In addition to "Daily Dose" (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 61 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: