Buying Constellation Software amidst its consternation!

After owning Constellation Software (CSU) for almost three years, I wrote the following in April 2025 (see final section):

“I do not see anything particularly concerning about the business today. It’s a very well run business and run by pretty competent and high integrity management. However, I think the risk-reward from valuation perspective is far from attractive at current valuation.

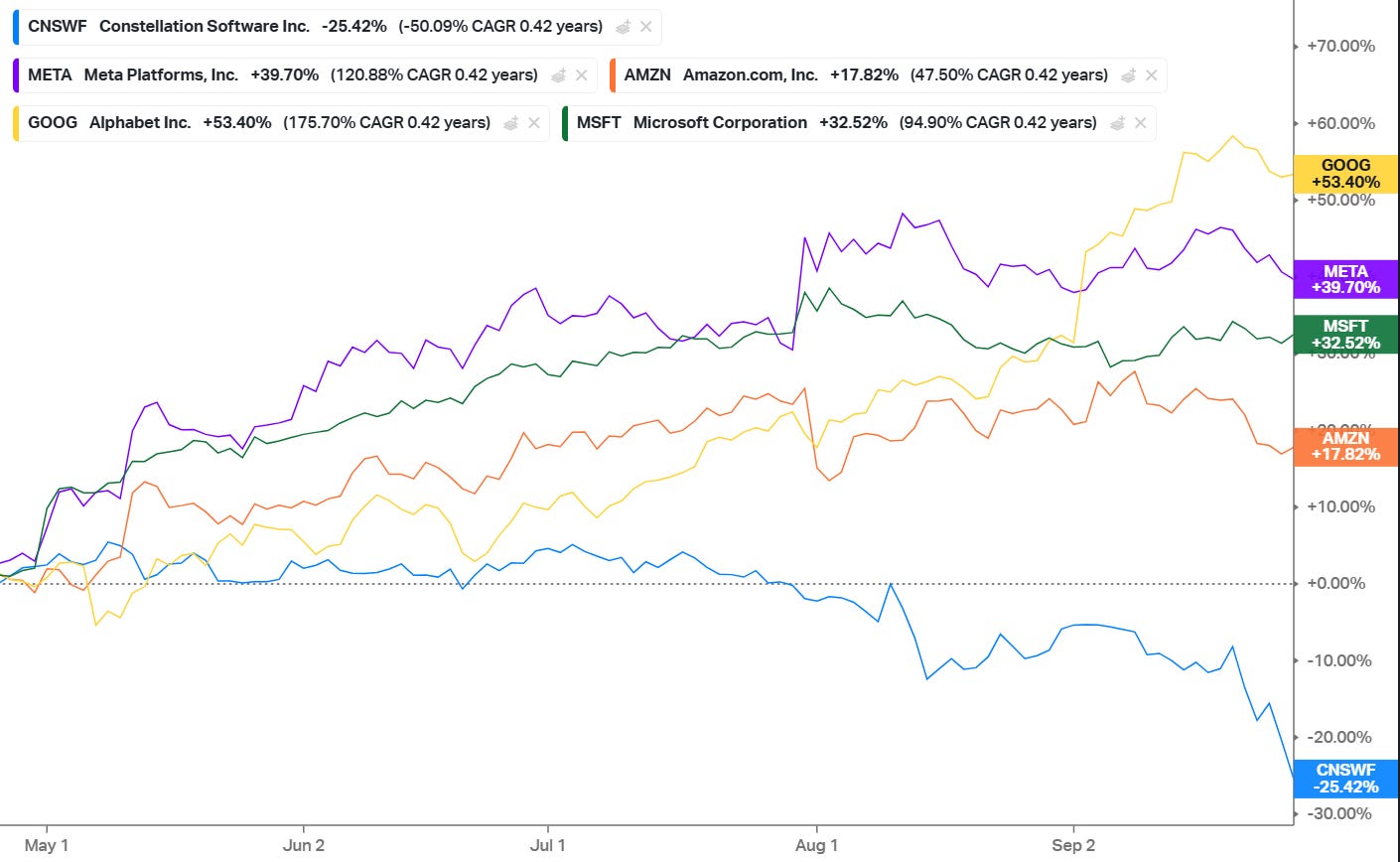

Speaking of better ideas from risk-reward perspective, I re-allocated my CSU sale equally to four big tech companies (Meta at $500, Amazon at $165, Microsoft at $378, and Google at $154).”

In a year I had some material misses, this turned out to be one of the better decisions!

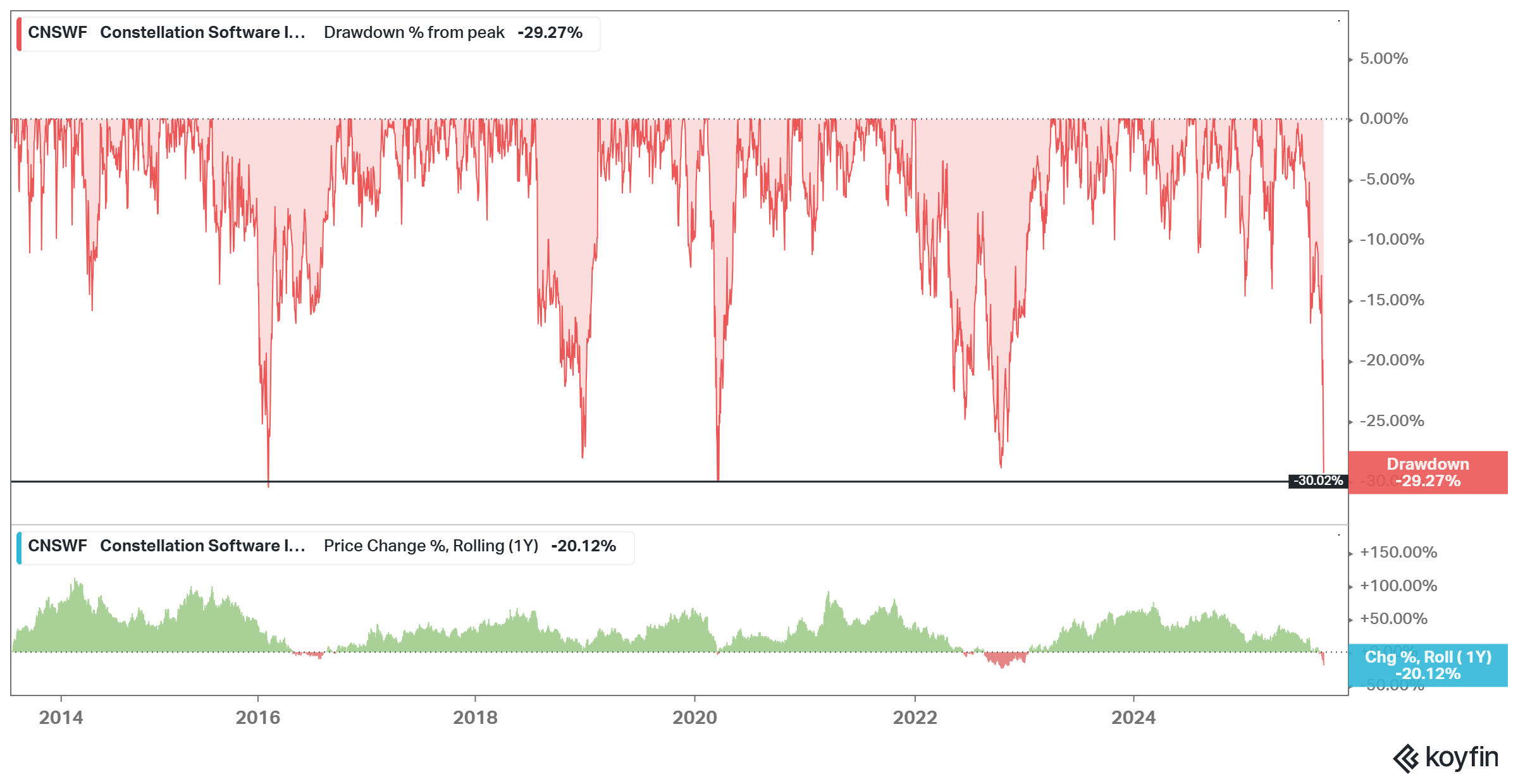

One of the beauties of public market investing is even the best companies go through a period of discomforting volatility. CSU almost defied this axiom pretty much its entire life as the company barely experienced even a 30% drawdown. We will learn shortly whether that will remain true or not in coming months as the stock is currently on the cusp of being in a 30% drawdown.

Admittedly, I was a bit confused looking at the stock going up after a rather shabby Q1 quarter this year; my confusion only compounded further when the stock started going down after a rather reassuring Q2. So, it’s not quite the fundamentals that are the primary culprit for their very recent drawdown.

One key source of Constellation’s current consternation is AI. As an owner of a thousands of “shitty” software companies, CSU is now being considered by many a potential victim in the road to “AGI”. While CSU management doesn’t even have usual quarterly calls, they decided to address AI related concerns in a conference call last week.

Mark Leonard had a more nuanced perspective on AI throughout the call. He didn’t strike me as someone who is “AGI” pilled; based on the ground reality of software businesses he has seen over the last few decades, he thinks there will be plenty of scope for creating value:

I believe that vertical market software is the distillation of a conversation between the vendor and the customer that has gone on frequently for a couple of decades.

And you distill those work practices down into algorithms and software and data and reports and it captures so much about the business. And being able to examine that in a new way because of AI, creates new opportunity to modify and change and suggest new approaches. So yes, I’m hopeful that, that unique and proprietary information will be of value.

Of course, even if he’s wrong on the margin, CSU buys companies with a lot of margin of safety thanks to their high hurdle rates (we don’t know exactly what, but it’s definitely not 10%):

So the advantage of using a high discount rate already is that it minimizes the value of the terminal value and your overall assessment of the attractiveness of the investment. So we’ve got that going for us inherently. We’re already discounting the future a lot.

CSU knows it owns not-so-fancy software products that happen to be mission critical for their customers, and given their R&D efforts on these products is quite minimal, the potential obsolescence of these products were always much more in CSU’s calculation even before AI than perhaps any other software companies in the world.

As a result, while CSU obviously wasn’t considering “AI” as the key risk for their software companies 5-10 years ago, the price they paid for these companies always factored in some sort of “asteroid” coming towards them. If the AI is indeed such an asteroid to software, I have mentioned before in my Deep Dive that I don’t expect CSU to be married to Vertical Market Software (VMS) and will look to allocate capital beyond software over time. Mark Leonard pretty much addressed this in his 2018 shareholder letter:

“If Constellation had started in 1895 instead of 1995, we might have had the objective of being a great perpetual owner of daily newspapers. The newspaper industry underwent a long period of high growth which attracted many new entrants, followed by local consolidation, conglomeration, and eventual decline. I anticipate that the VMS industry will evolve similarly.

One day Constellation may find that VMS businesses are too expensive to rationally acquire. If that happens, I hope we’ll have had the foresight and luck to find some other high ROE non-VMS businesses in which to invest at attractive prices. I am already casting about for such opportunities. If we don’t find attractive sectors in which to invest, then we’ll return our FCF to our investors. Even if re-investment opportunities become scarcer, Constellation doesn’t end… it will continue to be a good (hopefully great) perpetual owner of its existing VMS portfolio, and will still deploy some capital opportunistically.”

It is more likely that AI may be a double edged sword for CSU. It is hard to exactly know where the debate will settle, but there is a scenario in which CSU is able to create more value to their existing customers and capture greater wallet share over time even if they lose some fraction of the customers to “vibe coding”:

You know, we capture the small companies as they graduate from horizontals. We take them and some of them grow enormously and become very successful, large companies. And then they graduate to no longer using our systems, but to using a much more proprietary system that they have a much stronger hand in driving. Now, AI has the potential to allow us to do way more work on making the client happy and customizing our solutions. But it also allows the client to potentially do that. And so there’s a natural tension there.

We obviously would love to capture that. Our clients, if they don’t have a list of five years worth of IT projects to get to, would obviously love to capture that as well. And so I think to some extent. Whenever we go see a large clients, IT director. We’re in a negotiation. Regarding what we’ll do and what they’ll do. And, you know, it’s not going to be an easy answer. It’s it’s going to be somewhere in between. And AI makes it potentially way more exciting for us to provide customization . But it also makes it much more likely that the client will do it themselves.

it’s important to consider that even if we rebuild with AI, we’re still going to have to maintain it. So I think in some cases it will enable us to modernize and rebuild our solutions more effectively than we were able to do so before. But at the same time, how we maintain, troubleshoot and bug fix our solutions, we’re still going to have to do that. Whether the code has been written by AI or by humans ten years ago.

While nobody knows how these debates will be settled, I would rather be a company providing mission critical software to customers who are perennial laggard in adopting the shiny new tech. So, even if the AI fears have a lot of merit, CSU will have plenty of time to allocate their capital appropriately. Of course, these pivots can still be painful to go through, but as I said before, this is a company run by very competent and more importantly, high integrity people.

Alas, CSU also just abruptly announced Mark Leonard’s retirement due to health reasons. There was no such indication even during the conference call couple of days ago, but through the grapevine I have heard it was indeed some sudden health related issues that led to such an unfortunate decision. Leonard is one of those rare personalities that I can only think of Buffett as his true peer.

One of my earnest beliefs about Warren Buffett is there will never be another one like him in my lifetime. It’s not that there may not be any other investor who will have higher return over 50-60 year period, rather there will never be one who will allow you to buy their investing vehicle without essentially any compensation at all. Buffett’s true charity was that anyone could buy Berkshire and for that privilege, they would have to pay essentially nothing to Buffett. Leonard too didn’t take any salary since 2014 (he did take compensation in the first 20 years of CSU operations), and anyone could enjoy the fruits of Leonard’s talent by buying CSU without paying him anything at all. I’m, of course, not saying anyone should be obligated to do such charity, but I do want to highlight and applaud something extraordinary when I see it.

Both Leonard and Buffett’s writing are deeply imbued with integrity and humility. In an investing world increasingly filled with scammers, fraudsters, and meme stocks, I feel deeply sad that both of them retired in the same year. Buffett is obviously sort of expected to due to his age, but Leonard’s retirement is a real shocker. I wish him a speedy recovery. Leonard will remain in the board, and I earnestly hope CSU will continue to be blessed with his acumen and guidance for years to come.

Leonard is going to be succeeded by Mark Miller who used to be the Chief Operating Officer of CSU. While it may be tempting to presume Leonard’s departure a nothingburger due to CSU’s deeply decentralized culture, I don’t want to understate the importance of towering figures in any company. CSU should prove to be quite resilient, but such sudden departure can affect the morale and may create some additional upheaval, especially when you are also dealing with big technological questions such as AI.

Having said that, I do think the valuation is starting to appear somewhat attractive from risk-reward perspective which is why I started a 2% position yesterday. Speaking of valuation, if you ask 10 CSU shareholders what LTM multiple the stock is currently trading at, you may get 10 different answers. I will explain why risk-reward is starting to appear attractive and show some valuation work (including excel file) behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 63 Deep Dives here.