ASML's China question

In my ASML Deep Dive last month, I wrote about China’s gigantic and increasing contribution on ASML’s business:

ASML revenue increased from €18 Billion in 2021 to €28 Billion in 2024. During this period, their revenue from China increased by €7.5 Billion; so basically ~75% of ASML’s incremental growth in the last three years came from China. As a result, China’s contribution to ASML’s revenue went from ~15% in 2021 to ~36% in 2024.

Coming into 2025, ASML management indicated China’s contribution to its revenue will come down to ~20%. As the year progressed, China remained stubbornly high in ASML’s revenue mix.

ASML discloses China’s contribution in ASML’s net system sales on a quarterly basis (system sales is ~75% of ASML’s overall revenue). In both Q1 and Q2 of 2025, China was 27% of ASML’s system sales. In Q3, it shot up to 42% of ASML’s system sales!

Now ASML management expects China revenue to “decline significantly” compared to 2024 and 2025 period. Clearly, ASML management was surprised by China’s performance in 2025, so who knows perhaps China can surprise them again to the upside. Here’s what management said about ASML’s China business yesterday in Q3 call:

on China, we have been very consistent that we thought that the level of business in the last 2, 3 years was very high and in no way normal. So I think we have been experiencing a very high cycle in China, especially through the last couple of years. And again, our expectation and the visibility we have right now is that next year, we go back to more reasonable business.

…we were actually quite surprised that the China sales this year are as strong as they are. But that -- but still the underlying assumption and our underlying perspective on the Chinese market is still the way it was a year ago. And that has to do with the fact that the Chinese market is a very specific one, right?

It’s focused on mainstream logic, as we call it. And simply given the dynamics, of that market. It is our assessment that the sales level that we currently see this year is very high in comparison to what we would think is a normalized level for that -- for the mainstream market. So that’s the reason why we’ve indicated this assumption of a significant decline. So that’s based on our understanding of the market. It’s based on the dialogues that we have with our customers. Could that change? Absolutely. I think we’ve seen that this year. That could change in comparison to our perspective. But if you ask us for an honest assessment at this stage, how we think it’s going to be in ‘26, it is as we communicated.

