Amazon 4Q'25 Update

After Meta and Alphabet’s eyebrow raising capex plan for 2026, Amazon came up with the biggest number: $200 Billion! Market basically said this in response:

While market may be currently in the mood of hating large capex numbers, I remain quite optimistic that it is indeed the right strategy long-term and I would do pretty much the same if I were in Amazon’s position.

Here are my highlights from yesterday’s call.

Revenue

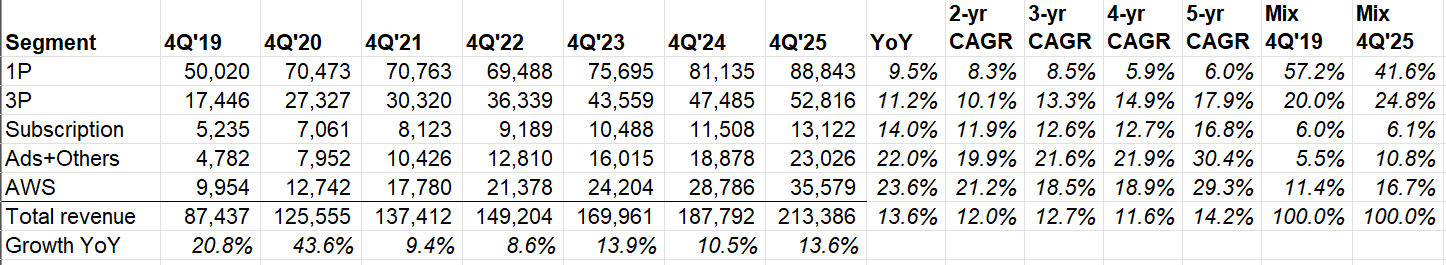

Apart from Amazon’s 1P retail business, everything else continues to grow at double digit rate. AWS, in fact, grew the fastest in 13 quarters.

I’ll discuss more about AWS later, but let’s talk more about Amazon ex-AWS first.

Amazon ex-AWS

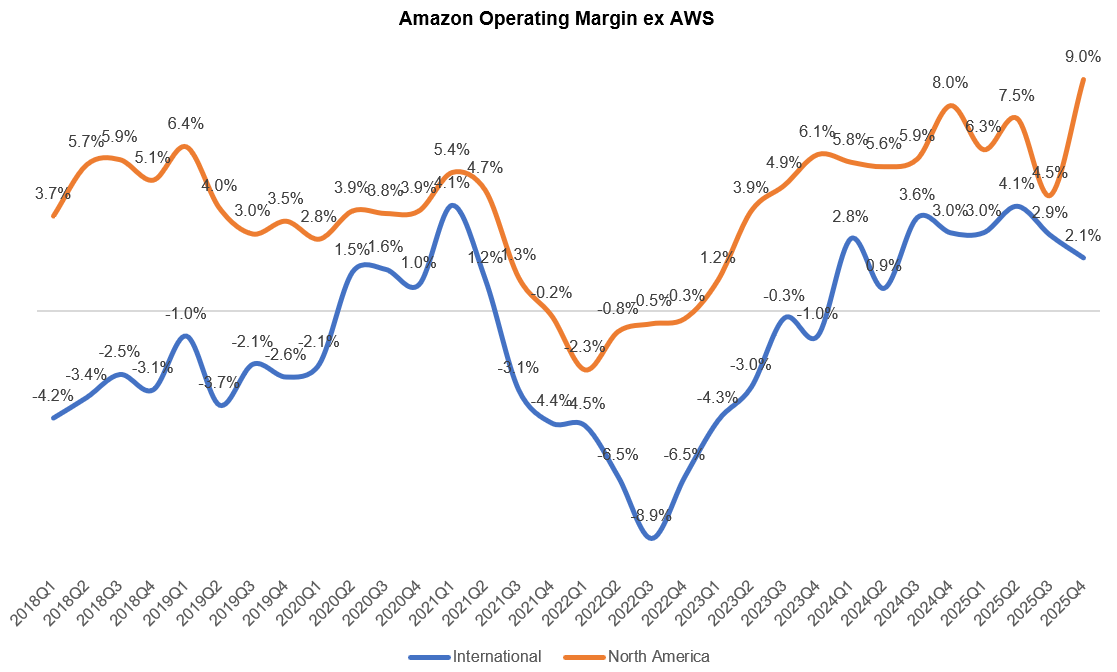

As I repeatedly mention in almost every quarter, Amazon retail business continues to be somewhat underestimated. Investors have complained a lot about retail overbuild during the Covid period, but notice what happened to the margin now. Even though North America segment was largely ~3% to ~5% operating margin business pre-Covid, it just reported 9% operating margin. In fact, Amazon had several one-off charges in Q4: a) $1.1 Billion tax dispute which affected the international segment, b) $730 Million severance costs which impacted all three segments, and c) $610 million asset impairments for their store business affecting North America segment. When you adjust for these one-off charges, the adjusted operating margin in North America was likely ~10%. Similarly, even though it may appear international segment’s operating margin went down significantly in 4Q’25, adjusting those one-off items would actually lead to margin expansion YoY.

Fulfillment+ Shipping

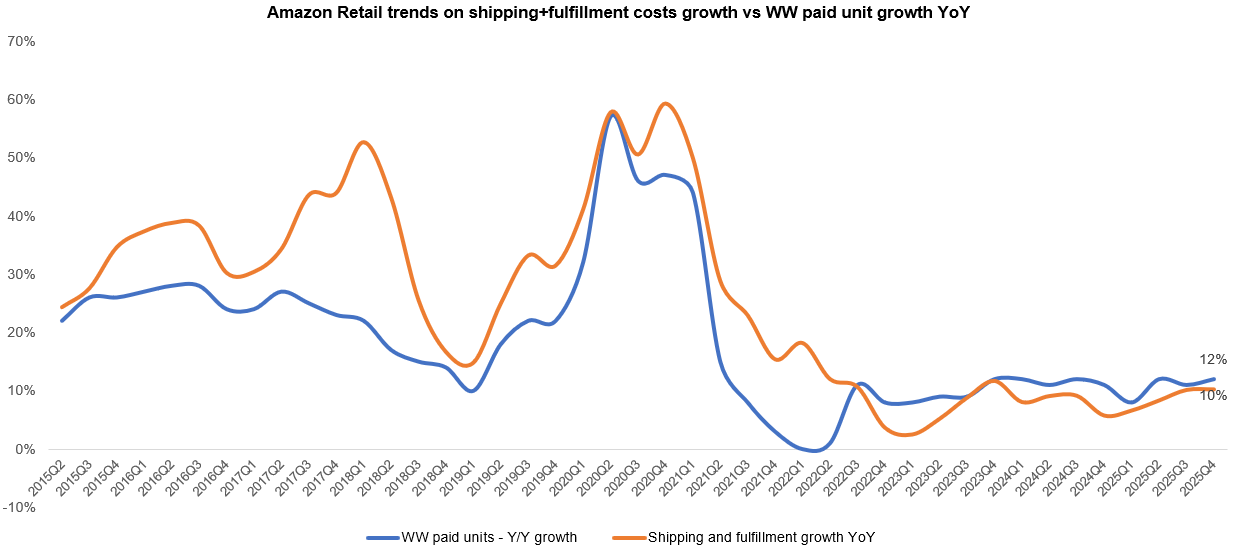

If you look at worldwide paid unit growth vs shipping+ fulfillment cost growth, you would notice that the latter used to consistently outpace the former pretty much all the time since 2015 until 3Q’22. Since then, unit growth has largely been faster than shipping+ fulfillment costs, indicating operating leverage in their logistics footprint.

Every Amazon earnings call makes me increasingly wary of owning any other physical retailer. It is quite clear that this company will not stop investing as long as they sniff a corner of profit pool in retail. Of course, not everyone will be vanquished in this competition against Amazon, but when it’s all said and done, it may just be a handful of retailers that can survive and compound their business over time.

Amazon used to mention that their grocery business was “over $100 Billion” even in early 2025. Yesterday they mentioned it’s now “over $150 Billion”. They are planning to launch more than 100 new Whole Foods stores in the next few years to serve the groceries market better. For context, that is almost ~20% expansion of Whole Foods current footprint. Some key quotes from the call yesterday on their retail business:

Last year, U.S. Prime members received over 8 billion items the same or next day, up more than 30% year-over-year, with groceries and everyday essentials making up half of the total items. For the third year in a row, globally, in 2025, we achieved both our fastest ever delivery speeds for Prime members while also reducing our cost to serve.

In the U.S., we delivered nearly 70% more items same day than the year before. We also continue increasing speed for rural customers with nearly 2x more average monthly customers in rural areas receiving same-day delivery year-over-year. Same-day is our fastest-growing delivery offering and nearly 100 million customers used it last year in the U.S.

our recently launched feature add to Delivery, which enables Prime members in the U.S. to add items to their upcoming Amazon deliveries with just one tap without going through checkout again or paying additional shipping fees. Just six months after launch, ad to delivery already makes up about 10% of all Prime volume fulfilled through the Amazon network each week. While this seems simple on the surface, this feature is supported by a lot of invention where we need to figure out in real time and with incredibly low latency, what items among Amazon's hundreds of millions of products are available to add to a customer's upcoming deliveries, surface them, find a way to include in their packages and deliver within the same customer promise.

There wasn’t much incremental about Rufus or their strategy around agentic commerce. Amazon has a strong hand here. They already own half the demand in e-commerce in the US. They’re now expecting Rufus will allow them to get a pie of the other half as well as it can buy for you from other websites beyond Amazon. They appear quite willing to partner with other chat bots at the “right value exchange”. Basically, as long as you give Amazon a lion’s share of the profit pool, your chat bot can crawl to their marketplace.

Advertising

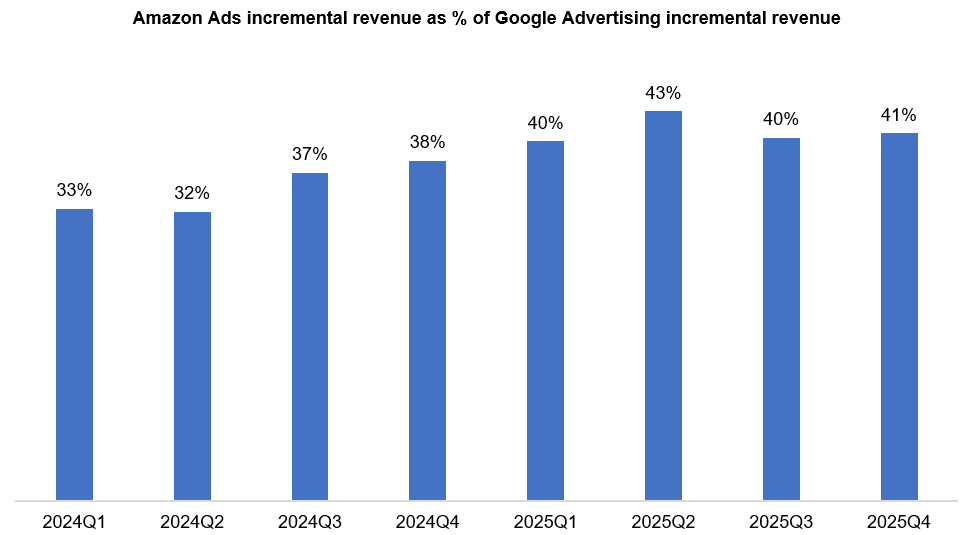

A big driver for retail profitability is advertising. Given Amazon ads are perhaps more of a competitor to Google than Meta, I think it’s interesting to track how Amazon is gaining share here.

While Amazon ads is still just ~26% the size of Google Advertising revenue, Amazon ads incremental revenue as a percentage of Google advertising incremental revenue was 41% in 4Q’25 (vs 38% in 4Q’24 and 40% in 3Q’25).

While sponsored ads on the marketplace likely remains the majority of advertising revenue, Prime Video ads is gaining momentum. From the call:

We saw continued growth in Prime Video ads, which is now available in 16 countries and is contributing meaningfully to our revenue growth. Prime Video has an average ad-supported audience of 315 million viewers globally, up from 200 million in early 2024.

I will discuss AWS and the rest of this update behind the paywall.

In addition to “Daily Dose” (yes, DAILY) like this, MBI Deep Dives publishes one Deep Dive on a publicly listed company every month. You can find all the 64 Deep Dives here.

AWS

Okay, now let’s talk about AWS.