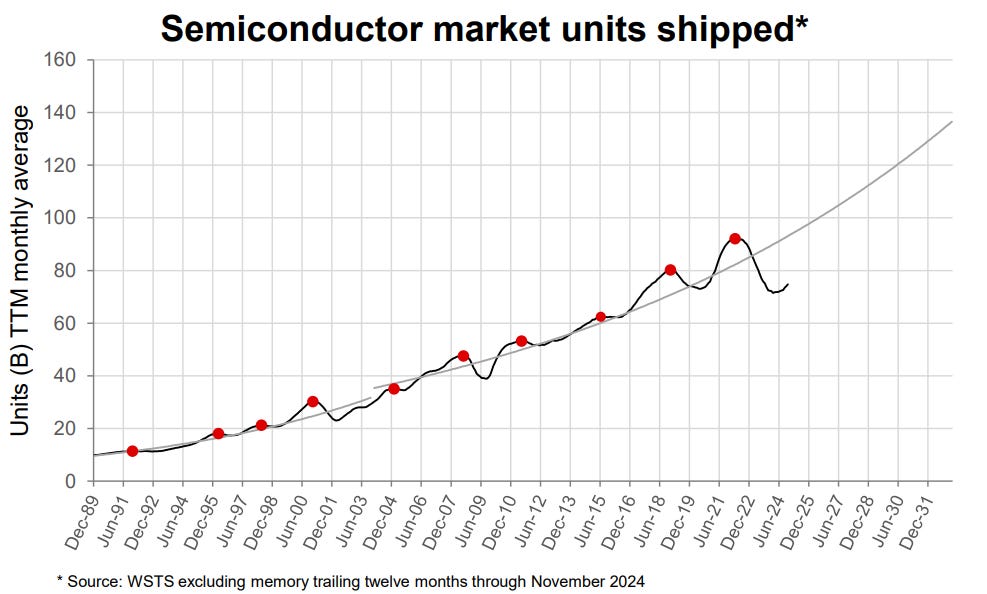

Indeed, it is quite surprising that Chinese companies are buying all these DUV machines from ASML for “mainstream logic” which are typically manufactured on older, more mature process nodes, generally considered to be 28 nanometers (nm) and larger. Texas Instruments mentioned in their 2Q’25 call that overall WSTS without memory is still 12-13% below the trendline. So it’s quite unlikely that the demand was through the roof for Chinese companies in the last couple of years to go for a buying spree of DUV machines. It is highly likely that geopolitics is a much greater consideration for Chinese buyers which is perhaps not the most reassuring news for ASML investors, especially given how the trade tension between China and the US has resurfaced. Even the Dutch government recently took control of Nexperia from the Chinese company Wingtech who bought Nexperia for $3.63 Billion in 2018.

Of course, China cannot quite retaliate directly by banning ASML; it’s good to be monopoly in this circumstance. Nonetheless, it is always quite challenging to map out geopolitical implications ex-ante; perhaps China is stockpiling enough DUV machines that even if DUV gets banned tomorrow, they will be fine for 5 years (if not longer). Beyond five years, China may be betting that they can rely on SMEE. Again, for context, ASML generated a cumulative €5 Billion revenue from China during 2016 to 2019 period. Now just in 2024 and 2025, their revenue from China in these two years in aggregate will be almost €20 Billion! Given the flaring trade tensions in recent weeks, I wouldn’t be surprised one bit if ASML has another ~€10 Billion revenue year from China next year. China’s ordering pattern in recent years doesn’t make it seem like they are very confident that they will have access to ASML’s DUV machines for too long!

For now, China has been a good business for ASML. It’s not only revenue contribution, their margins in China are also higher. From ASML in 3Q’25 call:

as you know, what we ship to China today to a very large extent is immersion. Immersion comes with a very good gross margin. So less China business would be dilutive on that front

Even though ASML management is assuming “significant decline” in China business in 2026, they nonetheless expect to see revenue growth in 2026:

…there has been a positive news flow across the industry in recent months that has helped to reduce the level of uncertainty that we were reporting last quarter. First, there were a number of announcements around the continued investment in AI infrastructure that supports demand in both leading edge logic and advanced DRAM. Second, the positive momentum around AI seems to extend to more customers in both logic and DRAM. Third, we see continued momentum around customers adopting more EUV layers in both logic and DRAM, migrating multi-patterning deep UV to single exposure EUV and continuing to support litho intensity.

We believe that the impact of these dynamics will only partially affect 2026; however, overall, we do not expect 2026 total net sales to be below 2025. In this environment, we also expect the 2026 EUV business to be up driven by the dynamic in advanced DRAM and leading-edge logic and the deep UV business to be down compared to 2025, driven by the dynamics with our Chinese customer.

While ASML’s tone about 2026 has certainly positively shifted from “we cannot confirm growth in 2026” during 2Q’25 call to “we do not expect 2026 net sales to be below 2025” in 3Q’25, I think it’s worth highlighting what revenue estimates for 2026 used to be in the last couple of years. Revenue estimates for 2026 peaked at €40.6 Billion in mid-2023, however, current estimates for 2026 are now almost ~20% below that! Moreover, I doubt many people were forecasting ~€10 Billion revenue contribution from China in 2024 and 2025. Surprisingly, even though today 2026 estimates are 20% below the peak in mid’23, the stock is up ~35% since then! That perhaps is more of an indication that ASML shareholders are happy to look through temporary issues as long as the monopoly remains firmly in tact!

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 63 Deep Dives here.

Current Portfolio:

Please note that these are NOT my recommendation to buy/sell these securities, but just disclosure from my end so that you can assess potential biases that I may have because of my own personal portfolio holdings. Always consider my write-up my personal investing journal and never forget my objectives, risk tolerance, and constraints may have no resemblance to yours.

My current portfolio is disclosed below: